Elfun Trusts (Trades, Portfolio) is a fairly unique mutual fund which is open to the employees of General Electric (GE, Financial) and its trustees. The fund reported ~$2.87 billion in stocks in its latest portfolio update, with 40 holdings as of Dec. 31, 2022.

The strategy of the fund managers is to focus on what they define as "high quality" U.S. companies which derive at least half of their revenue from U.S. business activities. In addition to quality, the fund likes to look for businesses which either pay dividends or have the potential to do so in the future.

Let's take a look at two of the high quality stocks the fund has was buying in the fourth quarter of 2022 according to its latest mutual fund report.

Investors should be aware that portfolio updates for mutual funds do not necessarily provide a complete picture of a guru’s holdings. The data is sourced from the quarterly updates on the website of the fund(s) in question. This usually consists of long equity positions in U.S. and foreign stocks. All numbers are as of the quarter’s end only; it is possible the guru may have already made changes to the positions after the quarter ended. However, even this limited data can provide valuable information.

1. Nvidia

Nvidia (NVDA, Financial) is a market leading provider of high performance graphics cards with ~80% of the GPU market share. Chances are if you have a high powered laptop or gaming PC it will likely use an Nvidia graphics card. Interestingly enough, Nvidia GPUs were also extremely popular for Bitcoin mining in 2020, and the company faced controversy for categorizing these profits as “gaming." In addition, Nvidia has a solid data center offering, an automotive technology platform and visualization expertise. This means Nvidia is in a prime position to benefit from the growth in the Metaverse. The Metaverse industry was valued at $22.79 billion in 2021 and is forecast to grow at a blistering 39.8% compound annual growth rate, reaching a value of close to $1 trillion by 2030 according to predictions from Global Data.

Cyclical financials

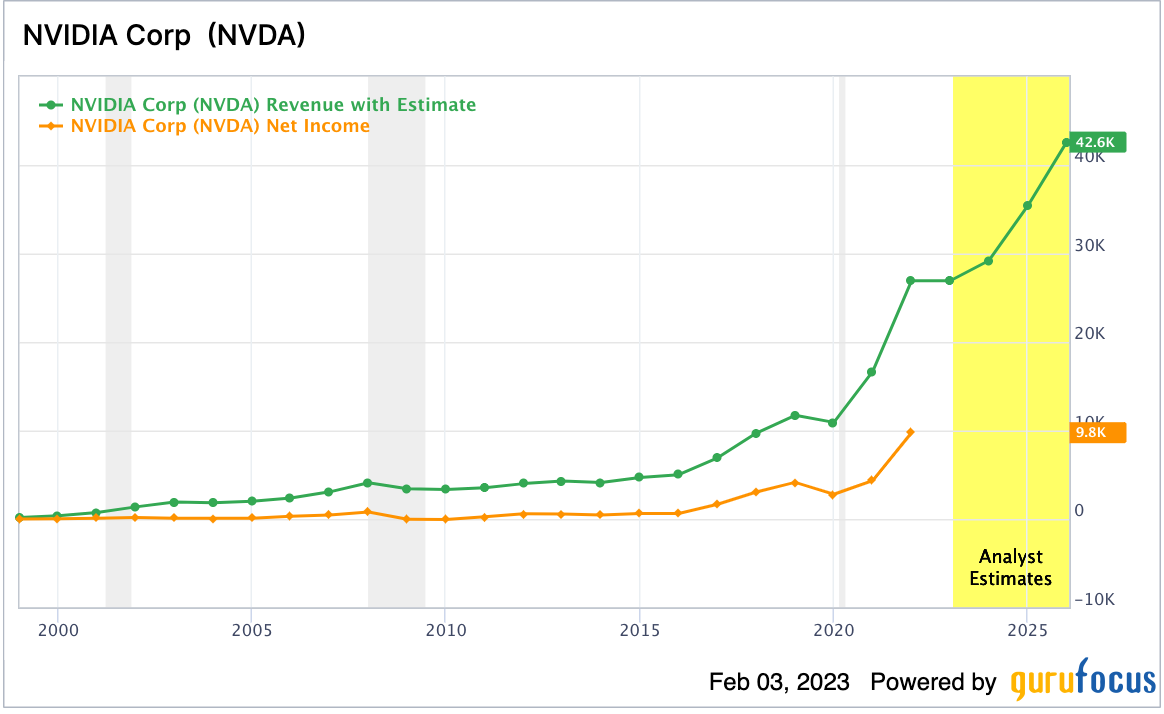

Nvidia reported an interesting mix of financial results for the third quarter of 2022. Its revenue was $5.93 billion, which actually decreased by 17% year-over-year despite beating analyst forecasts by $145 million.

Its core gaming segment reported revenue of $1.57 billion in sales, which plummeted by a staggering 51% year-over-year. This may seem terrible at first glance but I believe context is key to understanding this decline. Gaming and GPUs had a huge boost in popularity during the lockdowns of 2020 and into 2021. This segment also benefited from the rise in cryptocurrency which boosted the number of people purchasing GPUs for mining. However, in 2022 the gaming market has undergone a cyclical correction, driven by a decline in new PC purchases and the macroeconomic environment.

I noticed a similar trend in other companies with gaming and/or PC segments, thus this dynamic is not specific to Nvidia. In addition, the crypto collapse has taken away the majority of crypto-related sales.

Nvidia reported strong data center revenue growth of a rapid 31% year-over-year to $3.83 billion. This has been driven by Nvidia’s popular A100 and H100 data center GPUs which are specifically designed to help with the high performance running of Artificial Intelligence workloads.

Nvidia is poised to benefit from the growth of major AI and cloud infrastructure providers. For example, Nvidia previously announced a partnership with Microsoft (MSFT, Financial) Azure (the second largest cloud provider in the world) to help it build an AI supercomputer.

Another positive for Nvidia was the company reported strong growth in its automotive segment, which increased revenue by a blistering 86% year-over-year to $251 million. This was driven by growth in Nvidia's Drive Orin platform, which is currently used by many established automakers in order to help accelerate their self driving and connectivity capabilities.

Nvidia reported a substantial 72% decline in its operating income to $601 million. This was driven by the slowdown in revenue as well as a sharp 31% increase in operating expenses. A positive for Nvidia is the main catalyst for this increase was an increase in hiring and investments into infrastructure.

Interestingly enough, Nvidia is one of the few technology companies which haven’t announced mass layoffs, which is a positive sign. There was even a leaked email from the CEO going around the internet which allegedly claimed mass employees layoffs weren’t going to occur. I believe this is a positive for the company and should help strengthen its competitive edge versus peers who are downsizing.

Valuation and guru investors

Nvidia trades at a price-sales ratio of 19, which is approximately 13% higher than its five-year average.

The good news is the GF Value chart indicates the stock is “fairly valued” at the time of writing, with an intrinsic value estimate of $237.90 per share.

In the fourth quarter of 2022, Elfun Trusts (Trades, Portfolio) purchased the stock, as did growth stock investing firm (Baillie Gifford (Trades, Portfolio)). During the quarter, shares traded at an average price of $147, which is ~48% cheaper than where the stock trades at the time of writing.

2. Waste Management

Waste Management (WM, Financial) is the largest garbage disposal company in the U.S. with a dominant market share. Waste may not seem like a glamorous industry, but in garbage gold can be found for investors. Legendary investor Peter Lynch was a big fan of "boring stocks" in general and Waste Management in particular. This is because most investors will be chasing after more exciting stocks and thus companies such as this often get less coverage, thus lower valuations.

In addition, waste is an industry which doesn’t entice a series of competition unlike the technology industry. Many entrepreneurs want to create the “next Facebook” but few want to create the next garbage disposal company. This dynamic means companies in the garbage industry often have high margins and solid returns on capital. For example, Waste Management has a fantastic 28% return on equity..

The company has a substantial footprint across the U.S. with close to 300 landfills across and over 26,000 trucks for garbage disposal.

Stable financials

For the fourth quarter of 2022, Waste Management reported $4.94 billion in revenue, which increased by 5.49% year-over-year, despite missing analyst estimates by $39.19 million.

The beautiful thing about the waste management industry is it's a stable service as people are continually producing waste which needs to be disposed of. There is also the increasing focus on recycling and producing energy from landfills, which has made waste removal a little more trendy.

The company reported operating income of $810 million in its fourth quarter, which increased by 12.34% year-over-year and has been fairly stable.

Waste Management has $351 million in cash and short term investments on its balance sheet. The business does have high long term debt of $14.57 billion.

Valuation and guru investors

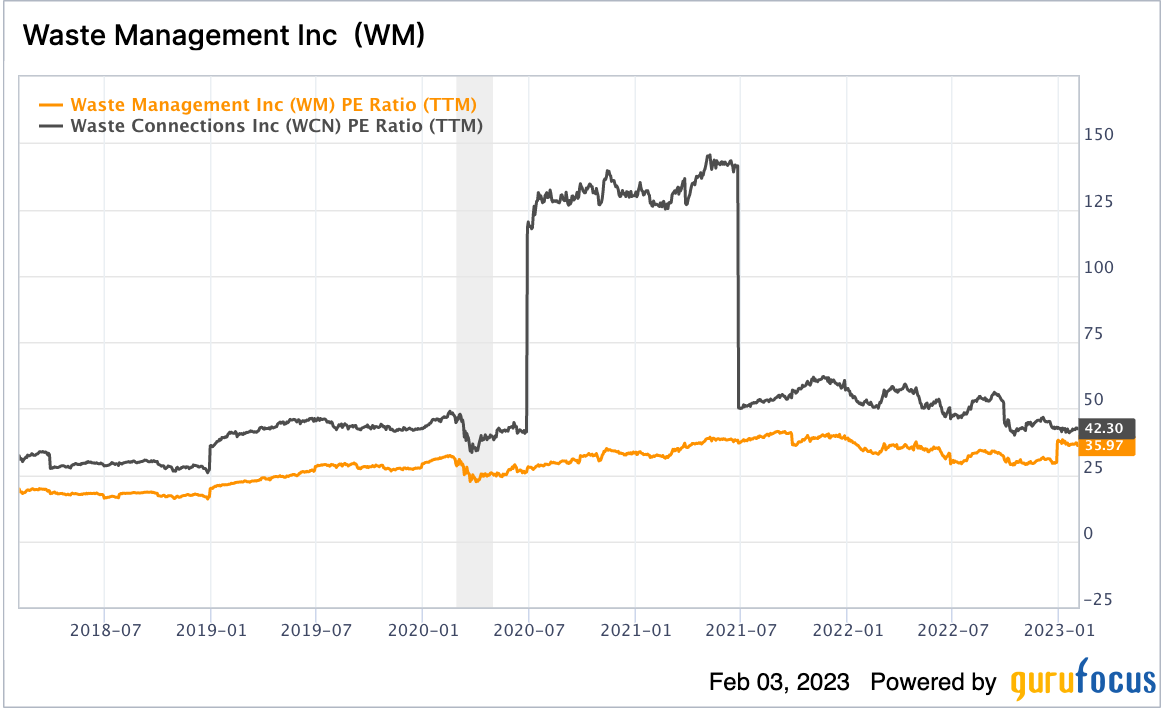

Waste Management trades at a forward price-earnings ratio of 25, which is 8.71% cheaper than its five-year average. The stock also trades at a cheaper trailing 12-month price-earnings ratio than Waste Connections (WCN), which is the third largest garbage disposal company in the U.S.

The GF Value chart indicates a fair value of $165.70 per share which means the stock is “fairly valued” at the time of writing.

Elfun Trusts (Trades, Portfolio) purchased the stock in the fourth quarter of 2022, during which shares traded at an average price of $160.90, which is approximately 7% more expensive than where the stock trades at the time of writing.

Final thoughts

Both Nvidia and Waste Management are two very different companies, but they do have one thing in common. They are both high quality businesses. Nvidia is facing headwinds from the cyclical decline in the gaming industry and other segments, but I believe this is only temporary. Waste Management is a stable “stalwart” which is unlikely to be disrupted by competitors any time soon. The company has produced consistent revenue despite the tough economic environment and is trading cheaper than its competitors.

Also check out: