Taiwan Semiconductor Manufacturing Co. Ltd. (TSM, Financial) is progressing as a leading innovator in the semiconductor industry, pushing value growth for investors with a nearly 33% year-to-date return.

The discussion focuses on critical bullish catalysts that are supporting its fundamental edge despite severe challenges.

Beyond 3nm logic technology and 3D SoC

Taiwan Semiconductor's technology advancements and developments in the semiconductor industry position it for continued growth and leadership. The company's focus on moving beyond 3 nanometer technology, 3D system-on-chip integration and advanced packaging technologies will drive innovation and meet the evolving needs of its customers.

The company's roadmap includes the introduction of new processes and variants to its 3nm technology family. For example, the N3P process, set to enter production in the second half of 2024, offer improved power, performance and chip density compared to the N3E process. It provides a 5% speed boost, 5% to 10% power reduction and 1.04 times more chip density. This enhancement will cater to customers looking for increased efficiency and performance.

Source: Taiwan Semiconductor's website

In addition to N3P, Taiwan Semiconductor is developing the N3X process, tailored explicitly for high-performance computing applications. The technology prioritizes performance and maximum clock frequencies, offering 5% more speed than N3P. In addition, it maintains the improved chip density of N3P and is projected for volume production in 2025. This development aligns with the growing demand for computing power in HPC applications.

The company's commitment to the automotive industry is evident through introducing the N3AE, or Auto Early, process. N3AE enables automotive applications on the advanced 3nm node, allowing customers to launch designs based on N3E. This early access to automotive-qualified technology will lead to the fully automotive-qualified N3A process in 2025. Taiwan Semiconductor's focus on automotive applications underscores the increasing importance of semiconductor technology in the automotive sector, particularly with the rise of electric vehicles and autonomous driving.

Looking further ahead, its 2nm technology is on track for production in 2025. The technology, employing nanosheet transistors, offers significant improvements over the N3E process. It promises up to 15% speed improvement, up to 30% power reduction and greater than 1.15 times chip density. The 2nm technology's energy efficiency and density advancements will meet the demands of emerging applications in areas such as artificial intelligence, 5G and edge computing.

Taiwan Semiconductor is also pushing the limits of CMOS RF technology with the development of N4PRF, the industry's most advanced CMOS radio frequency technology. N4PRF aims to support digital-intensive RF applications, such as WiFi 7 RF system-on-chip, offering greater logic density and lower power consumption compared to the N6RF technology. This development aligns with the increasing need for efficient and high-performance RF solutions in the era of 5G and smart internet of things applications.

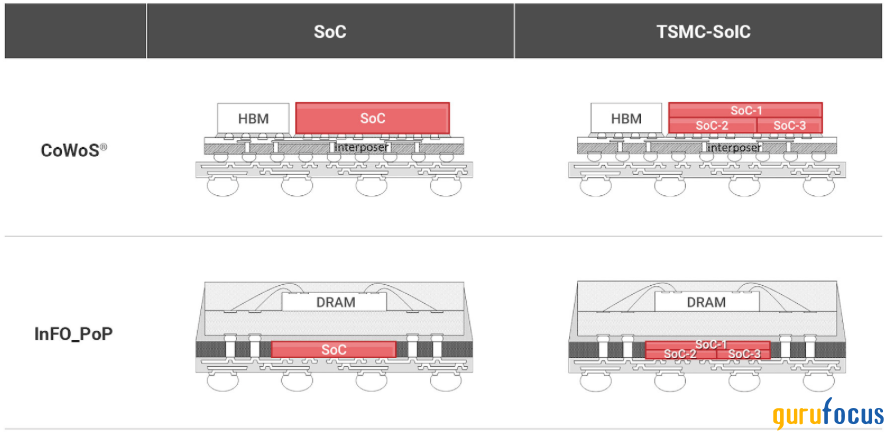

Furthermore, the 3DFabric advanced packaging and silicon stacking technologies continue to evolve. The development of chip on wafer on substrate (CoWoS) solutions with a large RDL interposer and microbump versions of system on integrated chips (SoIC) solutions expand Taiwan Semiconductor's advanced packaging capabilities. These advancements enable higher integration of processors, memory and subsystems in a single package, meeting the demands of HPC and data center applications.

Overall, TSMC's commitment to research and development remains strong. The company continues to invest heavily in exploring new technologies, such as beyond-2nm nodes, 3D transistors, new memory and low-R interconnect. Collaborations with external research bodies and industry consortia contribute to extending Moore's Law and developing future cost-effective technologies and manufacturing solutions.

Source: Taiwan Semiconductor's 3DFabric

Hedging against China

Taiwan Semiconductor is facing increasing pressure to diversify its manufacturing facilities outside of Taiwan due to the geopolitical tensions and potential risks associated with China's actions over Taiwan. As a result, the company has taken steps to expand its production and operations in the United States, with the construction of a facility in Arizona, and is now in talks with German authorities for subsidies to build a plant in Germany.

The negotiations for a German chip facility highlight the growing global competition for semiconductor manufacturing capacity. Taiwan Semiconductor is seeking up to 50% subsidies for the proposed plant, which could cost around $10.7 billion to build. In addition, the involvement of partners such as NXP Semiconductors (NXPI, Financial), Robert Bosch and Infineon Technologies (XTER:IFX, Financial) indicates the importance of collaboration in the semiconductor industry.

If successful, Taiwan Semiconductor's expansion into Germany would make it a truly flexible global enterprise, operating on three continents. This move aligns with industry demand, political pressures and the need for it to hedge against risks associated with its heavy reliance on Taiwan for semiconductor manufacturing. The European Union's recent passage of the Chips Act, aimed at boosting domestic chip production, further supports its potential investment in Germany.

However, it is vital to consider the geopolitical implications and potential challenges that the company may face in its expansion plans. For example, the potential destruction of facilities in the event of a Chinese invasion has raised concerns and could impact the perception of U.S.-Taiwan relations. Moreover, Taiwan Semiconductor's expansion plans outside of Taiwan have sparked debates about the U.S. government's intention to siphon away core industries from Taiwan, potentially reducing dependency on the country. These debates highlight the complexities and sensitivities involved in its strategic decisions and the broader geopolitical landscape.

Fundamentally, Taiwan Semiconductor's potential investment in Germany can be viewed in the context of its efforts to secure its position as a leading chipmaker while navigating geopolitical risks. The outcome of the ongoing negotiations with German authorities and the European Commission will determine the level of government subsidies and support the company will receive for the facility.

If Taiwan Semiconductor proceeds with the German plant, it is likely to focus initially on producing 28-nanometer generation computer chips, catering to the demand for established chip types used in various applications such as automotive electronics. As a result, it may directly support nearly 12% of its revenue. The EU's Chips Act and the support from local and European governments provide a favorable environment for the company's expansion plans, which may give it a competitive advantage over its peers in capturing the long-term structural growth of the industry.

However, Taiwan Semiconductor must carefully navigate its expansion's potential challenges and implications. Any act of war, including the destruction of its facilities, would have severe economic consequences and impact global supply chains.

Source: First-quarter earnings presentation

Buffett's exit

Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway (BRK.A, Financial)(BRK.B, Financial) recently exited its Taiwan Semiconductor investment completely, which has raised questions about the company's prospects, particularly amid geopolitical tensions and a slump in the semiconductor industry.

One of the main reasons cited by Buffett for selling the stake is the concern over geopolitical tensions, particularly between China and Taiwan. China claims sovereignty over Taiwan and is willing to use force if the country declares independence. The potential for escalation in this conflict poses a significant risk to Taiwan Semiconductor's operations and supply chain given its location.

Another factor is the semiconductor industry faces challenges, including a slump in demand for consumer electronics. Taiwan Semiconductor has forecasted a drop in revenue for the current quarter and a decrease in sales for the whole year. The weak global electronics demand, inventory glut and geopolitical risks have dampened investor sentiment toward the industry. Taiwan Semiconductor's ability to navigate these challenges, adapt to changing market dynamics and maintain its competitive edge will be crucial for its future performance.

Despite the concerns raised by Buffett's exit, other prominent institutional investors, like BlackRock, Tiger Global and Coatue, have added to their holdings. This suggests that smart money still sees potential value in the company. Furthermore, Taiwan Semiconductor has been actively investing in expanding its fabrication capacity in the U.S. and Japan to address concerns about overreliance on Taiwan and cater to global customers' demands. These investments position it to capture opportunities in emerging technologies and strengthen its market position.

Overall, Taiwan Semiconductor's reputation as a technological leader in chip manufacturing remains intact despite Buffett's recent divestment.

Conclusion

In conclusion, the key growth drivers are Taiwan Semiconductor's focus on advancing beyond-3nm technology, 3D SoC integration and advanced packaging. The introduction of N3P and N3X processes and the development of 2nm technology highlight the company's commitment to innovation and meeting customer demands.

The company's efforts to diversify manufacturing outside Taiwan, with expansion in the U.S. and a potential investment in Germany, help mitigate geopolitical risks. While Buffett's exit may be cause for concern, other institutional investors have shown confidence in the stock. Lastly, ongoing investments in fabrication capacity and Taiwan Semiconductor's reputation as a technological leader position it well for sustainable value growth over the long term.

Also check out: