After enduring a prolonged drop in value, PayPal Holdings Inc. (PYPL, Financial) is not merely adapting, but spearheading a remarkable turnaround. By embracing Web3, blockchain technology and strategic investments, the payment giant is set to capitalize on digital transactions. With a keen focus on user base expansion, enhanced merchant acceptance and international growth, the company has fortified its position as a market leader. Moreover, its strategic investments in cutting-edge companies across various financial sectors provide an additional catalyst for sustained growth.

Performance and management's long-term focus

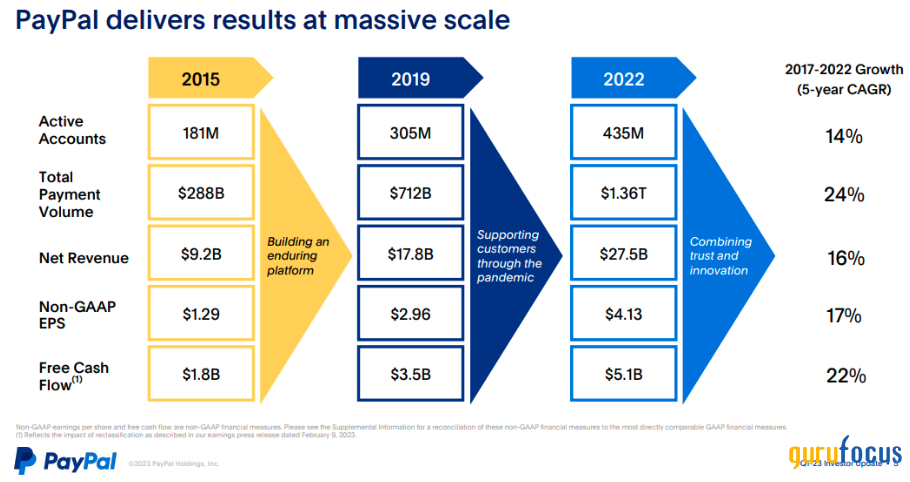

One of the key indicators of PayPal's potential turnaround is its expanding user base and increased engagement. For the first quarter of the year, the company reported 433 million active accounts, representing a 1% year-over-year increase. Moreover, the total payment volume increased by 10% over the same period, indicating higher user activity and engagement.

These data points suggest PayPal's turnaround depends on acquiring new users and increasing the activity level of its existing user base.

Source: Investor update.

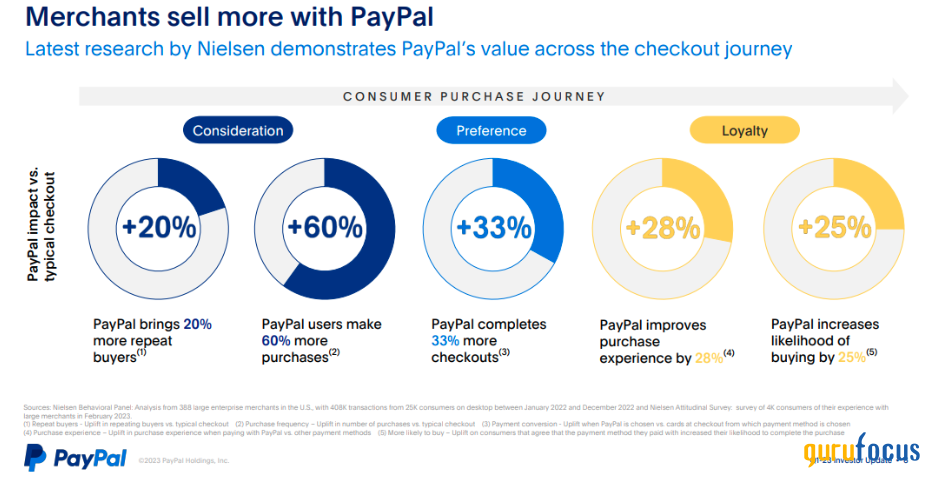

Another area showing signs of progress was merchant acceptance. Active merchant accounts grew by 6% year over year, reaching 35 million in 2022. This growth demonstrates that more merchants are adopting PayPal's services, providing convenience and trust for customers and merchants alike. The increasing merchant acceptance further solidifies the company's position in the market and supports its long-term value growth.

Additionally, mobile payments may become a significant driver of PayPal's growth. In the first quarter, Venmo payment volumes increased 9% year over year. This statistic highlights the company's ability to capture the mobile payment market and adapt to changing consumer preferences. With the increasing prevalence of smartphones and the convenience they offer, its strong presence in mobile payments fundamentally supports a potential turnaround in the company's valuation.

Further, PayPal's international expansion efforts may also continue to yield positive results. The company experienced 6% year-over-year growth in international total payment volume in the first quarter. This data suggests PayPal's services are resonating with customers globally, and its global expansion strategies effectively tap into new markets. Additionally, strategic partnerships with popular e-commerce platforms and digital wallet providers may extend its reach further and facilitate its growth in international markets.

Notably, PayPal's TPV growth across each segment of its business in the first quarter is a vital positive indicator. International and cross-border growth, as well as growth in branded checkout and Venmo, contributed to strong TPV growth. This expansion in transaction volumes and customer base suggests PayPal's efforts to attract and retain users may lead to a significant improvement in its valuation.

Source: Investor update

Web3 adoption and blockchain

PayPal's recent foray into the Web3 and blockchain space through strategic investments in Chaos Labs and Magic reflects the company's astute recognition of the growing significance of decentralized finance and efforts to capitalize on the potential of Web3 technologies. These investments are clear indicators of PayPal's focus on remaining at the forefront of the evolving financial landscape and expanding its service offerings to cater to the changing needs of its customer base.

Chaos Labs, a pioneering automated economic security system for crypto protocols, addresses the escalating risks and vulnerabilities faced by DeFi platforms. With prominent DeFi clients such as Aave, Chainlink and Uniswap, the company has firmly established itself as a trusted player. The $20 million seed funding round, jointly led by Galaxy and PayPal Ventures, will enable Chaos Labs further to develop its suite of risk and security products. This strategic move aligns harmoniously with PayPal's core objective of providing secure and reliable financial services to its customers within the crypto realm.

Similarly, PayPal's investment in Magic, a wallet-as-a-service provider, highlights the company's keen interest in simplifying the onboarding process for Web3 applications. Magic's secure and user-friendly solutions empowers companies to transition their customers into the Web3 ecosystem effortlessly. The $52 million strategic funding round led by PayPal Ventures may greatly bolster Magic's ability to expand its enterprise offerings and accelerate the mainstream adoption of Web3. This move harmonizes perfectly with the company's broader strategy of embracing digital assets and spearheading the widespread acceptance of cryptocurrencies.

Looking ahead, PayPal's active involvement in the Web3 and blockchain spaces positions it to capitalize on the burgeoning demand for decentralized financial services and Web3 applications. By investing in specialized companies like Chaos Labs and Magic, PayPal is expanding its product portfolio and establishing strategic partnerships and collaborations with key industry players. This enables it to leverage these companies' technological advancements and expertise to enhance its own services and provide innovative solutions to customers.

Further, by proactively staying ahead of the curve and embracing emerging technologies, PayPal aims to maintain its competitive edge and effectively adapt to the ever-evolving needs of consumers. This forward-thinking approach solidifies the company's position as a leader within the fintech industry and lays the foundation for future growth and innovation.

Several key data points underpin the long-term advantages of PayPal's pivot towards Web3 adoption and blockchain technology. First, through investments in companies like Chaos Labs and Magic, PayPal Ventures strategically positions itself within the emerging Web3 ecosystem. This strategic positioning enables the company to tap into the potential of DeFi, a sector experiencing rapid growth and continuous innovation. By supporting startups that provide risk management solutions and wallet-as-a-service offerings, PayPal may become a significant player in the rapidly expanding digital economy.

Additionally, integrating cryptocurrency transfers into the PayPal and Venmo platforms signifies a substantial opportunity for the company to diversify its revenue streams. As increasing numbers of customers embrace cryptocurrencies, the seamless and secure transfer of digital assets enhances the overall user experience and attracts a broader customer base. This move aligns seamlessly with the surging demand for digital assets and strengthens PayPal's position as a leading player in the digital payments space.

Progressive strategic investments

PayPal's strategic investments in Finanzguru, Deep Instinct, Mintoak and Aspire demonstrate its commitment to implementing a sustainable turnaround and expanding its reach in various financial industry sectors.

Finanzguru, Germany's leading open-banking-enabled financial advisor, has experienced remarkable success, boasting 1.5 million registered users and achieving tripled revenues in 2022. PayPal Ventures' investment in Finanzguru may accelerate profitable growth in Germany, expand its product platform and strengthen its team. The move aligns with PayPal's strategy of supporting fintech companies that provide personalized financial advice and enhance access to financial services. The company's impressive user base and revenue growth indicate a strong market demand for their services, presenting an opportunity for PayPal to tap into the German market and broaden its customer base.

Deep Instinct, a cybersecurity company leveraging deep learning for threat prevention, has also gotten PayPal Ventures' attention. The key data point that bolsters this investment is Deep Instinct's unique ability to detect and prevent cyber threats earlier than other solutions. By adopting a prevention-first model, Deep Instinct aligns perfectly with PayPal's focus on cybersecurity. This investment signifies the company's confidence in the disruptive technology offered by Deep Instinct and its potential to drive the cybersecurity industry forward. Deep Instinct's superior threat detection capabilities present an invaluable asset to PayPal in safeguarding its systems and protecting customer data.

Mintoak, an India-based SaaS platform catering to merchant services, has secured funds through a Series A funding round led by PayPal Ventures. This investment aims to empower Mintoak to strengthen its technology stack, expand its product portfolio and enter new markets in the Middle East, Africa and Southeast Asia. The data point that supports this investment is Mintoak's significant growth potential and its ability to serve small and medium-sized enterprises while assisting banks in delivering comprehensive business solutions to their customers. As the Indian fintech market continues to thrive, PayPal's investment in Mintoak positions it to leverage the burgeoning opportunities in the expanding merchant segment.

Source: Investor update.

Specific risks and downsides

PayPal faces several specific risks and downsides that may impact its turnaround efforts and long-term growth.

The regulatory environment is a big concern as governments worldwide scrutinize the fintech industry and impose stricter regulations on data privacy, anti-money laundering and financial transactions. Compliance with these regulations can be costly and time-consuming, potentially impacting PayPal's profitability and growth.

Additionally, operating margin pressure is a significant downside for PayPal, as the data reveals a decline in its margins due to increasing expenses. The company has been investing in technology, marketing, customer acquisition and compliance, which significantly pressures its profitability. Dependency on partnerships is both an advantage and a risk for PayPal. The company collaborates with e-commerce platforms and digital wallet providers to expand its user base and transaction volume.

PayPal also faces competition from alternative payment platforms such as Block Inc.'s (SQ, Financial) Square and Stripe. These platforms offer similar services and are gaining traction. Losing market share to these competitors could hinder the company's ability to reaccelerate growth.

Furthermore, the data suggests the growth of PayPal's active users (active accounts) has slowed. This decline indicates a potential saturation of the company's market reach. Acquiring new users is crucial for sustaining long-term growth, and any stagnation or decline could hinder PayPal's turnaround efforts.

Takeaway

In conclusion, PayPal's strategic investments in Web3 adoption, blockchain technology and various areas of the financial industry, coupled with its expanding user base, improved merchant acceptance, mobile payment dominance and international expansion efforts, reflect its commitment to driving sustainable growth and innovation.

However, the company faces market saturation, regulatory challenges, margin pressure, evolving consumer preferences, slower revenue growth and competition from alternative payment platforms. Despite these challenges, PayPal's proactive approach, focus on emerging technologies and strategic investments position it well for the future, while continuous adaptation and customer-centric strategies will be vital for sustaining its turnaround.