In the exhilarating landscape of investing, the term "analyst picks" resonates like a beacon guiding investors through the turbulent market waves. Every investor, novice or seasoned, values this insightful information to navigate their financial journey successfully.

As a result, remaining informed of the latest analyst upgrades and downgrades is important when navigating the markets. By going through these picks, readers can ensure their investment decisions are data-driven and based on expert advice.

Nonetheless, before we proceed, it is important to note that recommendations from analysts should not be regarded as the ultimate guide in assessing a company. Many factors come into play in determining whether a stock is valuable. Moreover, when making a decision, it is crucial to comprehend whether it aligns with the needs of your portfolio. All these elements contribute significantly to ensuring the chosen stock complements your portfolio.

Simultaneously, I will not solely rely on analyst recommendations. I will also leverage the GuruFocus All-in-One Screener, a Premium feature, to better understand these two stocks currently capturing substantial attention from analysts. So, without wasting any more time, here are two stocks that analysts have recently praised.

Carnival

In the cruise ship realm, one vessel appears to be navigating the choppy waters of the stock market quite deftly: Carnival Corp. (CCL, Financial). With a jaw-dropping year-to-date return of over 125%, it seems to be charting an upward course despite the lingering storm clouds of the recent financial statement that showed a net loss.

Argus upgrading its rating from hold to buy is a significant development in the Carnival story. The research firm also upped its price target to $21. On Tuesday, the stock closed at $17.98.

The reasons for this vote of confidence lie in the company's evident resilience and its strategic moves of increased marketing spending and substantial liquidity. With a keen eye on profitability, the company is streamlining operations and efficiently modernizing its fleet, two elements that Argus analyst John Staszak praised in a note to clients.

Although Carnival has temporarily suspended share buybacks and dividend disbursements, Argus predicts this halt on dividends will not persist in the long run.

One word comes to mind when we analyze the cruise line itself: debt. Carnival has historically been characterized by an aggressive financing strategy, consistently employing substantial debt levels to fund its operations. Over the past decade, the company's debt-to-equity ratio has significantly shifted, ranging from a low of 0.32 to a high of 5.98. Presently, this figure stands at its maximum of 5.98, underscoring the company's significant reliance on borrowed capital. This trend became markedly apparent during the Covid-19 pandemic, when the company significantly amplified its debt accumulation. By opting for debt financing, it has taken a deliberate approach to navigating the challenging financial seas, albeit with added risks and responsibilities.

Carnival's story is a refreshing tale of strategic resilience in this whirlpool of market uncertainties, making it one to watch in the analyst picks. However, the optimism might be priced in considering the run up in shares. And its debt position certainly does not help.

Forward Air

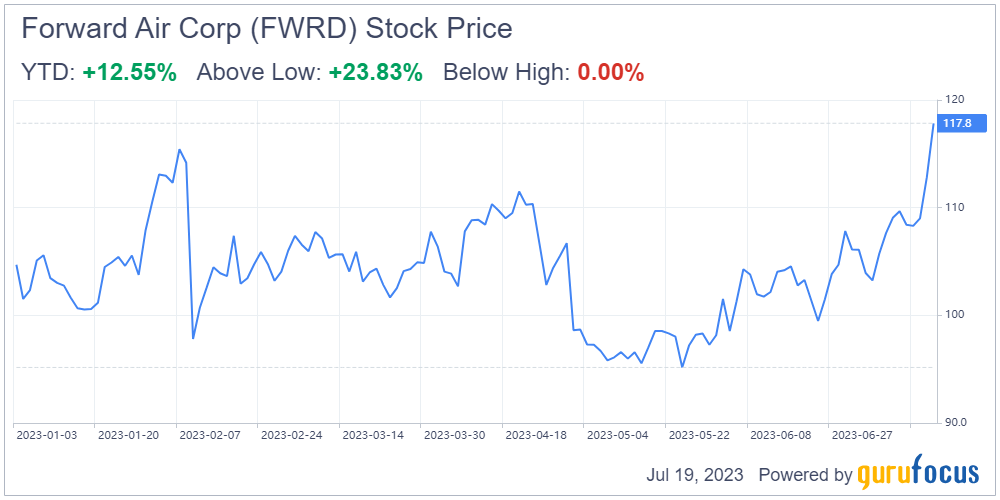

Forward Air Corp. (FWRD, Financial), a prominent ground transportation and logistics provider in North America, got a substantial boost from Baird, a financial services company.

The firm upgraded Forward Air's stock from a neutral rating to outperform, raising the price target from $106 to $130. This positive assessment came as the company's stock closed at $112.81 on July 18. Forward Air has seen a 13.81% increase in the past month and a 17.21% increase over the past 12 months.

The latest earnings report showcases the resilience of Forward Air amid a volatile market. Although the company experienced a decrease in various financial metrics, such as net profit margin and operating income, it exceeded earnings per share expectations. This positive surprise indicates the company's ability to navigate challenging conditions effectively. Analysts and investors should watch the company as it continues to demonstrate its capabilities in the ground transportation and logistics sector.

Forward Air's extensive range of services, including expedited less than truckload, full truckload and intermodal solutions, positions it as a convenient and efficient option for businesses of all sizes. With a network spanning over 10,000 daily lanes across more than 40 states, Forward Air has established a strong presence in the industry. The company's recent expansion into intermodal drayage operations in Linden, New Jersey further enhances its capabilities and market reach. As the company continues to adapt and innovate, it remains a compelling choice for investors seeking potential stock picks and recommendations in the transportation and logistics sector.

Forward Air's current price-earnings ratio is 16.94. Compared to its 10-year historical range, the current ratio is closer to the minimum value of 12.86 and below the median of 23.27. It is significantly lower than the maximum price-earnings ratio over the past 10 years, which is 110.75.

Hence, when considering the price-earnings ratio alone, it may indicate that Forward Air's stock is undervalued relative to its historical values. Nonetheless, its recent earnings performance suggests the company is facing challenges. Consequently, it is imperative for investors to take a nuanced approach and thoroughly analyze the situation before making a decision on the stock.