Align Technology Inc (ALGN, Financial) has seen a significant daily gain of 15.47%, with an Earnings Per Share of 4.05 as of July 27, 2023. Given these figures, it raises the question: Is the stock modestly undervalued? This article aims to provide a comprehensive valuation analysis of Align Technology (ALGN). Let's delve into the details.

Company Overview

Align Technology is the leading manufacturer of clear aligners, with its flagship product, Invisalign, dominating over 90% of the market. The company's robust growth is reflected in its market cap of $30 billion and impressive sales figures of $3.7 billion. The current stock price stands at $392.44 per share, offering an intriguing contrast with the GF Value of $504.4, indicating that the stock might be modestly undervalued.

Understanding the GF Value

The GF Value is a unique measure that helps determine a stock's intrinsic value. It considers historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates. If the stock price significantly deviates from the GF Value Line, it could indicate that the stock is overvalued or undervalued, thus influencing its future returns.

Align Technology's stock appears to be modestly undervalued according to the GF Value. With a market cap of $30 billion and a current price of $392.44 per share, the stock's future return is likely to be higher than its business growth due to its undervaluation.

Assessing Financial Strength

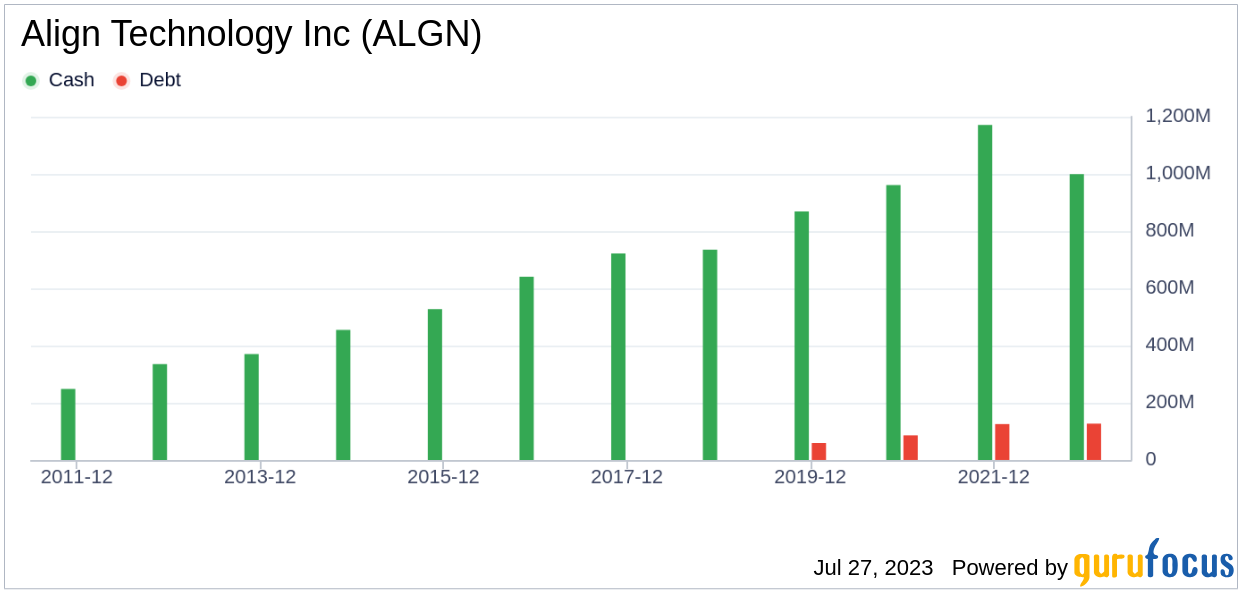

Investing in companies with low financial strength could result in permanent capital loss. Thus, it's crucial to review a company’s financial strength before purchasing its shares. Align Technology, with a cash-to-debt ratio of 6.97, ranks better than 63.62% of companies in the Medical Devices & Instruments industry, suggesting a strong balance sheet.

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, is generally less risky. Align Technology has been profitable for the past 10 years, with an operating margin of 15.91%, ranking better than 76.09% of companies in its industry. This strong profitability is complemented by a promising growth rate, with a 3-year average revenue growth rate better than 71.23% of companies in the industry, and a 3-year average EBITDA growth rate of 10.3%.

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC) can provide insights into its profitability. If the ROIC exceeds the WACC, it indicates that the company is creating value for shareholders. For Align Technology, the ROIC over the past 12 months was 7.09, while the WACC stood at 11.43.

Conclusion

In conclusion, Align Technology (ALGN, Financial) appears to be modestly undervalued. The company boasts strong financial health, impressive profitability, and promising growth, ranking better than 53.53% of companies in the Medical Devices & Instruments industry. To delve deeper into Align Technology's financials, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, consider exploring the GuruFocus High Quality Low Capex Screener.