On July 27, 2023, Carrier Global Corp (CARR, Financial) saw a daily gain of 4.15%, with its stock price reaching $56.69. With Earnings Per Share (EPS) of 2.96, the question arises: is the stock modestly overvalued? In this article, we delve into a comprehensive valuation analysis to answer this question. Stay with us as we unravel the financial intricacies of Carrier Global (CARR).

Company Overview

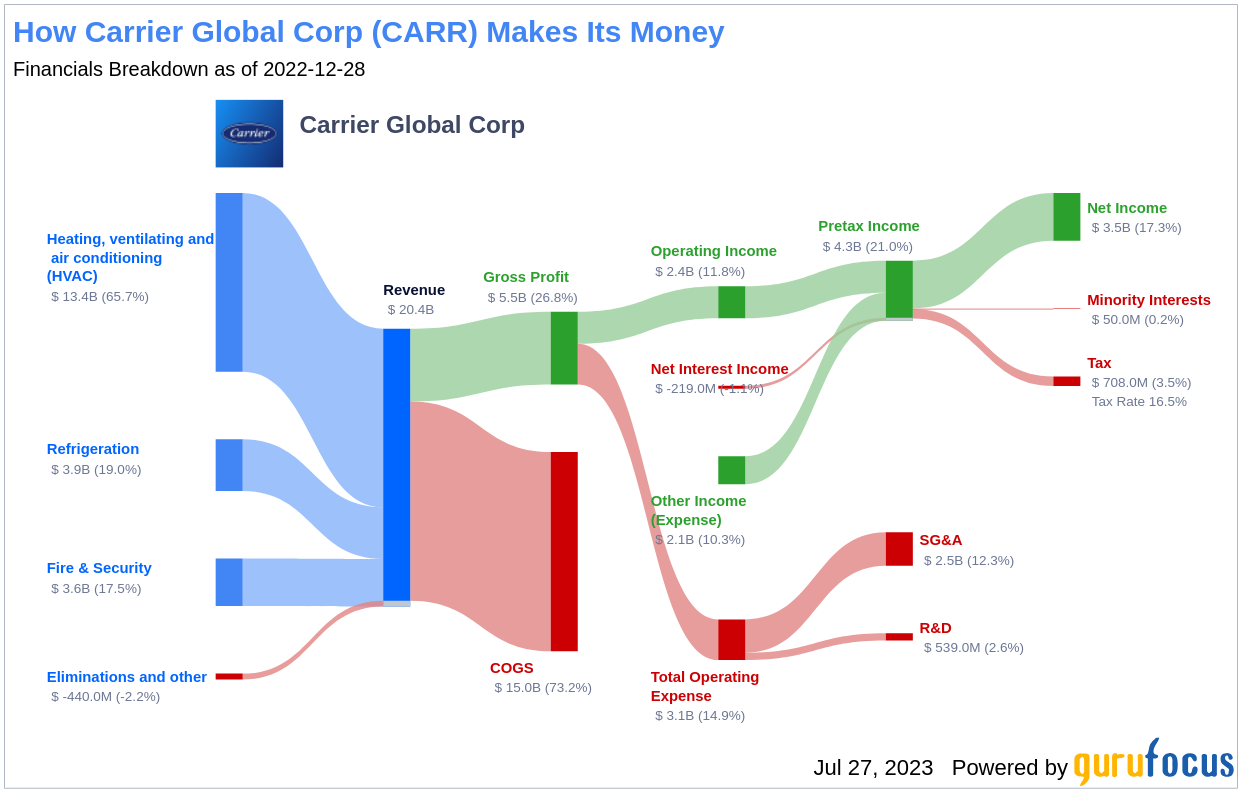

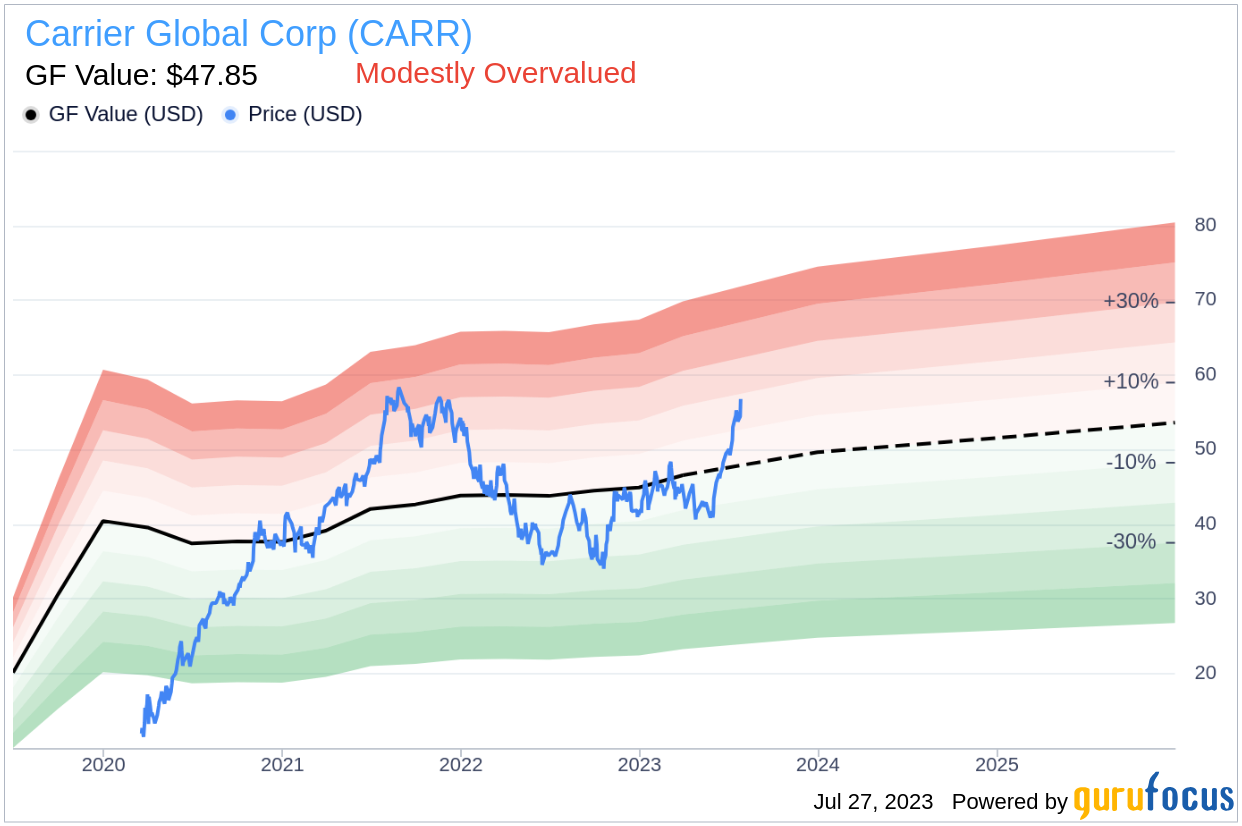

Carrier Global Corp, known for manufacturing heating, ventilation, air conditioning, refrigeration, and fire and security products, serves both residential and commercial markets. The company recently announced its plans to divest its fire and security and commercial refrigeration businesses and acquire Germany-based Viessmann for approximately $13 billion. With a market cap of $47.3 billion and sales of $21 billion, Carrier Global's stock price currently stands at $56.69, above its GF Value of $47.85, indicating a modest overvaluation.

Understanding the GF Value

The GF Value is a proprietary measure of a stock's intrinsic value, computed considering historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line denotes the stock's ideal fair trading value.

According to GuruFocus' valuation method, Carrier Global (CARR, Financial) appears to be modestly overvalued. If the stock price is significantly above the GF Value Line, it indicates overvaluation and potential for poor future returns. Conversely, if it's significantly below, the stock may be undervalued and likely to offer higher future returns. Given its current overvaluation, Carrier Global's long-term stock return might be lower than its business growth.

Financial Strength

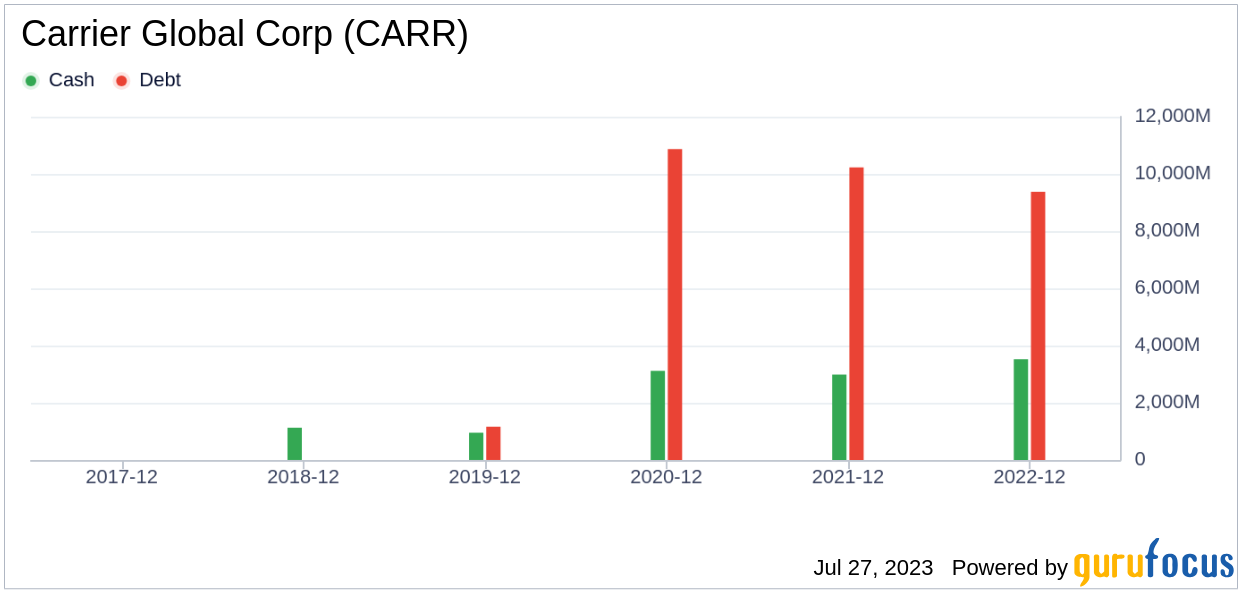

Investing in companies with poor financial strength carries a higher risk of permanent capital loss. Therefore, understanding a company's financial strength is crucial. Carrier Global's cash-to-debt ratio is 0.36, lower than 64.71% of companies in the Construction industry, indicating fair financial strength.

Profitability and Growth

Investing in profitable companies, especially those demonstrating consistent profitability over the long term, is typically less risky. Carrier Global, with an operating margin of 11.24%, ranks better than 79.25% of companies in the Construction industry. Furthermore, its 3-year average revenue growth rate is better than 50.1% of companies in the same industry, indicating fair profitability and growth.

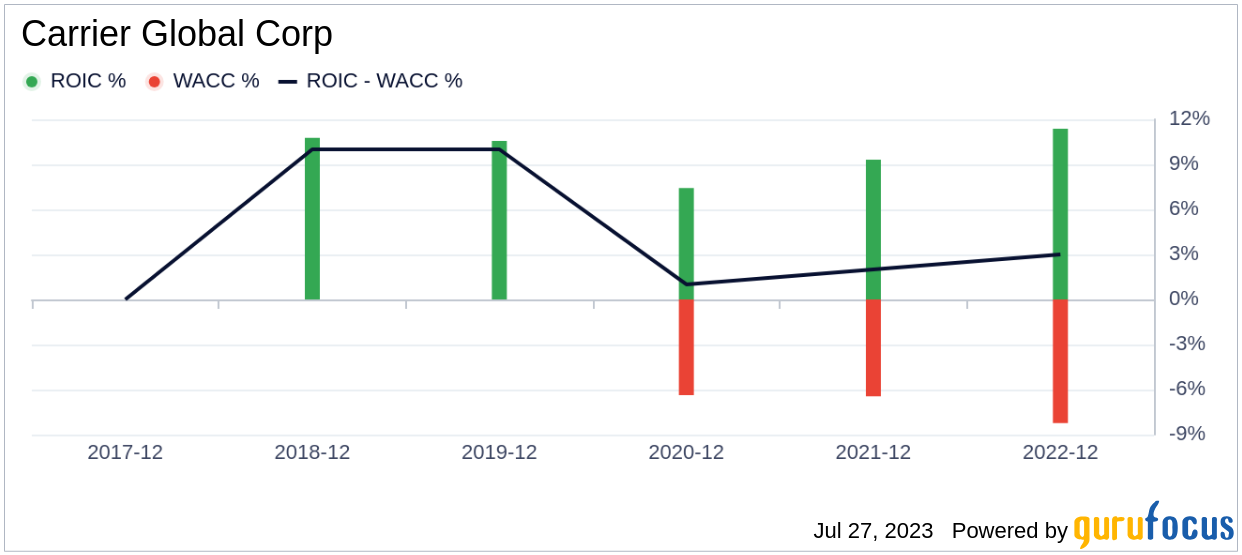

ROIC vs WACC

Return on invested capital (ROIC) measures how well a company generates cash flow relative to its invested capital. The weighted average cost of capital (WACC) is the average rate a company is expected to pay to finance its assets. If the ROIC exceeds the WACC, the company is likely creating value for its shareholders. Carrier Global's ROIC is 11.76 while its WACC is 10.26, indicating value creation.

Conclusion

In conclusion, Carrier Global Corp (CARR, Financial) appears to be modestly overvalued. Its financial condition is fair, and its profitability is also fair. Its growth ranks better than 80.32% of companies in the Construction industry. For more detailed financial information about Carrier Global, you can check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, visit the GuruFocus High Quality Low Capex Screener.