On July 28, 2023, Meta Platforms Inc (META, Financial) saw a daily gain of 3.71%, with its Earnings Per Share (EPS) standing at 8.58. The question we aim to answer is: Is the stock modestly undervalued? This article provides a comprehensive valuation analysis of Meta Platforms, offering valuable insights for potential investors. We invite you to read on for an in-depth evaluation.

Company Overview

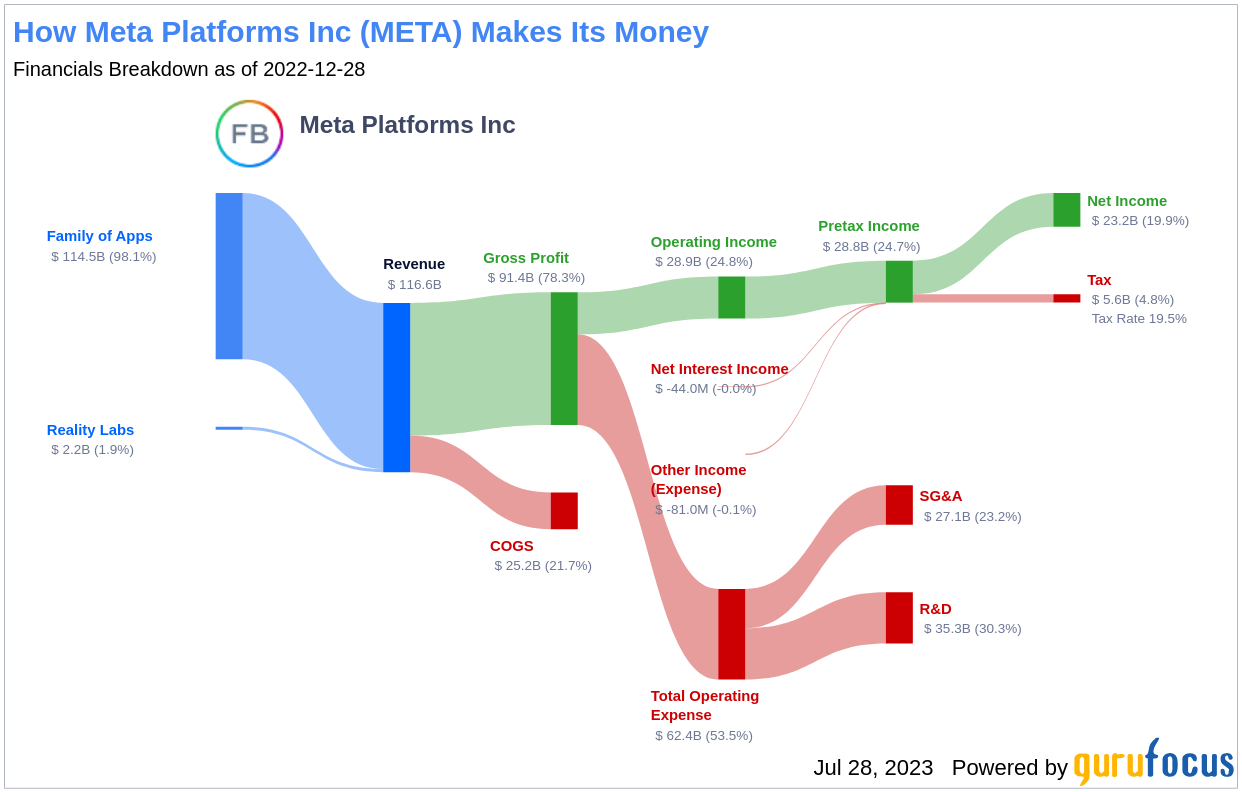

Meta Platforms Inc (META, Financial) is the world's largest online social network, boasting 3.8 billion monthly active users across its family of apps. Users interact in various ways, from exchanging messages to sharing news, photos, and videos. The ecosystem primarily includes Facebook, Instagram, Messenger, WhatsApp, and several features surrounding these products. Over 90% of the firm's total revenue comes from advertising, with more than 45% originating from the U.S. and Canada, and over 20% from Europe.

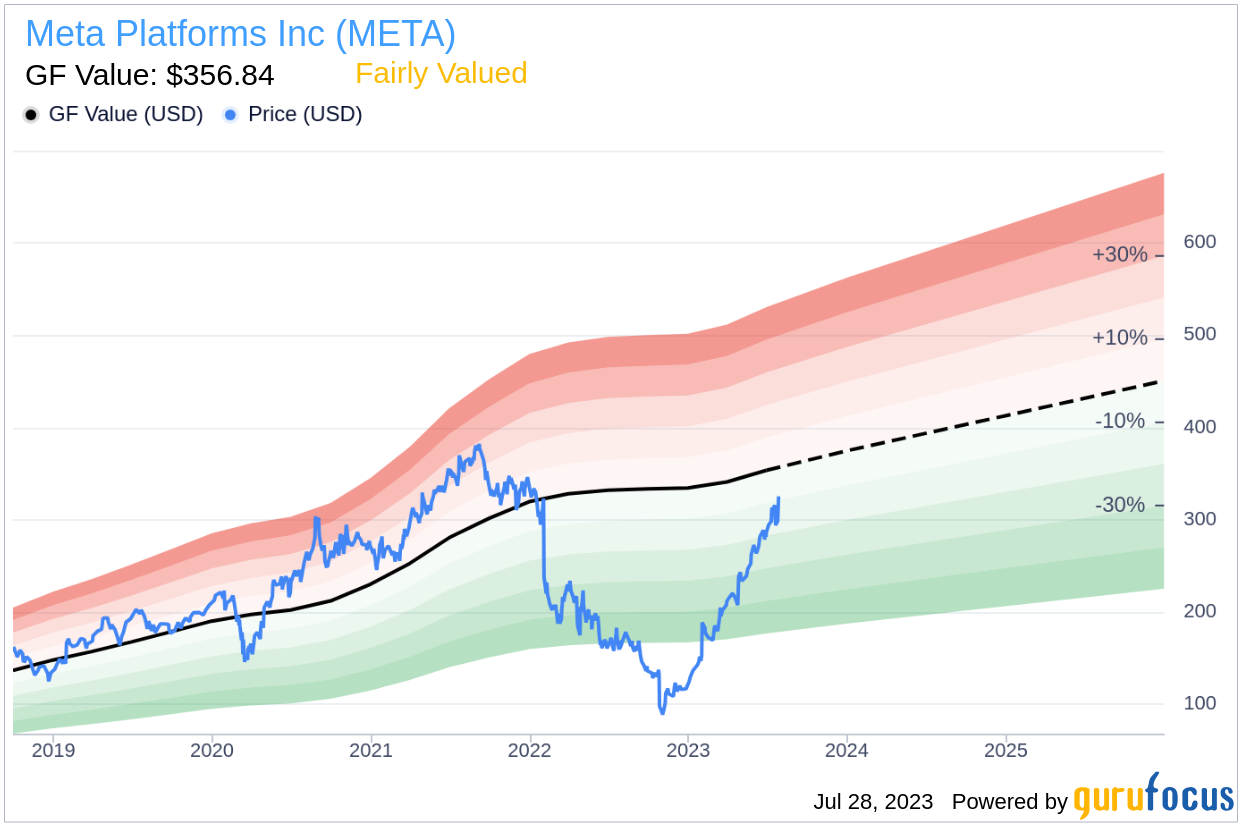

The current stock price for Meta Platforms stands at $323.29 per share, with a market cap of $831.9 billion. Comparatively, the GF Value, an estimation of fair value, is $356.84. This comparison sets the stage for a deeper exploration of the company's value.

Understanding GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line on the summary page provides an overview of the stock's ideal fair trading value.

According to GuruFocus Value calculation, Meta Platforms (META, Financial) is modestly undervalued. The stock is believed to be traded at a fair value of $356.84, based on historical multiples, past business growth, and analyst estimates of future business performance. If a stock is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher. As Meta Platforms is relatively undervalued, the long-term return of its stock is likely to be higher than its business growth.

These companies may deliver higher future returns at reduced risk.

Financial Strength

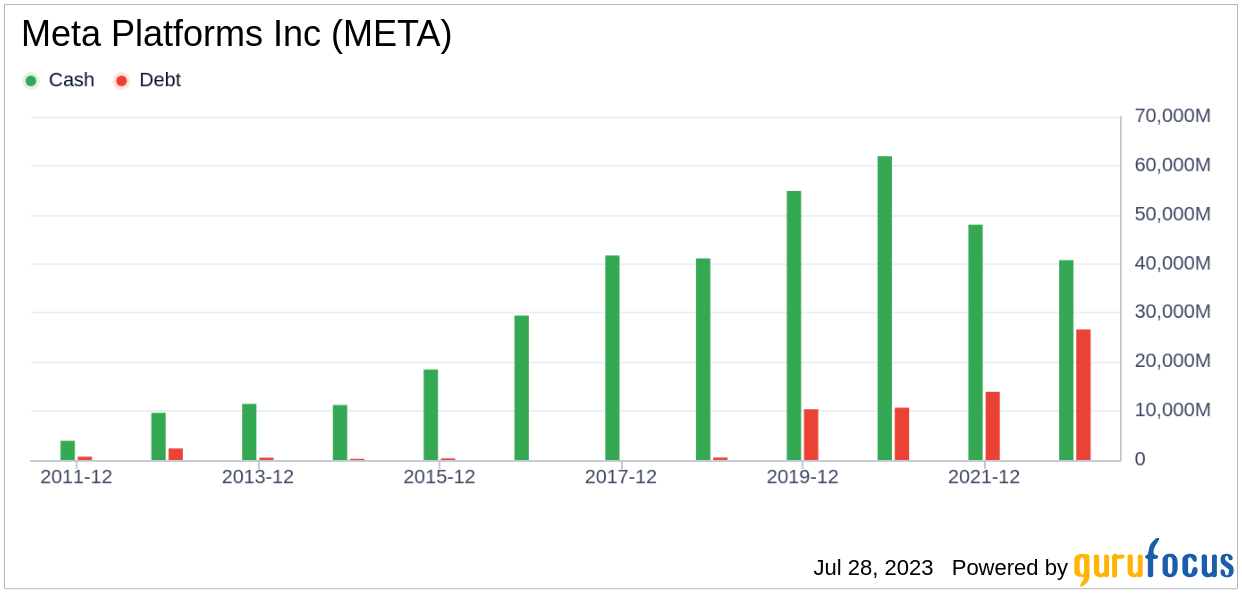

Investing in companies with low financial strength could result in permanent capital loss. It's crucial to carefully review a company's financial strength before deciding to buy shares. Looking at the cash-to-debt ratio and interest coverage can give a good initial perspective. Meta Platforms has a cash-to-debt ratio of 1.36, which ranks worse than 73.37% of companies in the Interactive Media industry. Based on this, GuruFocus ranks Meta Platforms's financial strength as 8 out of 10, suggesting a strong balance sheet.

Profitability and Growth

Investing in profitable companies, especially those demonstrating consistent profitability over the long term, poses less risk. A company with high profit margins is also typically a safer investment than one with low profit margins. Meta Platforms has been profitable 10 out of the past 10 years. Over the past twelve months, the company had a revenue of $120.5 billion and an Earnings Per Share (EPS) of $8.58. Its operating margin is 23.56%, which ranks better than 84.77% of companies in the Interactive Media industry. Overall, GuruFocus ranks the profitability of Meta Platforms at 9 out of 10, indicating strong profitability.

One of the most important factors in the valuation of a company is growth. Long-term stock performance is closely correlated with growth. Companies that grow faster create more value for shareholders, especially if that growth is profitable. The average annual revenue growth of Meta Platforms is 20.6%, which ranks better than 71.43% of companies in the Interactive Media industry. The 3-year average EBITDA growth is 10.5%, which ranks better than 51.28% of companies in the Interactive Media industry.

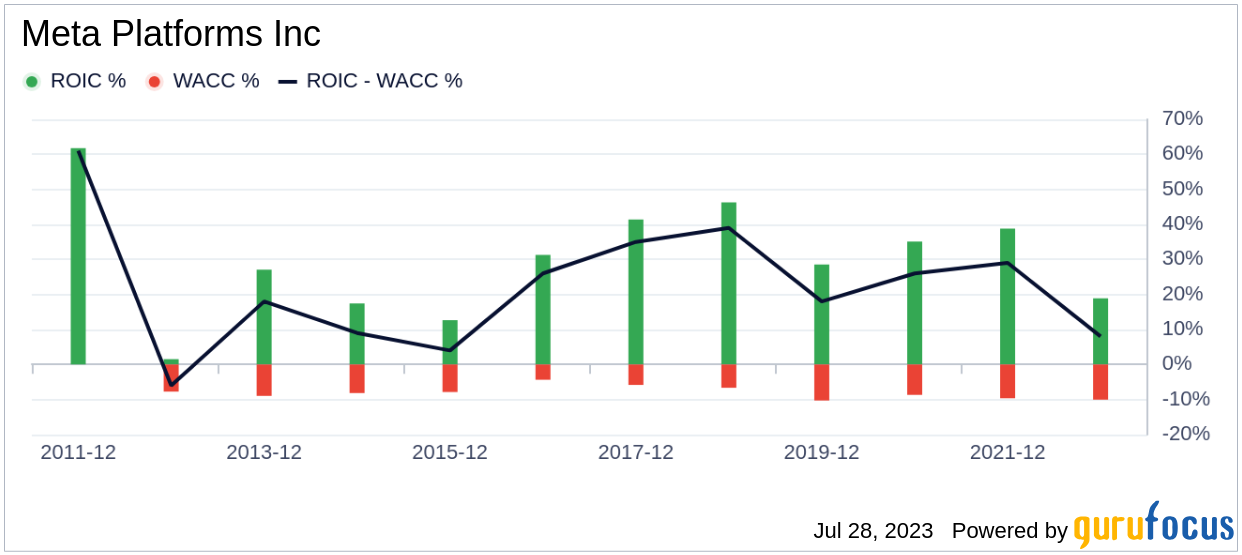

ROIC vs WACC

Evaluating a company's profitability can also be done by comparing its return on invested capital (ROIC) to its weighted cost of capital (WACC). ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. If the ROIC is higher than the WACC, it indicates that the company is creating value for shareholders. Over the past 12 months, Meta Platforms's ROIC was 17.49, while its WACC came in at 10.17.

Conclusion

In conclusion, the stock of Meta Platforms (META, Financial) is believed to be modestly undervalued. The company's financial condition is strong and its profitability is robust. Its growth ranks better than 51.28% of companies in the Interactive Media industry. To learn more about Meta Platforms stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.