Advanced Micro Devices Inc (AMD, Financial) experienced a 3.15% gain, closing at a price of $116.71 per share on August 4, 2023. Despite a Loss Per Share of $0.02, our analysis suggests that the stock is fairly valued. This article aims to provide a comprehensive valuation analysis of AMD, offering insights into the company's financial health and future prospects. We invite you to delve into this detailed analysis.

Advanced Micro Devices Inc: An Overview

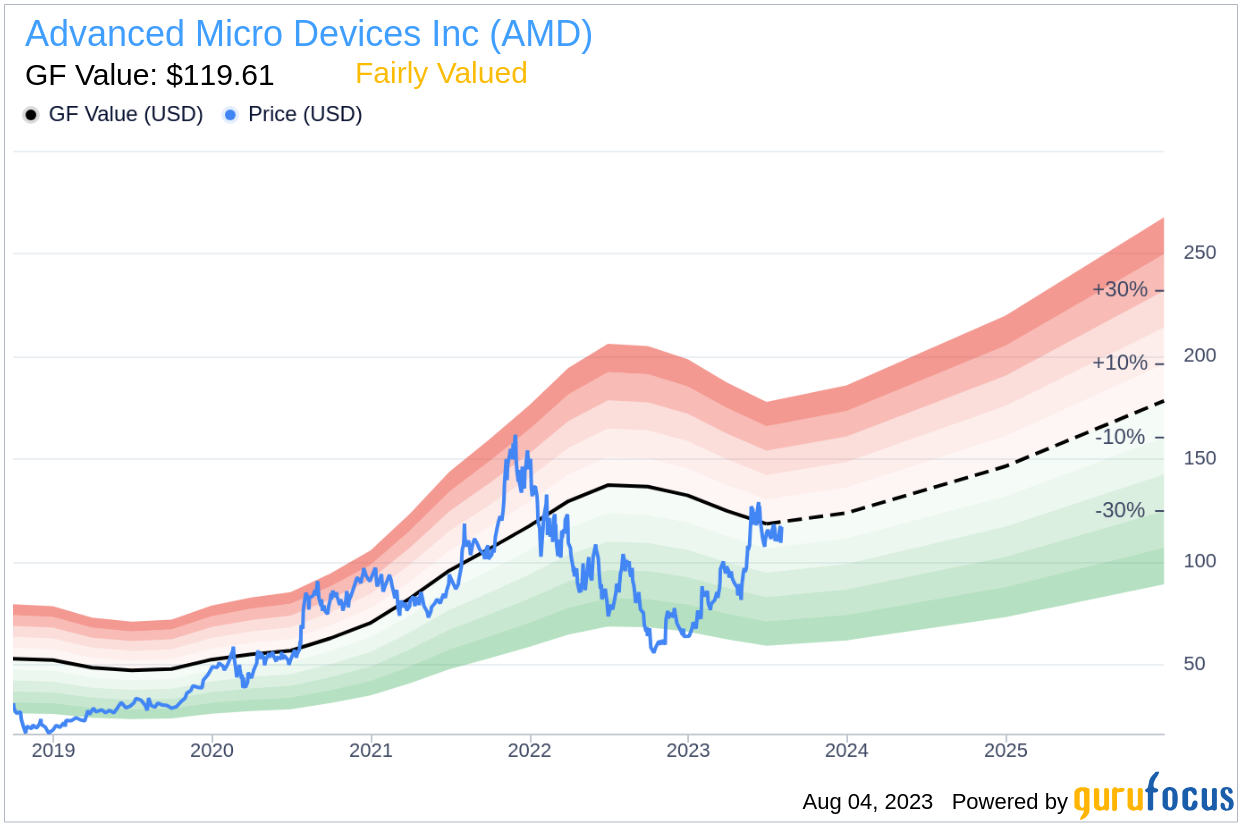

Advanced Micro Devices designs microprocessors for the computer and consumer electronics industries. The firm has a significant presence in the personal computer and data center markets, supplying CPUs and GPUs. It also provides chips for popular game consoles like Sony PlayStation and Microsoft Xbox. The company's acquisition of ATI in 2006 and Xilinx in 2022 diversifies its business and boosts its opportunities in key markets such as data centers and automotive. With a current market cap of $188.6 billion, the stock is trading close to its GF Value of $119.61, suggesting it's fairly valued.

Understanding the GF Value

The GF Value is a proprietary measure that estimates a stock's intrinsic value. It considers historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates. The GF Value Line represents the stock's ideal fair trading value. If a stock price significantly deviates from the GF Value Line, it may be overvalued or undervalued, impacting its future returns.

For Advanced Micro Devices, the GF Value calculation suggests that the stock is fairly valued. This means that the long-term return of its stock is likely to align with the rate of its business growth.

Financial Strength of Advanced Micro Devices

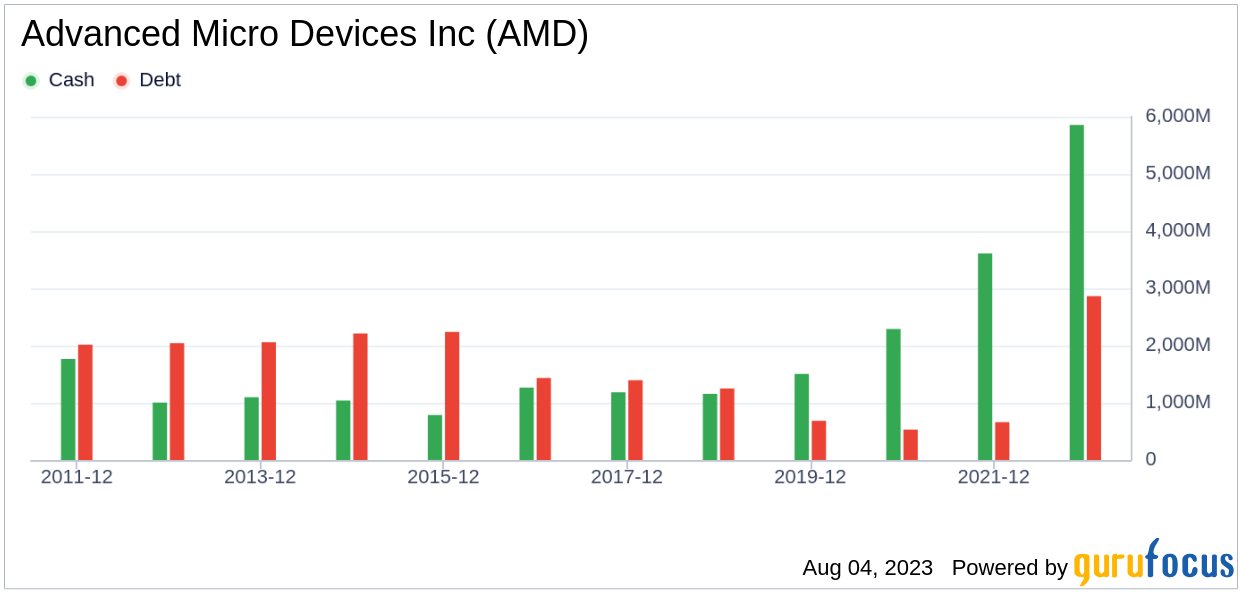

Investing in companies with robust financial strength can minimize the risk of permanent capital loss. The cash-to-debt ratio and interest coverage can provide an initial perspective on the company's financial strength. Advanced Micro Devices has a cash-to-debt ratio of 2.2, ranking better than 52.21% of companies in the Semiconductors industry. GuruFocus ranks Advanced Micro Devices's financial strength as 8 out of 10, indicating a strong balance sheet.

Profitability and Growth of Advanced Micro Devices

Companies consistently profitable over the long term offer less risk for investors. Advanced Micro Devices has been profitable 5 times over the past 10 years. With a revenue of $21.9 billion over the past twelve months and an operating margin of -1.73%, the company's profitability is ranked 7 out of 10.

Long-term stock performance is closely correlated with growth. Companies that grow faster create more value for shareholders. The average annual revenue growth of Advanced Micro Devices is 35.7%, ranking better than 88.82% of companies in the Semiconductors industry. The 3-year average EBITDA growth is 76%, outperforming 90.52% of companies in the industry.

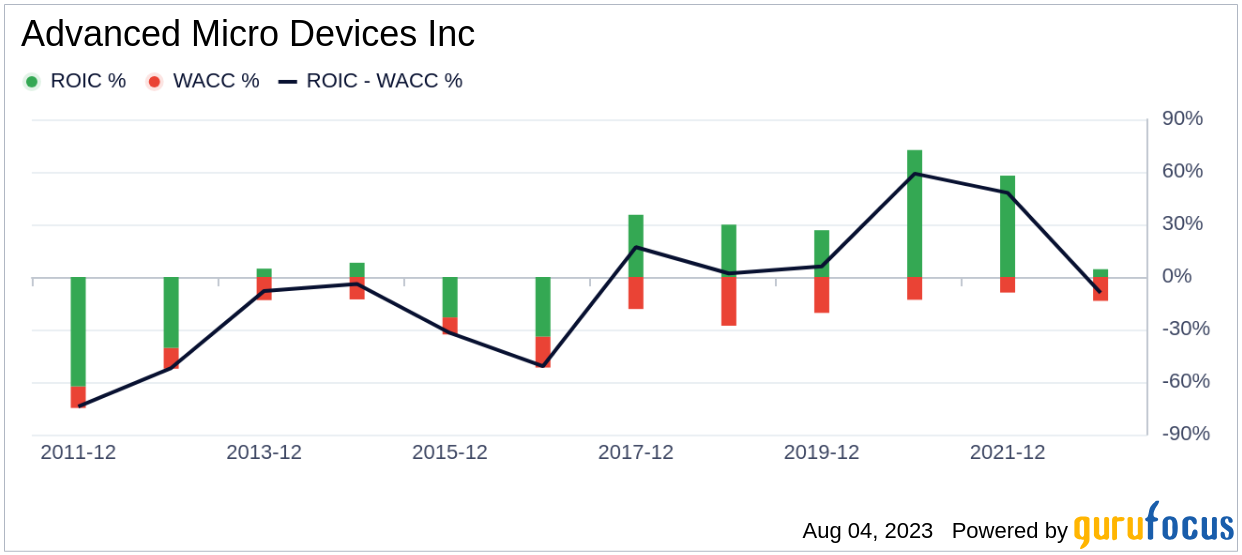

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to the weighted average cost of capital (WACC) can provide insights into its profitability. If the ROIC exceeds the WACC, the company is creating value for shareholders. For the past 12 months, Advanced Micro Devices's ROIC is -0.08, and its WACC is 16.66.

Conclusion

In conclusion, Advanced Micro Devices (AMD, Financial) stock appears to be fairly valued. The company exhibits strong financial health and fair profitability. Its growth outperforms 90.52% of companies in the Semiconductors industry. For more information about Advanced Micro Devices stock, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, visit the GuruFocus High Quality Low Capex Screener.