Despite a daily loss of 3.56%, Broadcom Inc (AVGO, Financial) boasts a 38.45% gain over the past three months. With an Earnings Per Share (EPS) of 31.89, the question arises: is Broadcom's stock modestly overvalued? This article presents an in-depth valuation analysis of Broadcom, underlining its financial strengths, profitability, and growth prospects. Let's delve into the details.

A Glance at Broadcom Inc

Broadcom Inc, the sixth-largest semiconductor company worldwide, has expanded into various software businesses, generating over $30 billion in annual revenue. It sells 17 core semiconductor product lines across wireless, networking, broadband, storage, and industrial markets, with Apple accounting for roughly one fifth of its sales. The company's current stock price stands at $851.71, while our computed GF Value, an estimation of its fair value, is $652.91, suggesting a modest overvaluation.

Understanding GF Value

The GF Value represents the intrinsic value of a stock based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

Our analysis indicates that Broadcom (AVGO, Financial) is modestly overvalued. The stock's current price of $851.71 per share and the market cap of $351.50 billion suggest a modest overvaluation. Hence, the long-term return of its stock is likely to be lower than its business growth.

Broadcom's Financial Strength

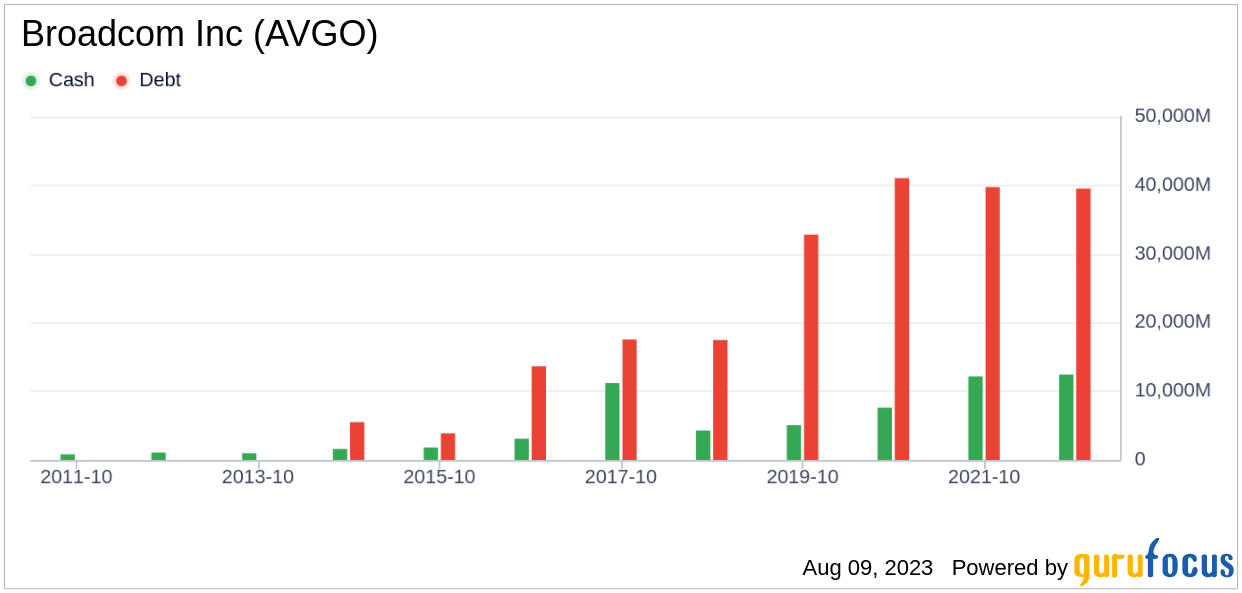

Companies with poor financial strength pose a high risk of permanent capital loss. Broadcom has a cash-to-debt ratio of 0.29, which ranks worse than 85.61% of companies in the Semiconductors industry. The overall financial strength of Broadcom is 6 out of 10, indicating fair financial health.

Profitability and Growth

Consistently profitable companies offer less risk for investors. Broadcom has been profitable 9 out of the past 10 years, with an operating margin of 45.3%, ranking better than 97.54% of companies in the Semiconductors industry. The profitability of Broadcom is ranked 9 out of 10, indicating strong profitability.

Growth is a crucial factor in a company's valuation. Broadcom's 3-year average revenue growth rate is better than 53.52% of companies in the Semiconductors industry. Its 3-year average EBITDA growth rate is 26%, which ranks better than 54.29% of companies in the Semiconductors industry.

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can also evaluate its profitability. Over the past 12 months, Broadcom's ROIC was 24.78, while its WACC came in at 10.22, indicating value creation for shareholders.

Conclusion

In summary, Broadcom's stock appears to be modestly overvalued. The company's financial condition is fair, its profitability is strong, and its growth ranks better than 54.29% of companies in the Semiconductors industry. To learn more about Broadcom stock, check out its 30-Year Financials here.

For high-quality companies that may deliver above-average returns, check out GuruFocus High Quality Low Capex Screener.