NVIDIA Corp (NVDA, Financial), a leading designer of discrete graphics processing units, has seen a daily loss of 5.5% and a 3-month gain of 48.62%. With an Earnings Per Share (EPS) of 1.92, the question arises: is the stock significantly overvalued? This article aims to provide an in-depth analysis of NVIDIA's valuation, financial strength, and growth prospects. Let's dive into the details.

Company Introduction

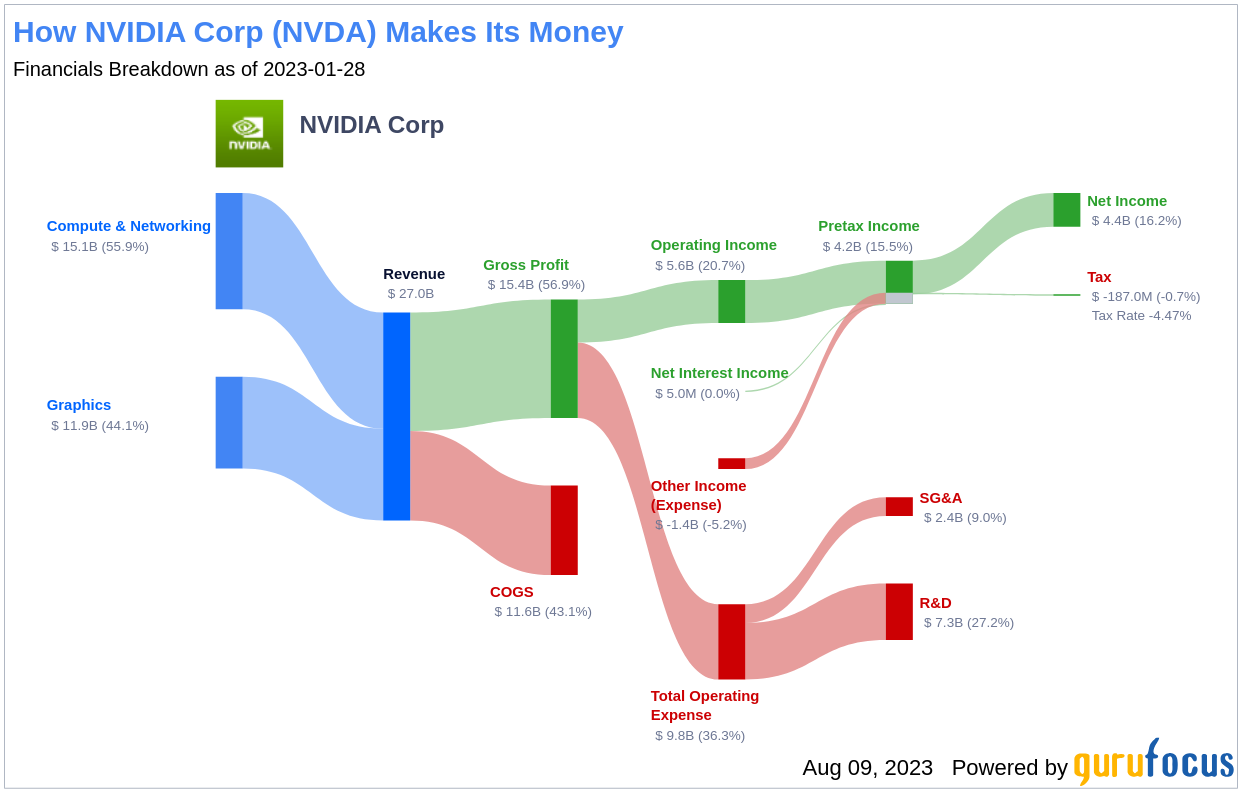

NVIDIA (NVDA, Financial) is renowned for enhancing computing platforms with its top-notch discrete graphics processing units. The firm's chips have diverse applications, ranging from PC gaming to data centers. Recently, NVIDIA has shifted its focus from traditional PC graphics applications to more complex opportunities, including artificial intelligence and autonomous driving. This shift leverages the high-performance capabilities of the firm's products.

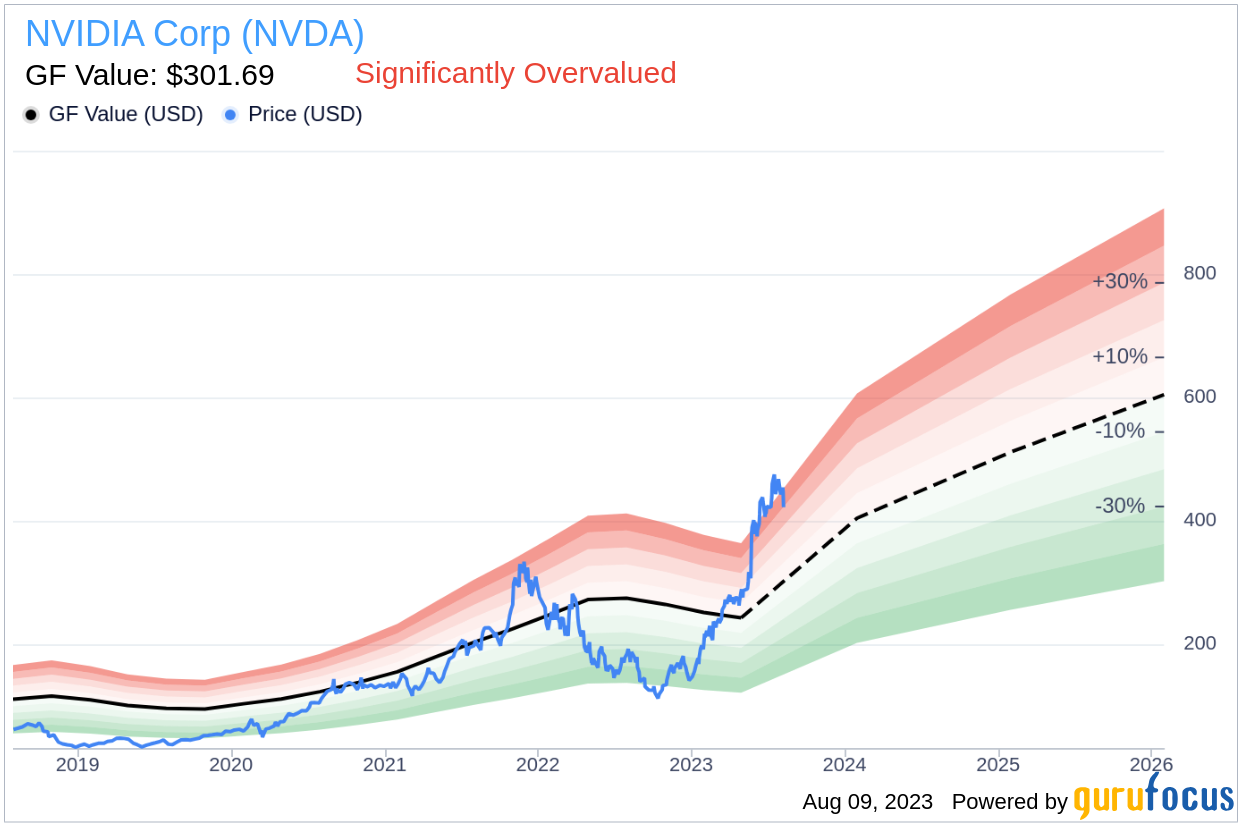

At the current price of $422.09 per share, NVIDIA has a market cap of $1 trillion, which is significantly higher than its GF Value of $301.69. This discrepancy suggests that the stock might be overvalued. The GF Value is an estimation of the fair value of the stock, providing a benchmark for investors to assess the stock's current price.

GF Value of NVIDIA

The GF Value of NVIDIA is derived from a proprietary method that considers historical trading multiples, GuruFocus adjustment factors based on past performance and growth, and future business performance estimates. The GF Value Line indicates the ideal fair trading value of the stock. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

Given NVIDIA's current price and market cap, the stock appears to be significantly overvalued. Therefore, the long-term return of its stock is likely to be much lower than its future business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength of NVIDIA

Investing in companies with poor financial strength carries a higher risk of permanent capital loss. Therefore, it's crucial to carefully review the financial strength of a company before deciding to invest in its stock. A good starting point is to look at the cash-to-debt ratio and interest coverage. NVIDIA has a cash-to-debt ratio of 1.27, which is worse than 58.82% of companies in the Semiconductors industry. However, GuruFocus ranks NVIDIA's overall financial strength at 8 out of 10, indicating strong financial strength.

Profitability and Growth of NVIDIA

Investing in profitable companies, especially those with consistent profitability over the long term, is usually less risky. NVIDIA has been profitable 10 out of the past 10 years. Over the past twelve months, the company had a revenue of $25.90 billion and an Earnings Per Share (EPS) of $1.92. Its operating margin is 17.37%, which ranks better than 75.08% of companies in the Semiconductors industry. Overall, the profitability of NVIDIA is ranked 10 out of 10, indicating strong profitability.

One of the most crucial factors in the valuation of a company is its growth. Companies that grow faster create more value for shareholders, especially if that growth is profitable. The average annual revenue growth of NVIDIA is 34.5%, which ranks better than 87.77% of companies in the Semiconductors industry. However, its 3-year average EBITDA growth is 20.1%, which ranks worse than 53.12% of companies in the Semiconductors industry.

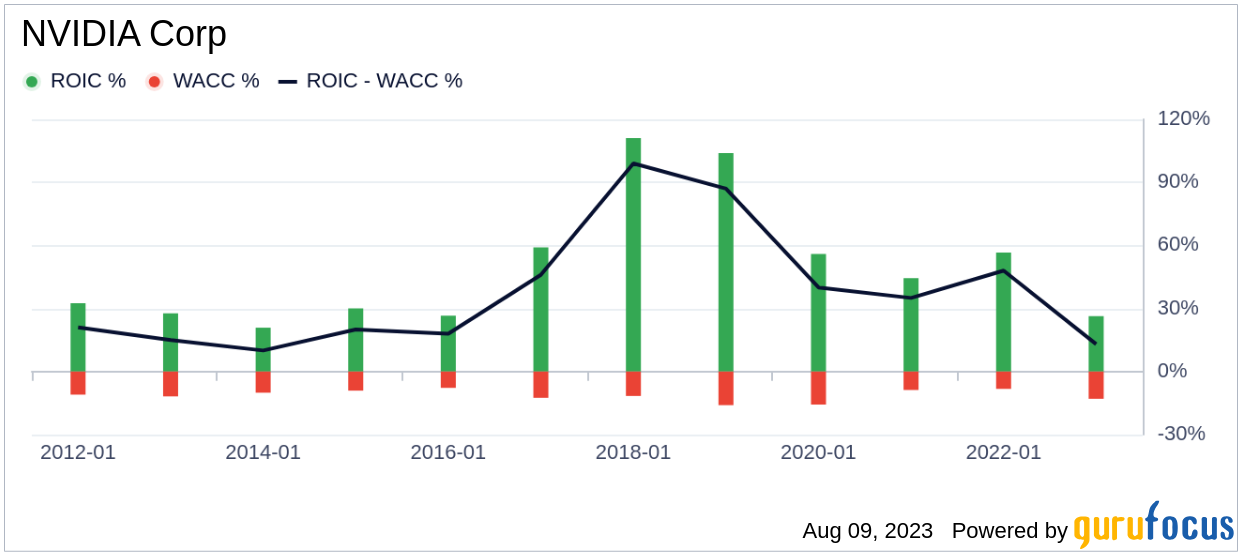

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can also provide insights into its profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. If ROIC exceeds WACC, the company is likely creating value for its shareholders. Over the past 12 months, NVIDIA's ROIC was 20.32, while its WACC was 16.53.

Conclusion

In conclusion, the stock of NVIDIA Corp (NVDA, Financial) appears to be significantly overvalued. Despite the company's strong financial condition and profitability, its growth ranks worse than 53.12% of companies in the Semiconductors industry. To learn more about NVIDIA stock, check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.