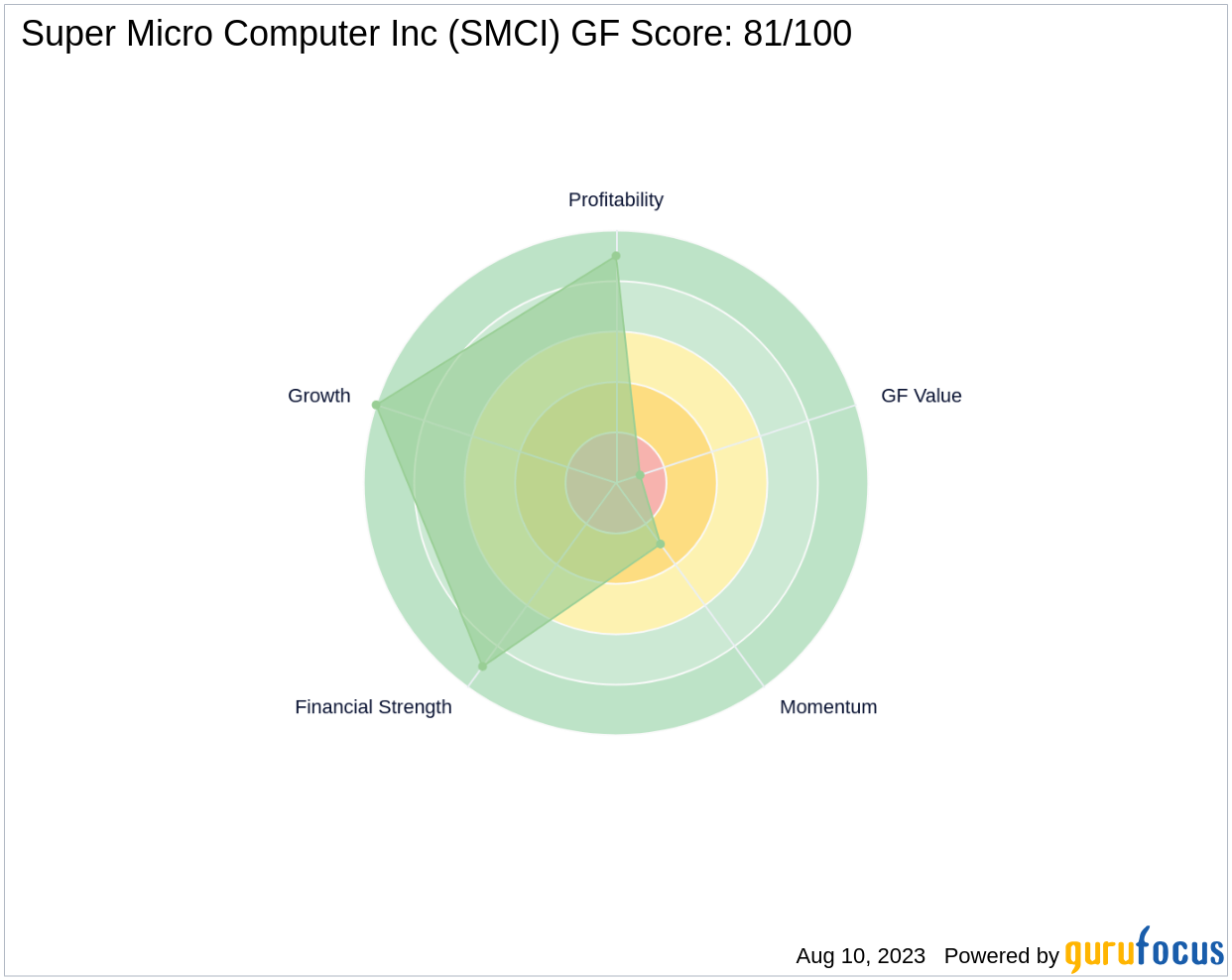

Super Micro Computer Inc (SMCI, Financial), a prominent player in the hardware industry, is currently trading at $277.98 with a market cap of $14.58 billion. The company's stock price has seen a gain of 4.45% today and an increase of 1.04% over the past four weeks. With a GF Score of 81 out of 100, SMCI falls into the category of stocks with good outperformance potential. This article will delve into the various aspects of SMCI's GF Score and what it suggests about the company's future performance.

Financial Strength: A Solid Foundation

SMCI's Financial Strength rank stands at 9 out of 10, indicating a robust financial situation. The company's high interest coverage of 72.55 and low debt to revenue ratio of 0.03 demonstrate its ability to manage debt effectively. Furthermore, an Altman Z score of 11.62 suggests a low probability of bankruptcy.

Profitability Rank: Consistent and Promising

The company's Profitability Rank is 9 out of 10, reflecting its consistent profitability. With an operating margin of 10.64% and a Piotroski F-Score of 7, SMCI demonstrates strong operational efficiency and financial health. The company has also maintained profitability for the past 10 years, indicating a stable business model.

Growth Rank: Impressive Trajectory

SMCI's Growth Rank is a perfect 10 out of 10, reflecting its impressive growth in terms of revenue and profitability. The company's 5-year revenue growth rate stands at 10.60%, and its 3-year revenue growth rate is 12.70%, indicating a consistent upward trajectory.

GF Value Rank: Room for Improvement

The company's GF Value Rank is 1 out of 10, suggesting that the stock is currently overvalued. However, given the company's strong financial strength, profitability, and growth, it may still present a viable investment opportunity for long-term investors.

Momentum Rank: Moderate Momentum

With a Momentum Rank of 3 out of 10, SMCI's stock price performance has been moderate. While the company's stock has seen some positive movement, it has not yet reached the high momentum levels of some of its competitors.

Competitor Analysis: Standing Strong

When compared to its main competitors in the hardware industry, SMCI holds its ground. NetApp Inc (NTAP, Financial) has a slightly higher GF Score of 87, while Western Digital Corp (WDC, Financial) and Seagate Technology Holdings PLC (STX, Financial) lag behind with GF Scores of 57 and 67, respectively. This suggests that SMCI has a strong performance potential relative to its competitors. For more details, please visit our competitors page.

In conclusion, Super Micro Computer Inc (SMCI, Financial) presents a compelling investment opportunity with its strong financial strength, consistent profitability, impressive growth, and good outperformance potential. However, investors should also consider its current overvaluation and moderate momentum before making investment decisions.