On August 9, 2023, Polar Asset Management Partners Inc. (Trades, Portfolio), a Toronto-based investment firm, reduced its stake in PHP Ventures Acquisition Corp. This article provides an in-depth analysis of the transaction, the profiles of the guru and the traded company, and the performance of the traded stock in the market.

Details of the Transaction

Polar Asset Management Partners Inc. (Trades, Portfolio) sold 21,179 shares of PHP Ventures Acquisition Corp on August 9, 2023, at a price of $10.96 per share. This transaction reduced the firm's total holdings in PHP Ventures Acquisition Corp to 278,821 shares, representing 0.06% of the firm's portfolio and 7.97% of PHP Ventures Acquisition Corp's total shares. The transaction had no significant impact on the firm's portfolio or the traded company's stock.

Profile of Polar Asset Management Partners Inc. (Trades, Portfolio)

Polar Asset Management Partners Inc. (Trades, Portfolio) is a Toronto-based investment firm with a portfolio of 1019 stocks, valued at $5.27 billion. The firm's top holdings include Sprott Physical Gold Trust(PHYS, Financial), S&P 500 ETF TRUST ETF(SPY, Financial), MACOM Technology Solutions Holdings Inc(MTSI, Financial), Bio-Rad Laboratories Inc(BIO, Financial), and Penumbra Inc(PEN, Financial). The firm primarily invests in the Financial Services and Technology sectors.

Overview of PHP Ventures Acquisition Corp

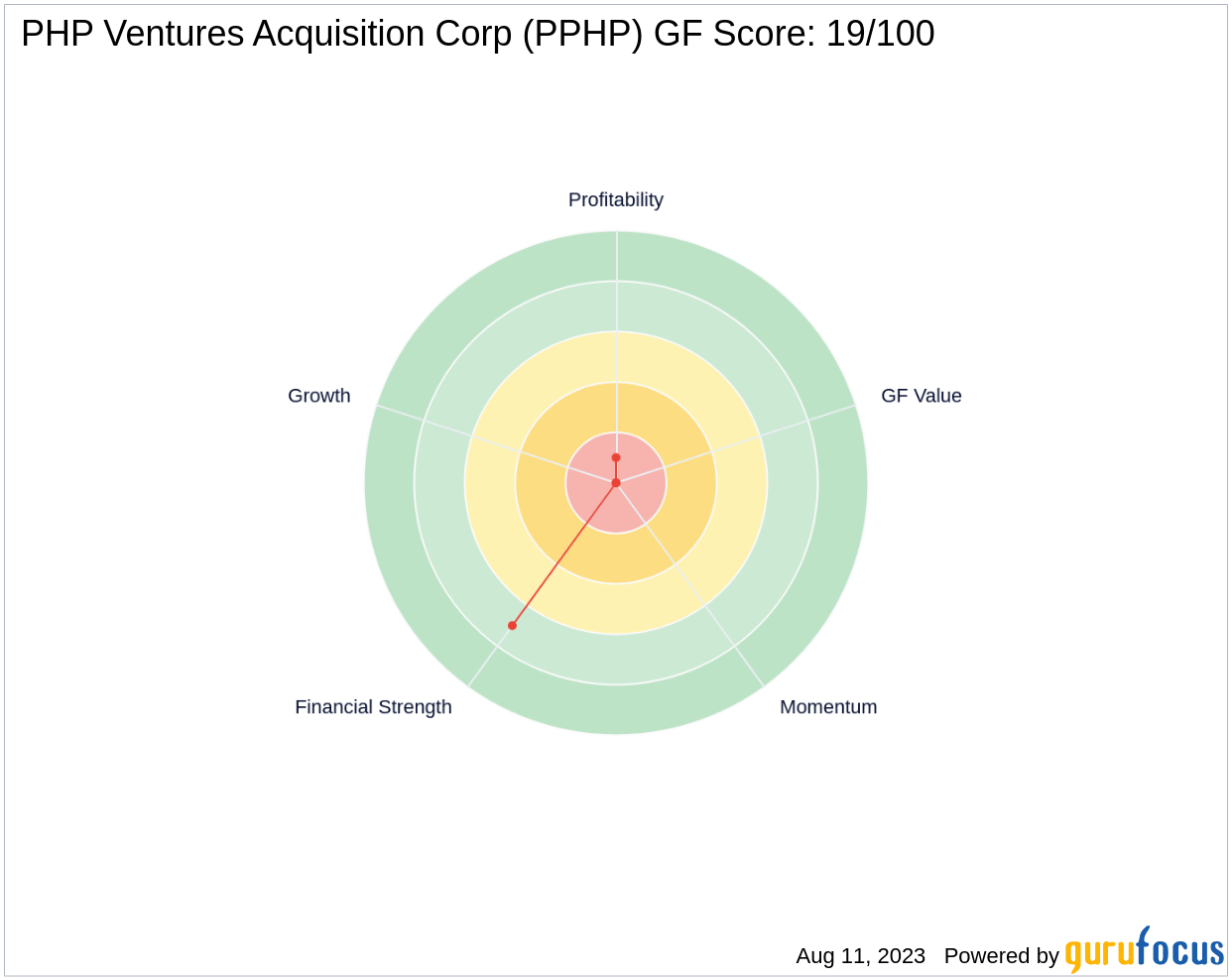

PHP Ventures Acquisition Corp is a Malaysia-based blank check company. The company, which went public on October 4, 2021, has a market capitalization of $38.295 million and a current stock price of $10.93. Since its IPO, the company's stock has gained 11.3%, and its year-to-date performance stands at 5.5%. The company's GF Score is 19/100, indicating poor future performance potential.

Analysis of the Traded Stock

PHP Ventures Acquisition Corp's financial strength is rated 7/10, according to its balance sheet rank. However, its profitability rank is only 1/10, indicating low profitability. The company's growth rank is 0/10, suggesting no growth potential. The company's Altman Z Score and cash to debt ratio are both 0, indicating financial distress and high debt levels, respectively.

Performance of the Traded Stock in the Market

PHP Ventures Acquisition Corp's RSI 5 Day, RSI 9 Day, and RSI 14 Day are 47.45, 51.95, and 53.81, respectively. The company's Momentum Index 6 - 1 Month and Momentum Index 12 - 1 Month are 1.70 and 6.34, respectively. The company's RSI 14 Day Rank and Momentum Index 6 - 1 Month Rank are 388 and 468, respectively.

Conclusion

In conclusion, Polar Asset Management Partners Inc. (Trades, Portfolio)'s recent transaction has reduced its stake in PHP Ventures Acquisition Corp but has not significantly impacted the firm's portfolio or the traded company's stock. PHP Ventures Acquisition Corp's poor GF Score and low profitability, growth, and financial strength ranks suggest that the company may not be a promising investment. However, the company's performance since its IPO and its year-to-date performance indicate some potential for growth. Investors should monitor the company's performance and the market's response to the transaction closely.