ON Semiconductor Corp (ON, Financial) has seen a daily gain of 1.94% and a three-month gain of 17.15%. The company's Earnings Per Share (EPS) stand at 4.37. However, the key question remains: Is the stock significantly overvalued? The following analysis will shed light on this question, diving deep into the company's valuation and financial performance.

Company Profile

ON Semiconductor Corp (ON, Financial) is a prominent supplier of power semiconductors and sensors, primarily catering to the automotive and industrial markets. As the second-largest power chipmaker worldwide and the leading supplier of image sensors to the automotive sector, ON Semiconductor has a significant market presence. The company has adopted a hybrid manufacturing strategy, offering flexibility in capacity. It is currently focusing on emerging applications such as electric vehicles, autonomous vehicles, industrial automation, and renewable energy.

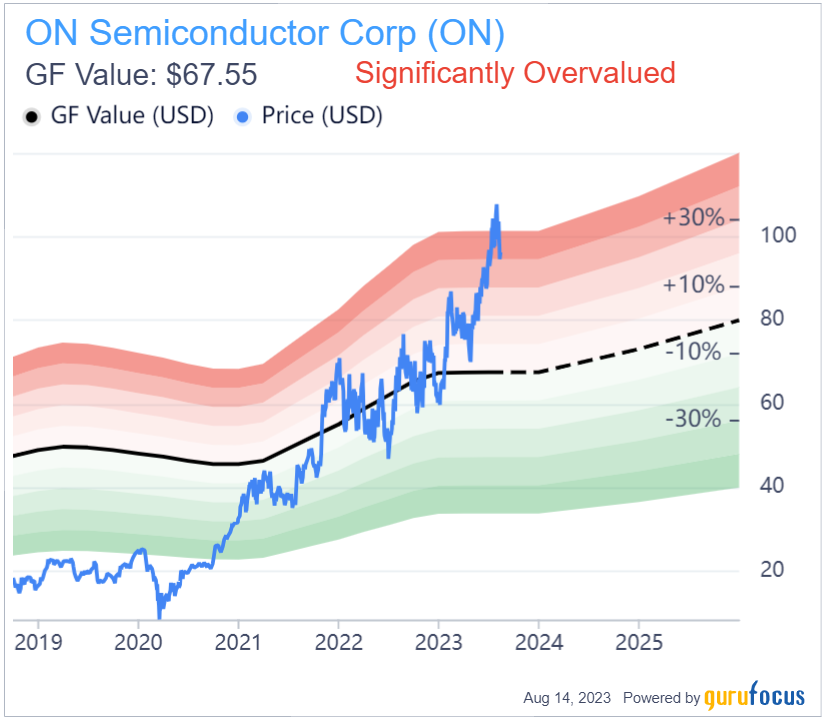

Understanding GF Value

The GF Value is a unique measure of a stock's intrinsic value. It is computed based on historical trading multiples, a GuruFocus adjustment factor that considers past performance and growth, and future business performance estimates. The GF Value Line provides an overview of the fair value at which the stock should ideally be traded. If the stock price is significantly above the GF Value Line, it is considered overvalued and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

ON Semiconductor's stock is believed to be significantly overvalued according to the GuruFocus Value calculation. With its current price at $96.4 per share and a market cap of $41.60 billion, the future return of ON Semiconductor's stock is likely to be much lower than its future business growth due to its overvaluation.

Link: These companies may deliver higher future returns at reduced risk.

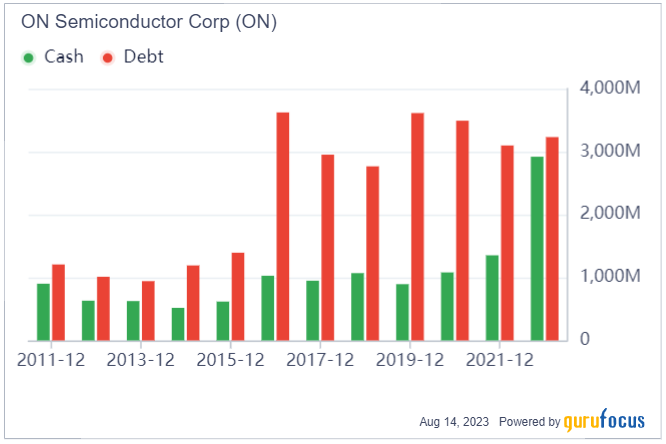

Financial Strength

Investing in companies with poor financial strength can pose a high risk of permanent capital loss. To avoid this, it's essential to review a company's financial strength before purchasing shares. ON Semiconductor's cash-to-debt ratio is 0.75, ranking worse than 69.51% of companies in the Semiconductors industry. However, the overall financial strength of ON Semiconductor is 8 out of 10, indicating strong financial health.

Profitability and Growth

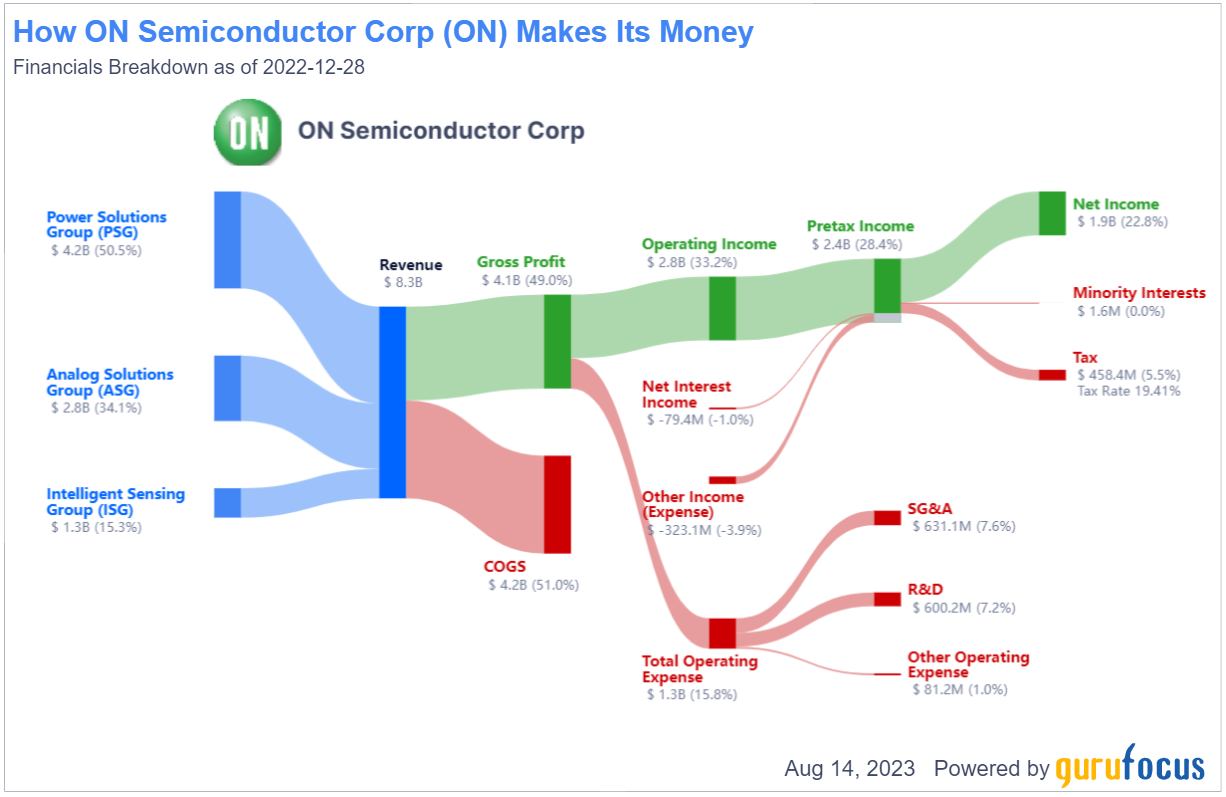

Investing in profitable companies, especially those with consistent profitability over the long term, is generally less risky. ON Semiconductor has been profitable 10 times over the past 10 years. Over the past twelve months, the company had a revenue of $8.40 billion and Earnings Per Share (EPS) of $4.37. Its operating margin is 32.66%, which ranks better than 94.32% of companies in the Semiconductors industry. Overall, the profitability of ON Semiconductor is ranked 9 out of 10, indicating strong profitability.

One of the most critical factors in a company's valuation is its growth. Companies that grow faster create more value for shareholders, especially if that growth is profitable. ON Semiconductor's average annual revenue growth is 11.9%, ranking worse than 50.35% of companies in the Semiconductors industry. However, its 3-year average EBITDA growth is 40%, ranking better than 72.47% of companies in the Semiconductors industry.

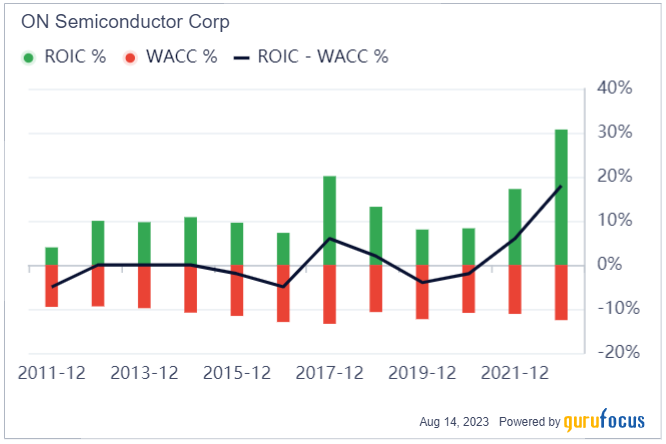

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to the weighted average cost of capital (WACC) is another method of determining its profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. When the ROIC is higher than the WACC, it implies the company is creating value for shareholders. For the past 12 months, ON Semiconductor's ROIC is 28.94, and its cost of capital is 11.28.

Conclusion

In conclusion, the stock of ON Semiconductor is believed to be significantly overvalued. Despite this, the company's financial condition is strong, and its profitability is strong. Its growth ranks better than 72.47% of companies in the Semiconductors industry. To learn more about ON Semiconductor stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.