With a daily gain of 1.59% and a three-month loss of -1.19%, Zebra Technologies Corp (ZBRA, Financial) is currently trading at $268.06 per share. Despite the recent fluctuations, the company boasts an impressive Earnings Per Share (EPS) of 12.51. But does this make the stock undervalued? In this analysis, we will delve into Zebra Technologies' valuation, financial strength, profitability, and growth to answer this question.

A Snapshot of Zebra Technologies

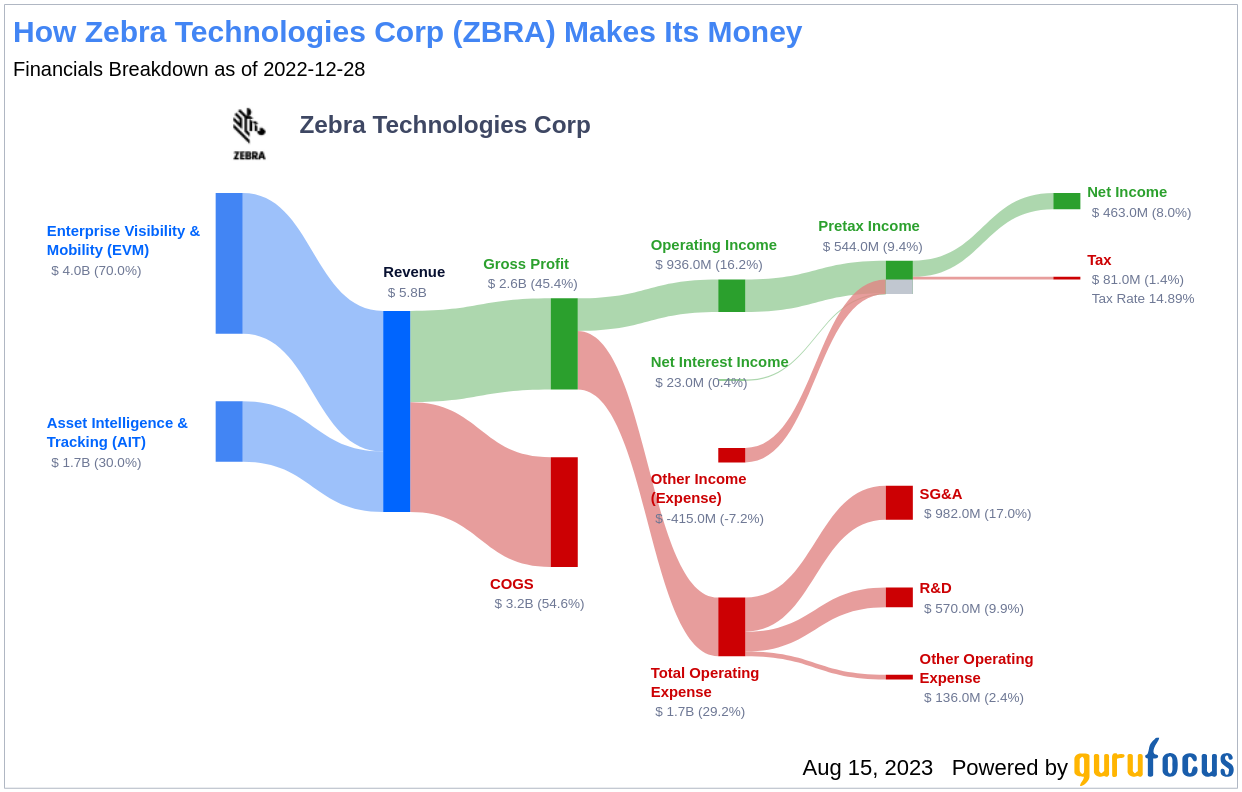

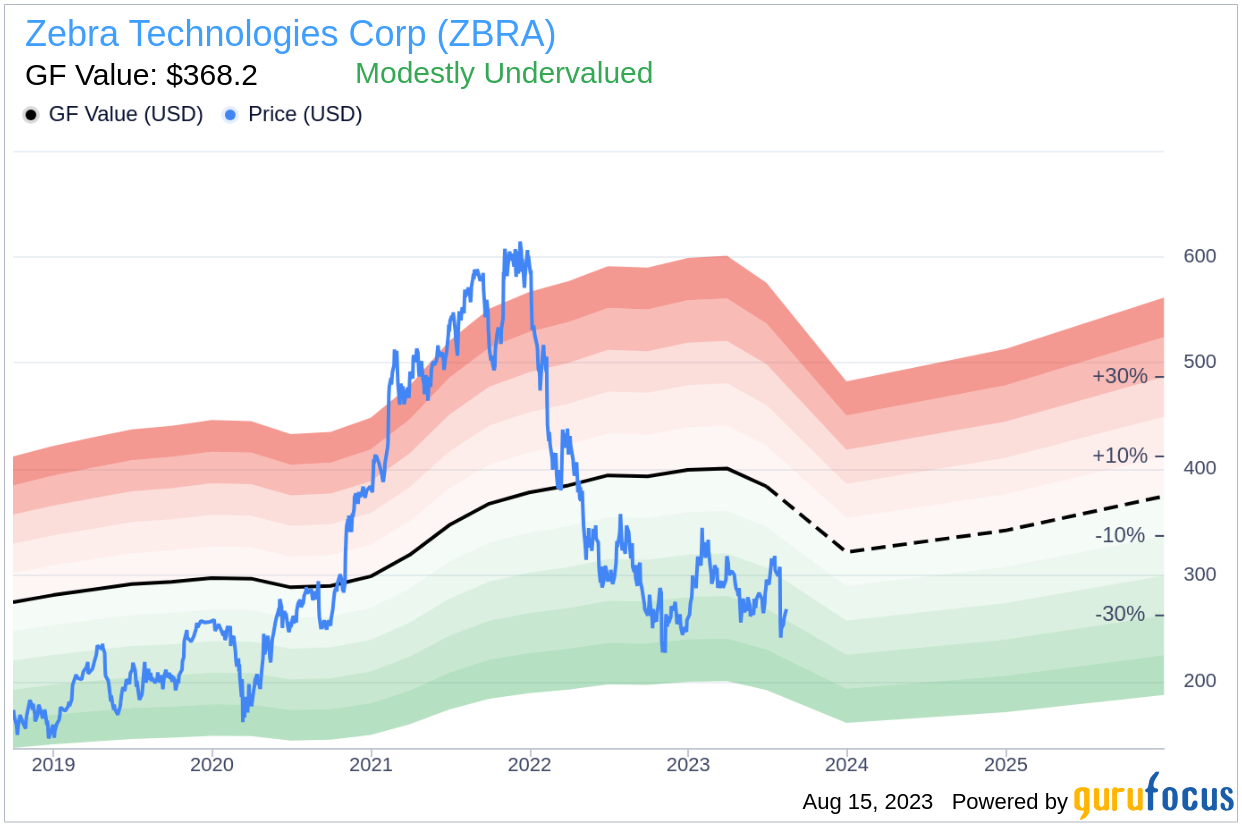

Zebra Technologies is a leading provider of automatic identification and data capture technology to enterprises. The company primarily serves the retail, transportation logistics, manufacturing, and healthcare markets, offering solutions like barcode printers and scanners, mobile computers, and workflow optimization software. With a market cap of $13.80 billion and annual sales of $5.50 billion, the company's stock is estimated to be modestly undervalued, trading below its GF Value of $368.2.

Understanding the GF Value

The GF Value is a proprietary measure that represents the intrinsic value of a stock. It is calculated based on historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates. If a stock's price is significantly above the GF Value Line, it is considered overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher. Zebra Technologies' current stock price suggests that it is modestly undervalued.

Financial Strength of Zebra Technologies

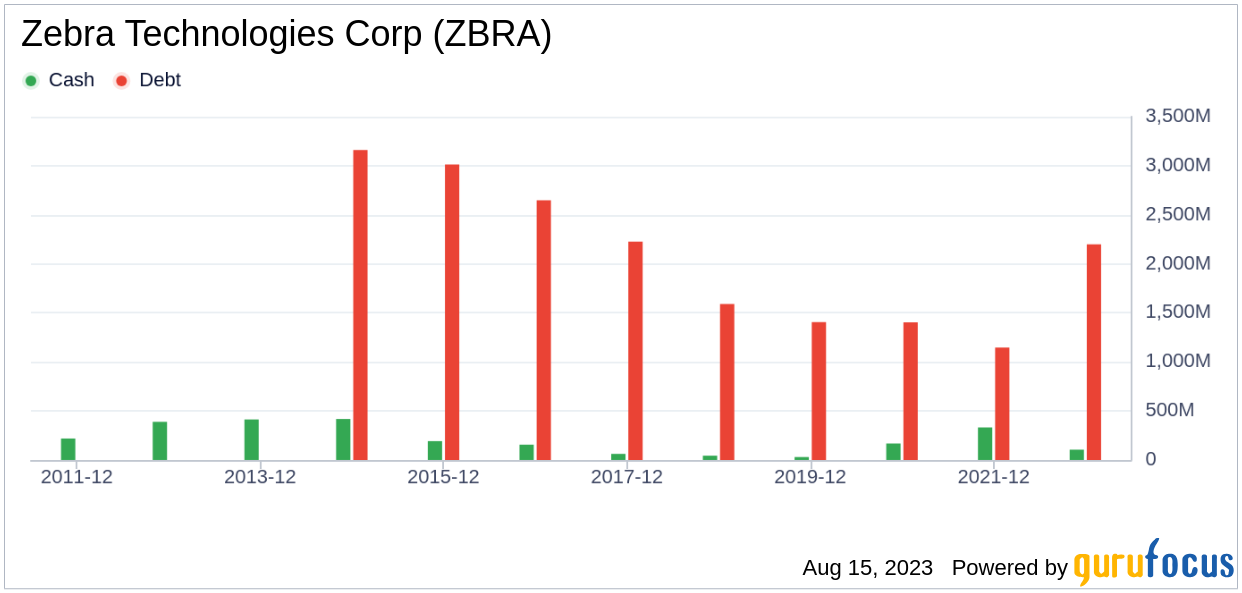

Investing in companies with poor financial strength carries a higher risk of permanent capital loss. Therefore, it is crucial to review a company's financial strength before investing. Zebra Technologies' cash-to-debt ratio of 0.03 is worse than 98.45% of companies in the Hardware industry. However, its overall financial strength is ranked 5 out of 10 by GuruFocus, indicating fair financial health.

Profitability and Growth of Zebra Technologies

Companies that have been consistently profitable over the long term offer less risk for investors. Zebra Technologies has been profitable 8 out of the past 10 years, with an operating margin of 16.76%, ranking better than 89.17% of companies in the Hardware industry. This strong profitability is complemented by a robust growth rate. The 3-year average annual revenue growth rate of Zebra Technologies is 10.2%, which ranks better than 67.23% of companies in the Hardware industry.

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) is another way to determine its profitability. Zebra Technologies' ROIC of 11.67 is slightly lower than its WACC of 12.69, implying that the company needs to improve its efficiency in generating cash flow relative to the capital it has invested in its business.

Conclusion

In summary, Zebra Technologies appears to be modestly undervalued. The company boasts fair financial strength, strong profitability, and robust growth, making it a potentially lucrative investment opportunity. For more details on Zebra Technologies' financials, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, visit GuruFocus High Quality Low Capex Screener.