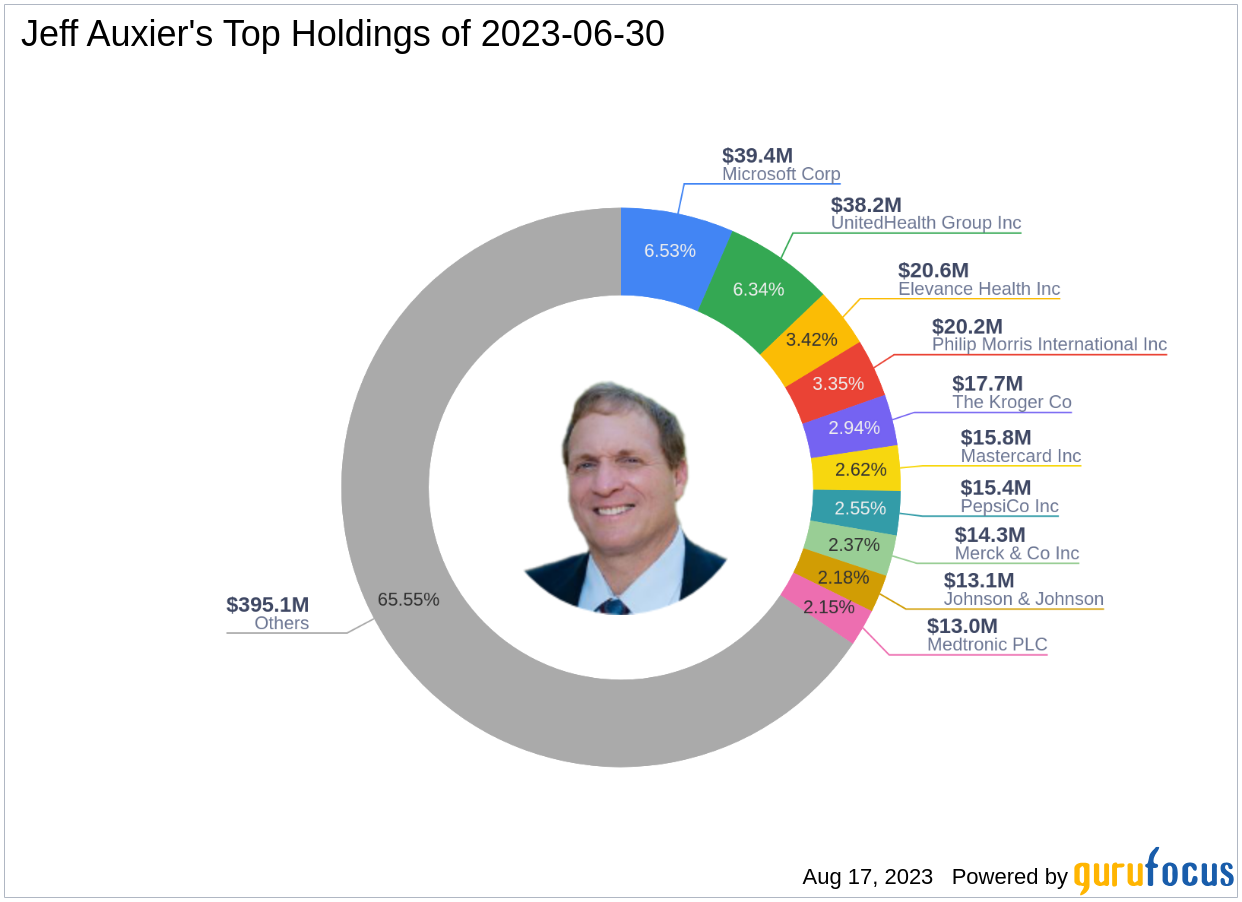

Jeff Auxier (Trades, Portfolio), the founder and CEO of Auxier Asset Management, recently filed the firm's 13F report for the second quarter of 2023, which ended on June 30, 2023. Auxier, who also manages the Auxier Focus Fund, is known for his value-oriented investment philosophy. The firm's portfolio contained 167 stocks with a total value of $603 million. The top holdings were Microsoft Corp. (MSFT), UnitedHealth Group Inc. (UNH, Financial), and ELV (ELV), accounting for 6.53%, 6.34%, and 3.42% of the portfolio respectively.

Top Three Trades of the Quarter

The following were the firm's top three trades of the quarter, which significantly impacted the equity portfolio.

UnitedHealth Group Inc (UNH, Financial)

Auxier Asset Management reduced its investment in UnitedHealth Group Inc (UNH) by 2,405 shares, impacting the equity portfolio by 0.2%. During the quarter, the stock traded for an average price of $488.72. As of August 17, 2023, UNH had a market cap of $462.07 billion and a stock price of $498.8282. Despite a -6.97% return over the past year, GuruFocus gives the company a financial strength rating of 7 out of 10 and a profitability rating of 10 out of 10. In terms of valuation, UNH has a price-earnings ratio of 22.32, a price-book ratio of 5.64, a PEG ratio of 1.69, a EV-to-Ebitda ratio of 14.17, and a price-sales ratio of 1.35.

Keurig Dr Pepper Inc (KDP, Financial)

During the quarter, the firm purchased 26,685 shares of Keurig Dr Pepper Inc (KDP), bringing the total holding to 39,559 shares. This trade had a 0.14% impact on the equity portfolio. The stock traded for an average price of $32.86 during the quarter. As of August 17, 2023, KDP had a market cap of $47.01 billion and a stock price of $33.645. Despite a -14.12% return over the past year, GuruFocus gives the company a financial strength rating of 5 out of 10 and a profitability rating of 7 out of 10. In terms of valuation, KDP has a price-earnings ratio of 29.51, a price-book ratio of 1.86, a EV-to-Ebitda ratio of 19.29, and a price-sales ratio of 3.26.

Mastercard Inc (MA, Financial)

The firm also reduced its investment in Mastercard Inc (MA) by 2,090 shares, impacting the equity portfolio by 0.13%. During the quarter, the stock traded for an average price of $375.05. As of August 17, 2023, MA had a market cap of $370.23 billion and a stock price of $392.94. Despite an 11.25% return over the past year, GuruFocus gives the company a financial strength rating of 6 out of 10 and a profitability rating of 10 out of 10. In terms of valuation, MA has a price-earnings ratio of 36.83, a price-book ratio of 67.28, a PEG ratio of 2.61, a EV-to-Ebitda ratio of 27.19, and a price-sales ratio of 15.93.

In conclusion, Jeff Auxier (Trades, Portfolio)'s Q2 2023 13F filing reveals a strategic approach to portfolio management, with significant trades in UnitedHealth Group Inc, Keurig Dr Pepper Inc, and Mastercard Inc. These trades reflect the firm's value-oriented investment philosophy and its focus on companies with strong financial strength and profitability ratings.

Also check out: