Alphabet Inc (GOOG, Financial) experienced a slight dip in its stock price by -2.2% on August 18, 2023, but it has seen a 3-month gain of 7.39%. With an Earnings Per Share (EPS) (EPS) of 4.72, the question arises: Is the stock modestly undervalued? This article delves into a comprehensive valuation analysis of Alphabet (GOOG), providing valuable insights for potential investors.

Company Overview

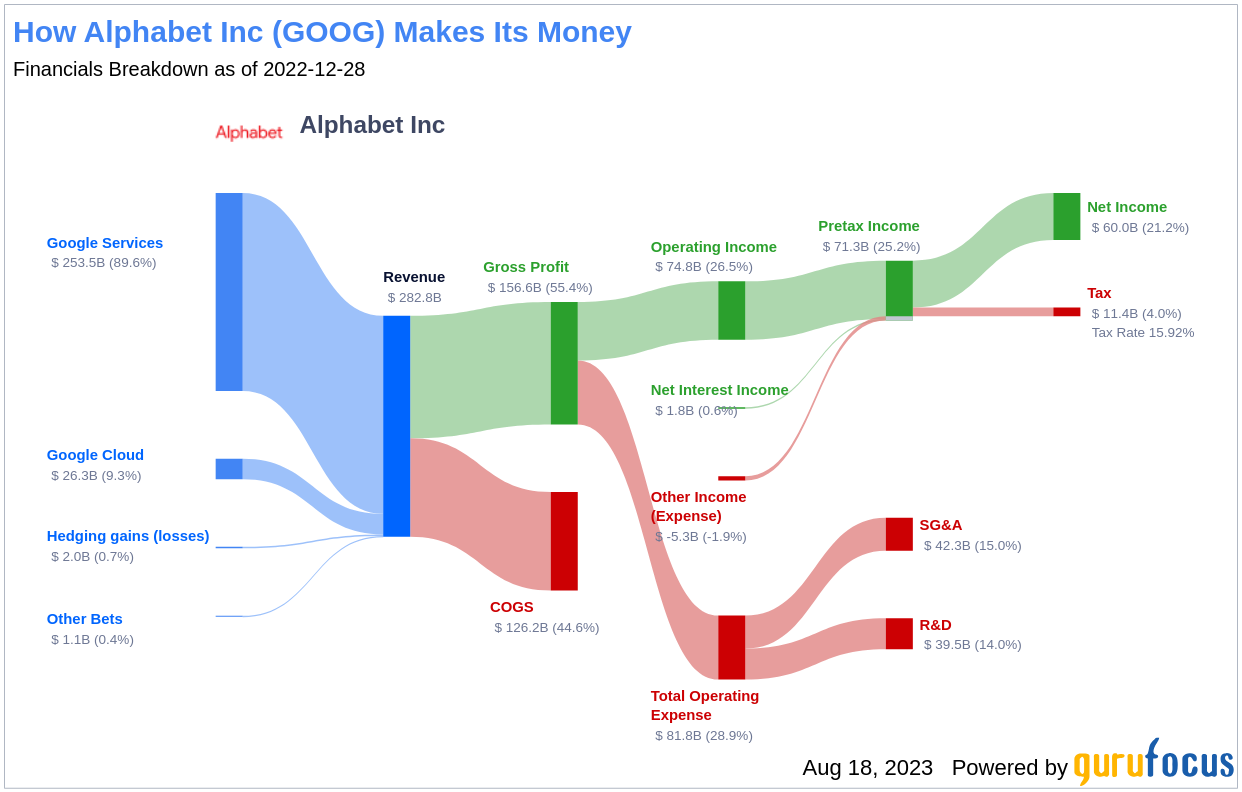

Alphabet Inc (GOOG, Financial) is a holding company, with internet media giant Google as a wholly owned subsidiary. Google generates 99% of Alphabet's revenue, primarily from online ads. Other revenue streams include sales of apps and content on Google Play and YouTube, cloud service fees, and other licensing revenue. Alphabet's moonshot investments are in its other bets segment, where it bets on technology to enhance health (Verily), provide faster internet access (Google Fiber), enable self-driving cars (Waymo), and more.

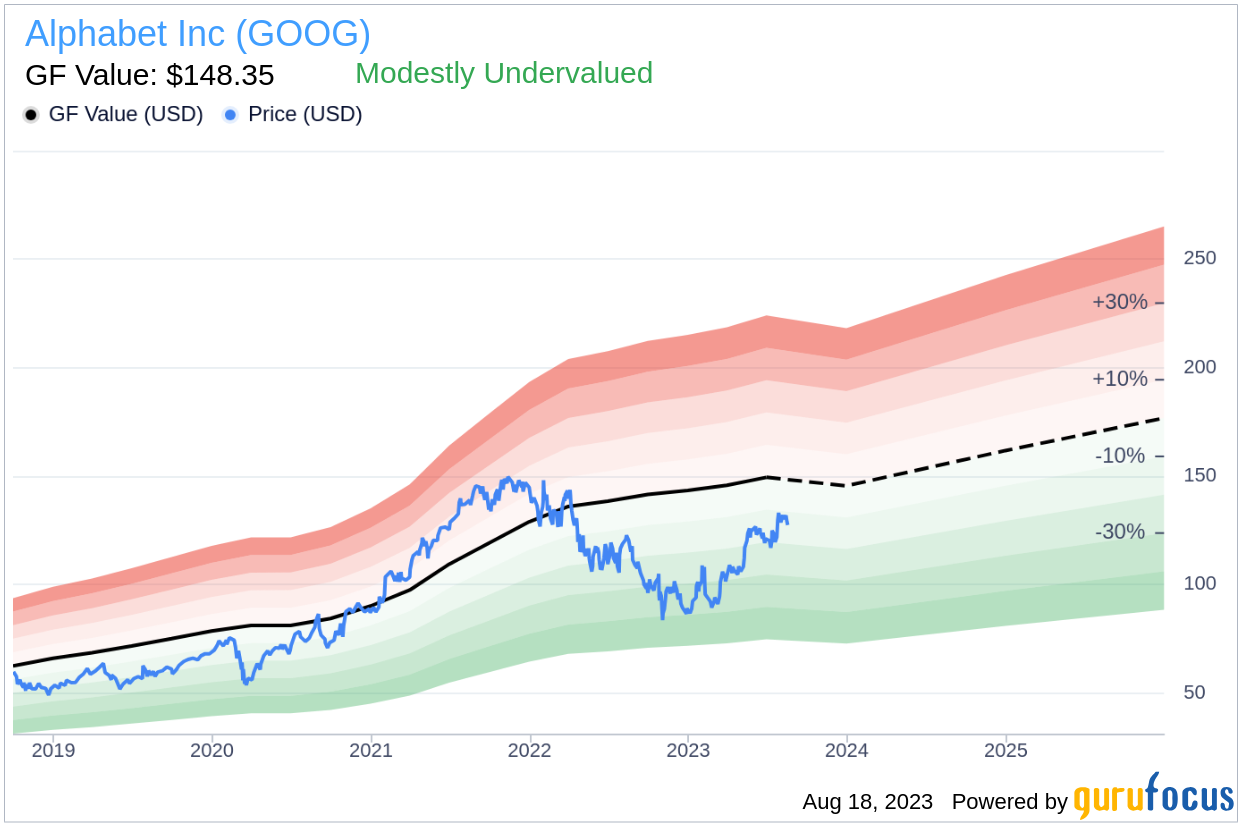

Understanding GF Value

The GF Value is a proprietary valuation model that considers historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line on our summary page gives an overview of the fair value that the stock should be traded at.

Alphabet (GOOG, Financial) is estimated to be modestly undervalued based on GuruFocus' valuation method. The stock's fair value is calculated based on historical multiples, an internal adjustment factor based on past business growth, and analyst estimates of future business performance. If the share price is significantly above the GF Value Line, the stock may be overvalued and have poor future returns. On the other hand, if the share price is significantly below the GF Value calculation, the stock may be undervalued and have higher future returns. At its current price of $127.59 per share, Alphabet stock is estimated to be modestly undervalued.

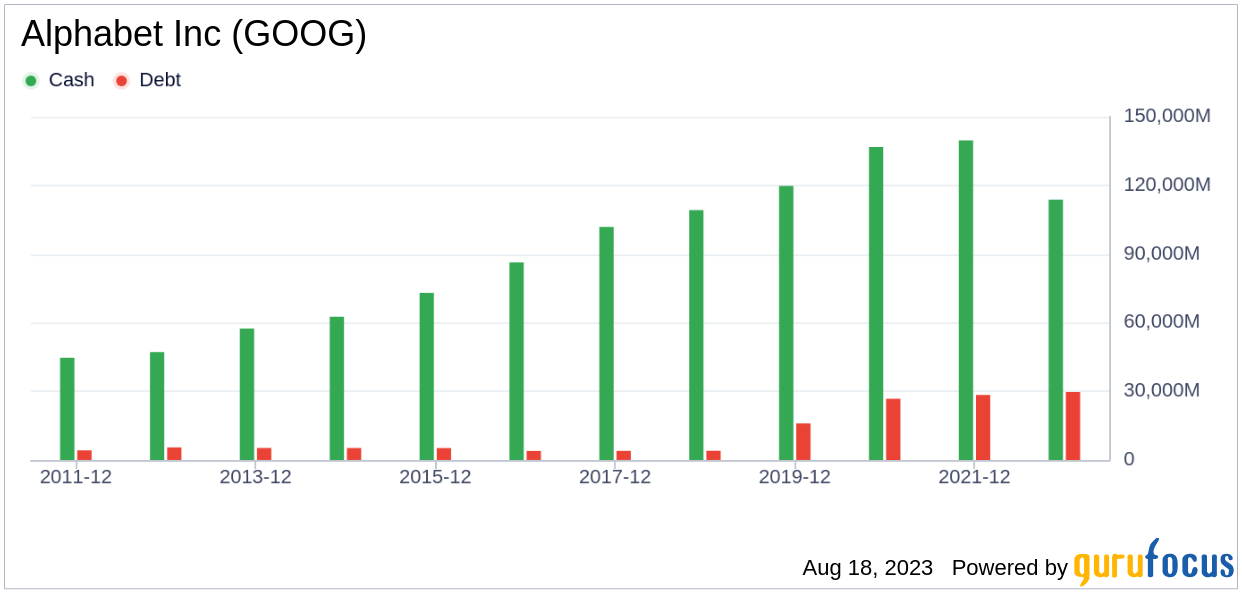

Financial Strength

Alphabet's financial strength is a critical factor in its valuation. A company's financial strength can be evaluated through its cash-to-debt ratio and interest coverage. Alphabet has a cash-to-debt ratio of 4.06, which ranks worse than 55.57% of companies in the Interactive Media industry. However, the overall financial strength of Alphabet is 9 out of 10, indicating that Alphabet's financial strength is strong.

Profitability and Growth

Alphabet's profitability and growth are also important factors to consider. The company has been profitable for 10 years over the past 10 years. During the past 12 months, the company had revenues of $289.50 billion and Earnings Per Share (EPS) of $4.72. Its operating margin of 25.75% is better than 87.69% of companies in the Interactive Media industry. Alphabet's 3-year average annual revenue growth rate is 22.9%, which ranks better than 73.68% of companies in the Interactive Media industry.

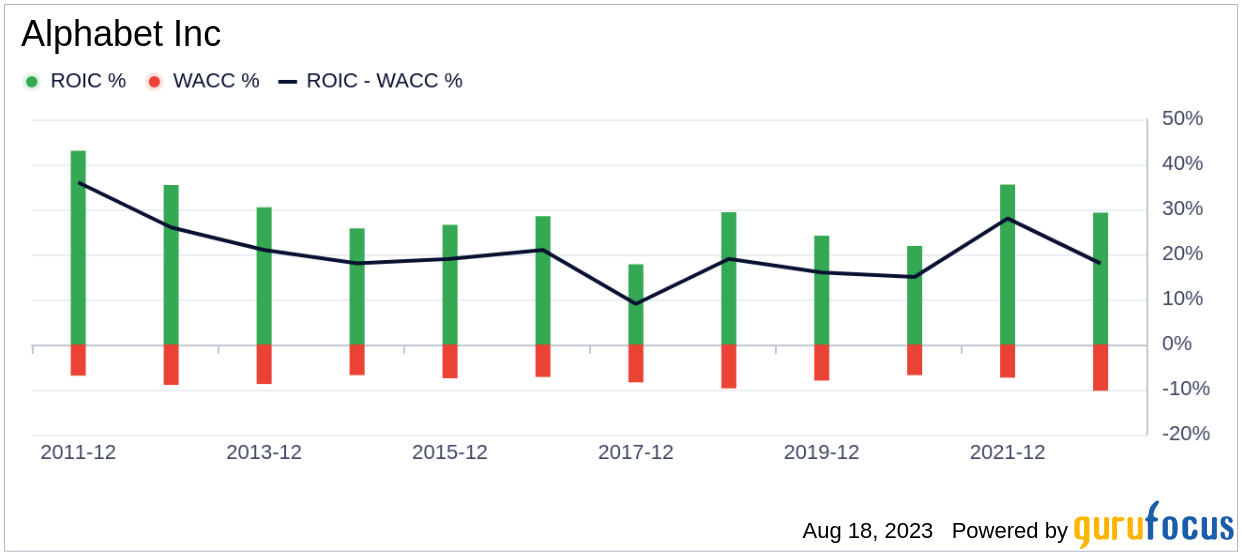

ROIC vs WACC

Another method of determining the profitability of a company is to compare its return on invested capital (ROIC) to the weighted average cost of capital (WACC). ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. Alphabet's ROIC is higher than its WACC, implying the company is creating value for shareholders.

Conclusion

Based on the comprehensive analysis, Alphabet (GOOG, Financial) stock is estimated to be modestly undervalued. The company's financial condition is strong, and its profitability is strong. Its growth ranks better than 63.4% of companies in the Interactive Media industry. To learn more about Alphabet stock, you can check out its 30-Year Financials here.

To find out the high quality companies that may deliver above average returns, please check out GuruFocus High Quality Low Capex Screener.