Hologic Inc (HOLX, Financial) experienced a daily gain of 2.84% and a 3-month loss of -7.61%. The company's Earnings Per Share (EPS) stands at 1.93. This analysis aims to determine if Hologic's stock is modestly overvalued. The subsequent valuation analysis will provide a clearer picture of the company's intrinsic value.

Understanding Hologic Inc (HOLX, Financial)

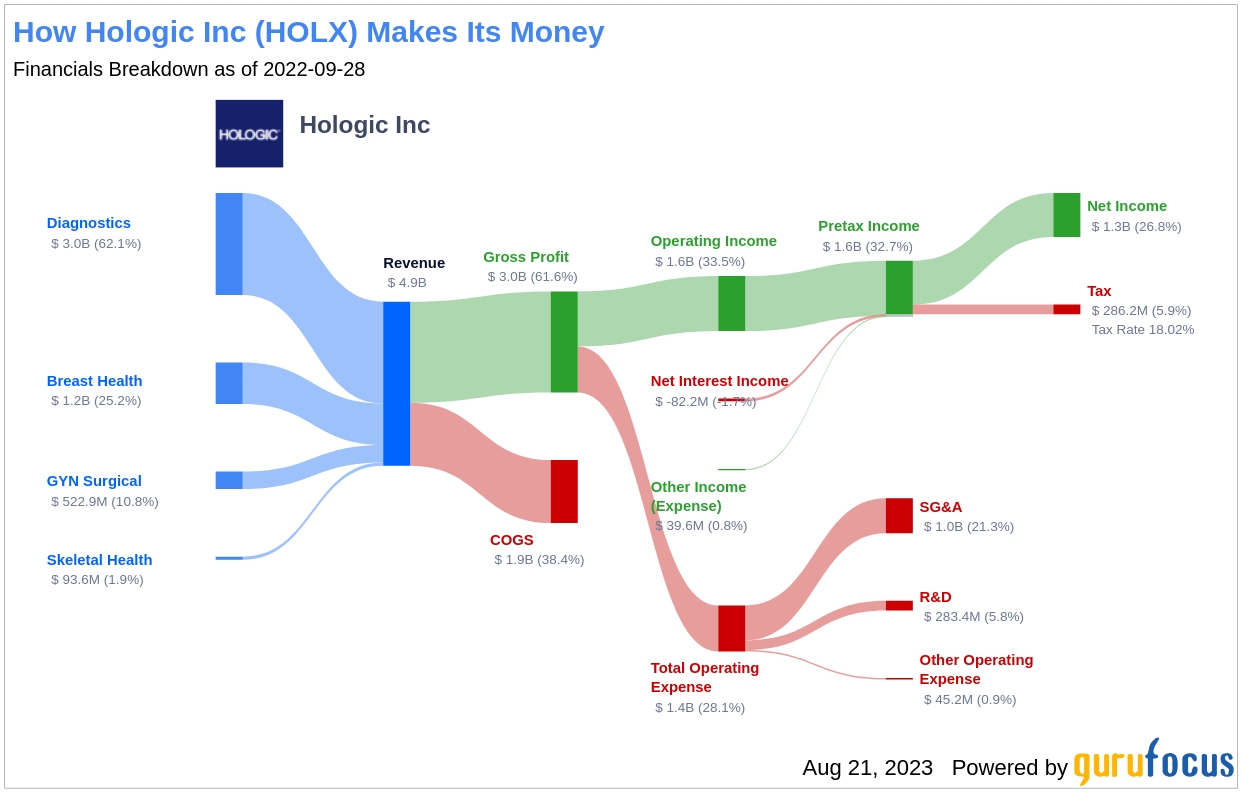

Hologic operates in four segments: diagnostics, breast health, surgical, and skeletal health. The company, which is headquartered in Bedford, Massachusetts, primarily focuses on the healthcare needs of women. The diagnostics segment contributes 64% of total sales, boosted by the pandemic, while breast health contributes 21%, suppressed by the pandemic. The surgical and skeletal health segments account for 12% and 2% of sales, respectively. The U.S. accounts for the largest portion of the firm's revenue (75%), followed by Europe (16%), Asia (6%), and other international markets (3%).

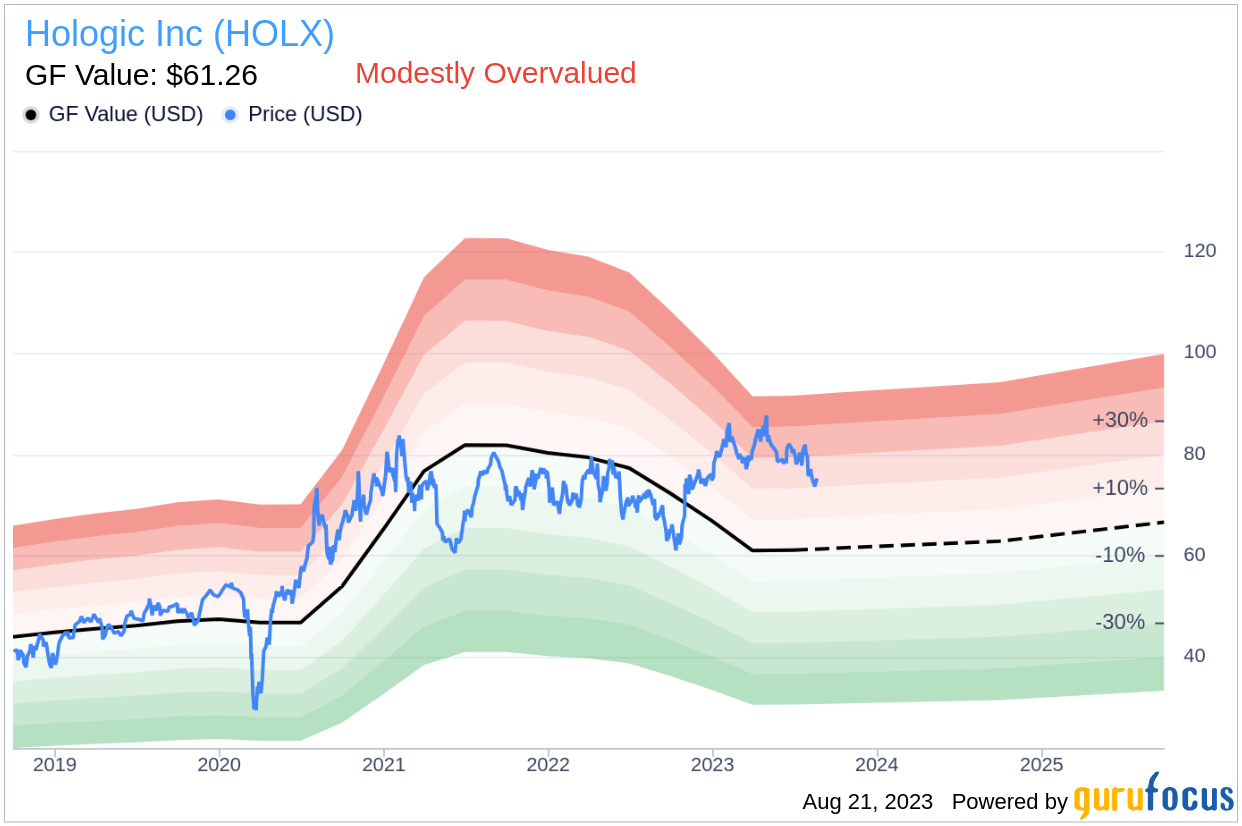

An Overview of GF Value

The GF Value is a proprietary valuation method that calculates a stock's intrinsic value. The GF Value Line provides a representation of the stock's fair trading value. This value is computed based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates. If a stock's price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

According to the GuruFocus Value calculation, Hologic (HOLX, Financial) stock is modestly overvalued. At its current price of $75.23 per share, Hologic has a market cap of $18.40 billion. As Hologic is relatively overvalued, the long-term return of its stock is likely to be lower than its business growth.

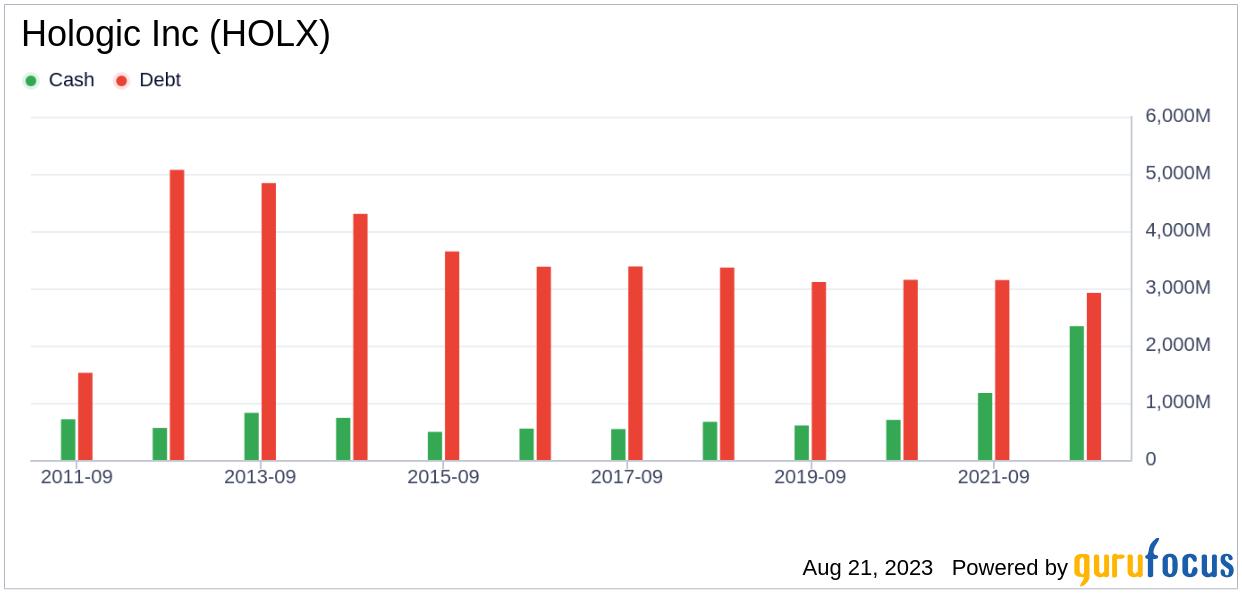

Financial Strength of Hologic

Companies with poor financial strength offer investors a high risk of permanent capital loss. To avoid this, an investor must review a company's financial strength before deciding to purchase shares. Hologic has a cash-to-debt ratio of 0.97, which ranks worse than 67.71% of 833 companies in the Medical Devices & Instruments industry. The overall financial strength of Hologic is 7 out of 10, indicating that the financial strength of Hologic is fair.

Profitability and Growth of Hologic

Companies that have been consistently profitable over the long term offer less risk for investors. Hologic has been profitable 7 over the past 10 years. Over the past twelve months, the company had a revenue of $4 billion and Earnings Per Share (EPS) of $1.93. Its operating margin is 18.4%, which ranks better than 79.37% of 824 companies in the Medical Devices & Instruments industry. Overall, the profitability of Hologic is ranked 7 out of 10, indicating fair profitability.

Growth is a crucial factor in a company's valuation. The 3-year average annual revenue growth rate of Hologic is 15.3%, which ranks better than 68.88% of 723 companies in the Medical Devices & Instruments industry. The 3-year average EBITDA growth rate is 86.4%, ranking better than 96.56% of 726 companies in the same industry.

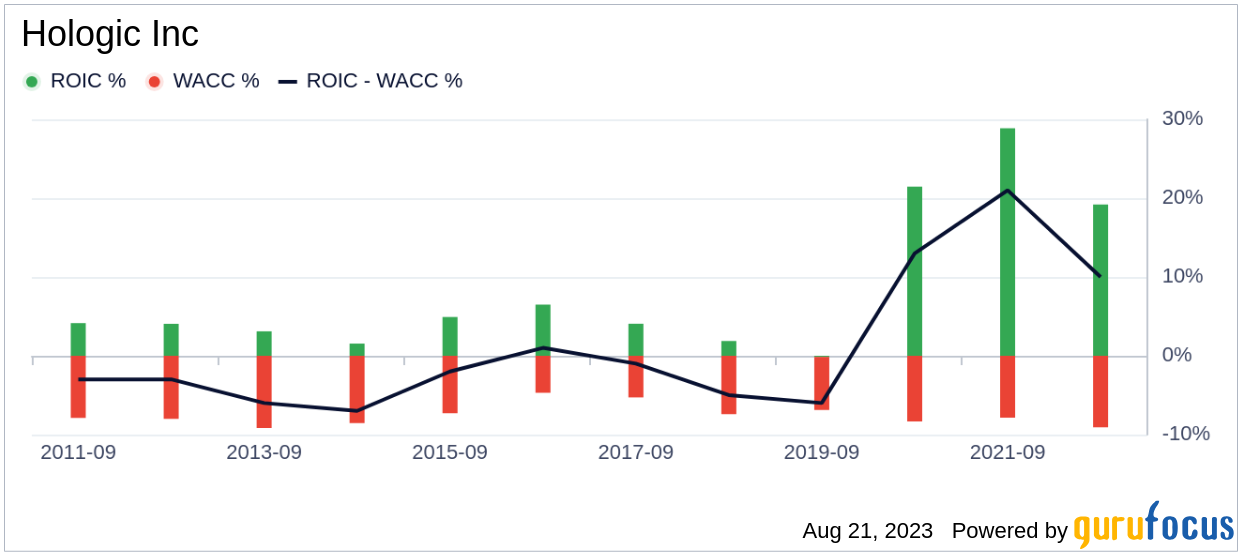

ROIC vs WACC

Comparing a company's return on invested capital and the weighted cost of capital provides another perspective on its profitability. Return on invested capital (ROIC) measures how well a company generates cash flow relative to the capital it has invested in its business. The weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its security holders to finance its assets. For the past 12 months, Hologic's return on invested capital is 8.66, and its cost of capital is 5.85.

Conclusion

In summary, Hologic (HOLX, Financial) stock is estimated to be modestly overvalued. The company's financial condition is fair, and its profitability is fair. Its growth ranks better than 96.56% of 726 companies in the Medical Devices & Instruments industry. To learn more about Hologic stock, you can check out its 30-Year Financials here.

To find out high quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.