Alphabet Inc (GOOGL, Financial) experienced a daily gain of 2.3%, with a 3.22% gain over the past three months. The company's Earnings Per Share (EPS) stands at 4.72. But is the stock modestly undervalued? This article offers an in-depth valuation analysis to answer that question. Let's delve into the financials and performance of Alphabet (GOOGL).

Company Overview

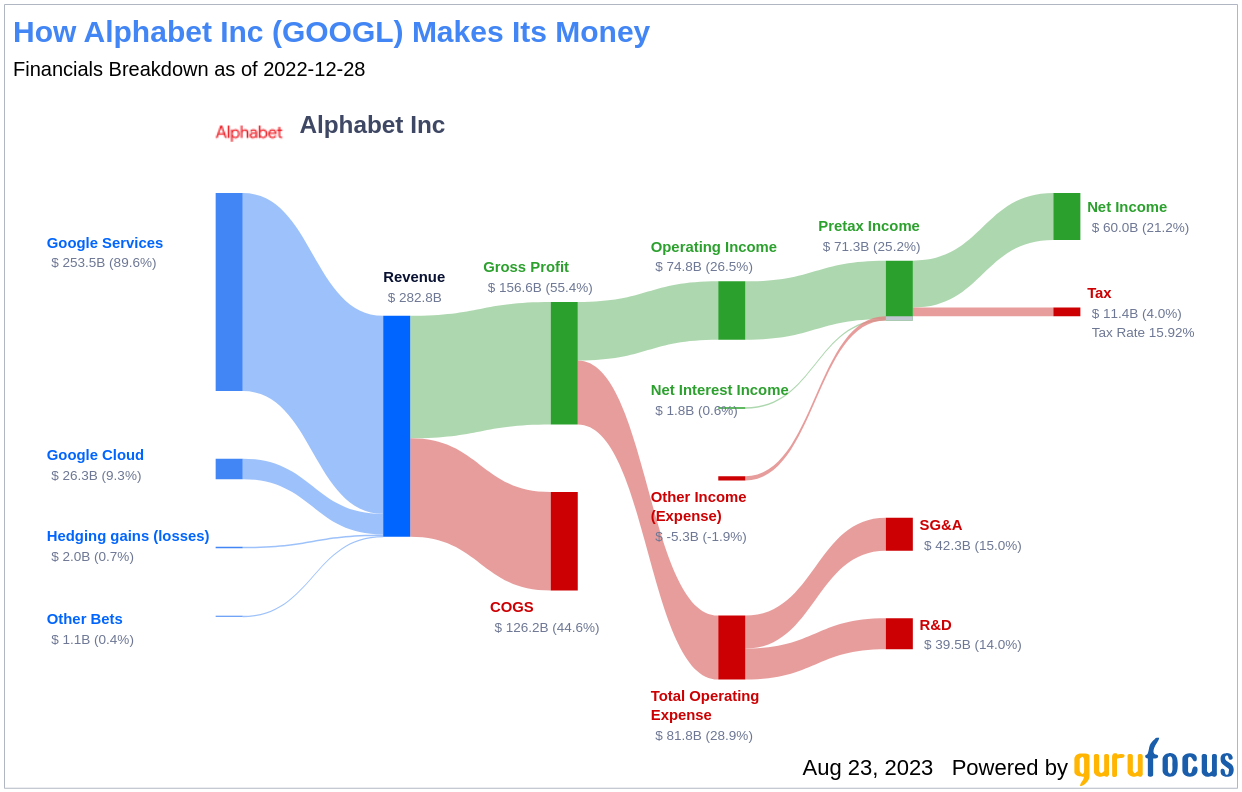

Alphabet Inc is a holding company with Google, an internet media giant, as a wholly-owned subsidiary. Google generates 99% of Alphabet's revenue, with more than 85% coming from online ads. Other revenue streams include sales of apps and content on Google Play and YouTube, cloud service fees, and other licensing revenue. Alphabet also earns from hardware sales such as Chromebooks, the Pixel smartphone, and smart home products, including Nest and Google Home. The company's moonshot investments are in its other bets segment, where it invests in technology to enhance health (Verily), provide faster internet access (Google Fiber), enable self-driving cars (Waymo), and more.

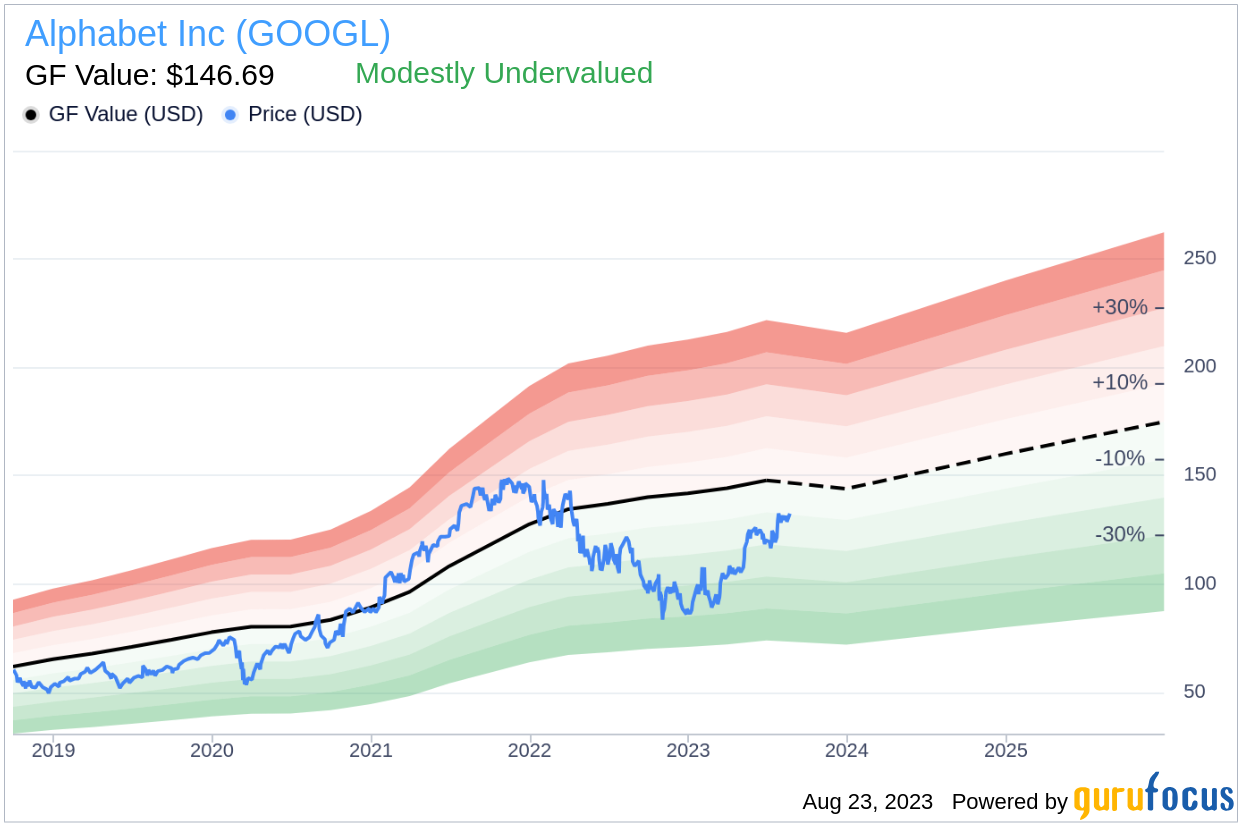

At its current price of $132.05 per share, Alphabet's stock appears to be modestly undervalued when compared to its GF Value of $146.69.

Understanding the GF Value

The GF Value represents the current intrinsic value of a stock, derived from our exclusive method. It's calculated based on historical multiples (PE Ratio, PS Ratio, PB Ratio, and Price-to-Free-Cash-Flow), a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of the business performance.

The GF Value Line on our summary page gives an overview of the fair value that the stock should be traded at. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. On the other hand, if it is significantly below the GF Value Line, its future return will likely be higher.

With Alphabet's stock price below the GF Value Line, it appears to be modestly undervalued, implying that the long-term return of its stock is likely to be higher than its business growth.

Financial Strength

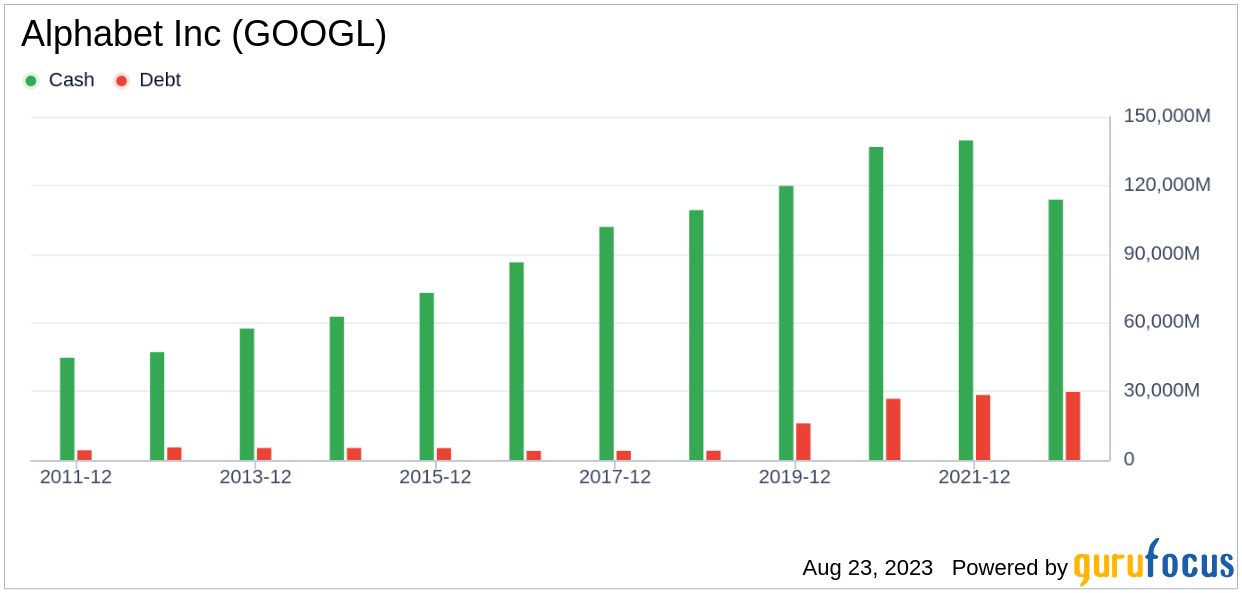

Assessing a company's financial strength is crucial to avoid the high risk of permanent capital loss. Key indicators include the cash-to-debt ratio and interest coverage. Alphabet's cash-to-debt ratio of 4.06 ranks worse than 55.11% of 548 companies in the Interactive Media industry. However, the overall financial strength of Alphabet is 9 out of 10, indicating strong financial health.

Profitability and Growth

Investing in profitable companies carries less risk, especially those that have demonstrated consistent profitability over the long term. Alphabet has been profitable 10 years over the past 10 years. Its operating margin of 25.75% is better than 85.15% of 586 companies in the Interactive Media industry. Overall, GuruFocus ranks Alphabet's profitability as strong.

Another crucial factor in a company's valuation is its growth. Companies that grow faster create more value for shareholders, especially if that growth is profitable. The average annual revenue growth of Alphabet is 22.9%, which ranks better than 73.74% of 514 companies in the Interactive Media industry. The 3-year average EBITDA growth is 21.8%, which ranks better than 63.08% of 390 companies in the Interactive Media industry.

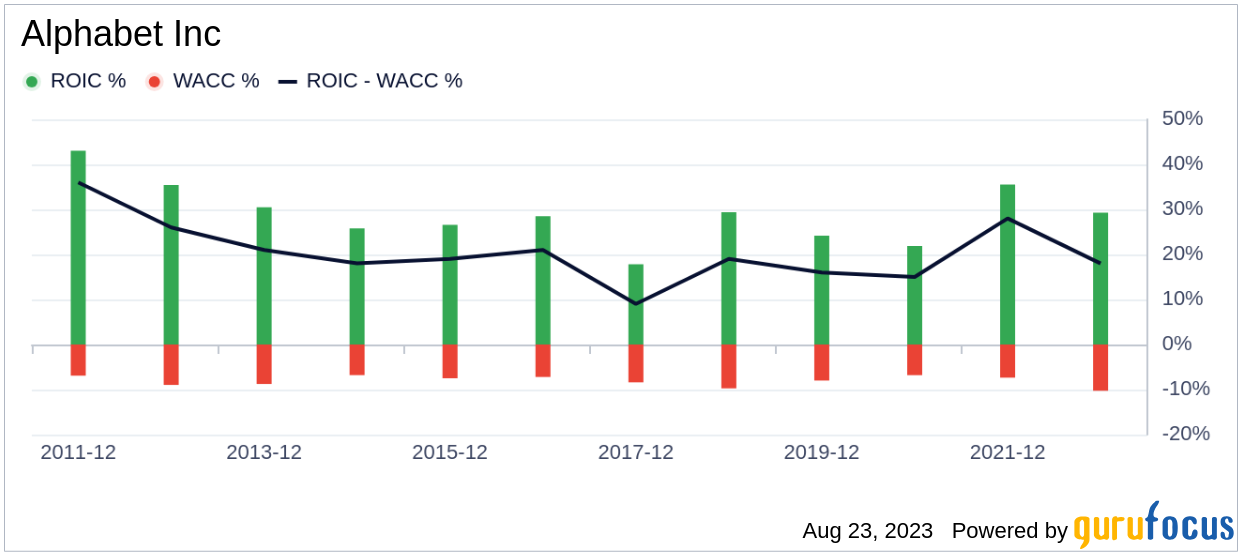

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to the weighted average cost of capital (WACC) is another method of determining its profitability. When the ROIC is higher than the WACC, it implies the company is creating value for shareholders. For the past 12 months, Alphabet's ROIC is 27.32, and its cost of capital is 11.03.

Conclusion

In conclusion, the stock of Alphabet (GOOGL, Financial) appears to be modestly undervalued. The company's financial condition is strong and its profitability is robust. Its growth ranks better than 63.08% of the companies in the Interactive Media industry. To learn more about Alphabet stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.