Boston Scientific (BSX, Financial) has been making waves in the stock market with a daily gain of 5.31%, and a 3-month gain of 4.92%. Its Earnings Per Share (EPS) stands at 0.6. But is this medical device producer fairly valued? This article delves into the valuation analysis of Boston Scientific, providing you with insights to make informed investment decisions.

Company Overview

Boston Scientific Corp (BSX, Financial) is renowned for its production of less invasive medical devices. These devices are inserted into the human body through small openings or cuts, aiding in various medical procedures such as angioplasty, cardiac rhythm management, interventional oncology, and more. The company's devices are marketed globally to healthcare professionals and institutions, with foreign sales accounting for nearly half of its total sales.

Currently, Boston Scientific (BSX, Financial) trades at $53.46 per share, with a market cap of $78.30 billion. But how does this stock price compare to its intrinsic value? The GF Value, a proprietary measure of a stock's fair value, provides an answer.

Understanding the GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated considering historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. It provides a fair value line indicating the ideal trading value of the stock.

For Boston Scientific, the GF Value stands at $50.15, suggesting that the stock is fairly valued at its current trading price. This fair valuation indicates that the long-term return of Boston Scientific's stock is likely to align closely with the rate of its business growth.

Link: These companies may deliever higher future returns at reduced risk.

Financial Strength

Investing in companies with poor financial strength can pose a high risk of permanent capital loss. Therefore, understanding a company's financial strength, including its cash-to-debt ratio and interest coverage, is crucial. Boston Scientific's cash-to-debt ratio is 0.05, ranking worse than 95.66% of companies in the Medical Devices & Instruments industry. However, its overall financial strength is 6 out of 10, indicating fair financial health.

Profitability and Growth

Investing in profitable companies, particularly those with consistent profitability over the long term, is generally less risky. Boston Scientific has been profitable for 6 out of the past 10 years, with an operating margin of 16.58%, ranking better than 77.58% of companies in its industry. The company's overall profitability rank is 6 out of 10, indicating fair profitability.

However, the company's growth ranks worse than 53.16% of companies in its industry, with a 3-year average annual revenue growth rate of 5%, and a 3-year average EBITDA growth rate of 7.4%.

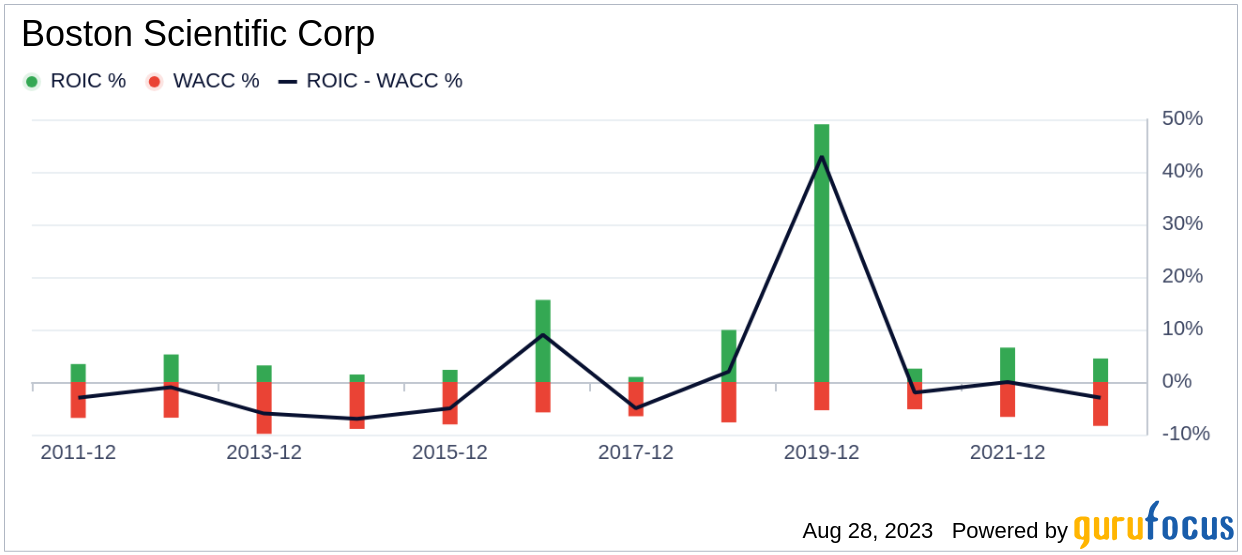

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC) provides another perspective on its profitability. If the ROIC is higher than the WACC, the company is creating value for shareholders. Over the past 12 months, Boston Scientific's ROIC was 4.6, while its WACC was 7.77.

Conclusion

In conclusion, Boston Scientific (BSX, Financial) appears to be fairly valued. The company's financial condition and profitability are fair, albeit with growth that ranks below more than half of the companies in its industry. To learn more about Boston Scientific stock, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, visit GuruFocus High Quality Low Capex Screener.