With a daily gain of 2.87%, a 3-month loss of -1.78%, and an Earnings Per Share (EPS) (EPS) of 3.07, Bath & Body Works Inc (BBWI, Financial) presents an intriguing case for value investors. The question arises: is Bath & Body Works significantly undervalued? This article aims to provide a comprehensive analysis of Bath & Body Works' valuation, diving into its financial health, profitability, and growth prospects. We invite you to read on for an in-depth exploration.

A Snapshot of Bath & Body Works Inc (BBWI, Financial)

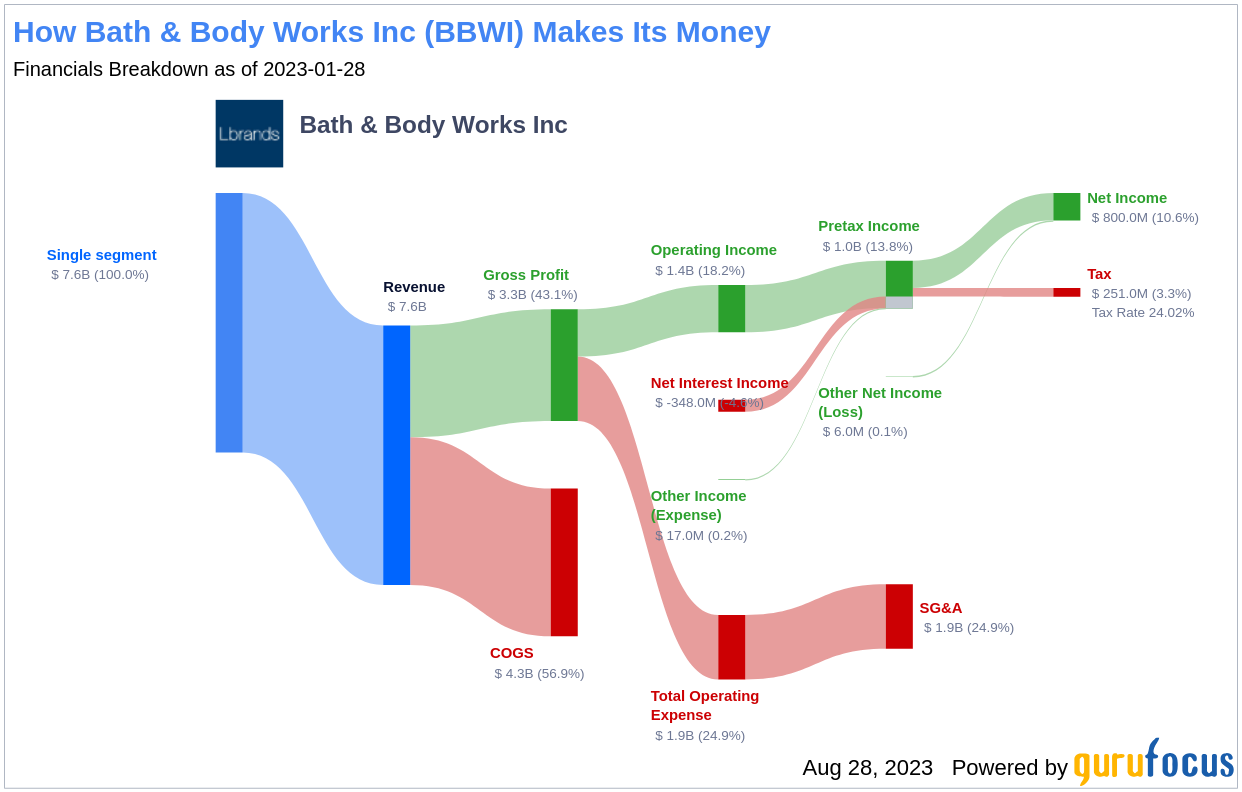

Bath & Body Works is a specialty home fragrance and fragrant body care retailer operating under the Bath & Body Works, C.O. Bigelow, and White Barn brands. The company primarily operates in North America, with less than 5% of sales from international markets in fiscal 2022. The company's brick-and-mortar network, composed of more than 1,800 retail stores, contributed 72% of sales in fiscal 2022, mirroring 2021 levels. Future growth is expected from store reformatting, digital and international channels, and new category expansion.

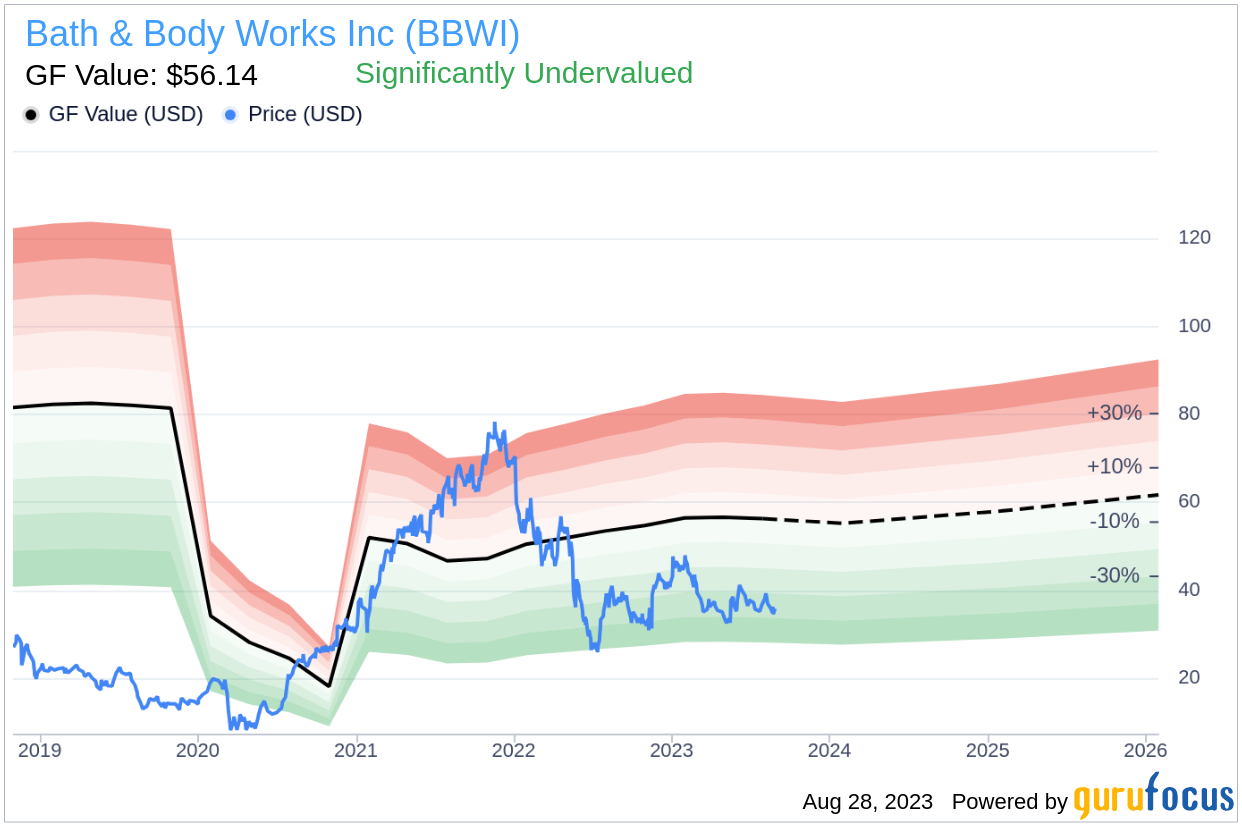

Understanding the GF Value

The GF Value is a proprietary measure that determines the current intrinsic value of a stock. The GF Value Line provides an overview of the fair value at which the stock should ideally be traded. This value is calculated based on historical multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates. If the stock price significantly deviates from the GF Value Line, it could indicate that the stock is either overvalued or undervalued, impacting its future returns.

Bath & Body Works (BBWI, Financial), with a current price of $35.84 per share and a market cap of $8.20 billion, appears to be significantly undervalued according to the GF Value. As Bath & Body Works is significantly undervalued, the long-term return of its stock is likely to be much higher than its business growth.

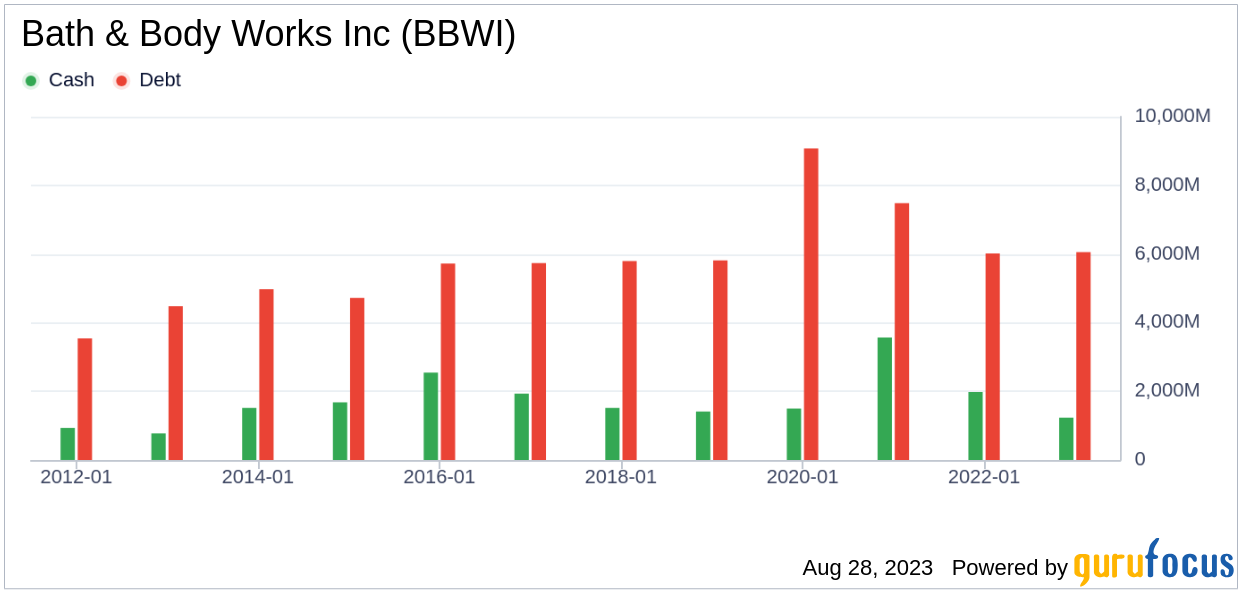

Assessing Bath & Body Works' Financial Strength

Investing in companies with low financial strength could result in permanent capital loss. Thus, it's crucial to review a company's financial strength before buying shares. Bath & Body Works has a cash-to-debt ratio of 0.13, which ranks worse than 77.19% of 1096 companies in the Retail - Cyclical industry. Based on this, GuruFocus ranks Bath & Body Works's financial strength as 4 out of 10, suggesting a poor balance sheet.

Profitability and Growth of Bath & Body Works

Investing in profitable companies, especially those demonstrating consistent profitability over the long term, usually poses less risk. Bath & Body Works has been profitable 9 out of the past 10 years. Over the past twelve months, the company had a revenue of $7.40 billion and Earnings Per Share (EPS) of $3.07. Its operating margin is 16.42%, which ranks better than 90.24% of 1096 companies in the Retail - Cyclical industry. Overall, GuruFocus ranks the profitability of Bath & Body Works at 8 out of 10, indicating strong profitability.

One of the most important factors in the valuation of a company is growth. Companies that grow faster tend to create more value for shareholders, especially if that growth is profitable. Bath & Body Works' average annual revenue growth is 18.6%, which ranks better than 79.85% of 1047 companies in the Retail - Cyclical industry. However, the 3-year average EBITDA growth is 7.1%, ranking worse than 52.39% of 901 companies in the Retail - Cyclical industry.

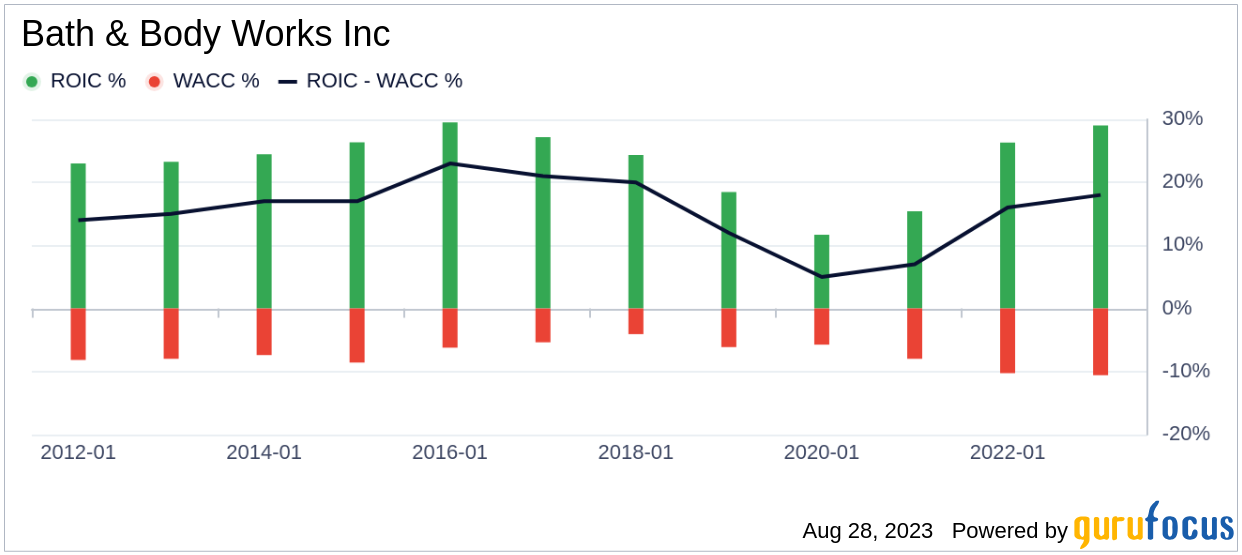

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can also evaluate profitability. If the ROIC exceeds the WACC, the company is likely creating value for its shareholders. Over the past 12 months, Bath & Body Works's ROIC was 26.04 while its WACC was 9.35.

Conclusion

In summary, Bath & Body Works (BBWI, Financial) appears significantly undervalued. Despite its poor financial condition, the company shows strong profitability. Its growth ranks worse than 52.39% of 901 companies in the Retail - Cyclical industry. To learn more about Bath & Body Works stock, you can check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.