Today, we delve into the valuation of PACCAR Inc (PCAR, Financial), a leading manufacturer of medium- and heavy-duty trucks. The stock currently stands at $81.81, with a day's loss of -3.96% and a 3-month gain of 14.85%. With an Earnings Per Share (EPS) of 6.96, we aim to answer the question: is PACCAR fairly valued? Join us as we unpack the intrinsic value of PACCAR (PCAR) using our proprietary GF Value.

Company Overview

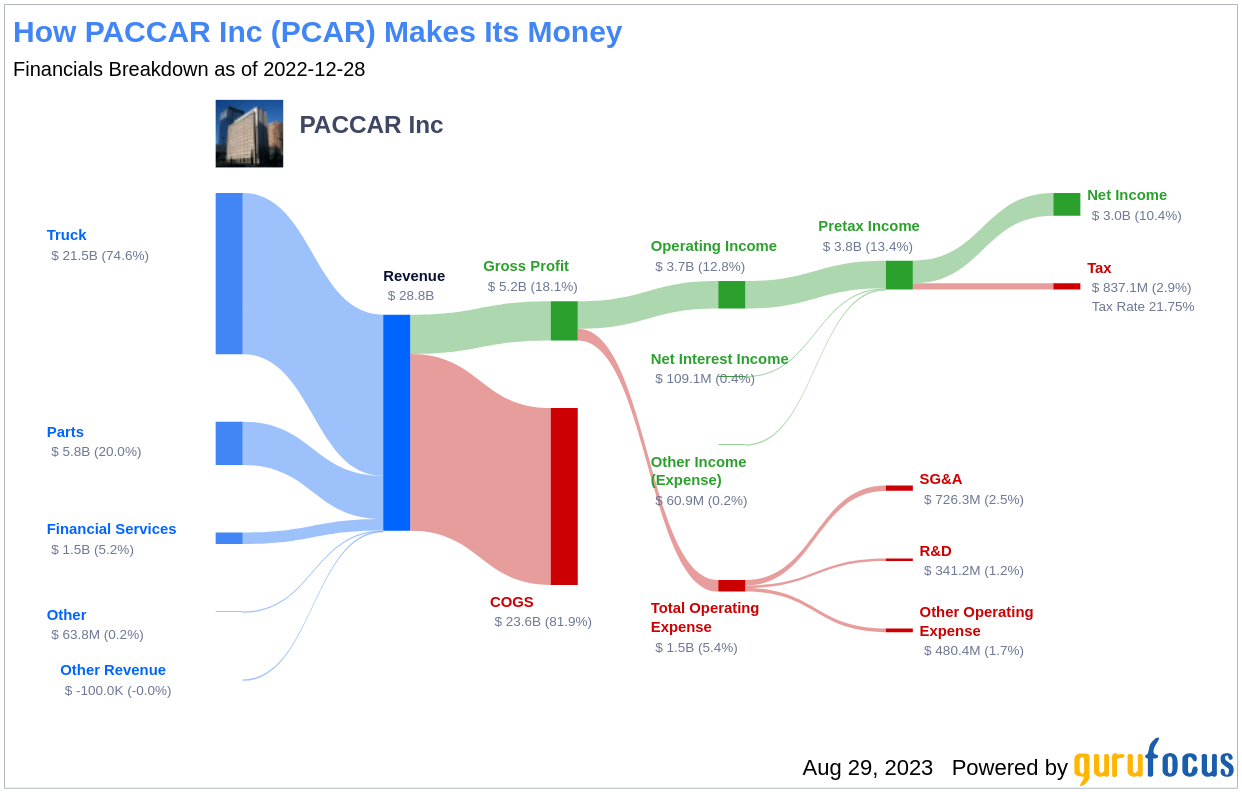

PACCAR Inc (PCAR, Financial) is a renowned manufacturer of medium- and heavy-duty trucks under premium brands Kenworth, Peterbilt, and DAF. With a commanding 30% of the Class 8 market share in North America and 17% in Europe, PACCAR's trucks are sold across the globe through over 2,300 independent dealers. PACCAR Financial Services further bolsters the company's offerings by providing retail and wholesale financing for customers and dealers. With a market cap of $42.80 billion and sales of $32.50 billion, PACCAR (PCAR) stands as a significant player in the industry.

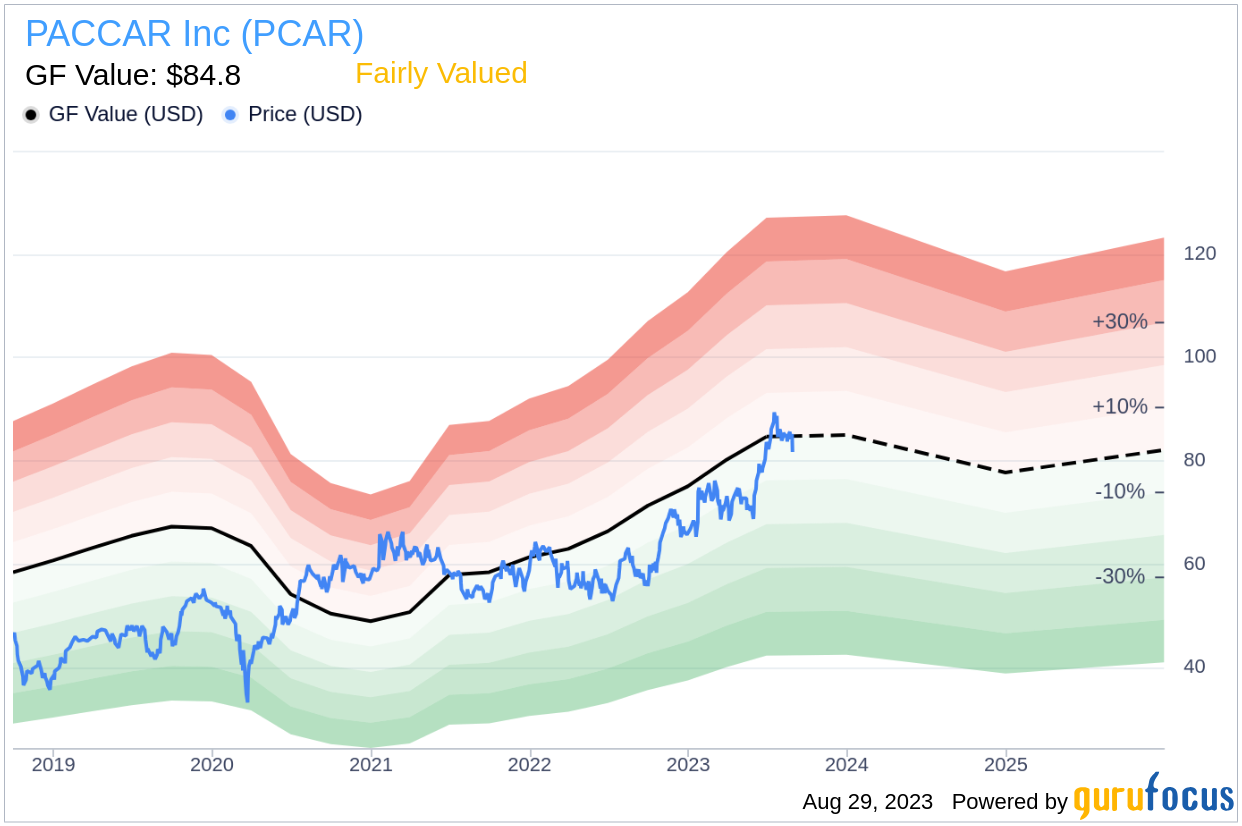

Understanding the GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line gives an overview of the fair value at which the stock should ideally be traded. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

For PACCAR (PCAR, Financial), the GF Value indicates that the stock is fairly valued. This suggests that the long-term return of its stock is likely to be close to the rate of its business growth. At its current price of $81.81 per share, PACCAR stock is estimated to be fairly valued.

Financial Strength

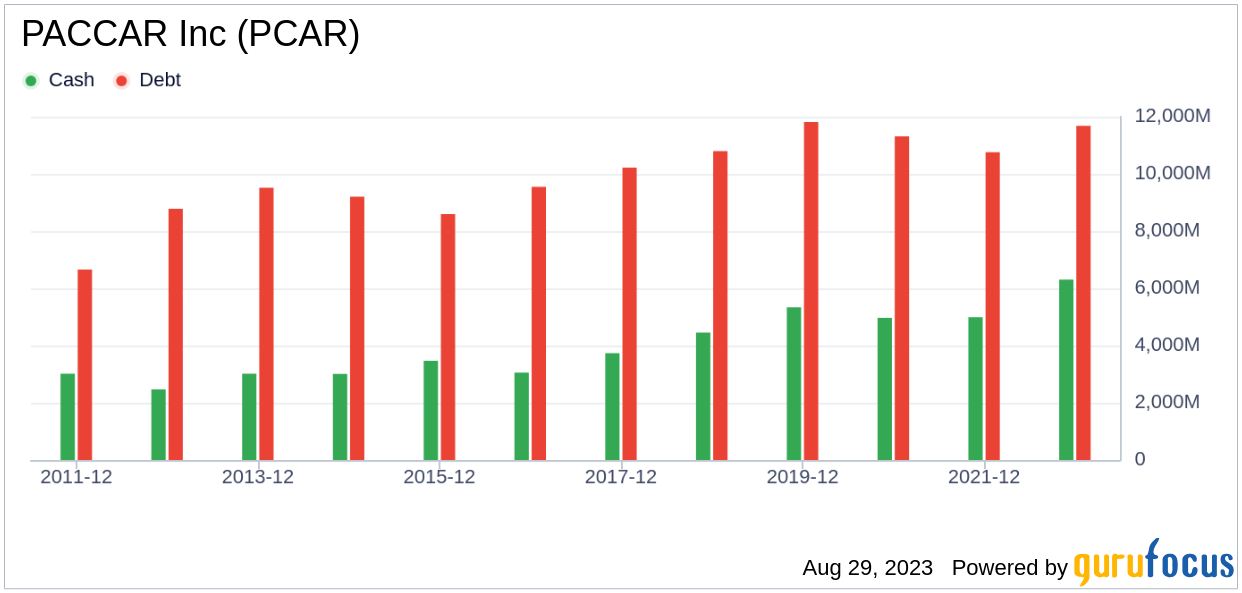

Financial strength is crucial in avoiding high risk of permanent capital loss. To understand PACCAR's financial strength, we look at the cash-to-debt ratio and interest coverage. PACCAR's cash-to-debt ratio of 0.54 ranks worse than 52.5% of 200 companies in the Farm & Heavy Construction Machinery industry. The overall financial strength of PACCAR is 7 out of 10, indicating fair financial strength.

Profitability and Growth

Profitable companies, especially those with consistent profitability over the long term, are less risky investments. PACCAR has been profitable 10 years over the past 10 years, with an operating margin of 15.3%, ranking better than 89% of 200 companies in the industry. The overall profitability of PACCAR is ranked 8 out of 10, indicating strong profitability.

Growth is a crucial factor in the valuation of a company. PACCAR's 3-year average revenue growth rate is worse than 55.9% of 195 companies in the Farm & Heavy Construction Machinery industry. PACCAR's 3-year average EBITDA growth rate is 3.2%, which ranks worse than 64.91% of 171 companies in the industry.

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) and the weighted cost of capital (WACC) provides another perspective on its profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. For the past 12 months, PACCAR's ROIC is 17.87, and its WACC is 6.99.

Conclusion

In conclusion, the stock of PACCAR (PCAR, Financial) is estimated to be fairly valued. The company's financial condition is fair, and its profitability is strong. However, its growth ranks worse than 64.91% of 171 companies in the Farm & Heavy Construction Machinery industry. For a deeper understanding of PACCAR, you can check out its 30-Year Financials here.

To find out high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.