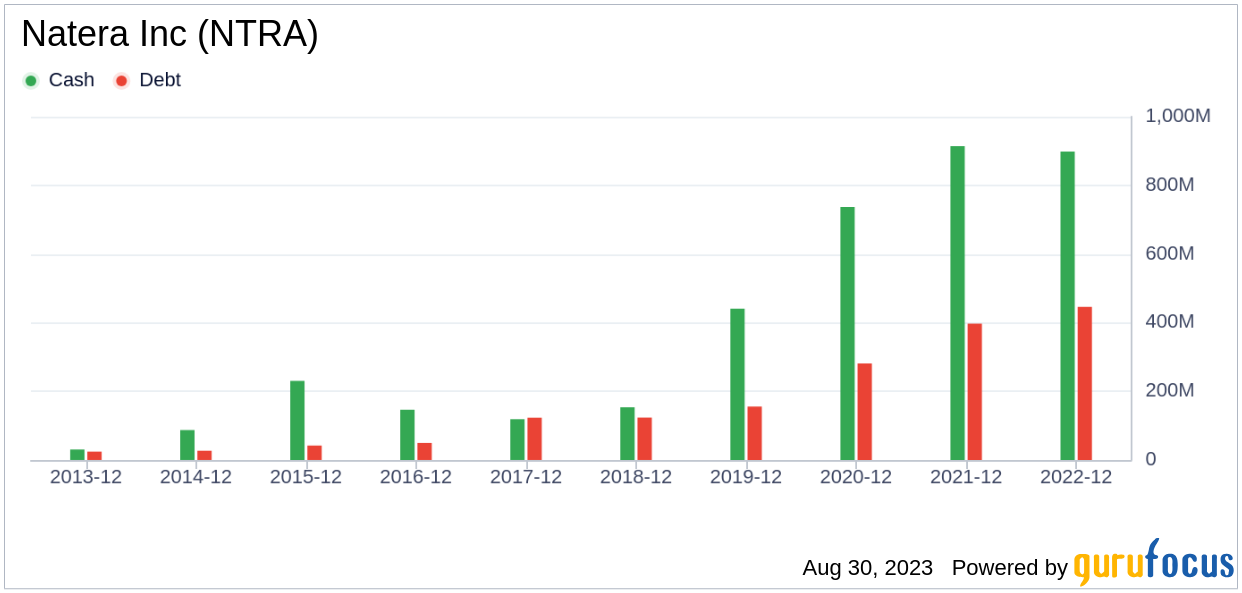

Natera Inc (NTRA, Financial), a leading player in the Medical Diagnostics & Research industry, has seen a significant surge in its stock price over the past quarter. The company's market cap stands at $6.61 billion, with its current stock price at $57.64, marking a 20.60% increase from its price three months ago, which was $52.48. Over the past week, the stock has gained 3.03%. The current GF Value of the stock is $86.31, down from $93.32 three months ago. Despite the decrease in GF Value, the stock is still significantly undervalued, a shift from its previous status as a possible value trap. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates.

Unpacking Natera Inc's Business Model

Natera Inc operates in the Medical Diagnostics & Research industry, offering proprietary molecular and bioinformatics technology. The company's key product offerings include the Panorama Non-Invasive Prenatal Test (NIPT), Horizon Carrier Screening (HCS), Signatera molecular residual disease (MRD) test, and Prospera. These products play a crucial role in screening for chromosomal abnormalities, determining carrier status for severe genetic diseases, detecting circulating tumor DNA in cancer patients, and assessing organ transplant rejection, respectively.

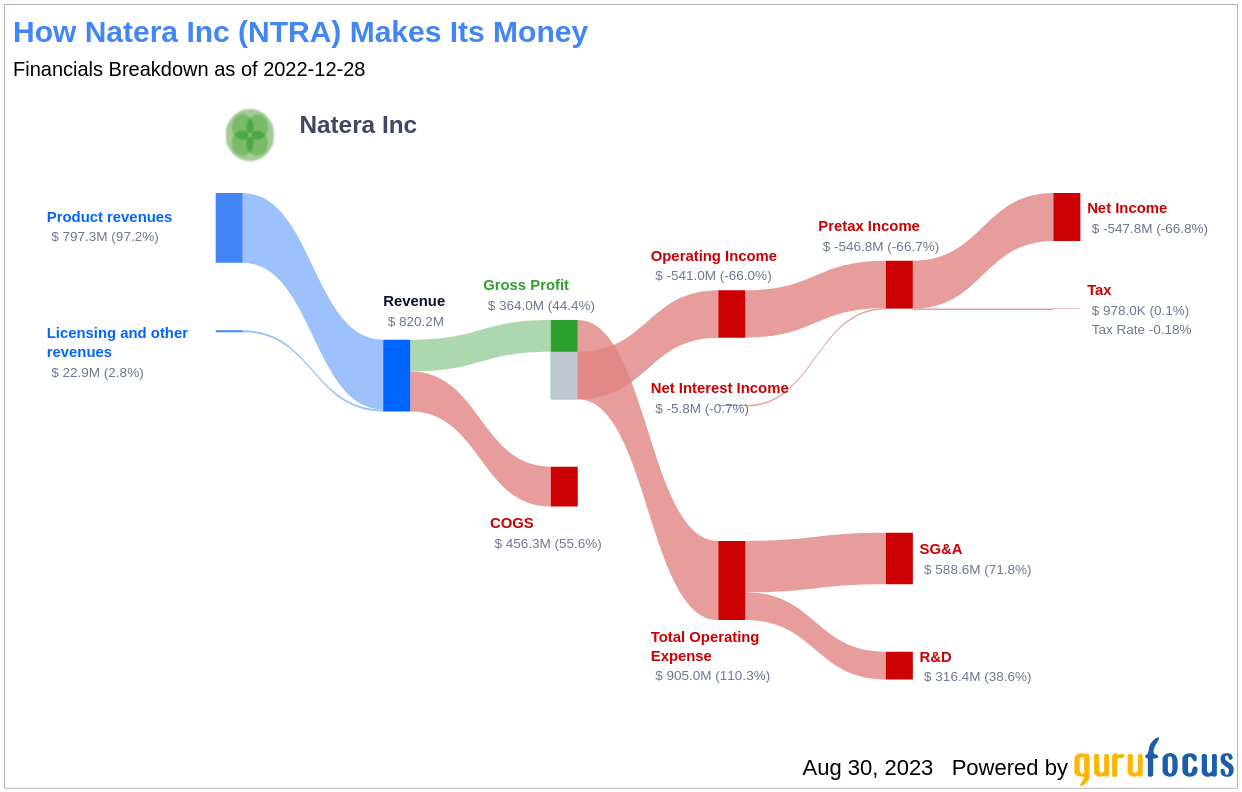

Profitability Analysis

As of June 30, 2023, Natera Inc's Profitability Rank stands at 3/10, indicating a need for improvement. The company's Operating Margin is -54.94%, better than 30.94% of companies in the same industry. Its ROE is -92.76%, outperforming 16.97% of competitors, while its ROA of -42.39% is better than 27.54% of industry peers. The company's ROIC is -145.73%, surpassing 14.04% of competitors.

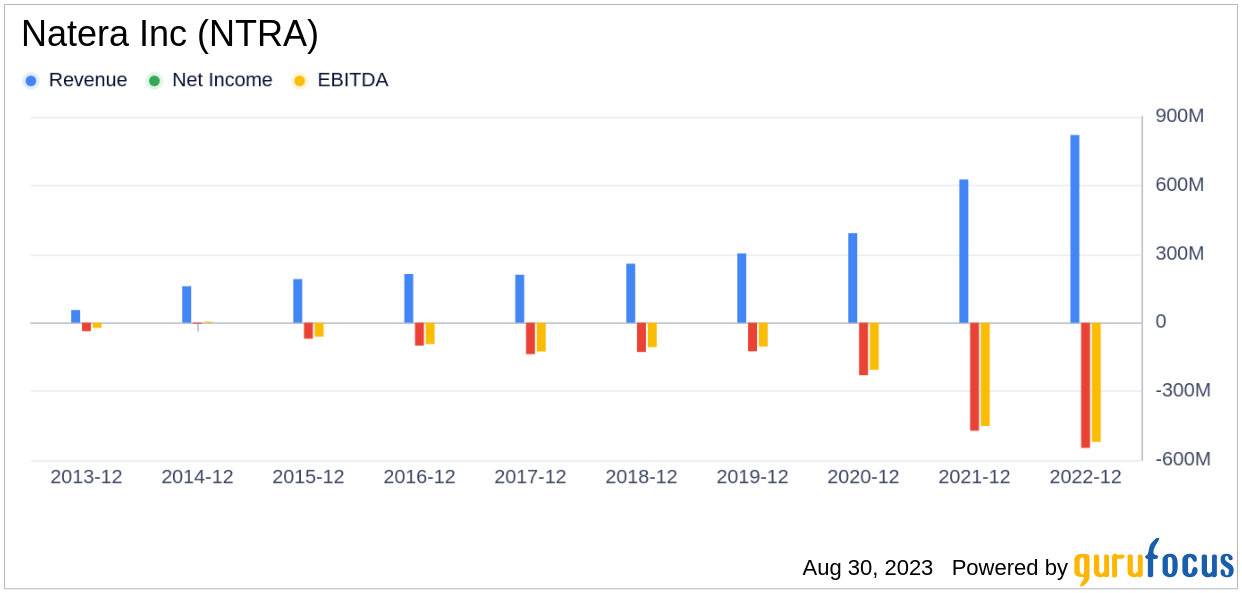

Growth Prospects

Natera Inc's Growth Rank is 7/10, indicating a strong growth trajectory. The company's 3-Year Revenue Growth Rate per Share is 24.20%, outperforming 75.25% of industry peers. Its 5-Year Revenue Growth Rate per Share is 16.00%, better than 64.5% of competitors. The projected Total Revenue Growth Rate for the next 3 to 5 years is 26.72%, surpassing 91.67% of industry peers. However, the company's 3-Year and 5-Year EPS without NRI Growth Rates are -46.00% and -21.60% respectively, only better than around 10% of competitors.

Top Holders of Natera Inc's Stock

Stanley Druckenmiller (Trades, Portfolio) is the top holder of Natera Inc's stock, owning 893,030 shares, which equates to 0.78% of the company's shares. Joel Greenblatt (Trades, Portfolio) holds the second-largest number of shares at 43,964, representing 0.04% of the company's shares. Paul Tudor Jones (Trades, Portfolio) holds 16,117 shares, accounting for 0.01% of the company's shares.

Competitive Landscape

Natera Inc faces stiff competition from Guardant Health Inc (GH, Financial), Ortho Clinical Diagnostics Holdings PLC (OCDX, Financial), and Neogen Corp (NEOG, Financial), with market caps of $4.7 billion, $4.19 billion, and $4.95 billion respectively.

Conclusion

In conclusion, Natera Inc's stock has seen a significant surge over the past quarter, and the company's GF Value indicates that it is significantly undervalued. Despite its low profitability rank, the company has shown strong growth prospects. However, it faces stiff competition from industry peers. Investors should keep a close eye on this stock and consider its growth potential and competitive position before making investment decisions.