Adobe Inc. (ADBE, Financial) recently reported a daily gain of 2.46%, and a significant 3-month gain of 33.43%. The company's Earnings Per Share (EPS) (EPS) stands at 10.48. This brings us to the question: Is Adobe modestly undervalued? This article aims to provide a comprehensive valuation analysis, inviting the reader to delve deeper into the financials of Adobe (ADBE).

Introduction to Adobe Inc.

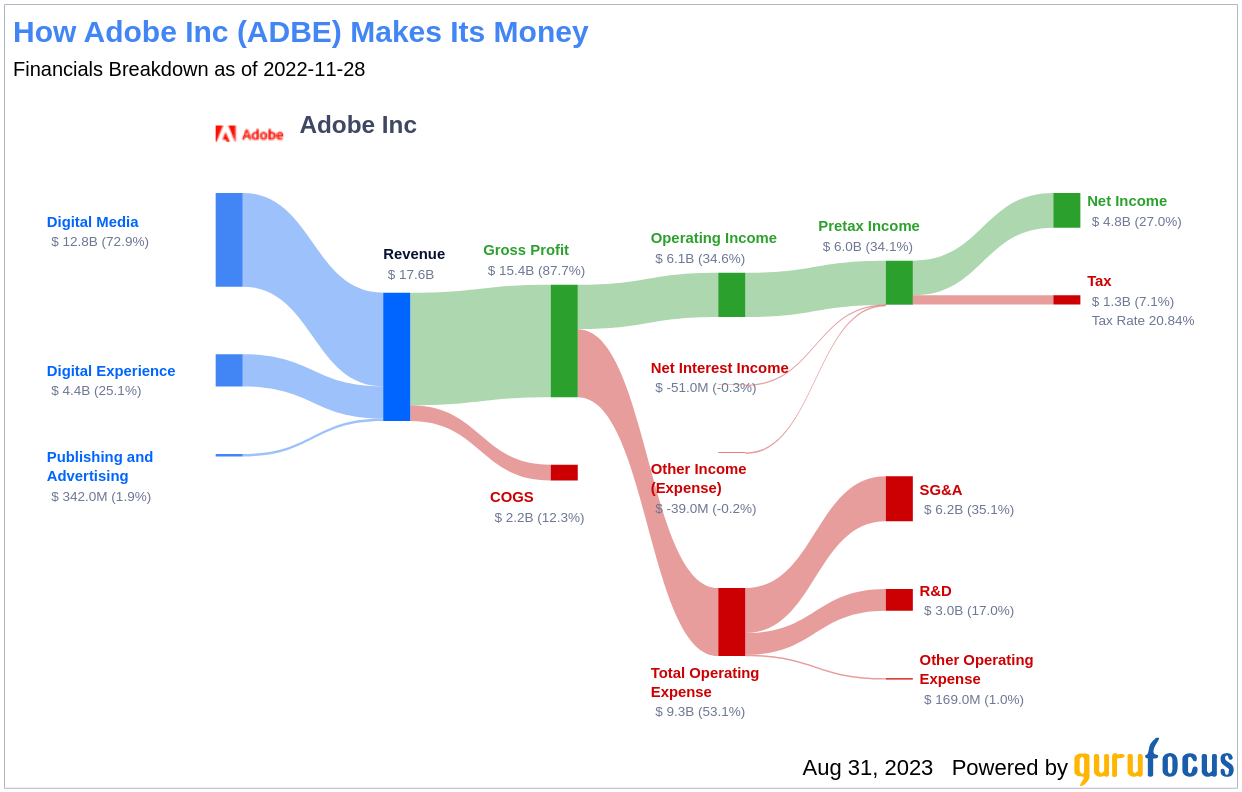

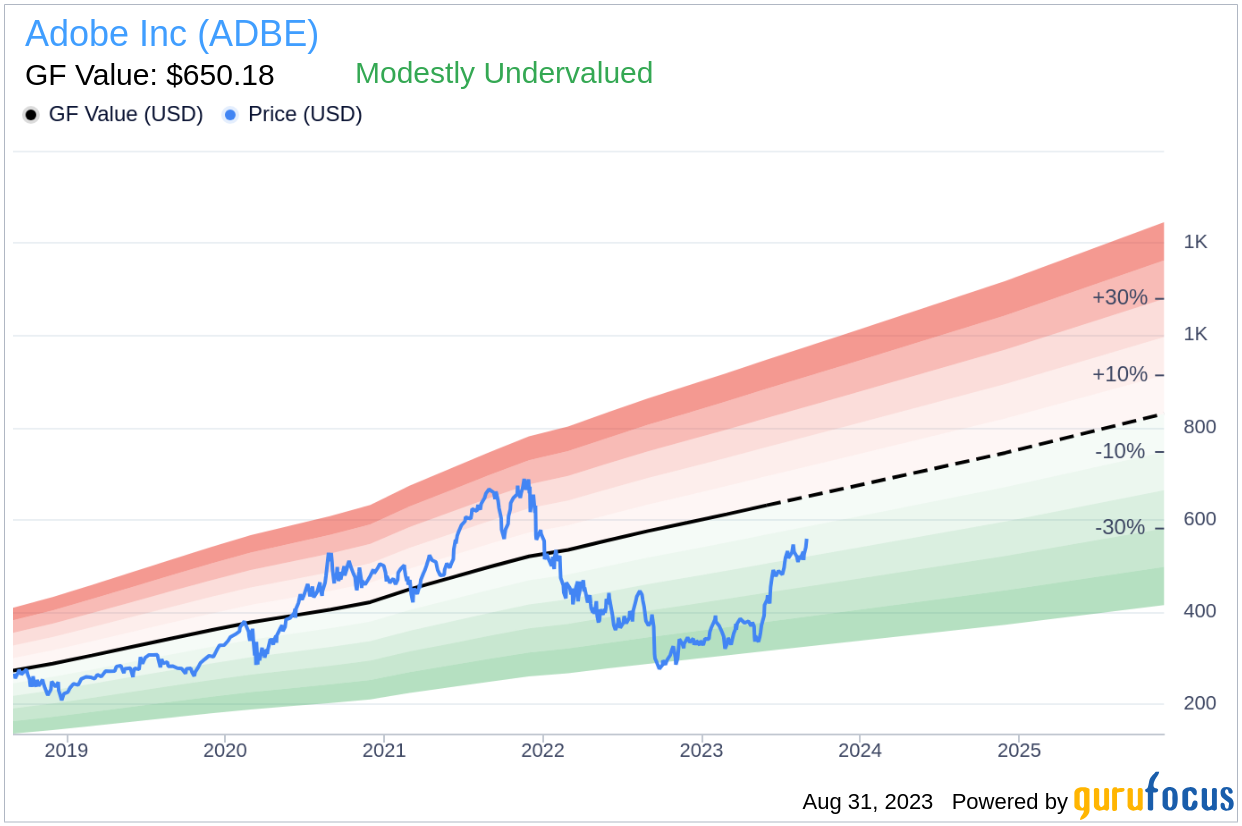

Adobe provides content creation, document management, and digital marketing and advertising software and services to creative professionals and marketers. The company operates with three segments: digital media content creation, digital experience for marketing solutions, and publishing for legacy products. As of August 31, 2023, Adobe's stock price is $558.77, while its estimated fair value (GF Value) is $650.18, suggesting that the stock might be modestly undervalued.

Understanding Adobe's GF Value

The GF Value of a stock represents its current intrinsic value, calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher. At its current price, Adobe (ADBE, Financial) has a market cap of $254.70 billion and is believed to be modestly undervalued. This suggests that the long-term return of Adobe's stock is likely to be higher than its business growth.

Assessing Adobe's Financial Strength

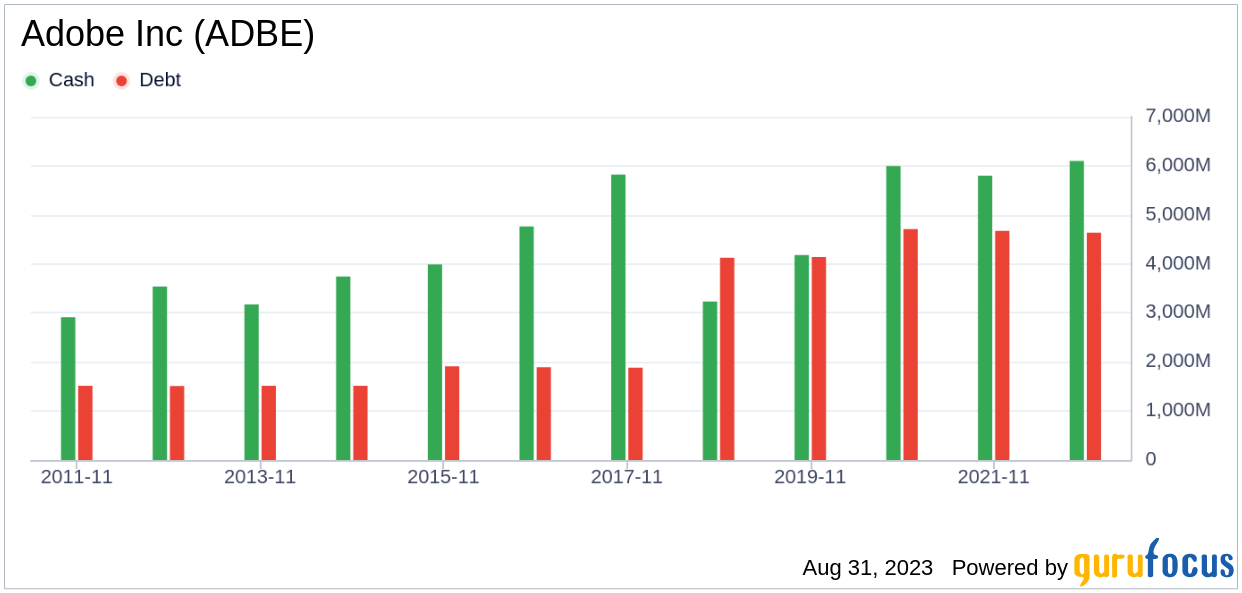

Investing in companies with low financial strength could result in permanent capital loss. Therefore, it's crucial to review a company's financial strength before investing. Adobe has a cash-to-debt ratio of 1.61, ranking worse than 58.48% of 2736 companies in the Software industry. Despite this, GuruFocus ranks Adobe's financial strength as 8 out of 10, suggesting a strong balance sheet.

Profitability and Growth of Adobe

Companies that have been consistently profitable offer less risk for investors. Adobe has been profitable 10 over the past 10 years, with a revenue of $18.40 billion and an EPS of $10.48 in the past twelve months. Its operating margin is 33.64%, ranking better than 96.44% of 2723 companies in the Software industry. The average annual revenue growth of Adobe is 18.1%, ranking better than 71.17% of 2390 companies in the Software industry.

ROIC vs WACC

One can evaluate a company's profitability by comparing its return on invested capital (ROIC) to its weighted average cost of capital (WACC). If the ROIC exceeds the WACC, the company is likely creating value for its shareholders. In the past 12 months, Adobe's ROIC is 19.6 while its WACC came in at 13.85.

Conclusion

In conclusion, Adobe (ADBE, Financial) appears to be modestly undervalued. The company's financial condition is strong, and its profitability is robust. Its growth ranks better than 68.59% of 1990 companies in the Software industry. To learn more about Adobe stock, you can check out its 30-Year Financials here.

To find out the high quality companies that may deliver above average returns, please check out GuruFocus High Quality Low Capex Screener.