Bath & Body Works Inc (BBWI, Financial) has seen a daily gain of 3.47% and a three-month gain of 6.1%, with an Earnings Per Share (EPS) (EPS) of 3.07. The big question for investors is: Is this stock significantly undervalued? In this article, we will delve into BBWI's financials and valuation to provide a comprehensive analysis. Keep reading to gain insights that could inform your investment decisions.

Company Overview

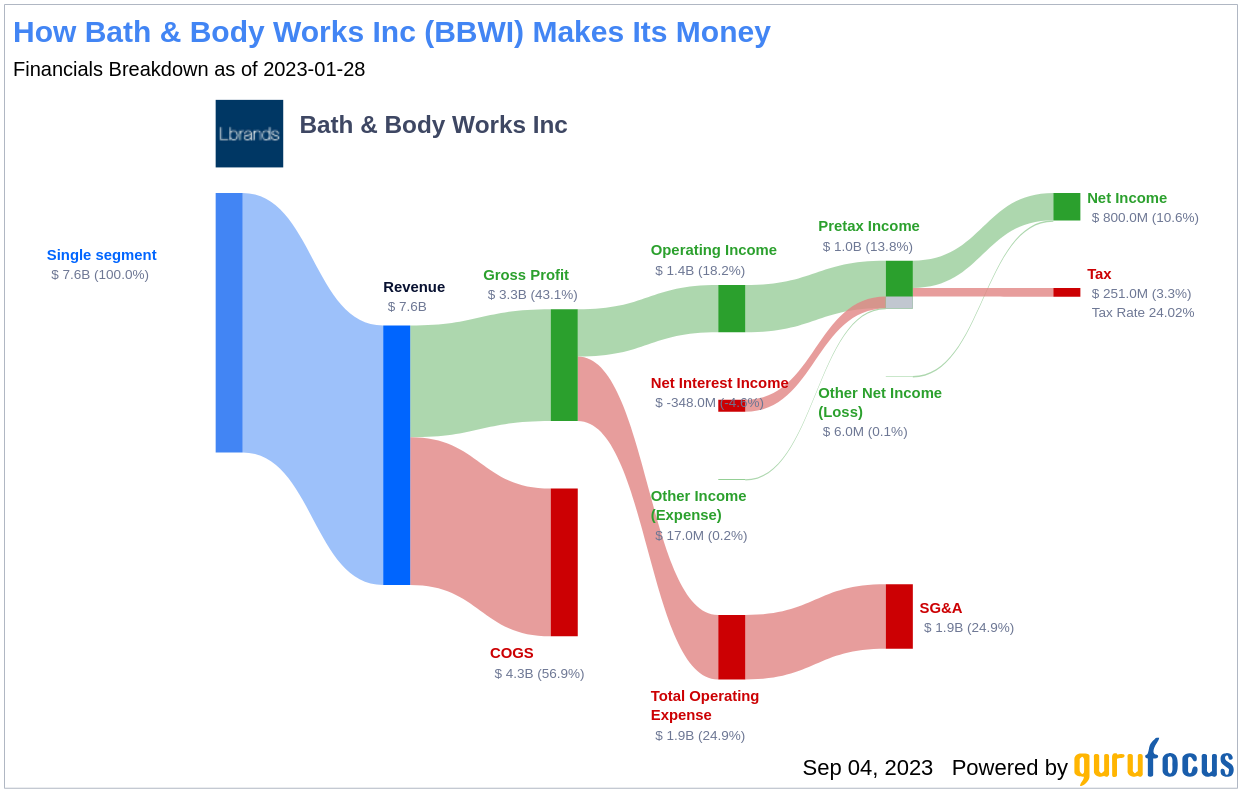

Bath & Body Works is a specialty retailer offering home fragrance and fragrant body care products under the Bath & Body Works, C.O. Bigelow, and White Barn brands. The company generates the majority of its sales from North America, with less than 5% coming from international markets in fiscal 2022. The company's future growth is expected to stem from store reformatting, digital and international channels, and new category expansion.

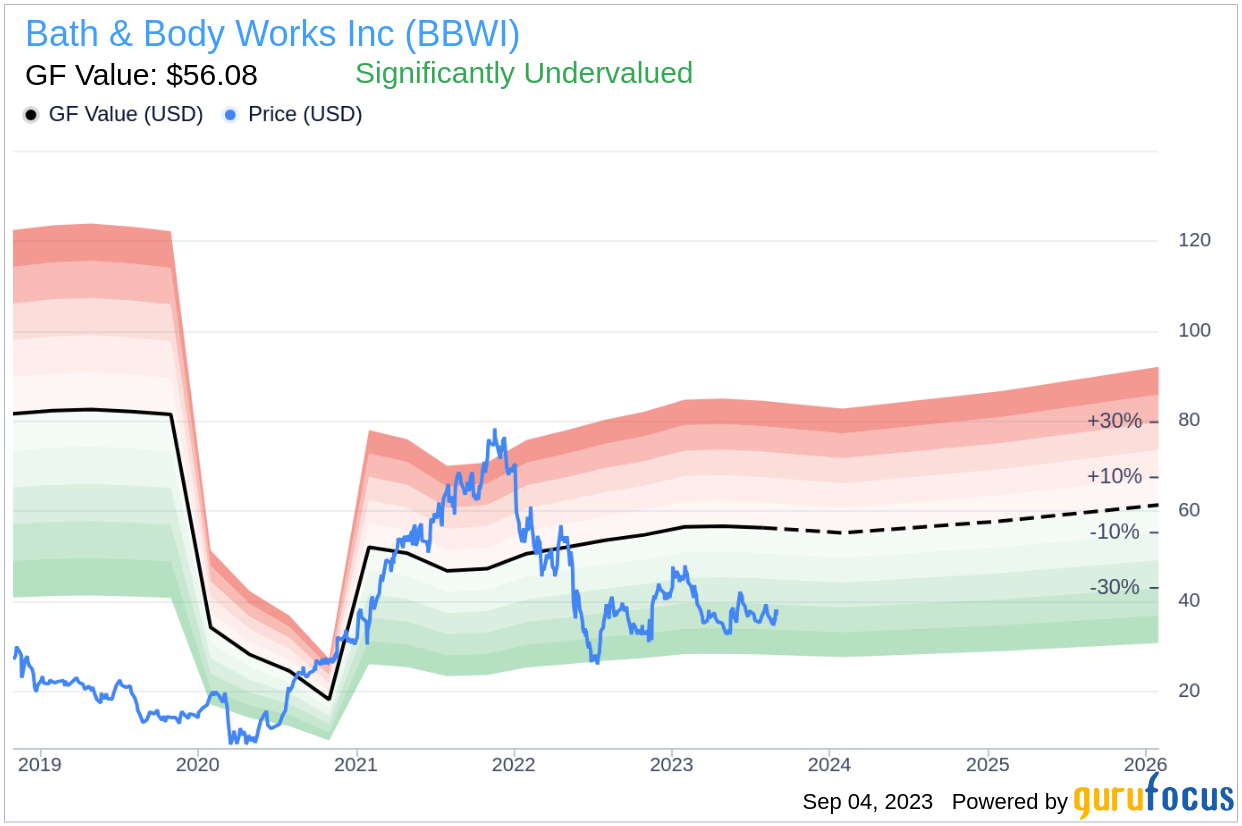

At a current price of $38.15 per share and a market cap of $8.70 billion, Bath & Body Works' stock seems significantly undervalued compared to its GF Value of $56.08. This discrepancy paves the way for a deeper exploration of the company's intrinsic value.

Understanding GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line provides an overview of the fair value at which the stock should ideally be traded. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

Given Bath & Body Works' current price and market cap, our analysis indicates that the stock is significantly undervalued. This suggests that the long-term return of its stock is likely to be much higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

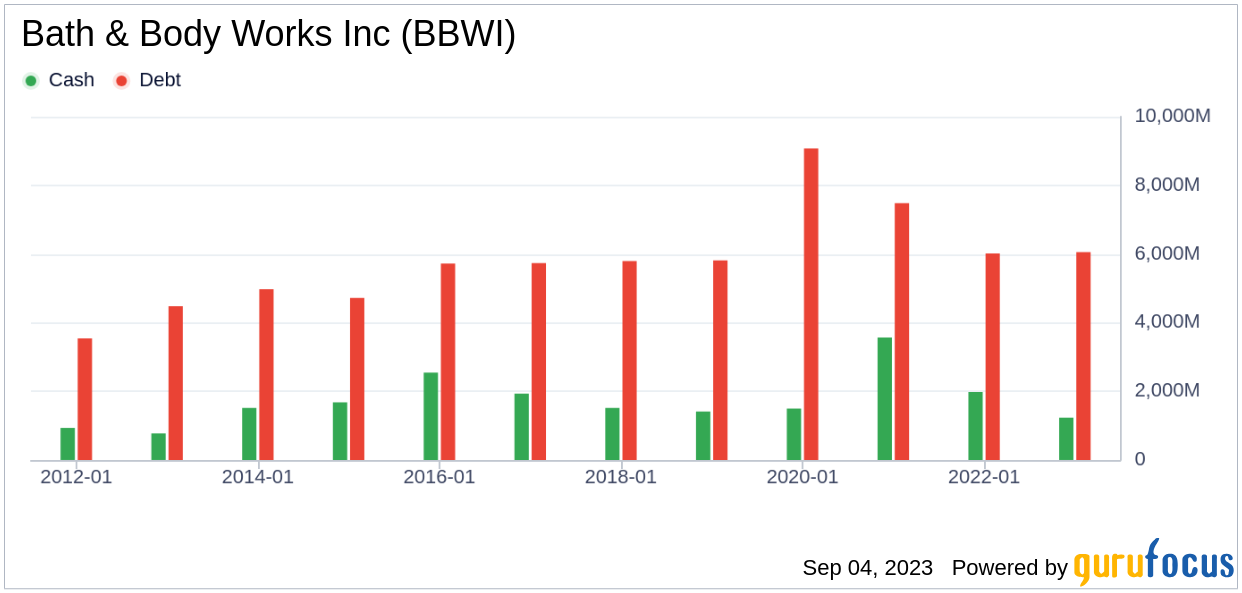

Assessing Financial Strength

Before investing in a company, it's crucial to assess its financial strength. Companies with poor financial strength pose a higher risk of permanent loss for investors. A useful way to understand a company's financial strength is by looking at its cash-to-debt ratio and interest coverage. Bath & Body Works' cash-to-debt ratio of 0.13 is lower than 77.26% of companies in the Retail - Cyclical industry, indicating poor financial strength.

Profitability and Growth

Consistent profitability over the long term reduces risk for investors. Higher profit margins usually indicate a better investment compared to a company with lower profit margins. Bath & Body Works has been profitable for 9 out of the past 10 years, with an operating margin of 16.42%, ranking better than 90.48% of companies in the Retail - Cyclical industry. This indicates strong profitability.

However, growth is a crucial factor in a company's valuation. Faster-growing companies create more value for shareholders, especially if the growth is profitable. Bath & Body Works' 3-year average annual revenue growth is 18.6%, ranking better than 79.96% of companies in the Retail - Cyclical industry. However, its 3-year average EBITDA growth rate is 7.1%, ranking worse than 51.84% of companies in the same industry, indicating relatively weak growth.

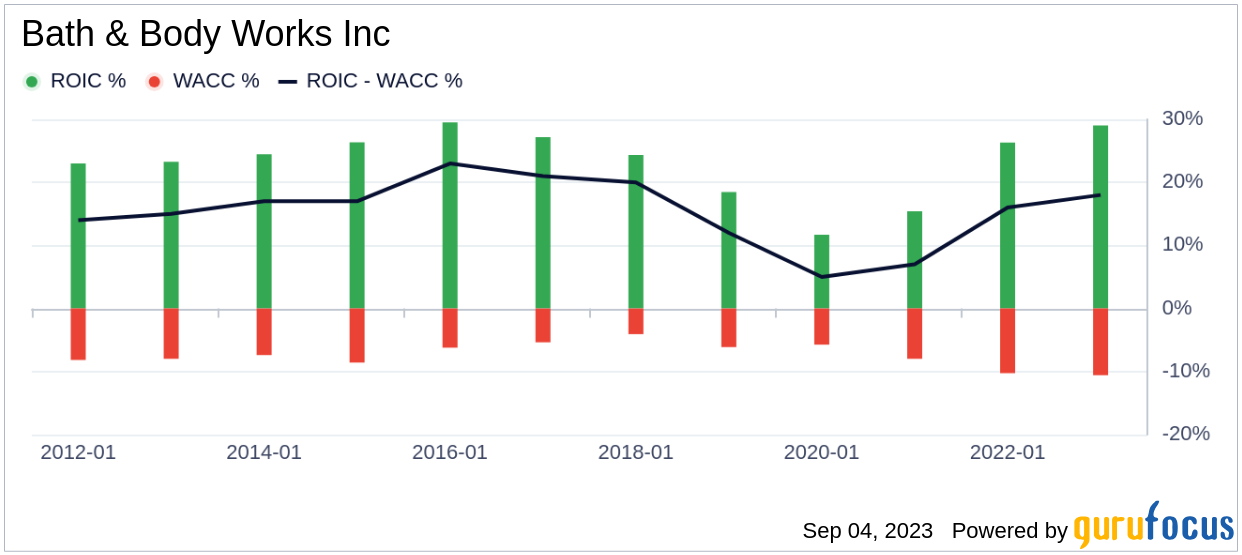

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can also help evaluate its profitability. Bath & Body Works' ROIC of 26.04% over the past 12 months exceeds its WACC of 9.51%, suggesting the company is creating value for its shareholders.

Conclusion

In conclusion, Bath & Body Works appears significantly undervalued. Despite its poor financial condition, its profitability is strong, and its growth ranks better than 51.84% of companies in the Retail - Cyclical industry. For more details about Bath & Body Works' financials, check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.