An Analysis of the Medical Surgical Products Manufacturer's Dividend History, Yield, and Growth

Becton Dickinson & Co(BDX, Financial) recently announced a dividend of $0.91 per share, payable on 2023-09-29, with the ex-dividend date set for 2023-09-07. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's deep dive into Becton Dickinson & Co's dividend performance and assess its sustainability.

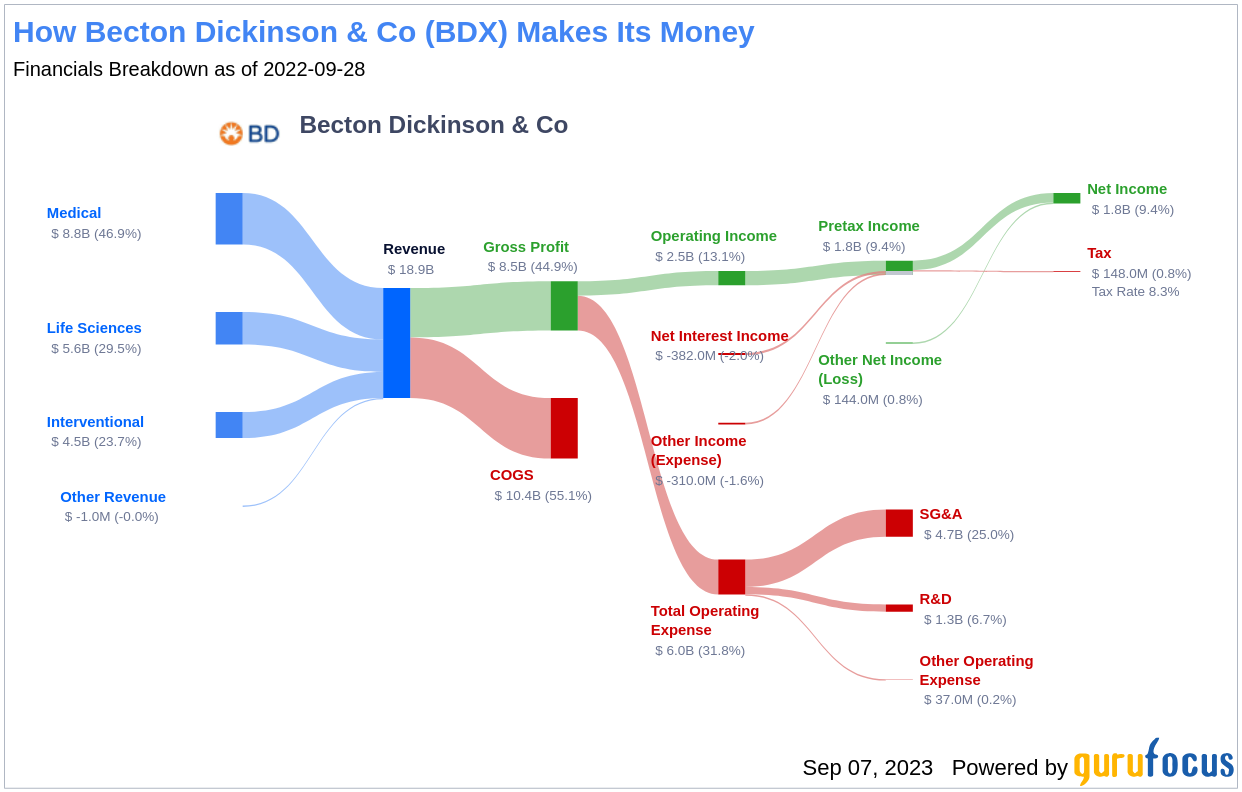

What Does Becton Dickinson & Co Do?

Becton, Dickinson is the world's largest manufacturer and distributor of medical surgical products, such as needles, syringes, and sharps-disposal units. The company also manufactures diagnostic instruments and reagents, flow cytometry and cell-imaging systems. BD Medical accounts for nearly half of the total business, with BD Life Sciences and BD Interventional making up the remainder. International revenue accounts for 43% of the company's business.

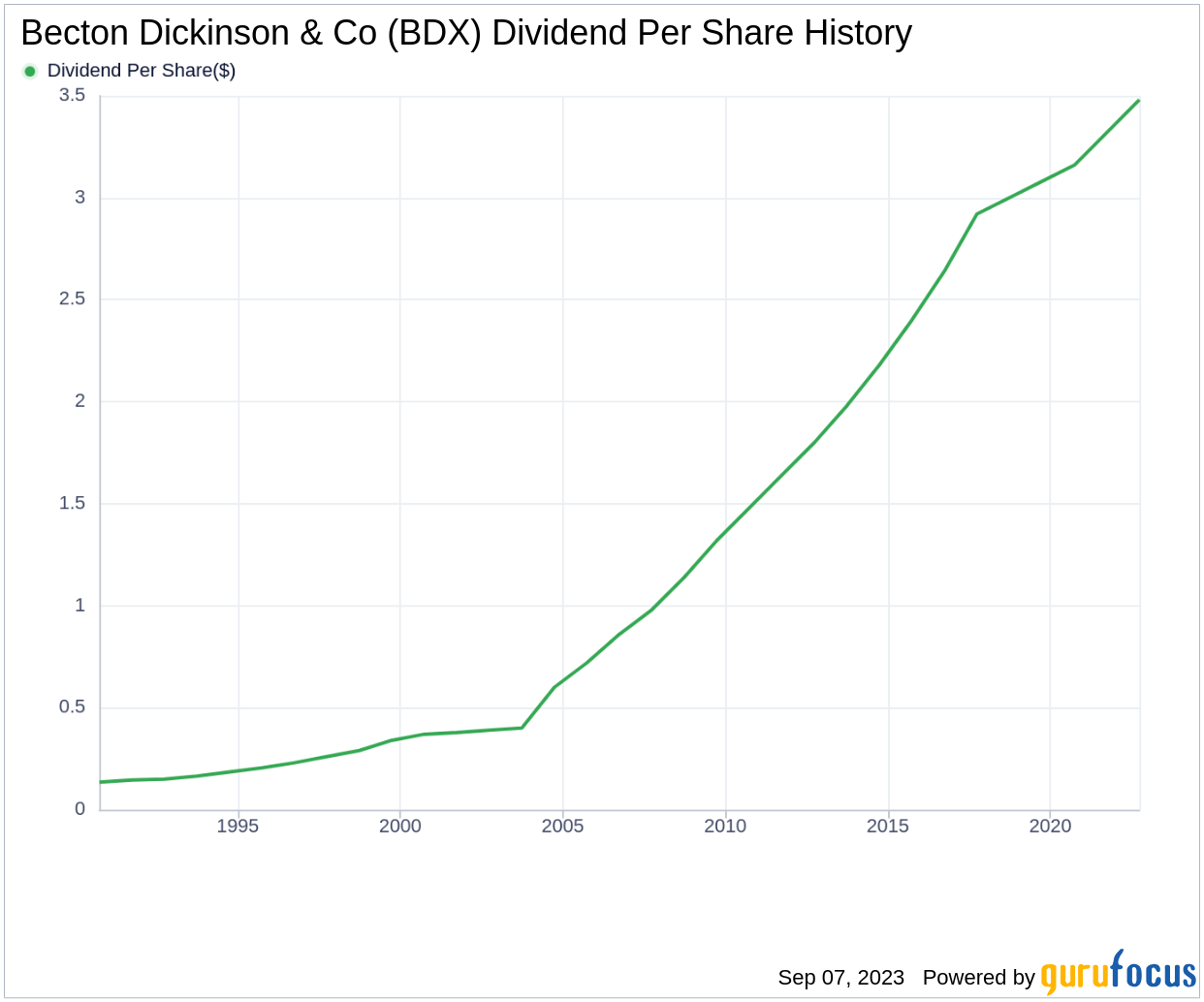

A Glimpse at Becton Dickinson & Co's Dividend History

Becton Dickinson & Co has maintained a consistent dividend payment record since 1972. Dividends are currently distributed on a quarterly basis. The company has increased its dividend each year since 1972, earning it the status of a dividend king.

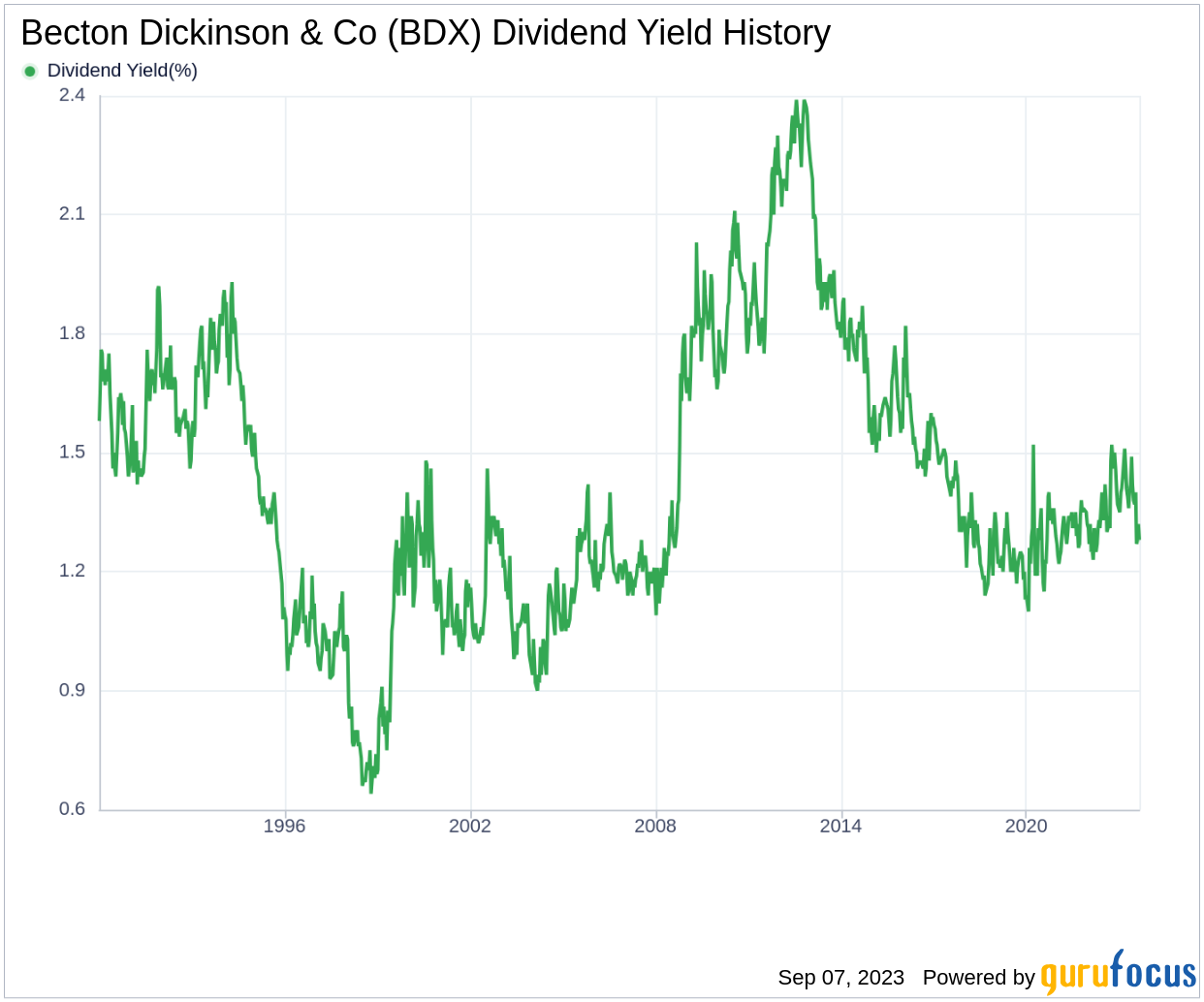

Breaking Down Becton Dickinson & Co's Dividend Yield and Growth

As of today, Becton Dickinson & Co currently has a 12-month trailing dividend yield of 1.35% and a 12-month forward dividend yield of 1.36%. This suggests an expectation of increased dividend payments over the next 12 months. Over the past three years, the company's annual dividend growth rate was 4.20%. Extended to a five-year horizon, this rate decreased to 3.50% per year. Over the past decade, Becton Dickinson & Co's annual dividends per share growth rate stands at 6.70%.

The Sustainability Question: Payout Ratio and Profitability

To assess the sustainability of the dividend, one needs to evaluate the company's payout ratio. The dividend payout ratio provides insights into the portion of earnings the company distributes as dividends. A lower ratio suggests that the company retains a significant part of its earnings, thereby ensuring the availability of funds for future growth and unexpected downturns. As of 2023-06-30, Becton Dickinson & Co's dividend payout ratio is 0.65.

Becton Dickinson & Co's profitability rank of 8 out of 10 suggests good profitability prospects. The company has reported positive net income for each year over the past decade, further solidifying its high profitability.

Growth Metrics: The Future Outlook

To ensure the sustainability of dividends, a company must have robust growth metrics. Becton Dickinson & Co's growth rank of 8 out of 10 suggests that the company's growth trajectory is good relative to its competitors.

The company's 3-year EPS growth rate showcases its capability to grow its earnings, a critical component for sustaining dividends in the long run. During the past three years, Becton Dickinson & Co's earnings increased by approximately 10.90% per year on average.

Lastly, the company's 5-year EBITDA growth rate of 17.80%, underperforms than approximately 40.37% of global competitors.

Conclusion

Considering Becton Dickinson & Co's consistent dividend payments, respectable dividend growth rate, reasonable payout ratio, high profitability, and compelling growth metrics, it seems the company's dividends are well-positioned for sustainability. However, the company's growth rate in comparison to its global competitors suggests there may be room for improvement. As always, potential investors should conduct thorough research and consider various factors before making investment decisions.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.