Bio-Rad Laboratories Inc (BIO, Financial) has seen a daily loss of 1.42% and a 3-month loss of 1.26%, with a per share loss of 15.01. The question that arises is whether the stock is significantly undervalued. This article delves into a valuation analysis of Bio-Rad Laboratories, providing a comprehensive view of its financial standing and future prospects.

Company Overview

Bio-Rad Laboratories, headquartered in Hercules, California, is a prominent player in the clinical diagnostics and life sciences markets. With a diversified geographic presence spanning the Americas, Europe, Africa, and Asia-Pacific, the company manufactures and markets products for clinical laboratories and research, biopharmaceutical production, and food testing. A significant stakeholder in Sartorius AG, a laboratory and biopharmaceutical supplier, Bio-Rad Laboratories commands a market cap of $10.60 billion.

Unpacking the GF Value

The GF Value is a proprietary measure that provides an estimate of a stock's intrinsic value. The GF Value Line, visible on our summary page, denotes the stock's ideal fair trading value. This value is computed considering historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates.

At its current price of $362.66 per share, Bio-Rad Laboratories (BIO, Financial) appears to be significantly undervalued according to the GF Value calculation. This suggests that the long-term return of its stock is likely to be much higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

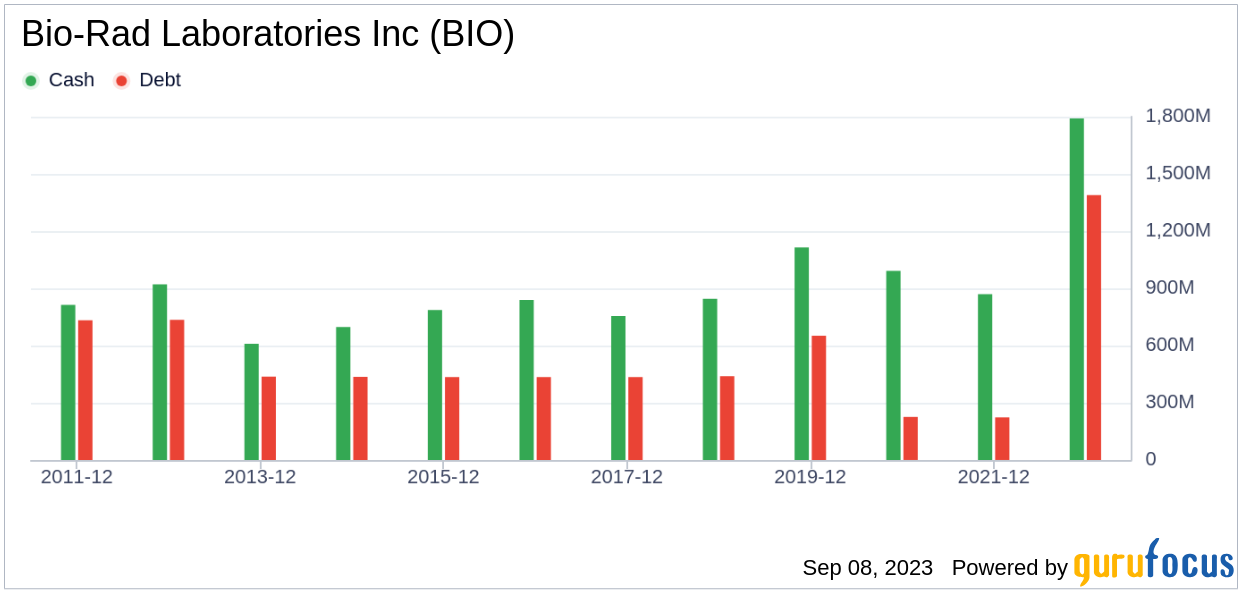

Before investing in a company, it's crucial to assess its financial strength. Companies with poor financial strength pose a higher risk of permanent loss. Key indicators of financial strength, such as the cash-to-debt ratio and interest coverage, reveal that Bio-Rad Laboratories has a cash-to-debt ratio of 1.25, which is worse than 61.44% of 835 companies in the Medical Devices & Instruments industry. However, the overall financial strength of Bio-Rad Laboratories is 7 out of 10, indicating fair financial health.

Profitability and Growth

Investing in profitable companies, especially those with consistent long-term profitability, is generally less risky. Bio-Rad Laboratories has been profitable for 9 out of the past 10 years, with an operating margin of 13.11%, which ranks better than 71.27% of 825 companies in the Medical Devices & Instruments industry. This indicates fair profitability .

However, growth is a crucial factor in a company's valuation. Companies that grow faster create more value for shareholders, especially if that growth is profitable. The average annual revenue growth of Bio-Rad Laboratories is 7.1%, which ranks worse than 51.03% of 725 companies in the Medical Devices & Instruments industry. The 3-year average EBITDA growth is 0%, which ranks worse than 0% of 729 companies in the Medical Devices & Instruments industry.

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can provide insights into its profitability. Bio-Rad Laboratories's ROIC is 2.77 while its WACC came in at 8.32, indicating that the company may not be creating value for its shareholders.

Conclusion

In conclusion, Bio-Rad Laboratories (BIO, Financial) appears to be significantly undervalued. The company's financial condition and profitability are fair, but its growth ranks worse than 0% of 729 companies in the Medical Devices & Instruments industry. For more detailed financial information about Bio-Rad Laboratories, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.