Insulet Corp (PODD, Financial) has experienced a daily loss of 4.34% and a significant 3-month loss of 41.54%. Despite these fluctuations, the company maintains an Earnings Per Share (EPS) of 0.89. The question that arises is: Is the stock significantly undervalued? This article aims to provide an in-depth valuation analysis of Insulet (PODD). So, let's delve into the details.

Introduction to Insulet Corp (PODD, Financial)

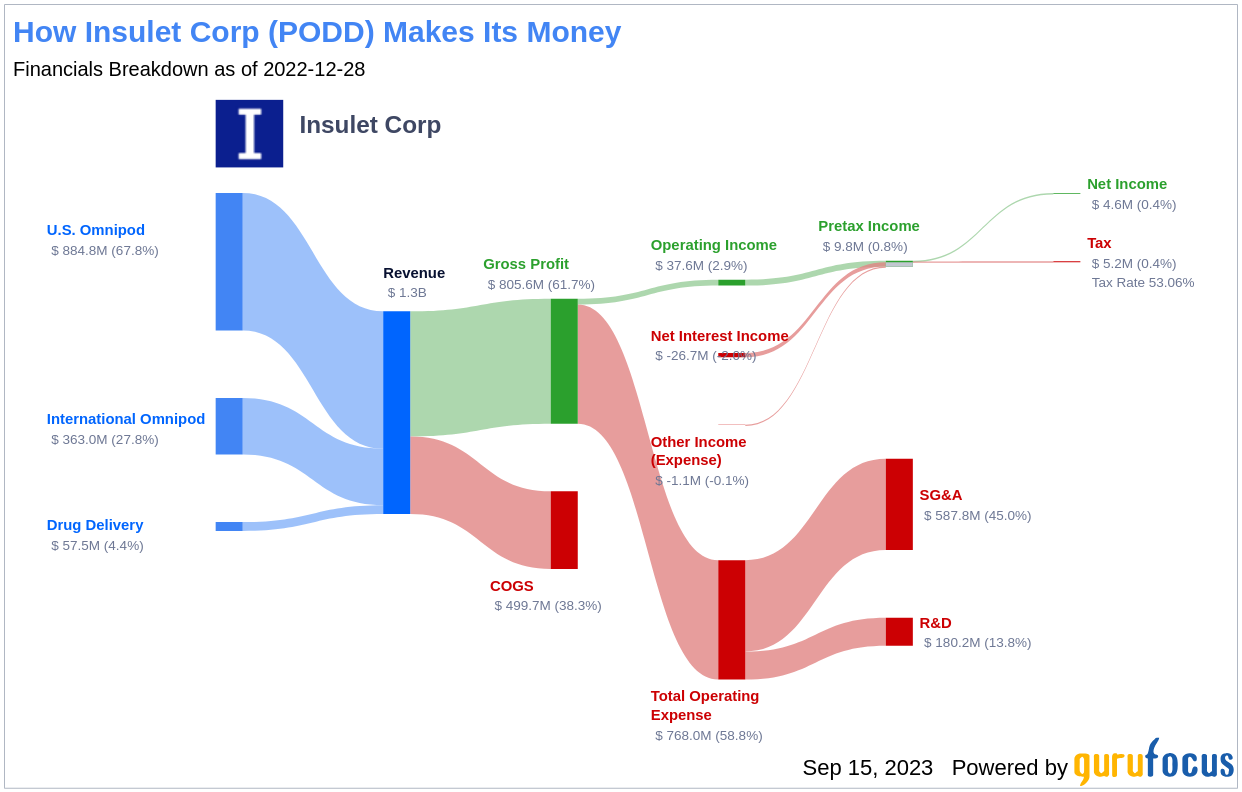

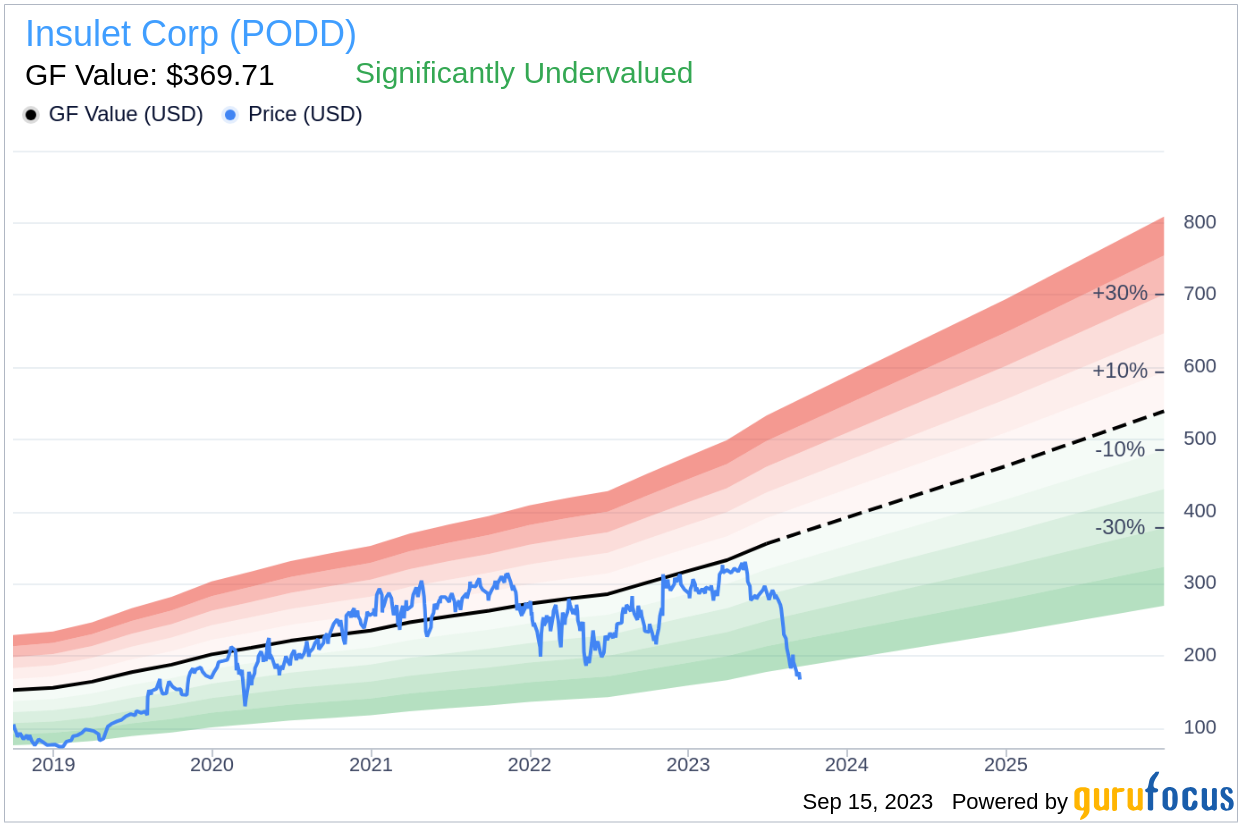

Founded in 2000, Insulet Corp aimed to simplify continuous subcutaneous insulin infusion therapy for diabetes. This led to the creation of the Omnipod system, a small disposable insulin infusion device that can be operated through a smartphone. Since its approval by the U.S. Food and Drug Administration in 2005, the Omnipod system is now used by approximately 360,000 insulin-dependent diabetics worldwide. Despite a current stock price of $167.13, the GF Value of Insulet stands at $369.71, suggesting that the stock might be significantly undervalued.

Understanding the GF Value of Insulet

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. If a stock's price is significantly above the GF Value Line, it is likely overvalued, and its future return might be poor. Conversely, if a stock's price is significantly below the GF Value Line, its future return is likely to be higher. Based on this analysis, Insulet (PODD, Financial) appears to be significantly undervalued, with a market cap of $11.70 billion.

Given its significant undervaluation, the long-term return of Insulet's stock is likely to be much higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

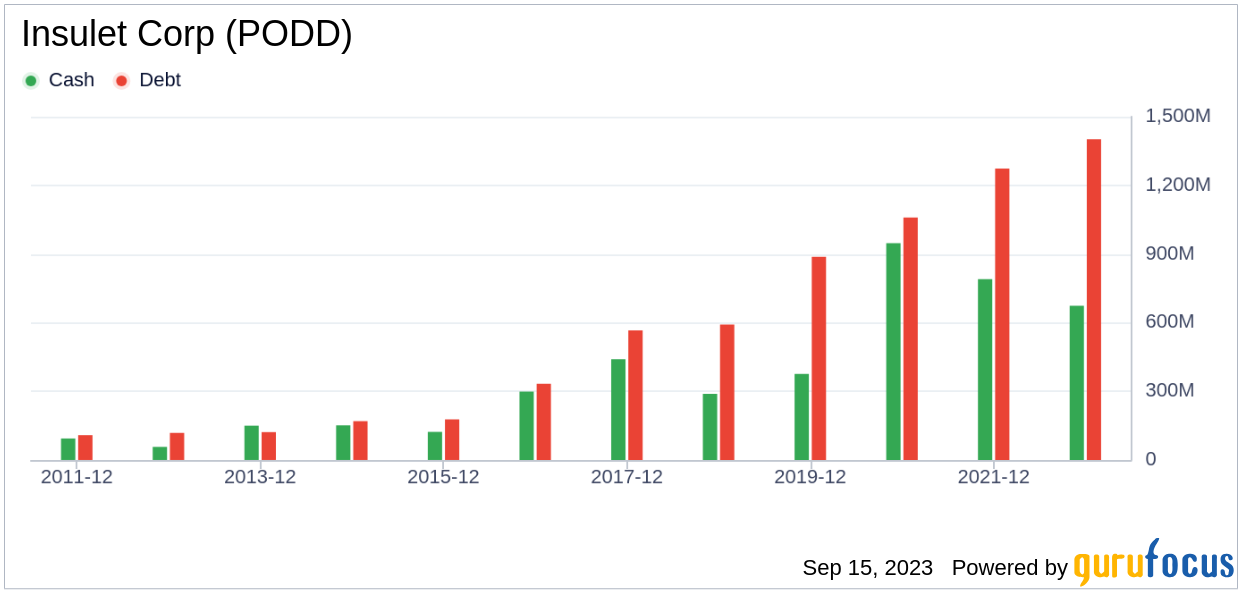

Insulet's Financial Strength

Before investing in a company, it's crucial to assess its financial strength. Companies with poor financial strength pose a higher risk of permanent loss. Insulet's cash-to-debt ratio of 0.46 is lower than 77.5% of 840 companies in the Medical Devices & Instruments industry, indicating fair financial strength.

Profitability and Growth of Insulet

Insulet's profitability and growth are also important factors to consider. The company has been profitable 5 out of the past 10 years, with an operating margin of 5.82%, ranking better than 57.59% of 830 companies in the Medical Devices & Instruments industry. However, its 3-year average EBITDA growth is 8.1%, ranking worse than 51.29% of 737 companies in the same industry.

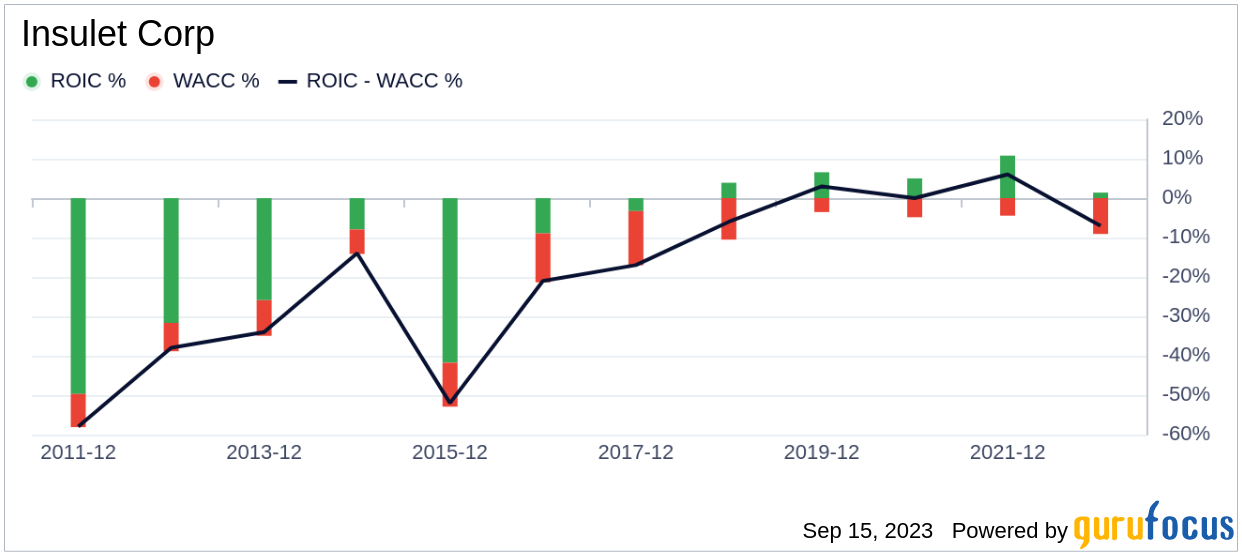

ROIC vs WACC

Another way to evaluate a company's profitability is to compare its Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC). For the past 12 months, Insulet's ROIC is 5.68, while its WACC is 9.3.

Conclusion

In conclusion, Insulet Corp (PODD, Financial) appears to be significantly undervalued. The company's financial condition and profitability are fair, but its growth ranks worse than 51.29% of 737 companies in the Medical Devices & Instruments industry. For more insights on Insulet's stock, you can check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.