Lennar Corp (LEN, Financial) recently reported a daily gain of 1.92%, contrasting with a three-month loss of 3.93%. The company's Earnings Per Share (EPS) stands at 13.49. This article seeks to answer the question - is Lennar Corp fairly valued? The ensuing analysis provides a deep dive into the company's valuation, financial strength, and growth prospects. Let's get started.

Company Introduction

Lennar Corp is the second-largest public homebuilder in the United States, primarily catering to first-time, move-up, and active adult homebuyers. With a significant presence in mortgage financing and related services, Lennar Corp has also made strides in multifamily construction and housing-related technology startups. The company's current stock price is $116.96, with a market cap of $33.20 billion. This price closely aligns with Lennar Corp's fair value (GF Value) of $117.4, suggesting a fair valuation.

Understanding GF Value

The GF Value is a proprietary measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. If a stock's price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

For Lennar Corp, the stock is estimated to be fairly valued, signifying that the long-term return of its stock is likely to be close to the rate of its business growth.

Assessing Financial Strength

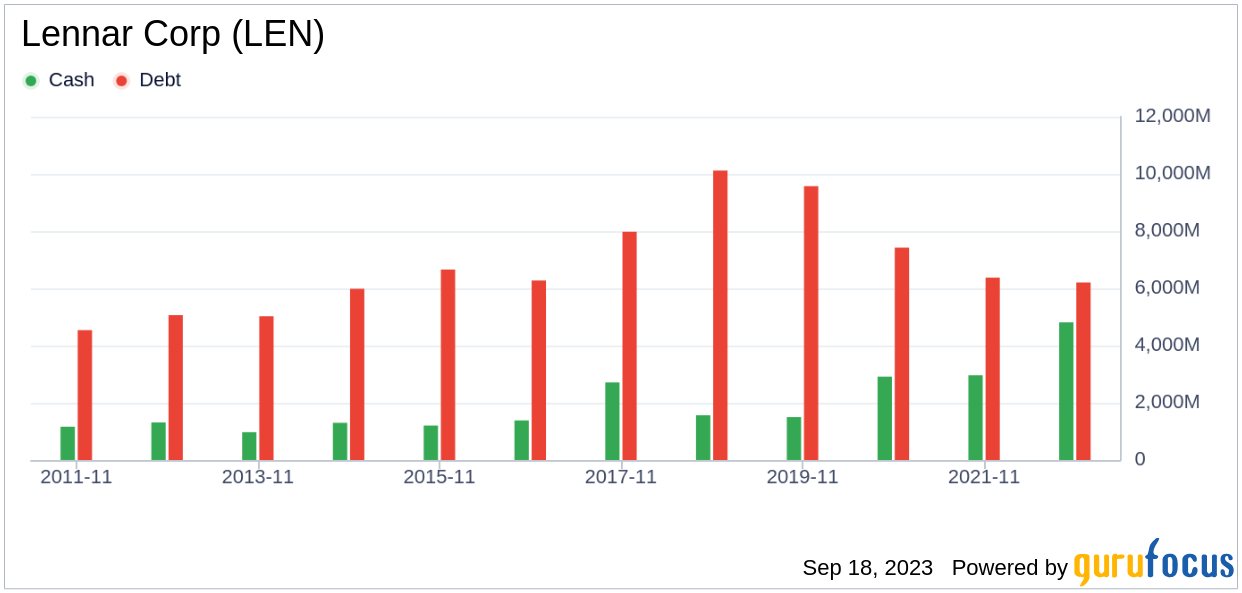

The financial strength of a company is crucial in mitigating the risk of permanent capital loss. Key indicators of financial strength include the cash-to-debt ratio and interest coverage. With a cash-to-debt ratio of 0.86, Lennar Corp ranks better than 61.32% of 106 companies in the Homebuilding & Construction industry. The overall financial strength of Lennar Corp is 7 out of 10, indicating a fair financial position.

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, poses less risk. Lennar Corp has been profitable for the past 10 years, with an operating margin of 17.43%, ranking better than 80.73% of 109 companies in the Homebuilding & Construction industry. The company's profitability is rated 9 out of 10 by GuruFocus, indicating strong profitability.

Another critical factor in company valuation is growth. Lennar Corp's average annual revenue growth is 18.5%, ranking better than 76.24% of 101 companies in the Homebuilding & Construction industry. The 3-year average EBITDA growth is 43.2%, which ranks better than 77.66% of companies in the industry.

Evaluating ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted cost of capital (WACC) is another effective way to assess its profitability. If the ROIC is higher than the WACC, it indicates that the company is creating value for shareholders. Over the past 12 months, Lennar Corp's ROIC was 14.55, while its WACC came in at 9.91.

Conclusion

In summary, Lennar Corp's stock is estimated to be fairly valued. The company's financial condition is fair, its profitability is strong, and its growth ranks better than 77.66% of companies in the Homebuilding & Construction industry. For a more detailed look at Lennar Corp's financials, you can check out its 30-Year Financials here.

Discover high-quality companies that may deliver above-average returns with reduced risk on the GuruFocus High Quality Low Capex Screener.