Boston Scientific Corp (BSX, Financial) recently reported a daily gain of 2.45%, and a 3-month gain of 0.12%. The company's Earnings Per Share (EPS) stands at 0.6. But is the stock fairly valued? This article provides an in-depth analysis of Boston Scientific's valuation, encouraging readers to delve deeper into the company's financial health and prospects.

About Boston Scientific Corp (BSX, Financial)

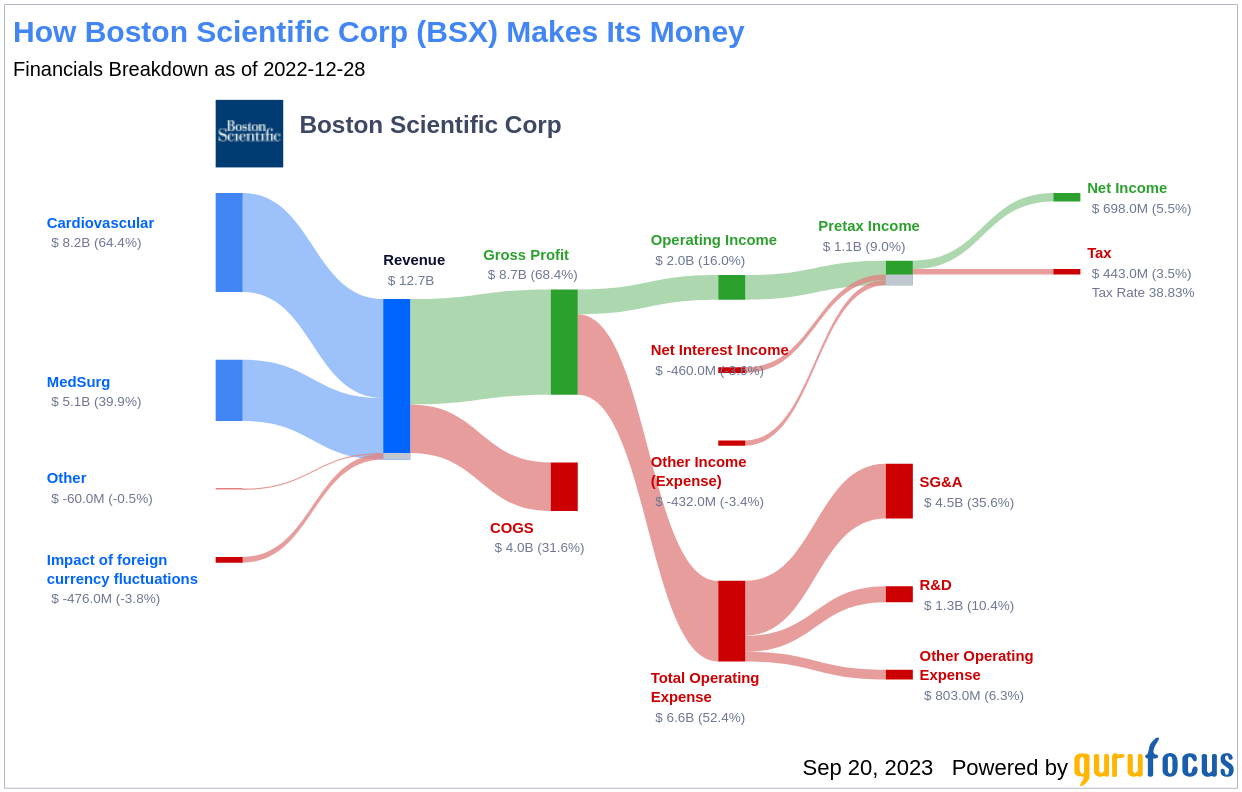

Boston Scientific is a leading manufacturer of less invasive medical devices used in various medical procedures. The company's devices are used globally in angioplasty, blood clot filtration, cardiac rhythm management, and other medical procedures. Nearly half of the company's total sales come from foreign markets. Boston Scientific's stock is currently priced at $54.33 per share, giving it a market cap of $79.60 billion. The company's GF Value, an estimation of its fair value, is $50.49, suggesting that the stock is fairly valued.

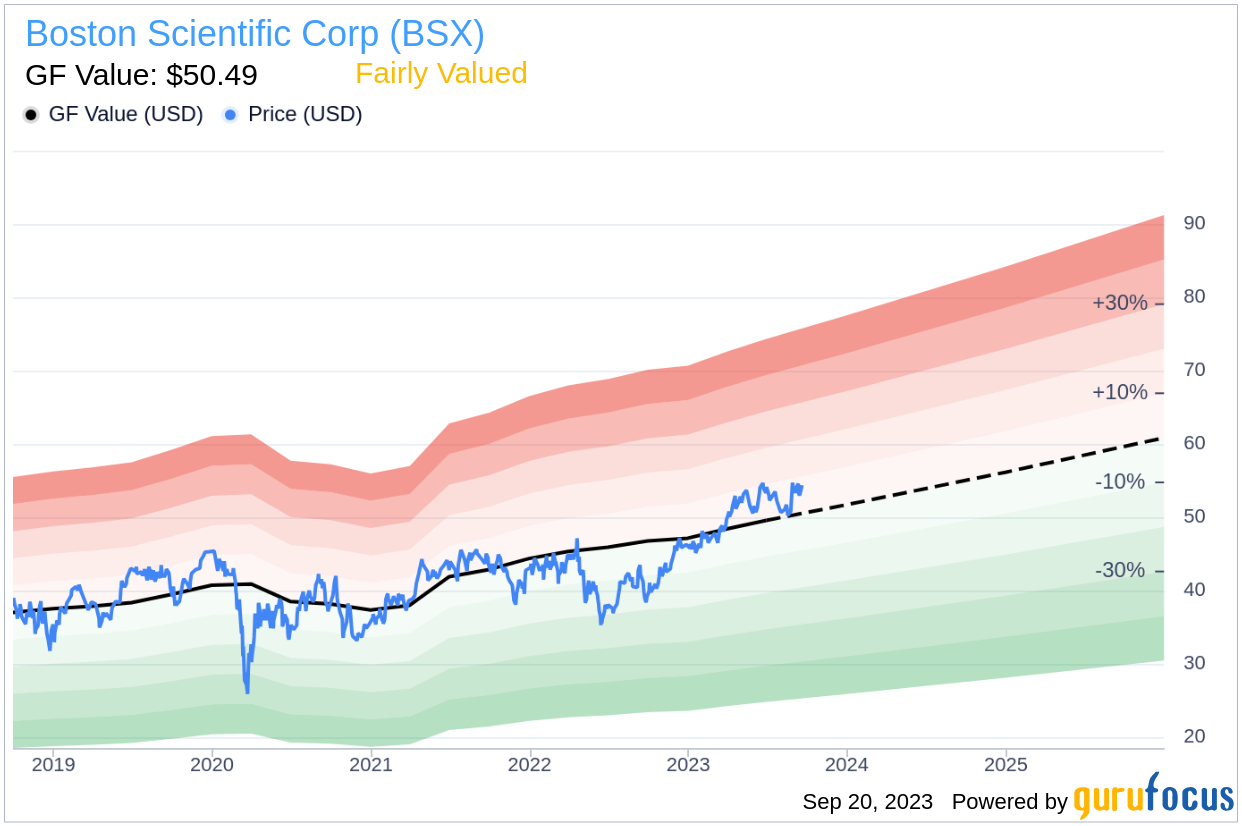

Understanding the GF Value of Boston Scientific (BSX, Financial)

The GF Value is a proprietary measure that estimates the intrinsic value of a stock. It considers historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line provides a visual representation of the stock's ideal fair trading value.

Boston Scientific's GF Value indicates that the stock is fairly valued. The GF Value is based on historical multiples, the company's past business growth, and estimates of future business performance. If a stock's price is significantly above the GF Value Line, it may be overvalued and likely to yield poor future returns. Conversely, if a stock's price is significantly below the GF Value Line, it may be undervalued and likely to yield high future returns. Given Boston Scientific's current price and market cap, the stock appears to be fairly valued. As a result, the long-term return of Boston Scientific's stock is likely to be close to the rate of its business growth.

Link: These companies may deliver higher future returns at reduced risk.Financial Strength of Boston Scientific

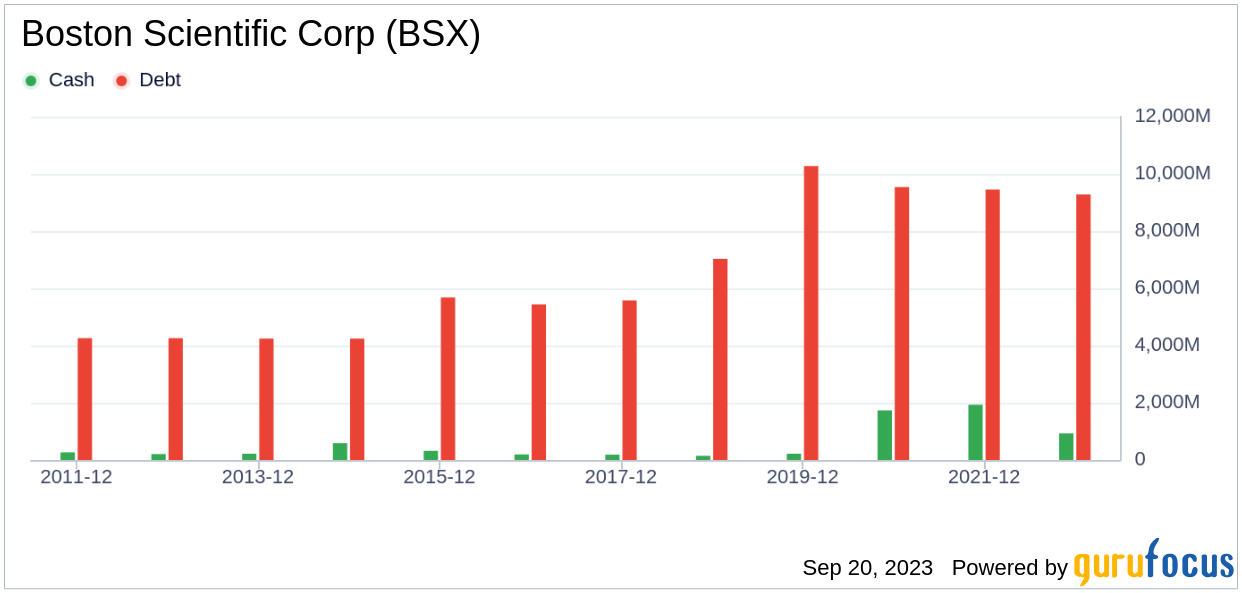

Companies with poor financial strength pose a high risk of permanent capital loss. To avoid this, investors must review a company's financial strength before purchasing shares. Key indicators of financial strength include the cash-to-debt ratio and interest coverage. Boston Scientific's cash-to-debt ratio of 0.05 ranks worse than 95.73% of 843 companies in the Medical Devices & Instruments industry. Overall, Boston Scientific's financial strength is rated 6 out of 10, indicating fair financial health.

Profitability and Growth of Boston Scientific

Investing in profitable companies is generally less risky, especially those that have demonstrated consistent profitability over the long term. Boston Scientific has been profitable 6 over the past 10 years. Over the past twelve months, the company had a revenue of $13.40 billion and Earnings Per Share (EPS) of $0.6. Its operating margin is 16.58%, which ranks better than 78.15% of 833 companies in the Medical Devices & Instruments industry. Overall, Boston Scientific's profitability is rated 6 out of 10, indicating fair profitability.

Growth is a crucial factor in a company's valuation. Boston Scientific's 3-year average revenue growth rate is worse than 56.91% of 731 companies in the Medical Devices & Instruments industry. Boston Scientific's 3-year average EBITDA growth rate is 7.4%, which ranks worse than 52.98% of 738 companies in the Medical Devices & Instruments industry.

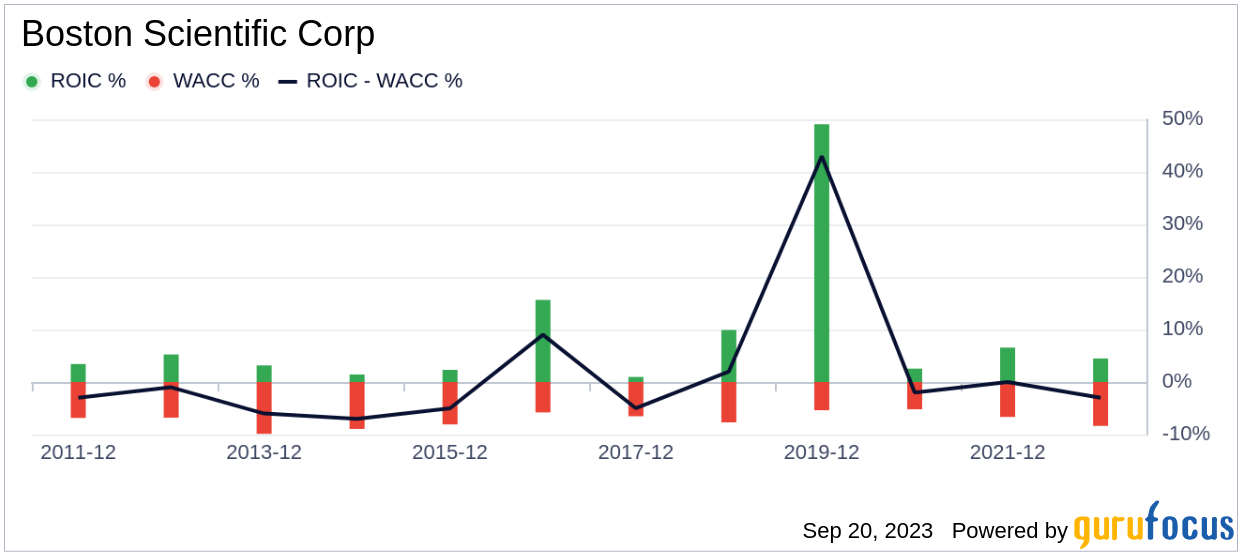

Another way to assess a company's profitability is to compare its return on invested capital (ROIC) with its weighted average cost of capital (WACC). For the past 12 months, Boston Scientific's ROIC is 4.6, and its WACC is 7.73.

Conclusion

In summary, Boston Scientific appears to be fairly valued. The company's financial condition is fair, and its profitability is also fair. Its growth ranks worse than 52.98% of 738 companies in the Medical Devices & Instruments industry. To learn more about Boston Scientific stock, you can check out its 30-Year Financials here.

Link: Find high-quality companies that may deliver above-average returns with GuruFocus High Quality Low Capex Screener.