Align Technology Inc (ALGN, Financial) experienced a -0.57% change in its daily stock price, leading to a 3-month loss of -4.9%. Despite these fluctuations, the company's Earnings Per Share (EPS) (EPS) remained at 4.07. This raises the question: Is Align Technology (ALGN) significantly undervalued? In this article, we delve into the company's valuation analysis to provide an answer. We encourage readers to follow through this in-depth analysis to gain a comprehensive understanding of Align Technology's intrinsic value.

Company Overview

Align Technology is the leading manufacturer of clear aligners, with its main product, Invisalign, controlling over 90% of the market. The company's robust performance is reflected in its market cap of $24.20 billion and sales amounting to $3.70 billion. Despite a stock price of $316.19, the fair value (GF Value) of Align Technology stands at $496.01, suggesting that the stock may be significantly undervalued.

Understanding GF Value

The GF Value is a proprietary measure of a stock's intrinsic value, computed considering historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line denotes the stock's ideal fair trading value.

Align Technology (ALGN, Financial) appears to be significantly undervalued according to the GF Value. With the current stock price significantly below the GF Value Line, the stock may be undervalued and have higher future returns. This suggests that the long-term return of Align Technology's stock is likely to be much higher than its business growth.

Financial Strength

Companies with poor financial strength pose a high risk of permanent capital loss. To avoid this, it's crucial to review a company's financial strength before deciding to purchase shares. Align Technology has a cash-to-debt ratio of 7.55, ranking better than 66.31% of 843 companies in the Medical Devices & Instruments industry. This indicates that Align Technology's financial strength is strong.

Profitability and Growth

Investing in profitable companies, especially those demonstrating consistent profitability over the long term, poses less risk. Align Technology, with high profit margins and a profitability rank of 10 out of 10, is a safer investment. Furthermore, the company's growth ranks better than 70.86% of 731 companies in the Medical Devices & Instruments industry, indicating a promising future.

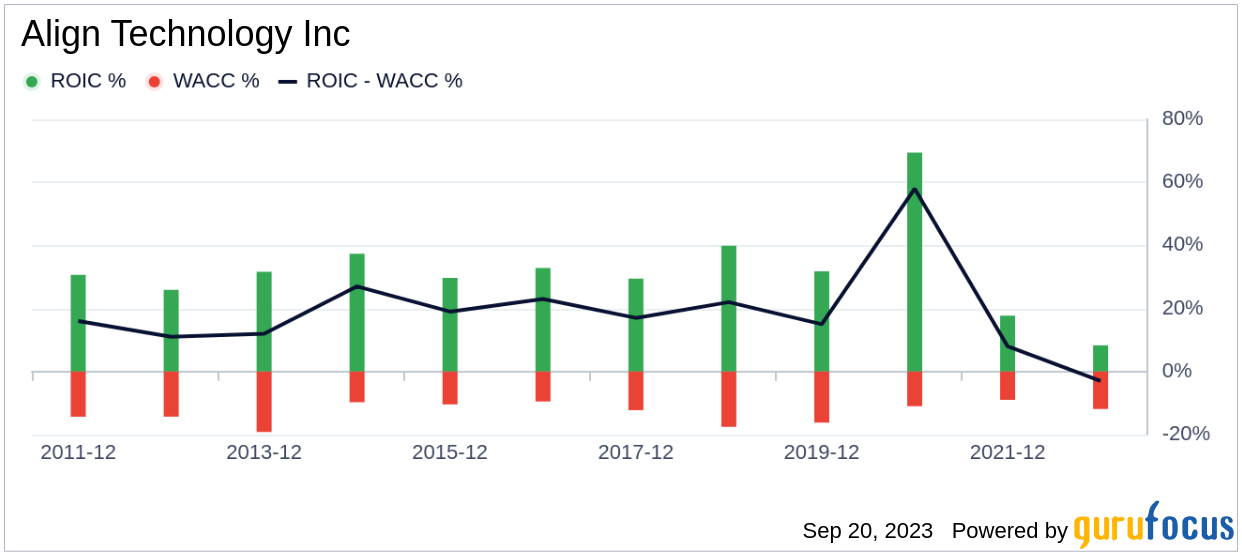

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to the weighted average cost of capital (WACC) is another way to determine its profitability. When the ROIC is higher than the WACC, it implies the company is creating value for shareholders. However, for the past 12 months, Align Technology's ROIC is 6.78, lower than its WACC of 12.38.

Conclusion

In conclusion, Align Technology (ALGN, Financial) appears to be significantly undervalued. The company's strong financial condition, high profitability, and promising growth outlook make it an attractive investment prospect. To learn more about Align Technology stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.