Oracle Corp (ORCL, Financial) experienced a daily loss of -2.28%, with a 3-month loss standing at -8.4%. The Earnings Per Share (EPS) (EPS) is currently at 3.36. With these figures, one may wonder, is the stock fairly valued? This article aims to answer this question by providing a detailed valuation analysis of Oracle (ORCL). Keep reading to gain insightful knowledge on the company's financial health and future prospects.

A Brief Introduction to Oracle Corp (ORCL, Financial)

Established in 1977, Oracle Corp provides database technology and enterprise resource planning (ERP) software to enterprises globally. As a pioneer of the first commercial SQL-based relational database management system, Oracle now boasts 430,000 customers in 175 countries, supported by a workforce of 136,000 employees. The company's market cap stands at $289.90 billion, with sales reaching $51 billion. Considering these figures, we aim to determine whether Oracle's current stock price of $105.83 aligns with its GF Value, an estimate of its fair value.

Understanding Oracle's GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line represents the ideal fair trading value of the stock. If the stock price significantly exceeds the GF Value Line, the stock may be overvalued, indicating potentially poor future returns. Conversely, if the stock price is significantly below the GF Value Line, the stock may be undervalued, suggesting higher future returns. For Oracle (ORCL, Financial), the GF Value suggests that the stock is fairly valued at its current price of $105.83 per share.

As Oracle is fairly valued, the long-term return of its stock is likely to be close to the rate of its business growth, offering a balanced investment opportunity.

Link: These companies may deliever higher future returns at reduced risk.

Assessing Oracle's Financial Strength

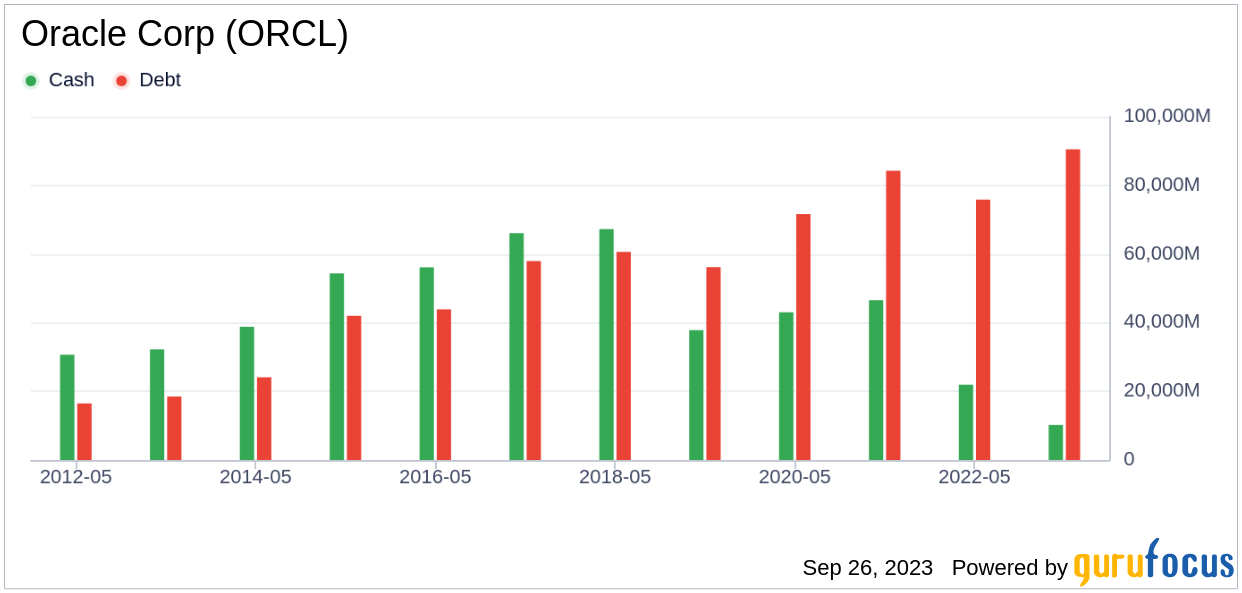

Investing in companies with poor financial strength can pose a high risk of permanent capital loss. To avoid this, it is crucial to review a company's financial strength before purchasing shares. Oracle's cash-to-debt ratio is 0.14, ranking worse than 89.35% of companies in the Software industry. This indicates that Oracle's overall financial strength is poor, with a rating of 4 out of 10.

Oracle's Profitability and Growth

Investing in profitable companies, especially those consistently profitable over the long term, is usually less risky. Oracle has been profitable for 10 out of the past 10 years, with an operating margin of 28.11%, ranking better than 94.43% of companies in the Software industry. This indicates strong profitability with a ranking of 9 out of 10.

Growth is a crucial factor in a company's valuation. Oracle's 3-year average annual revenue growth is 15%, ranking better than 65.48% of companies in the Software industry. The 3-year average EBITDA growth rate is 9.4%, ranking in the top 50% of the Software industry. This suggests decent growth prospects for Oracle.

Comparing Oracle's ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can provide insights into its profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate a company is expected to pay on average to finance its assets. When ROIC is higher than WACC, the company is creating value for shareholders. Oracle's ROIC for the past 12 months is 9.92, while its WACC stands at 10.17.

Concluding Thoughts

In summary, Oracle (ORCL, Financial) appears to be fairly valued. Despite its poor financial condition, its profitability is strong, and its growth ranks better than 50% of companies in the Software industry. To learn more about Oracle stock, you can check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.