Exploring the Dividend History, Yield, and Growth Rates of Stryker Corp (SYK, Financial)

Stryker Corp (SYK) recently announced a dividend of $0.75 per share, payable on October 31, 2023, with the ex-dividend date set for September 28, 2023. As investors anticipate this upcoming payment, it's worth examining Stryker Corp's dividend history, yield, and growth rates. Using GuruFocus data, let's delve into Stryker Corp's dividend performance and its sustainability.

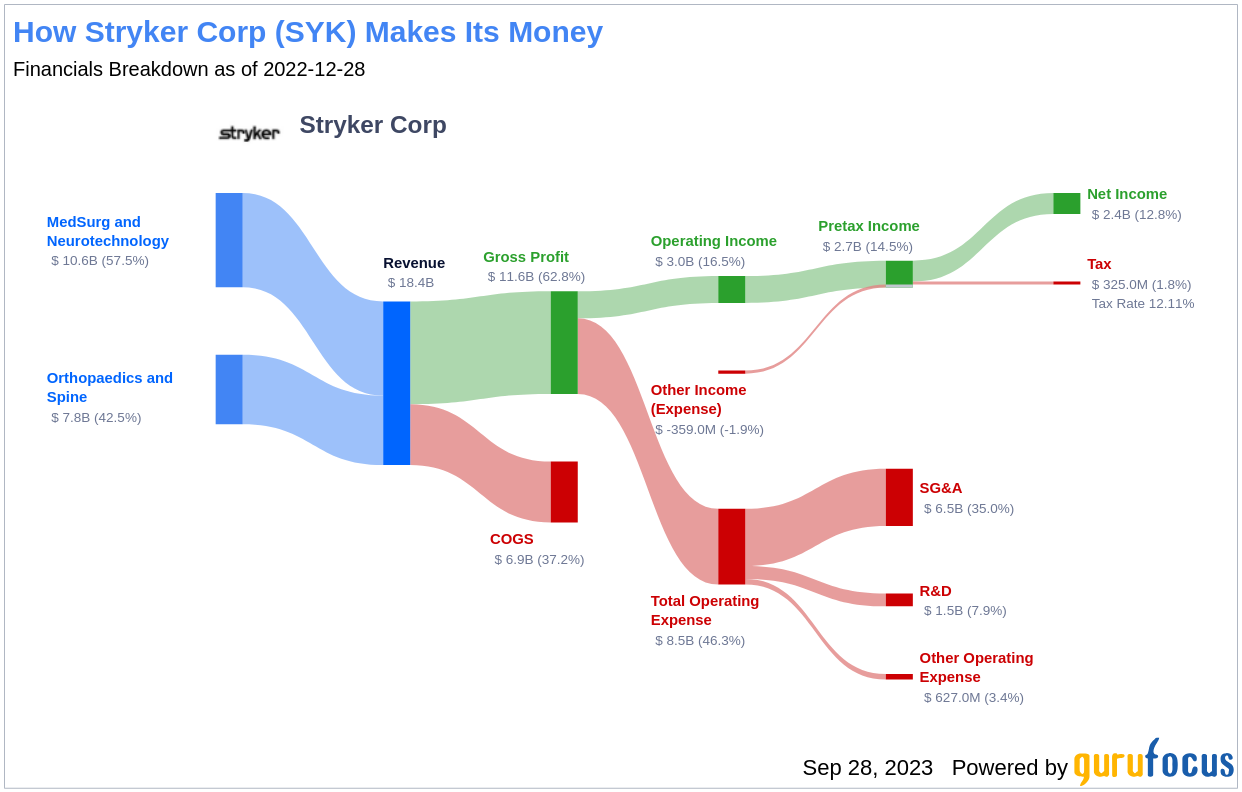

Understanding Stryker Corp's Business Model

Stryker Corp designs, manufactures, and markets a diverse range of medical equipment, instruments, consumable supplies, and implantable devices. The company's product portfolio encompasses hip and knee replacements, endoscopy systems, operating room equipment, embolic coils, hospital beds, and spinal devices. Stryker Corp is one of the three largest competitors in reconstructive orthopedic implants and holds a leadership position in operating room equipment. Approximately one-fourth of Stryker Corp's total revenue originates from outside the United States.

Tracing Stryker Corp's Dividend History

Stryker Corp has upheld a consistent dividend payment record since 1991, with dividends currently distributed on a quarterly basis. The company has increased its dividend each year since 1994, earning it the status of a dividend aristocrat, an honor bestowed on companies that have increased their dividend each year for at least the past 29 years.

Dissecting Stryker Corp's Dividend Yield and Growth

As of today, Stryker Corp has a 12-month trailing dividend yield of 1.08% and a 12-month forward dividend yield of 1.10%, indicating an expected increase in dividend payments over the next 12 months.

Over the past three years, Stryker Corp's annual dividend growth rate was 9.90%. This rate increased to 10.20% per year over a five-year horizon. Over the past decade, Stryker Corp's annual dividends per share growth rate stands at a remarkable 11.60%.

Based on Stryker Corp's dividend yield and five-year growth rate, the 5-year yield on cost of Stryker Corp stock as of today is approximately 1.76%.

Assessing Dividend Sustainability: Payout Ratio and Profitability

To evaluate the sustainability of the dividend, it's crucial to consider the company's payout ratio. The dividend payout ratio reveals the portion of earnings the company distributes as dividends. A lower ratio indicates that the company retains a significant part of its earnings, ensuring funds for future growth and unexpected downturns. As of June 30, 2023, Stryker Corp's dividend payout ratio is 0.42.

Stryker Corp's profitability rank is 9 out of 10 as of June 30, 2023, suggesting strong profitability prospects. The company has reported positive net income each year over the past decade, further solidifying its high profitability.

Future Outlook: Growth Metrics

A company must have robust growth metrics to ensure the sustainability of dividends. Stryker Corp's growth rank of 9 out of 10 suggests a promising growth trajectory relative to its competitors.

Revenue is the lifeblood of any company, and Stryker Corp's revenue per share, combined with the 3-year revenue growth rate, indicates a strong revenue model. Stryker Corp's revenue has increased by approximately 7.20% per year on average, a rate that underperforms approximately 50.21% of global competitors.

The company's 3-year EPS growth rate showcases its capability to grow its earnings, a critical component for sustaining dividends in the long run. Over the past three years, Stryker Corp's earnings have increased by approximately 4.00% per year on average, a rate that underperforms approximately 56.9% of global competitors.

Lastly, the company's 5-year EBITDA growth rate is 6.30%, which underperforms approximately 60.04% of global competitors.

Conclusion

In conclusion, Stryker Corp's consistent dividend payments, impressive growth rate, reasonable payout ratio, high profitability, and solid growth metrics make it a compelling option for dividend-focused investors. However, its revenue and EPS growth rates lag behind some global competitors, which is a point to consider. Therefore, potential investors should weigh these factors before making an investment decision.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.