On September 28, 2023, Micron Technology Inc (MU, Financial) closed at $65.26 per share, marking a daily loss of 4.32%. Over the past three months, the stock has seen a decrease of 3.48%. Despite these numbers, the company reported a Loss Per Share of 2.68. This raises a critical question: is Micron Technology significantly overvalued? In this article, we delve into a comprehensive valuation analysis of Micron Technology to answer this question.

Company Snapshot

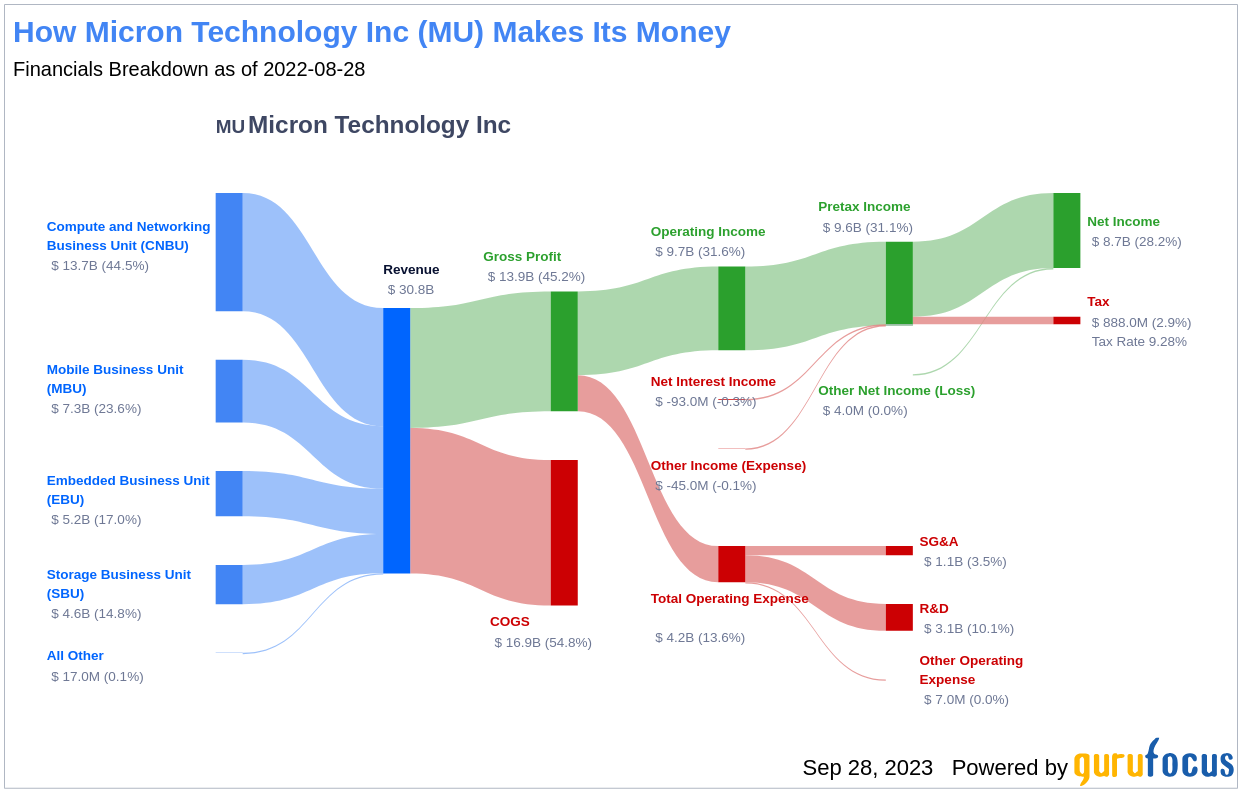

Micron Technology Inc is one of the world's largest semiconductor companies, specializing in memory and storage chips. Its primary revenue stream comes from dynamic random access memory (DRAM), with minority exposure to NAND flash chips. Serving a global customer base, Micron Technology sells its chips into data centers, mobile phones, consumer electronics, and industrial and automotive applications. Notably, the company is vertically integrated.

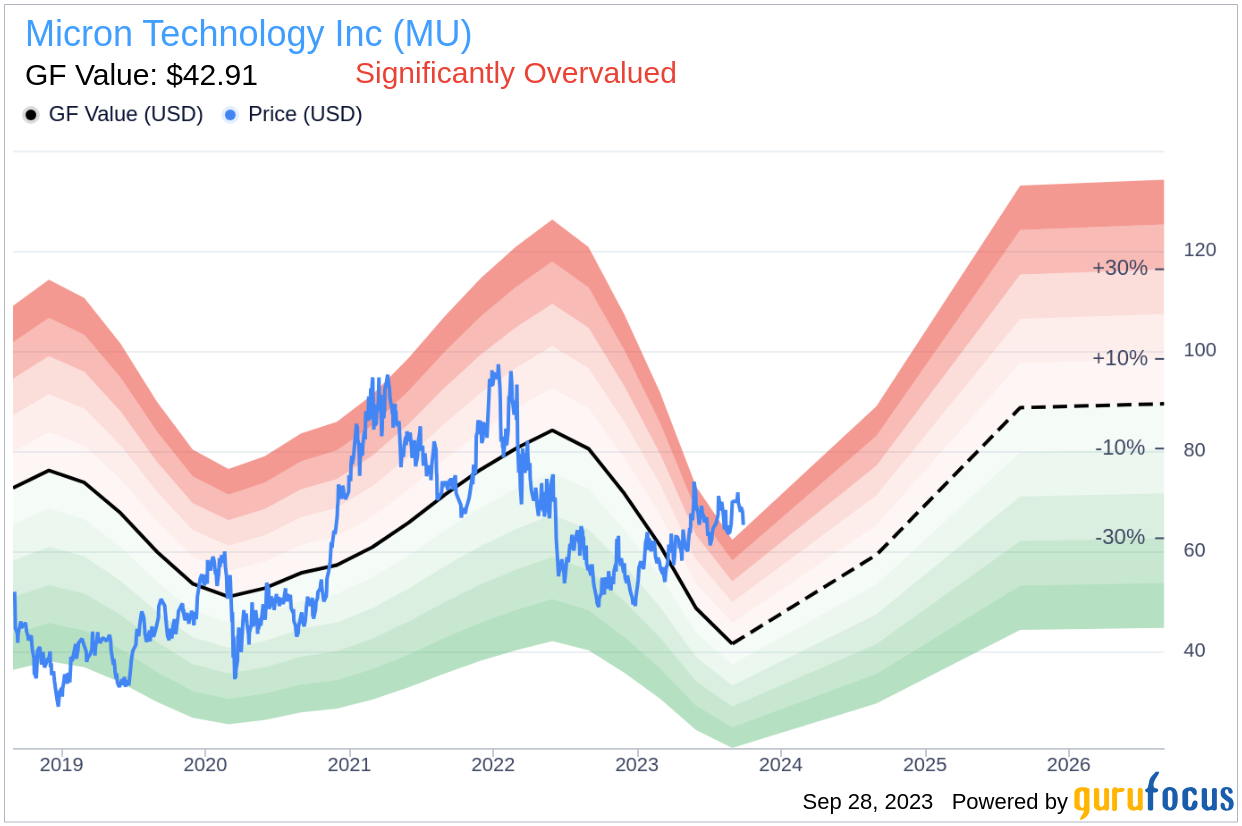

At its current price of $65.26 per share, Micron Technology Inc has a market cap of $71.50 billion. However, when compared to the GF Value of $42.91, it appears that the stock could be significantly overvalued. This calls for a deeper analysis of the company's value, combining financial assessment with essential company details.

Understanding the GF Value

The GF Value is a proprietary metric that represents the current intrinsic value of a stock. It is calculated based on historical trading multiples, a GuruFocus adjustment factor based on the company's past performance and growth, and future business performance estimates. The GF Value Line provides an overview of the stock's fair trading value. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

Applying this to Micron Technology (MU, Financial), the stock appears to be significantly overvalued. With a market cap of $71.50 billion at its current price of $65.26 per share, the long-term return of its stock is likely to be much lower than its future business growth.

Financial Strength

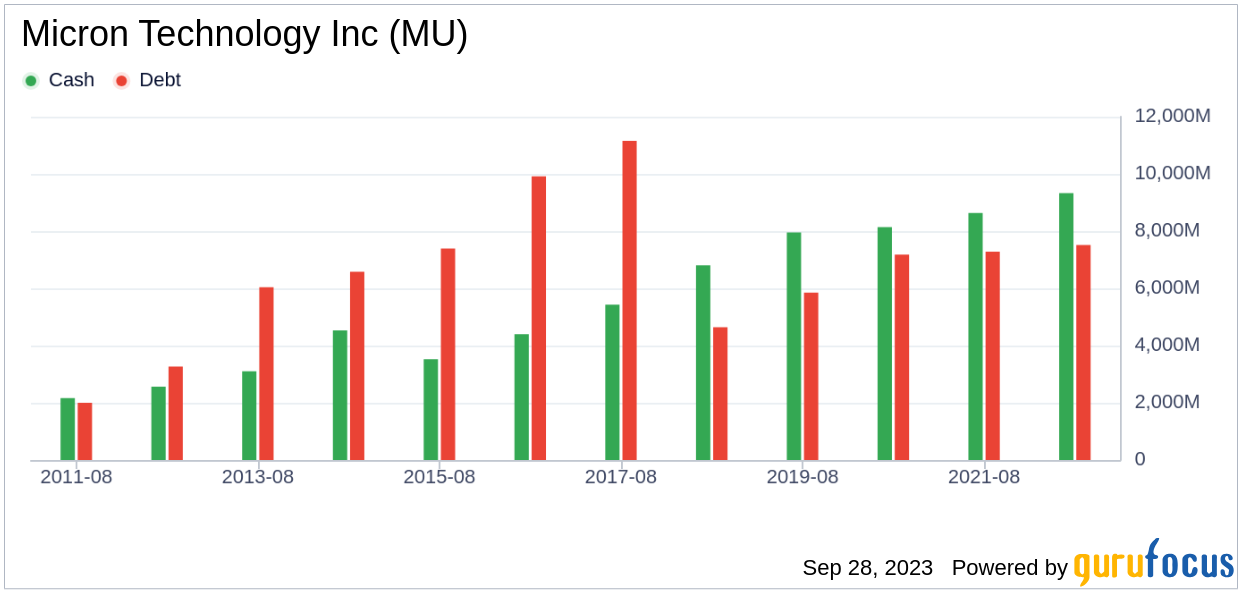

Investing in companies with low financial strength could result in permanent capital loss. Therefore, a careful review of a company's financial strength is crucial before deciding to buy shares. Micron Technology has a cash-to-debt ratio of 0.75, ranking worse than 71.38% of 905 companies in the Semiconductors industry. Based on this, GuruFocus ranks Micron Technology's financial strength as 6 out of 10, suggesting a fair balance sheet.

Profitability and Growth

Investing in profitable companies carries less risk, especially if they have demonstrated consistent profitability over the long term. Micron Technology has been profitable 9 years over the past 10 years. However, its operating margin of -14.09% is worse than 81.76% of 954 companies in the Semiconductors industry. Despite this, GuruFocus ranks Micron Technology's profitability as strong.

Growth is a critical factor in the valuation of a company. The faster a company is growing, the more likely it is to be creating value for shareholders, especially if the growth is profitable. However, Micron Technology's growth ranks worse than 54.98% of 873 companies in the Semiconductors industry, with a 3-year average annual revenue growth rate of 10.2% and an average EBITDA growth rate of 10.9%.

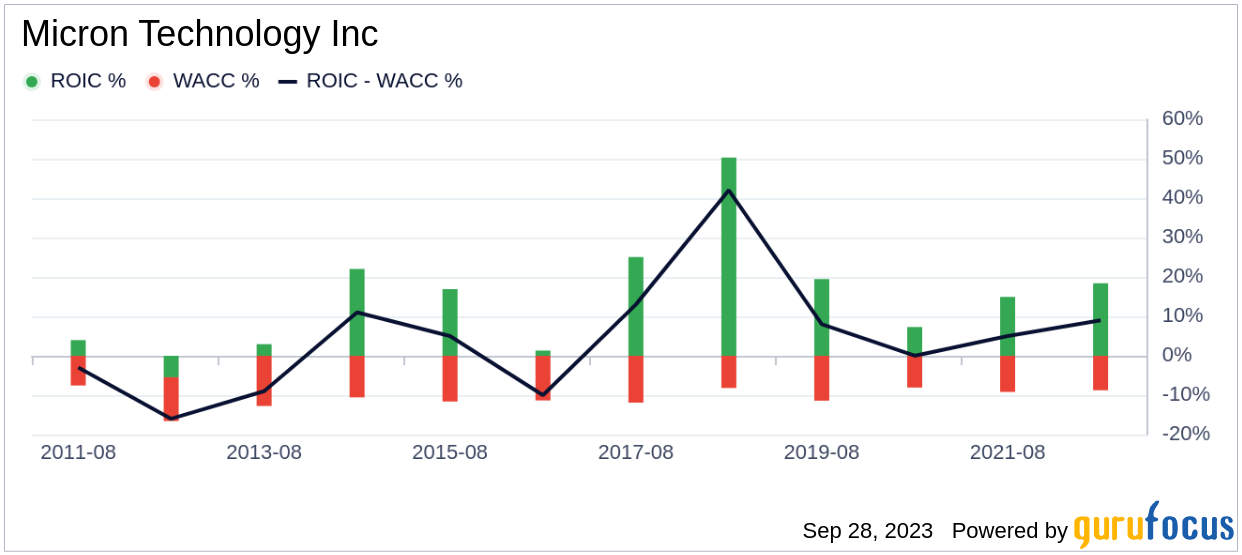

ROIC vs WACC

Another way to evaluate a company's profitability is by comparing its return on invested capital (ROIC) to its weighted average cost of capital (WACC). ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. If the ROIC exceeds the WACC, the company is likely creating value for its shareholders. However, Micron Technology's ROIC of -5.52 is less than its WACC of 11.36, suggesting potential issues in value creation.

Conclusion

In conclusion, Micron Technology (MU, Financial) stock appears to be significantly overvalued. The company's financial condition is fair, and its profitability is strong. However, its growth ranks worse than 65.72% of 776 companies in the Semiconductors industry. To learn more about Micron Technology stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.