On October 5, 2023, Lamb Weston Holdings Inc (LW, Financial) experienced a daily gain of 11.5%, despite a 3-month loss of 10.97%. The company's Earnings Per Share (EPS) stands at 6.92. With these figures in mind, the question we seek to answer is: Is Lamb Weston Holdings' stock modestly undervalued? This article presents a thorough valuation analysis of Lamb Weston Holdings. We encourage you to read on for more insights.

A Brief Overview of Lamb Weston Holdings Inc (LW, Financial)

Lamb Weston Holdings is the world's second-largest producer of branded and private-label frozen potato products such as French fries, sweet potato fries, tater tots, diced potatoes, mashed potatoes, hash browns, and chips. The company also produces a small range of appetizers, including onion rings, mozzarella sticks, and cheese curds. Lamb Weston Holdings became an independent company in 2016 when it was spun off from Conagra.

As of October 5, 2023, Lamb Weston Holdings' stock price stands at $100.9 per share, with a market cap of $14.70 billion. The company's GF Value, an estimation of fair value, is $114.52, suggesting that the stock is modestly undervalued.

Understanding Lamb Weston Holdings' GF Value

The GF Value is a proprietary measure that represents the current intrinsic value of a stock. The GF Value Line on our summary page provides an overview of the fair value at which the stock should ideally be traded. It is calculated based on three factors:

- Historical multiples (PE Ratio, PS Ratio, PB Ratio, and Price-to-Free-Cash-Flow) at which the stock has traded.

- GuruFocus adjustment factor based on the company's past returns and growth.

- Future estimates of the business performance.

At its current price of $100.9 per share, Lamb Weston Holdings has a market cap of $14.70 billion and the stock is believed to be modestly undervalued. Because Lamb Weston Holdings is relatively undervalued, the long-term return of its stock is likely to be higher than its business growth.

Lamb Weston Holdings' Financial Strength

Companies with poor financial strength pose a high risk of permanent capital loss to investors. To avoid this, it's crucial to review a company's financial strength before purchasing shares. Both the cash-to-debt ratio and interest coverage of a company are great ways to understand its financial strength. Lamb Weston Holdings has a cash-to-debt ratio of 0.09, ranking it lower than 79.73% of 1786 companies in the Consumer Packaged Goods industry. The overall financial strength of Lamb Weston Holdings is 5 out of 10, indicating that the financial strength of Lamb Weston Holdings is fair.

Profitability and Growth of Lamb Weston Holdings

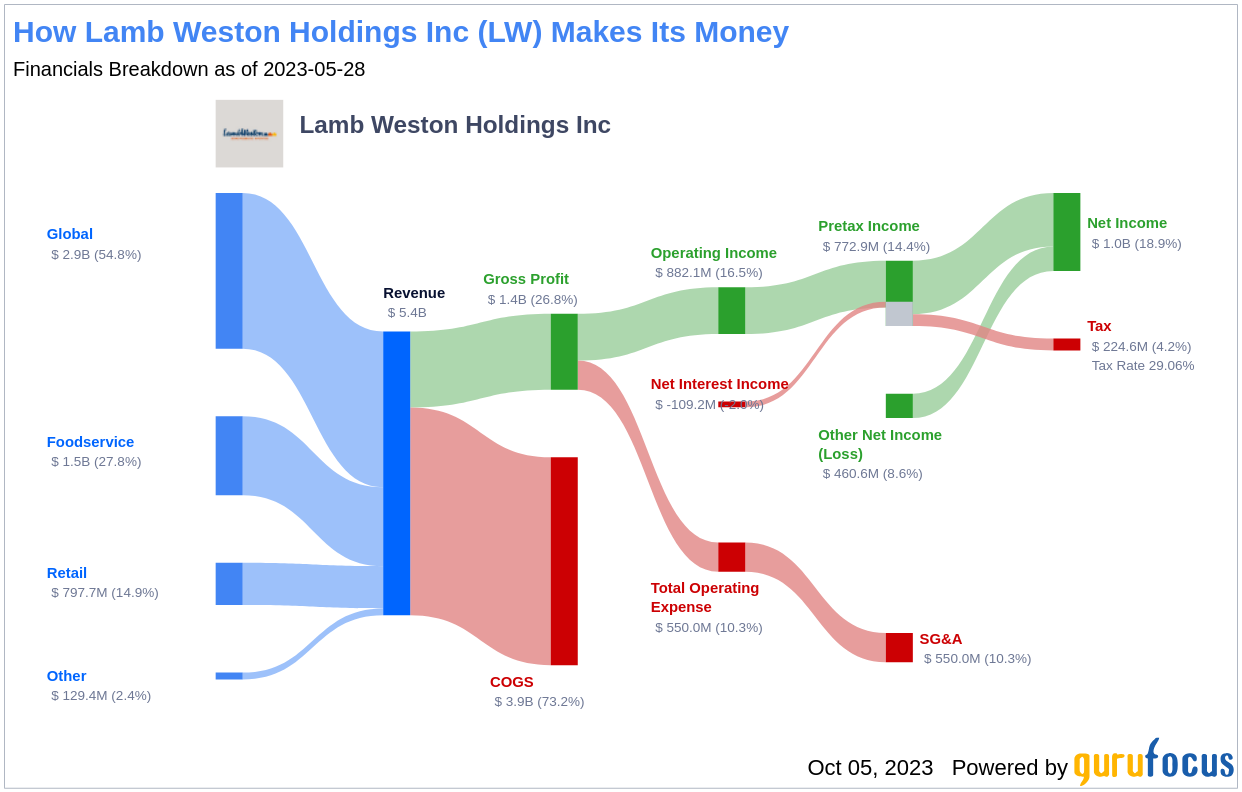

Investing in profitable companies carries less risk, especially in companies that have demonstrated consistent profitability over the long term. Typically, a company with high profit margins offers better performance potential than a company with low profit margins. Lamb Weston Holdings has been profitable 10 years over the past 10 years. During the past 12 months, the company had revenues of $5.40 billion and Earnings Per Share (EPS) of $6.92. Its operating margin of 16.49% is better than 88.3% of 1829 companies in the Consumer Packaged Goods industry. Overall, GuruFocus ranks Lamb Weston Holdings's profitability as strong.

Growth is probably the most important factor in the valuation of a company. GuruFocus research has found that growth is closely correlated with the long term performance of a company's stock. The faster a company is growing, the more likely it is to be creating value for shareholders, especially if the growth is profitable. The 3-year average annual revenue growth rate of Lamb Weston Holdings is 12.6%, which ranks better than 68.81% of 1712 companies in the Consumer Packaged Goods industry. The 3-year average EBITDA growth rate is 14.8%, which ranks better than 64.03% of 1518 companies in the Consumer Packaged Goods industry.

ROIC vs WACC

One can also evaluate a company's profitability by comparing its return on invested capital (ROIC) to its weighted average cost of capital (WACC). Return on invested capital (ROIC) measures how well a company generates cash flow relative to the capital it has invested in its business. The weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its security holders to finance its assets. If the return on invested capital exceeds the weighted average cost of capital, the company is likely creating value for its shareholders. During the past 12 months, Lamb Weston Holdings's ROIC is 16.56 while its WACC came in at 5.9.

Conclusion

In summary, the stock of Lamb Weston Holdings is believed to be modestly undervalued. The company's financial condition is fair and its profitability is strong. Its growth ranks better than 64.03% of 1518 companies in the Consumer Packaged Goods industry. To learn more about Lamb Weston Holdings stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.