An Examination of the Company's Dividend Performance and Sustainability

Abbott Laboratories (ABT, Financial) recently announced a dividend of $0.51 per share, payable on 2023-11-15, with the ex-dividend date set for 2023-10-12. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's delve into Abbott Laboratories's dividend performance and assess its sustainability.

Understanding Abbott Laboratories

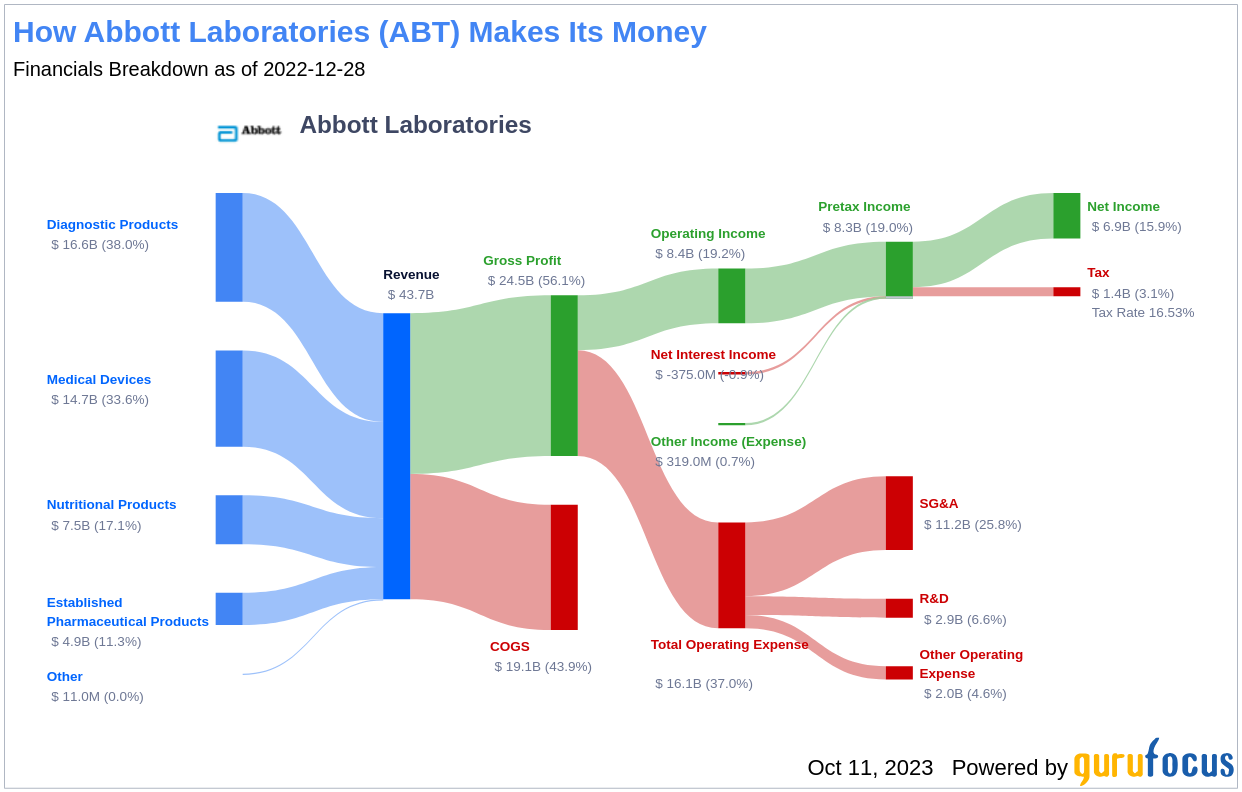

Abbott Laboratories manufactures and markets a wide range of medical devices, adult and pediatric nutritional products, diagnostic equipment and testing kits, and branded generic drugs. With products ranging from pacemakers, coronary stents, infant formula to molecular diagnostic platforms, the company has a strong global presence, deriving approximately 60% of its sales outside the United States.

Abbott Laboratories's Dividend History

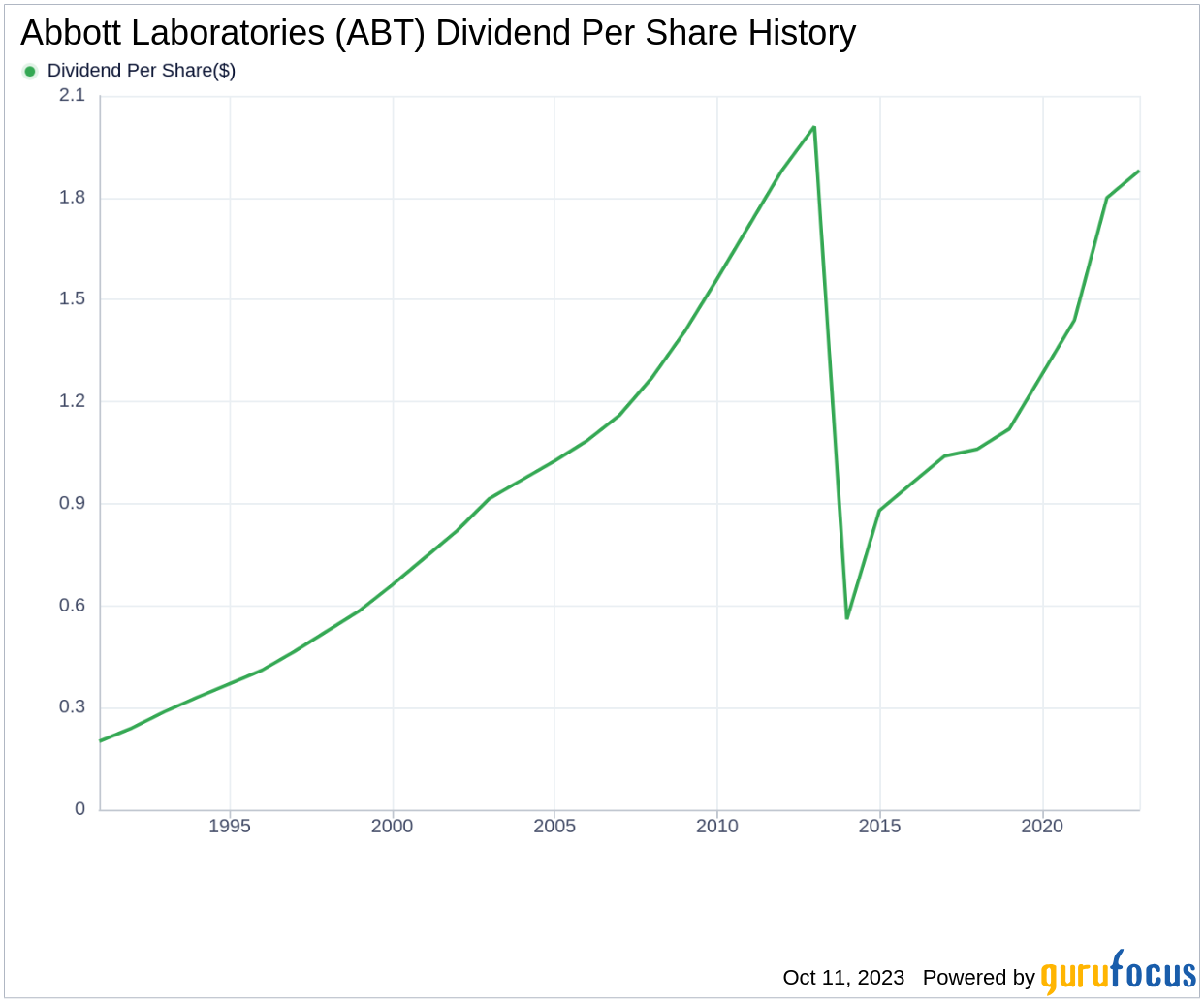

Abbott Laboratories has a long-standing history of consistent dividend payments since 1972, distributed on a quarterly basis. The company has increased its dividend each year since 1972, earning it the title of a dividend king, a distinction given to companies that have increased their dividend each year for at least the past 51 years.

Abbott Laboratories's Dividend Yield and Growth

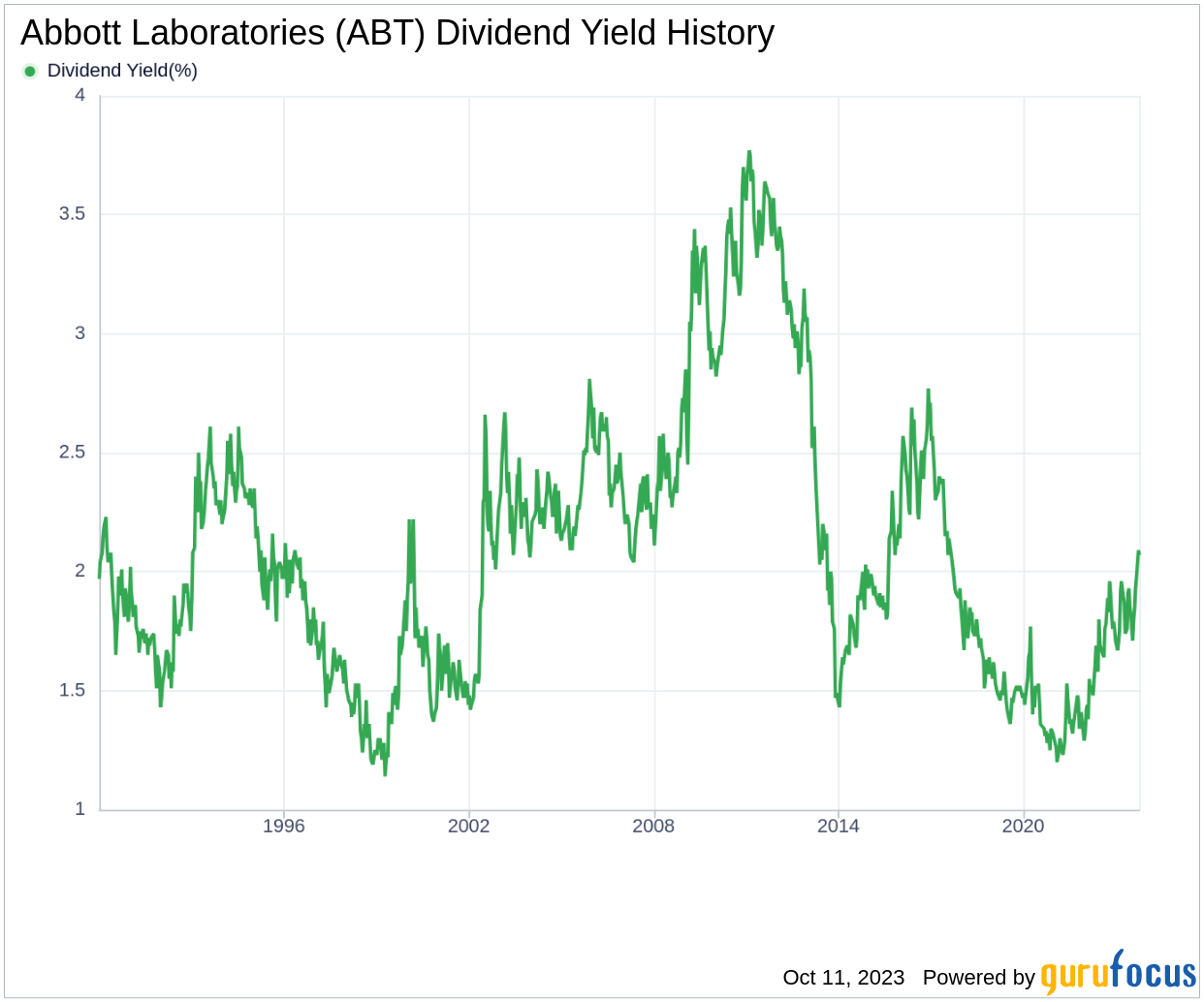

As of today, Abbott Laboratories boasts a 12-month trailing dividend yield of 2.05% and a 12-month forward dividend yield of 2.09%, indicating an expectation of increased dividend payments over the next 12 months. Over the past three years, Abbott Laboratories's annual dividend growth rate was 13.70%, which decreased slightly to 13.40% per year over a five-year horizon. However, the company's annual dividends per share growth rate over the past decade stands at a solid 6.10%.

Dividend Sustainability: Payout Ratio and Profitability

When evaluating the sustainability of Abbott Laboratories's dividends, the company's dividend payout ratio of 0.67 as of 2023-06-30 indicates a significant retention of earnings for future growth and potential downturns. The company's profitability rank of 9 out of 10, combined with a decade-long positive net income record, further solidifies its high profitability and dividend sustainability.

Future Outlook: Growth Metrics

Abbott Laboratories's growth rank of 9 out of 10, combined with a high revenue per share and a strong 3-year revenue growth rate of 11.40% per year, indicate a robust revenue model. The company's impressive 3-year EPS growth rate of 23.80% per year and a 5-year EBITDA growth rate of 69.00% further strengthen its growth prospects and dividend sustainability.

Conclusion

Abbott Laboratories's consistent dividend payments, impressive growth rate, low payout ratio, high profitability, and robust growth metrics make it a promising choice for investors seeking reliable dividend income. However, as always, it is crucial for investors to conduct their own thorough research and consider their individual financial goals before making investment decisions.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: (Free Trial)