Dollar Tree Inc (DLTR, Financial) has recently experienced a daily gain of 2.48%, despite a 3-month loss of -24.33%. The company's Earnings Per Share (EPS) stands at 5.5, pointing to its potential profitability. The question that arises is: Is Dollar Tree (DLTR) stock modestly undervalued? This article will provide an in-depth valuation analysis, aiming to answer this question and more. Read on to gain valuable insights into Dollar Tree's financial performance and intrinsic value.

Company Overview

Dollar Tree operates discount stores across the U.S. and Canada, with over 8,134 shops under its namesake banner and 8,206 Family Dollar units as of the end of fiscal 2022. The company offers a variety of branded and own-label goods, with the majority of items priced at $1.25. Dollar Tree's fiscal 2022 sales were derived from consumables (45%), variety items (50%), and seasonal goods (5%).

The company's stock is currently trading at $112.83 per share, with a market cap of $24.80 billion. In contrast, the GF Value, an estimation of the stock's fair value, is at $153.13, indicating that Dollar Tree (DLTR, Financial) may be modestly undervalued.

Understanding the GF Value

The GF Value is a unique measure of a stock's intrinsic value, derived from historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line on our summary page provides an overview of the fair value at which the stock should ideally be traded.

According to the GF Value, Dollar Tree (DLTR, Financial) is modestly undervalued. This suggests that the long-term return of its stock is likely to be higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Assessing Financial Strength

Before investing in a company, it's crucial to evaluate its financial strength. Companies with poor financial strength pose a higher risk of permanent loss. The cash-to-debt ratio and interest coverage are great indicators of a company's financial strength. Dollar Tree's cash-to-debt ratio stands at 0.05, which is lower than 90.85% of 306 companies in the Retail - Defensive industry. The company's overall financial strength is rated 6 out of 10, indicating fair financial health.

Profitability and Growth

Consistent profitability over the long term reduces the risk for investors. Dollar Tree has been profitable 9 out of the past 10 years, with an operating margin of 5.82%, ranking better than 75.96% of 312 companies in the Retail - Defensive industry.

Growth is a crucial factor in a company's valuation. Dollar Tree's 3-year average revenue growth rate is better than 63.89% of 288 companies in the Retail - Defensive industry. The company's 3-year average EBITDA growth rate is 18.8%, ranking better than 74.32% of 257 companies in the same industry.

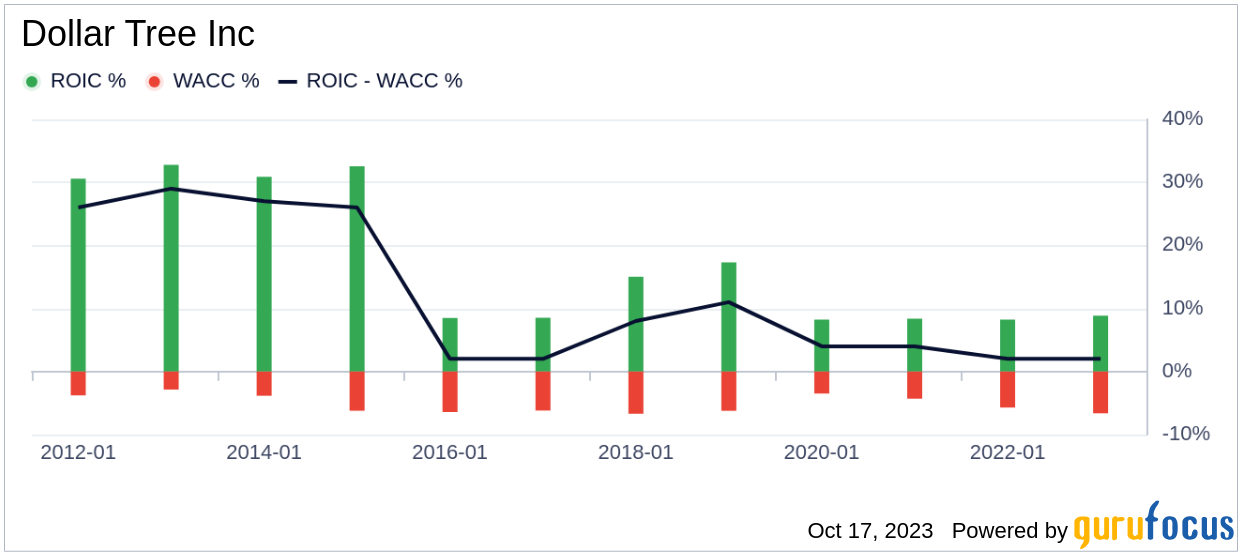

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted cost of capital (WACC) is another way to evaluate its profitability. Dollar Tree's ROIC over the past 12 months was 6.37, while its WACC came in at 7.29.

Conclusion

In summary, Dollar Tree's (DLTR, Financial) stock is estimated to be modestly undervalued. The company's financial condition is fair, and its profitability is fair. Its growth ranks better than 74.32% of 257 companies in the Retail - Defensive industry. To learn more about Dollar Tree stock, you can check out its 30-Year Financials here.

To find out high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.