Warner Bros. Discovery Inc (WBD, Financial), the result of a merger between two major media firms, stands as one of the world's largest media entities. With an impressive portfolio that includes HBO, Discovery, CNN, TLC, and popular franchises like Superman, Rick and Morty, and Game of Thrones, the company's influence is widespread. Warner Bros. Discovery Inc operates two major streaming services, Max and Discovery+, and owns content production studios such as Warner Bros., HBO, Discovery Studios, DC Films, and Cartoon Network Studios.

Ownership and Performance Overview

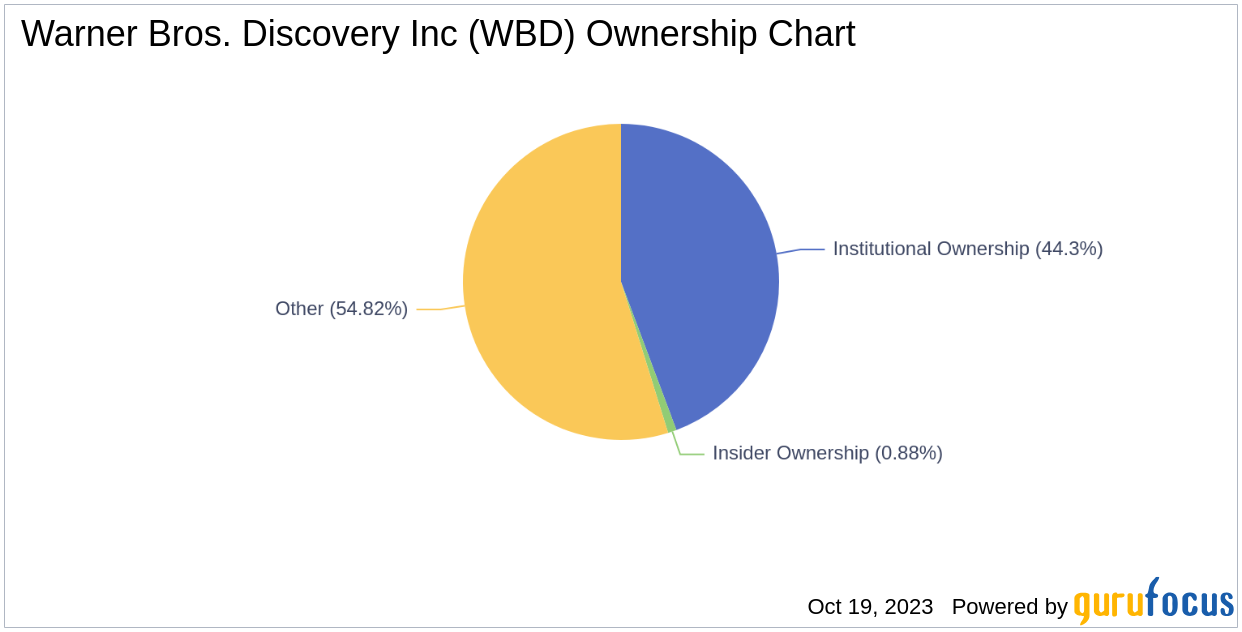

As per the most recent data, Warner Bros. Discovery Inc has an outstanding share count of 2.44 billion. Institutional ownership is at 1.08 billion shares, making up 44.3% of the total shares, while insiders hold 21.40 million shares, accounting for 0.88% of the total share count.

The company's stock value has declined by approximately 2.96% in the past week. However, as of Oct 19, 2023, the stock saw a rise by 0.47%, contrasting with its three-month return of -19.99%. The company's market cap dropped to $30.56 billion in the most recent quarter from $36.78 billion in the preceding one, sparking interest in the company's ownership trends.

Institutional Ownership and Key Players

Warner Bros. Discovery Inc's institutional ownership history reveals the trust and confidence that major players have in the company's future. As of 2023-09-30, the institutional ownership level is 44.3%, up from 43.61% as of 2023-06-30 and 38.39% from a year ago.

Among the most significant stakeholders, top fund managers Seth Klarman (Trades, Portfolio), HOTCHKIS & WILEY (Trades, Portfolio), and Bill Nygren (Trades, Portfolio) hold 1.04%, 0.89%, and 0.88% of shares outstanding, respectively. The recent institutional trading activity provides a snapshot of the market sentiment.

Financial Performance and Future Prospects

Over the past three years, Warner Bros. Discovery Inc's Ebitda growth averaged -10.2% per year, underperforming 69.19% of 766 companies in the Media - Diversified industry. The company's estimated earnings growth for the future is -23.7% per year, lower than the earnings growth of 0% during the past three years.

Insider Ownership and Activities

Warner Bros. Discovery Inc's insider ownership as of 2023-08-31 is approximately 0.88%, up from 0.81% from a year ago. This increase reflects the confidence of those closely familiar with the company's operations. In the past three months, Warner Bros. Discovery Inc had one insider buy transaction: Gerhard Zeiler, President, International bought 38,000 shares on 2023-08-07.

Concluding Thoughts

In the ever-evolving realm of stocks, understanding the nuances of ownership and earnings is critical. Warner Bros. Discovery Inc's recent dip is a case study in how major players react to market shifts, and their movements offer crucial insights for potential investors. A holistic view, combining both past performance and future projections, remains key to sound investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.