With a daily gain of 4.17% and a 3-month gain of 5.3%, Boston Scientific Corp (BSX, Financial) has been drawing attention in the market. Investors are keenly observing its Earnings Per Share (EPS) of $0.82, pondering whether the current stock valuation is justified. As we delve into the financial intricacies of Boston Scientific (BSX), the question arises: is the stock Fairly Valued? The following analysis aims to shed light on this valuation conundrum, guiding readers through a detailed examination of the company's worth.

Company Introduction

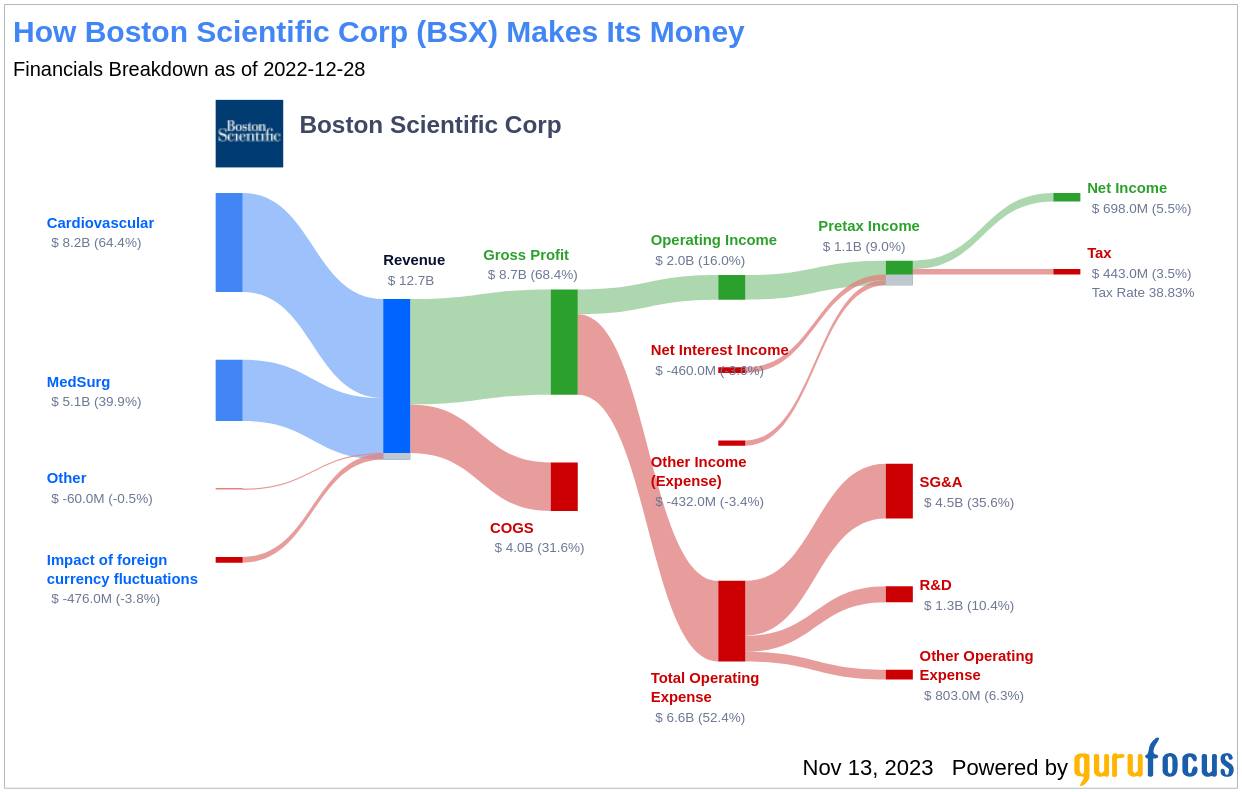

Boston Scientific Corp (BSX, Financial) is a pioneer in the medical devices industry, known for its minimally invasive products that revolutionize patient care. With a portfolio ranging from angioplasty devices to neuromodulation for chronic pain management, Boston Scientific has cemented its place as a global healthcare provider. With nearly half of its sales generated internationally, the company's market reach is extensive. Balancing the current stock price of $53.71 against the GF Value of $51.3, we embark on an insightful journey to determine the true value of Boston Scientific (BSX).

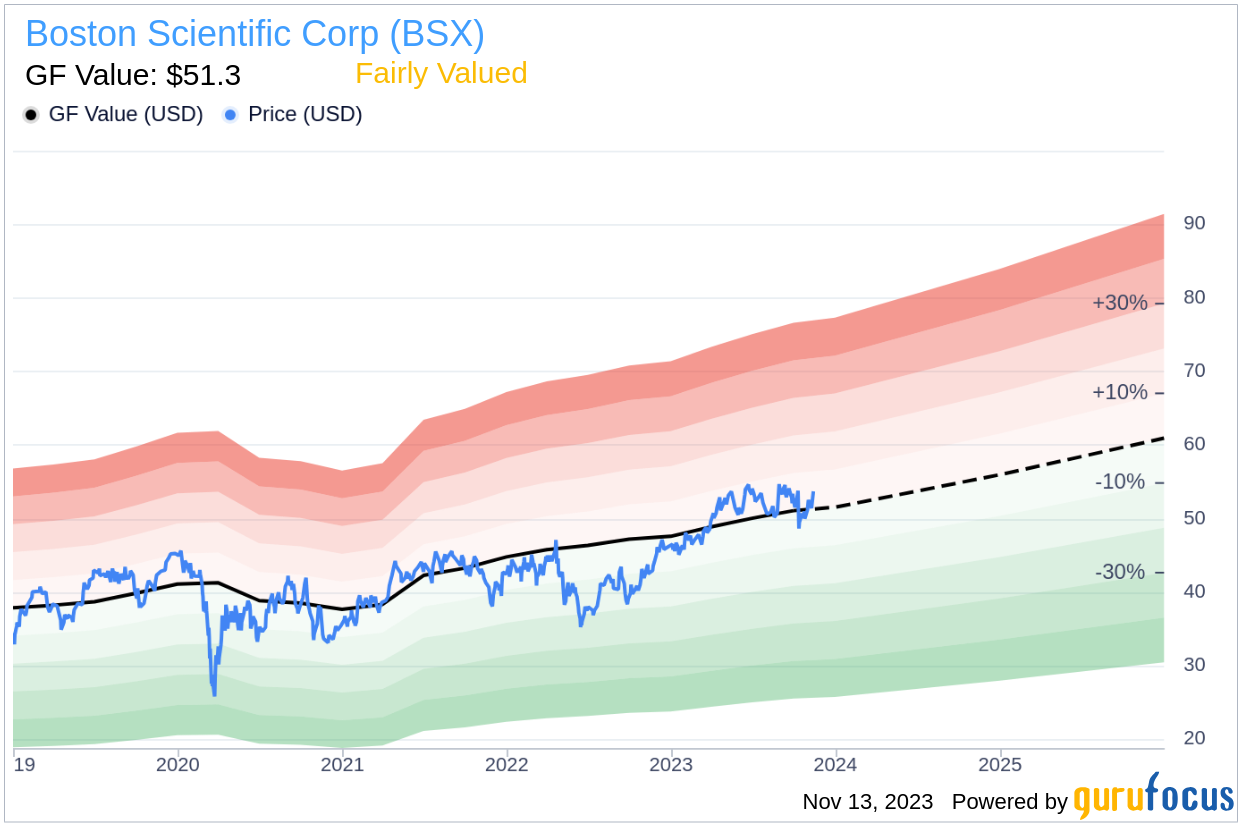

Summarize GF Value

The GF Value is a unique metric that captures the intrinsic value of a stock, factoring in historical trading multiples, an adjustment for past performance, and expected future business outcomes. This valuation suggests that Boston Scientific (BSX, Financial) is currently trading at a fair price, with a market cap of $78.70 billion. The GF Value serves as a benchmark, indicating that when a stock trades significantly above this line, it may be overvalued, while a price below suggests a potentially undervalued stock with higher future returns.

Given that Boston Scientific sits close to its GF Value, investors can anticipate returns that align with the company's business growth rate over the long term.

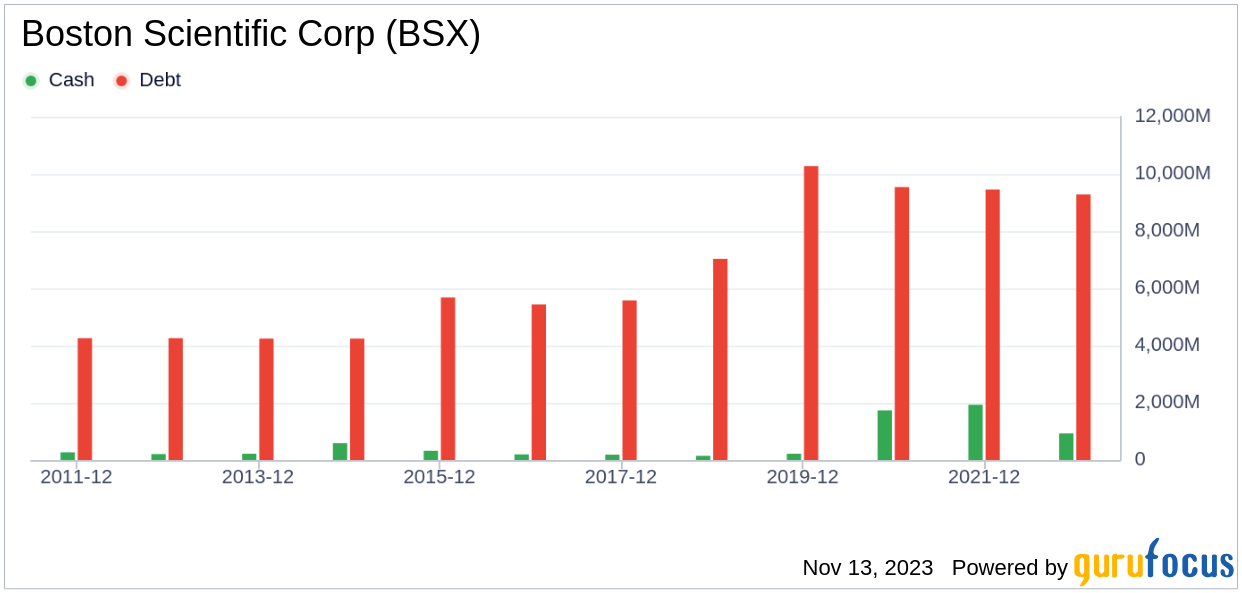

Financial Strength

Investing in companies with robust financial strength is crucial to mitigate the risk of capital loss. Boston Scientific's cash-to-debt ratio stands at 0.1, placing it in a challenging position compared to its industry peers. Despite this, the company's overall financial strength is deemed fair, with a GuruFocus ranking of 6 out of 10.

Profitability and Growth

Profitability is a cornerstone of investment safety, and Boston Scientific has maintained profitability for 6 out of the past 10 years. With an impressive operating margin of 16.89%, the company outperforms 80.24% of its industry counterparts. However, when it comes to growth, Boston Scientific's average annual revenue growth is modest, and its 3-year average EBITDA growth rate is on par with industry norms.

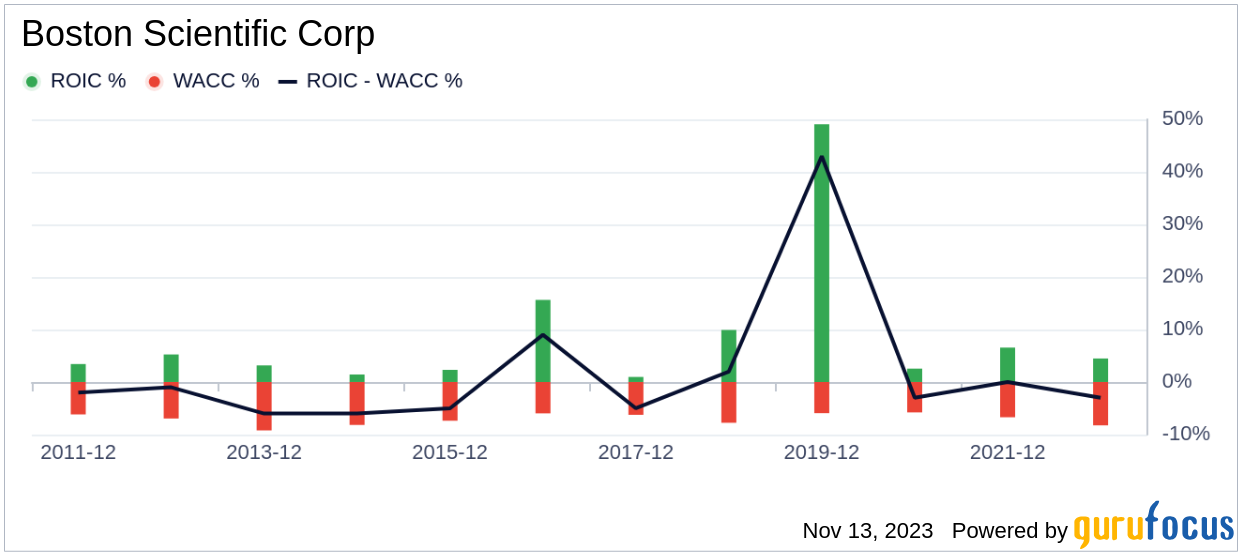

ROIC vs WACC

Comparing the Return on Invested Capital (ROIC) with the Weighted Average Cost of Capital (WACC) provides insight into value creation. Boston Scientific's ROIC of 5.2 is currently below its WACC of 7.5, suggesting that the company needs to improve its efficiency in generating returns on its investments.

Conclusion

In conclusion, Boston Scientific (BSX, Financial) presents itself as a fairly valued investment opportunity. The company's financial health is stable, and its profitability is reasonable. However, its growth and value creation metrics suggest there is room for improvement. Investors seeking to understand the full picture of Boston Scientific's financial landscape can explore its 30-Year Financials here.

To discover high-quality companies that may offer above-average returns with reduced risk, visit the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.