Amidst the volatility of the stock market, Bath & Body Works Inc (BBWI, Financial) has experienced a notable daily loss of 4.22%, alongside a three-month decline of 19.18%. However, with an Earnings Per Share (EPS) of 3.07, investors are left pondering whether the stock is significantly undervalued. This article delves into the valuation analysis of Bath & Body Works, aiming to uncover the true investment potential of its shares.

Company Introduction

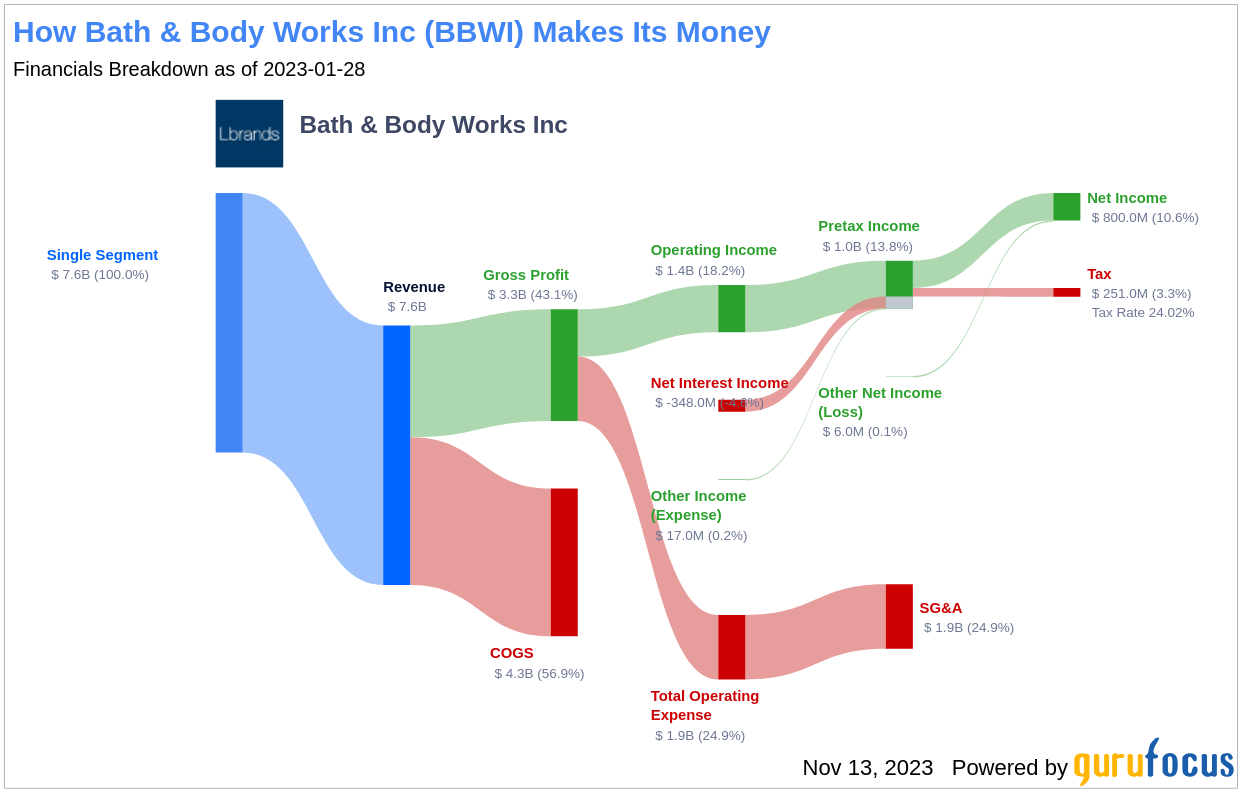

Bath & Body Works Inc (BBWI, Financial) is a renowned specialty retailer, known for its fragrant body care and home fragrance products. Operating primarily in North America, the company has a strong brick-and-mortar presence with over 1,800 retail stores, complemented by growing digital and international channels. Despite a challenging market, Bath & Body Works has maintained a robust operating margin of 16.42% and a Return on Invested Capital (ROIC) of 26.04%. With a market cap of $6.80 billion and sales reaching $7.40 billion, the company's financials present an intriguing case when juxtaposed with the GF Value, which estimates the stock's fair value at $55.69.

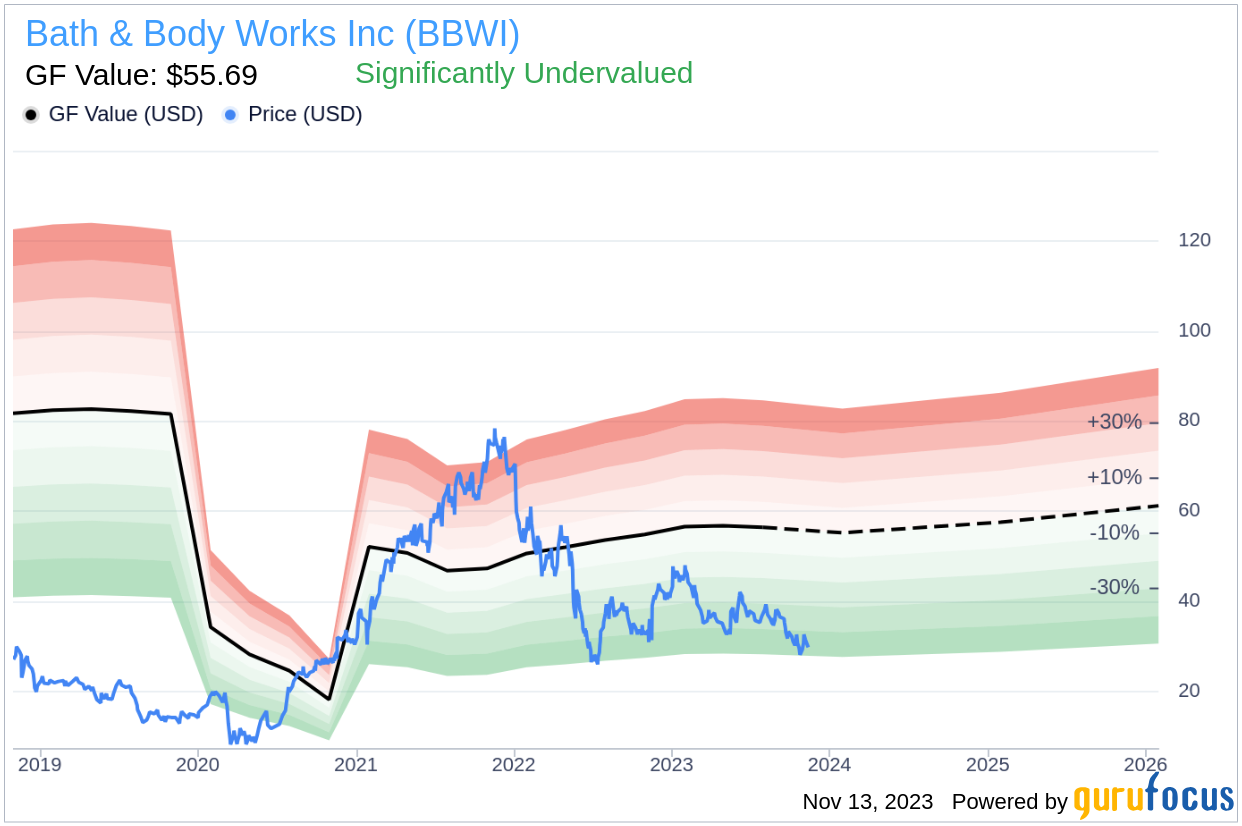

Summarize GF Value

The GF Value is a proprietary metric that determines the intrinsic value of a stock based on historical trading multiples, a GuruFocus adjustment factor, and anticipated business performance. Bath & Body Works (BBWI, Financial) is currently trading at $29.73 per share, which is significantly below the GF Value, indicating that the stock may be undervalued. Considering the company's valuation in light of its GF Value suggests a potential for higher future returns, assuming the business growth continues its trajectory.

Link: These companies may deliver higher future returns at reduced risk.

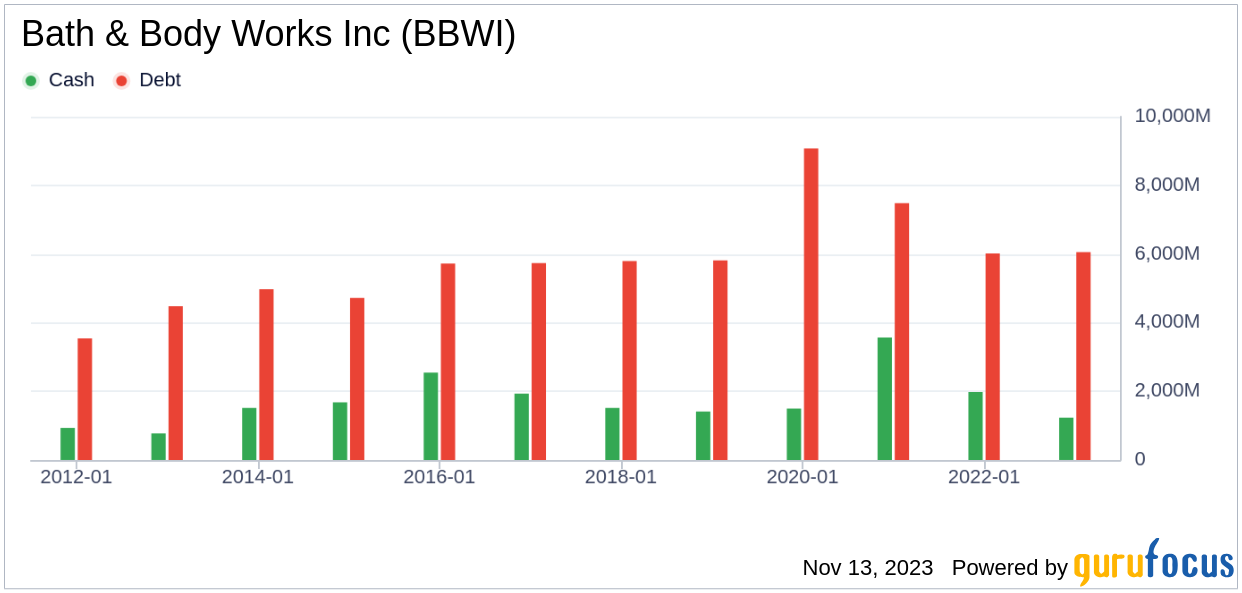

Financial Strength

Investing in companies with robust financial strength is vital to mitigate the risk of capital loss. Bath & Body Works' cash-to-debt ratio stands at 0.13, which is lower than the industry average, reflecting potential financial vulnerability. With a financial strength ranking of 4 out of 10, the company's fiscal health warrants careful scrutiny by investors.

Profitability and Growth

Profitability is a key indicator of a company's investment appeal. Bath & Body Works has consistently maintained profitability with an impressive operating margin that surpasses most of its industry peers. The company's profitability rank of 8 out of 10 signifies its strong position. In terms of growth, Bath & Body Works has an admirable annual revenue growth rate, although its 3-year average EBITDA growth is less impressive when compared to industry counterparts.

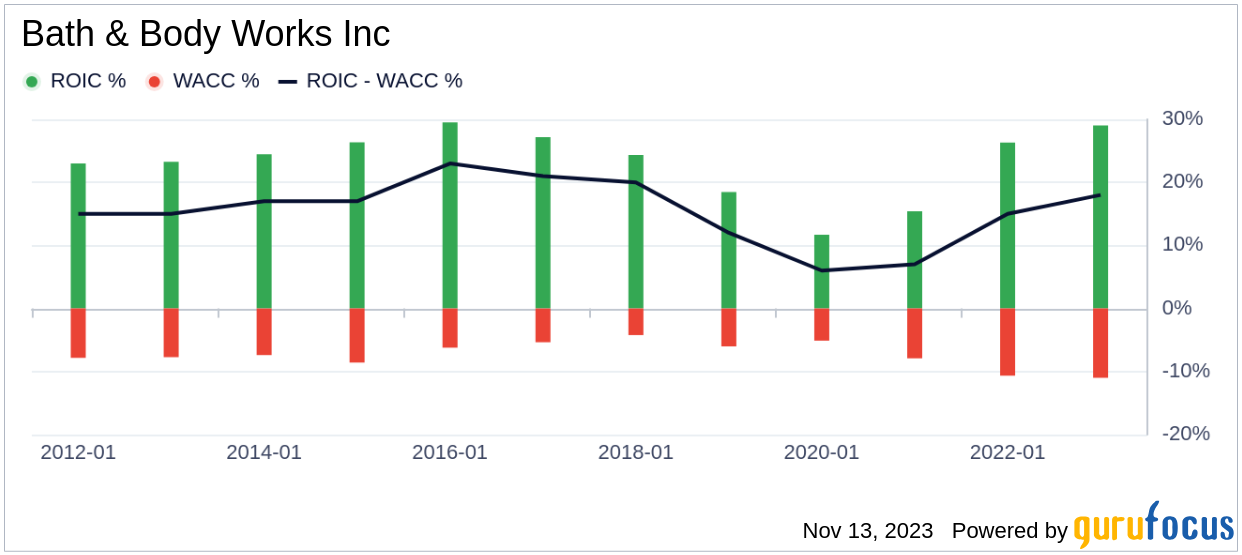

ROIC vs WACC

An effective way to assess a company's value creation is by comparing its Return on Invested Capital (ROIC) with its Weighted Average Cost of Capital (WACC). Bath & Body Works boasts an ROIC of 26.04%, significantly higher than its WACC of 9.49%, indicating the company's proficiency in generating cash flow relative to its invested capital.

Conclusion

In conclusion, Bath & Body Works Inc (BBWI, Financial) appears to be significantly undervalued based on its current market price and GF Value. While the company's financial condition poses some concerns, its strong profitability and growth prospects may offer a compelling case for investors. For a more detailed financial analysis, interested parties can explore Bath & Body Works' 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.