eBay Inc (EBAY, Financial) has recently experienced a daily loss of 2.81% and a 3-month decline of 12.48%, leaving investors questioning the stock's valuation. With an Earnings Per Share (EPS) of 5.06, the critical question arises: Is eBay significantly undervalued? This article delves into a valuation analysis to uncover the answer and invites readers to explore the comprehensive financial assessment that follows.

Company Introduction

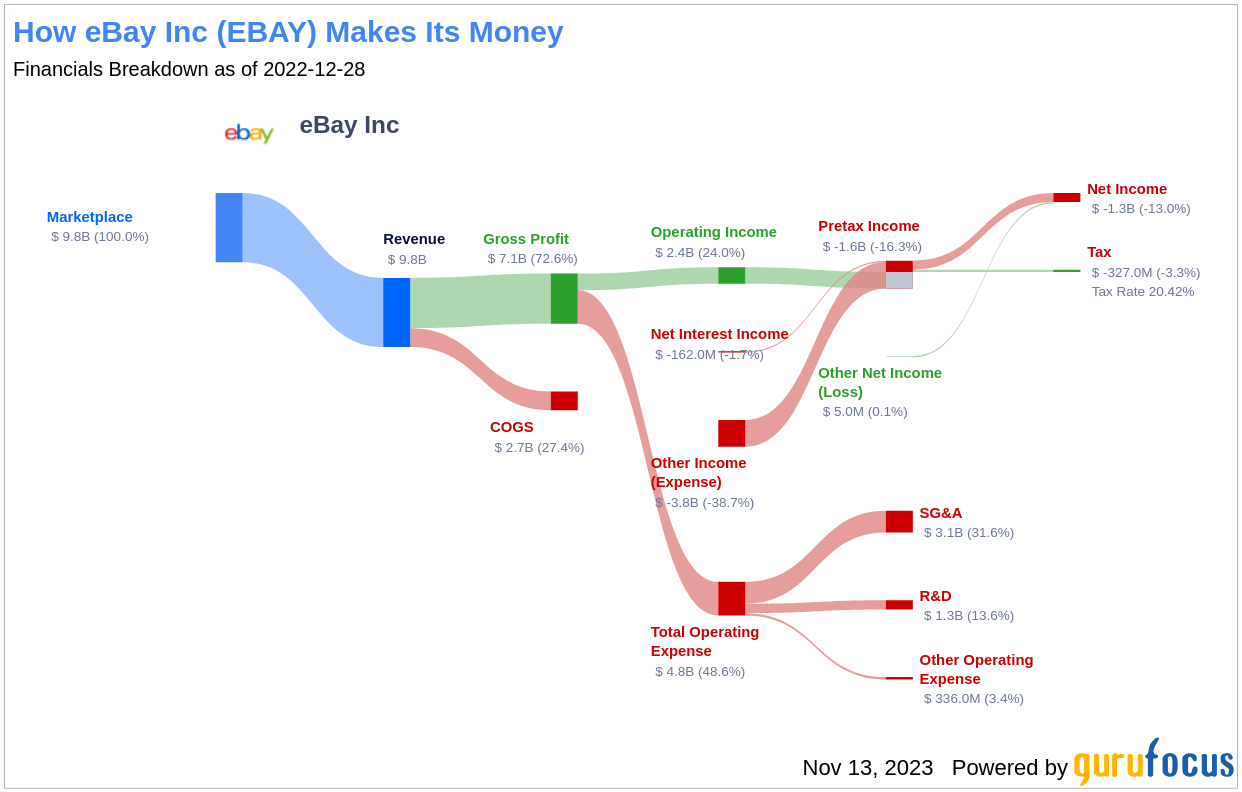

eBay operates one of the world's largest e-commerce marketplaces, boasting a $74 billion gross merchandise volume in 2022 and ranking among the top 10 global e-commerce companies. With a diverse revenue stream from listing fees, advertising, service provider revenue-sharing, and managed payments, eBay connects over 132 million buyers with approximately 20 million sellers. The company enjoys a strong international presence, especially in the U.K., Germany, and Australia, with international markets accounting for just over 50% of its GMV. This snapshot sets the stage for a deeper valuation analysis, contrasting the current stock price with the GF Value, an estimate of eBay's fair value.

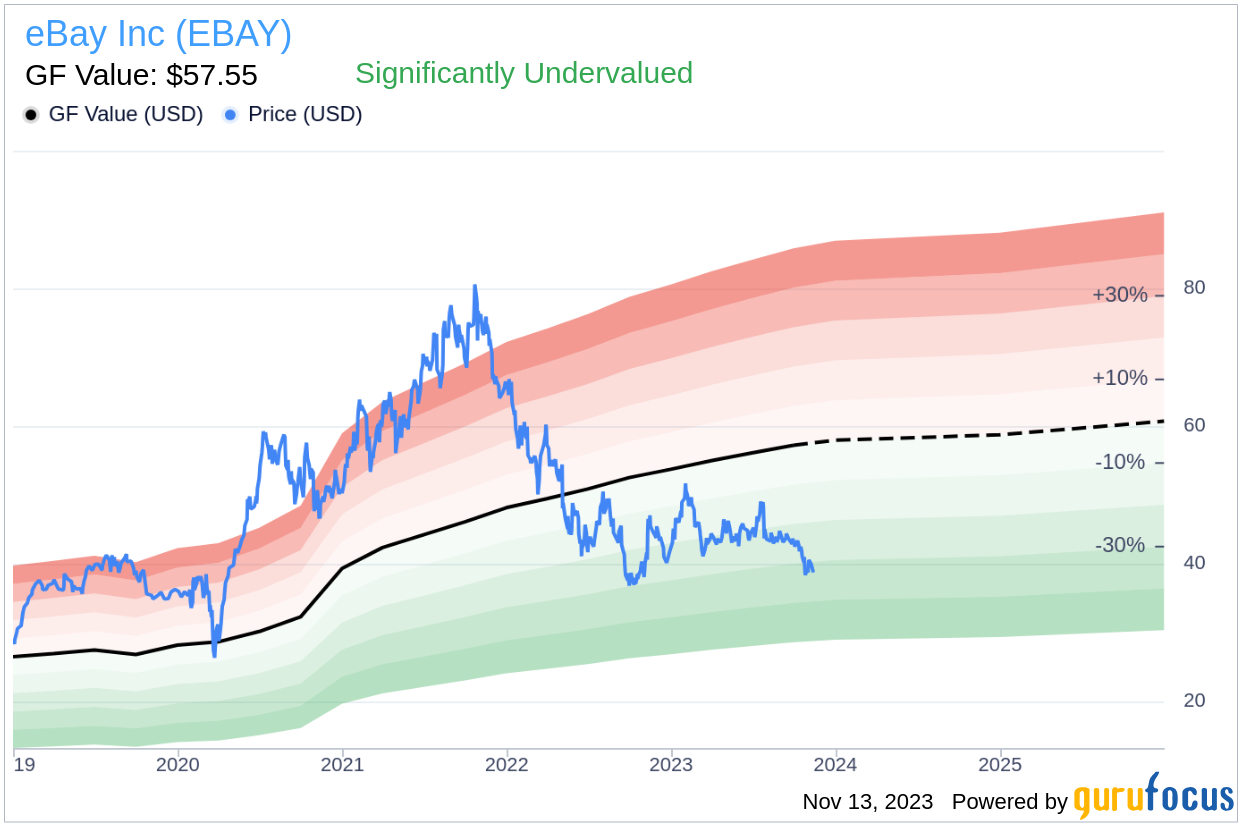

Summarize GF Value

The GF Value is a proprietary measure that suggests the intrinsic value of eBay, factoring in historical trading multiples, a GuruFocus adjustment for past performance and growth, and future business estimates. The GF Value Line, a visual guide on our summary page, indicates the fair trading value of eBay's stock. According to this measure, eBay (EBAY, Financial), with a current price of $38.73 and a market cap of $20.10 billion, is significantly undervalued. The implication is that eBay's long-term stock return could substantially exceed its business growth, given the current valuation.

Link: These companies may deliver higher future returns at reduced risk.Financial Strength

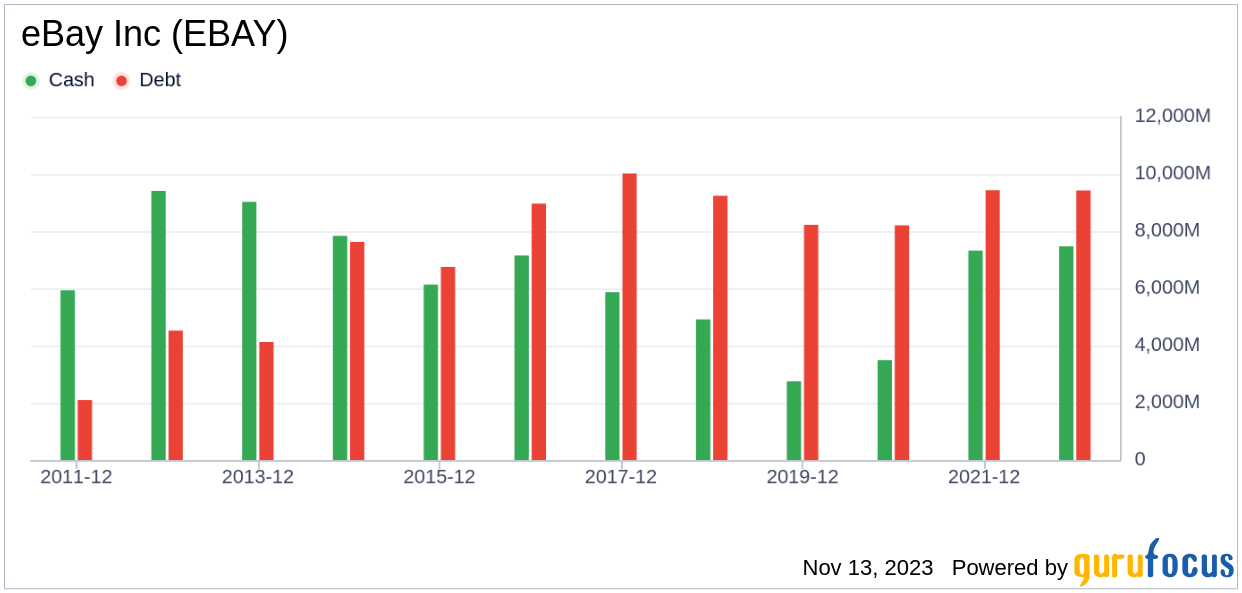

Investing in companies with robust financial strength mitigates the risk of capital loss. eBay's cash-to-debt ratio stands at 1.06, surpassing 65.59% of its peers in the Retail - Cyclical industry. With a financial strength rating of 6 out of 10, eBay's financial standing is considered fair.

Profitability and Growth

Consistent profitability is a hallmark of a less risky investment. eBay has remained profitable for 8 out of the past 10 years, with a remarkable operating margin of 20.84%, which ranks better than 94.89% of its industry counterparts. This level of profitability has earned eBay a strong rating of 8 out of 10. On the growth front, eBay's 3-year average revenue growth rate is commendable, outperforming 87.51% of the industry. However, its 3-year average EBITDA growth rate is 0%, which is less impressive.

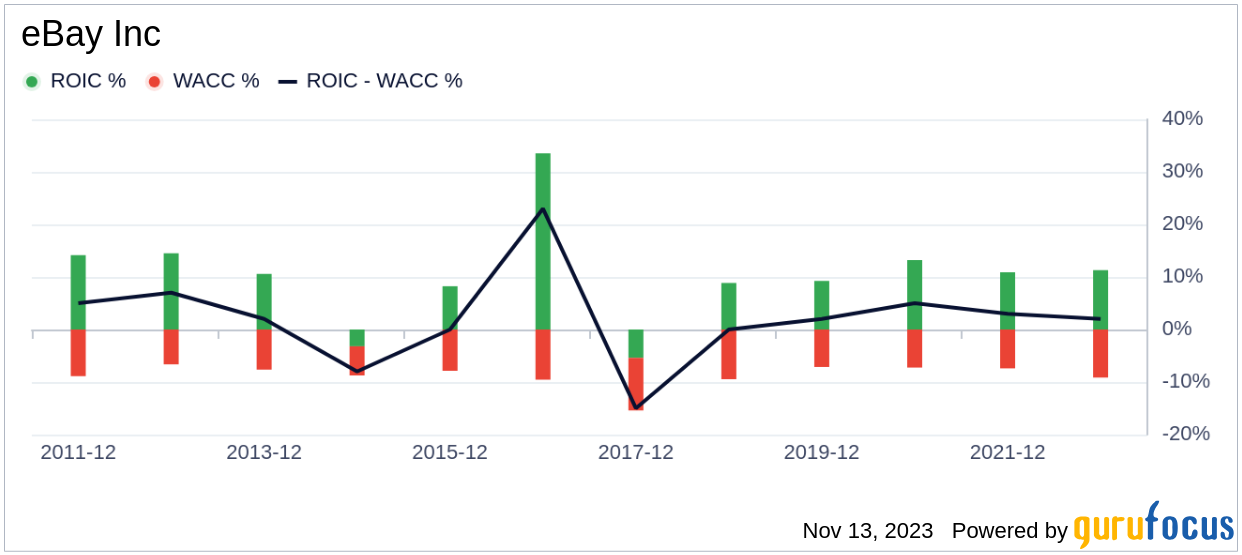

ROIC vs WACC

Comparing Return on Invested Capital (ROIC) to the Weighted Average Cost of Capital (WACC) is another way to assess profitability. eBay's ROIC is 12.2, surpassing its WACC of 9.59, indicating that the company is creating value for shareholders.

Conclusion

In summary, eBay (EBAY, Financial) is significantly undervalued based on GuruFocus' valuation metrics. The company's financial health is fair and its profitability robust, although its growth is not leading the industry. For a detailed look at eBay's financials, visit the 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.