Amidst the fluctuations of the stock market, Fox Corp (FOXA, Financial) has recently experienced a daily loss of 1.79% and a 3-month decline of 13.8%. Despite these setbacks, the company maintains an Earnings Per Share (EPS) of 2.04. This raises the question: is Fox (FOXA) modestly undervalued? The following analysis delves into the valuation of Fox, providing investors with a comprehensive understanding of its market position and potential for growth.

Company Introduction

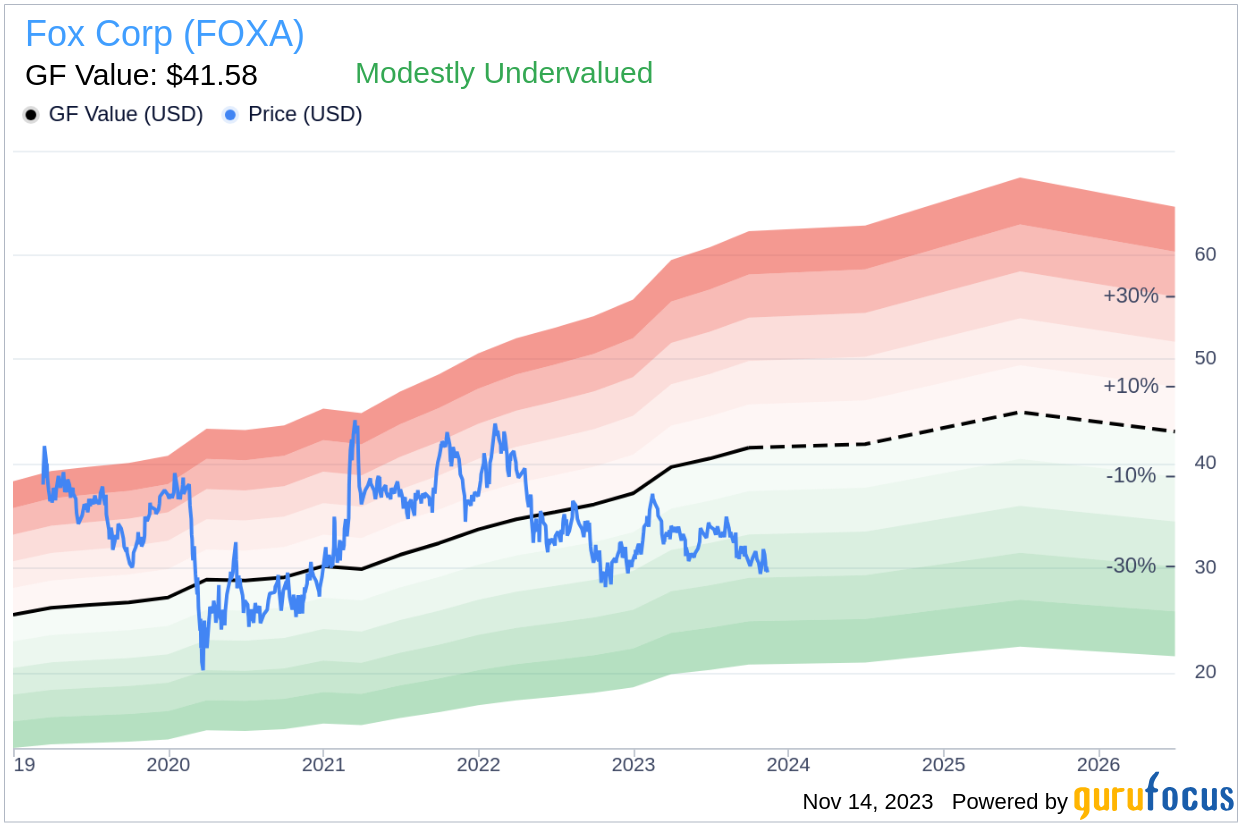

Fox represents a significant player in the U.S. media landscape, not least due to its notable assets such as Fox News, the FOX broadcast network, and various sports and business channels. The company's history, marked by the sale of certain assets to Disney and strategic acquisitions like Credible Labs, showcases its evolution and focus on live sports and news. With a stock price of $29.59 and a market cap of $13.80 billion, it is crucial to compare these figures against the GF Value, which estimates Fox's fair value at $41.58, to gauge the stock's potential undervaluation.

Summarize GF Value

The GF Value is a unique metric that signifies the intrinsic value of a stock, integrating historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line serves as a benchmark for fair trading value. Fox (FOXA, Financial) appears modestly undervalued with its current price below the GF Value Line, suggesting a promising outlook for future returns relative to its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

Investing in companies with robust financial strength is crucial to avoid permanent capital loss. Fox's financial strength is rated as 6 out of 10 by GuruFocus, with a cash-to-debt ratio of 0.47, positioning it in the lower half of the Media - Diversified industry. This assessment underlines the importance of evaluating financial health when considering an investment in Fox.

Profitability and Growth

Consistent profitability is a key indicator of a lower-risk investment. Fox has demonstrated strong profitability, with an operating margin of 17.04%, ranking it higher than the majority of its peers. Additionally, the company's growth, with an average annual revenue increase of 12%, suggests a positive trajectory for value creation, especially when paired with profitable growth.

ROIC vs WACC

An effective measure of profitability is the comparison between Return on Invested Capital (ROIC) and Weighted Average Cost of Capital (WACC). Fox's ROIC of 11.19 exceeds its WACC of 6.2, indicating that the company is generating value for its shareholders. This comparison is a strong testament to Fox's ability to efficiently allocate capital for business growth.

Conclusion

Overall, Fox (FOXA, Financial) presents itself as modestly undervalued with fair financial conditions and strong profitability. Its growth ranking outperforms a significant portion of the Media - Diversified industry. Those interested in a deeper dive into Fox's financials can explore its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.