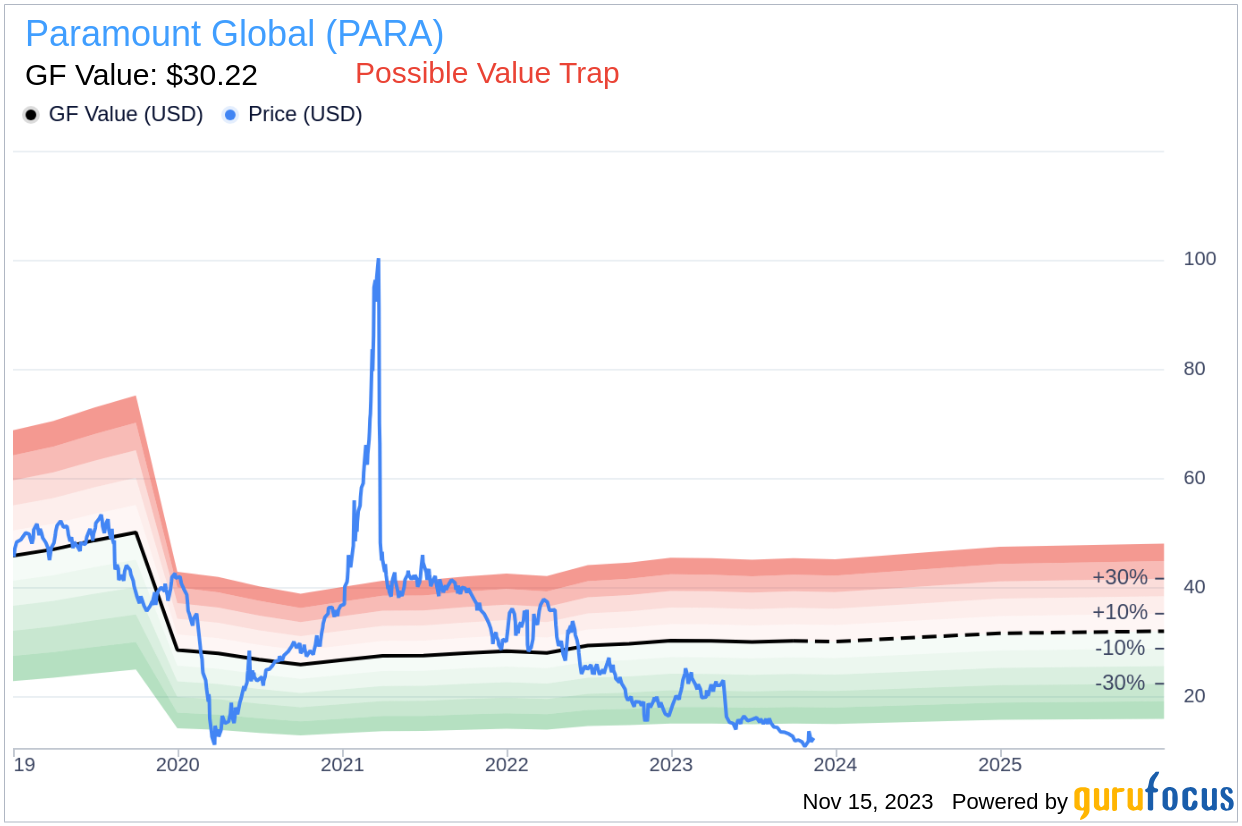

Value-focused investors are constantly searching for undervalued stocks that promise a high return potential. Paramount Global (PARA, Financial), with its current price of $13.17 and a recent daily gain of 5.19%, seems to be a candidate for such an investment. Despite a 3-month decrease of 13.99%, its GF Value is estimated at $30.22, suggesting a possible undervaluation. However, investors must tread carefully, as this apparent bargain could be masking underlying financial troubles.

Understanding GF Value

The GF Value is a proprietary measure that represents the intrinsic value of a stock. Calculated from historical multiples, adjustments based on past performance, and future business estimates, the GF Value Line is a benchmark for what the stock should be trading at. Ideally, the stock price will oscillate around this line, with significant deviations indicating overvaluation or undervaluation. However, this is just one piece of the puzzle when considering an investment in Paramount Global.

Identifying the Warning Signs

Despite the allure of a low stock price, Paramount Global's financial indicators raise red flags. The company's Piotroski F-score is a mere 1 out of 9, while its Altman Z-score stands at a concerning 1.07. These scores suggest a weak financial position, which may indicate that Paramount Global is a potential value trap. Investors should consider these warning signs as part of a comprehensive due diligence process.

Deciphering Financial Health Scores

The Piotroski F-score evaluates a company's financial health through nine criteria, including profitability, leverage, liquidity, and operating efficiency. Paramount Global's low score indicates financial weakness, which is a cause for concern. The Altman Z-score, on the other hand, predicts bankruptcy risk based on a combination of five financial ratios. A score below 1.8 points to a high likelihood of financial distress, further compounding the risks associated with investing in Paramount Global.

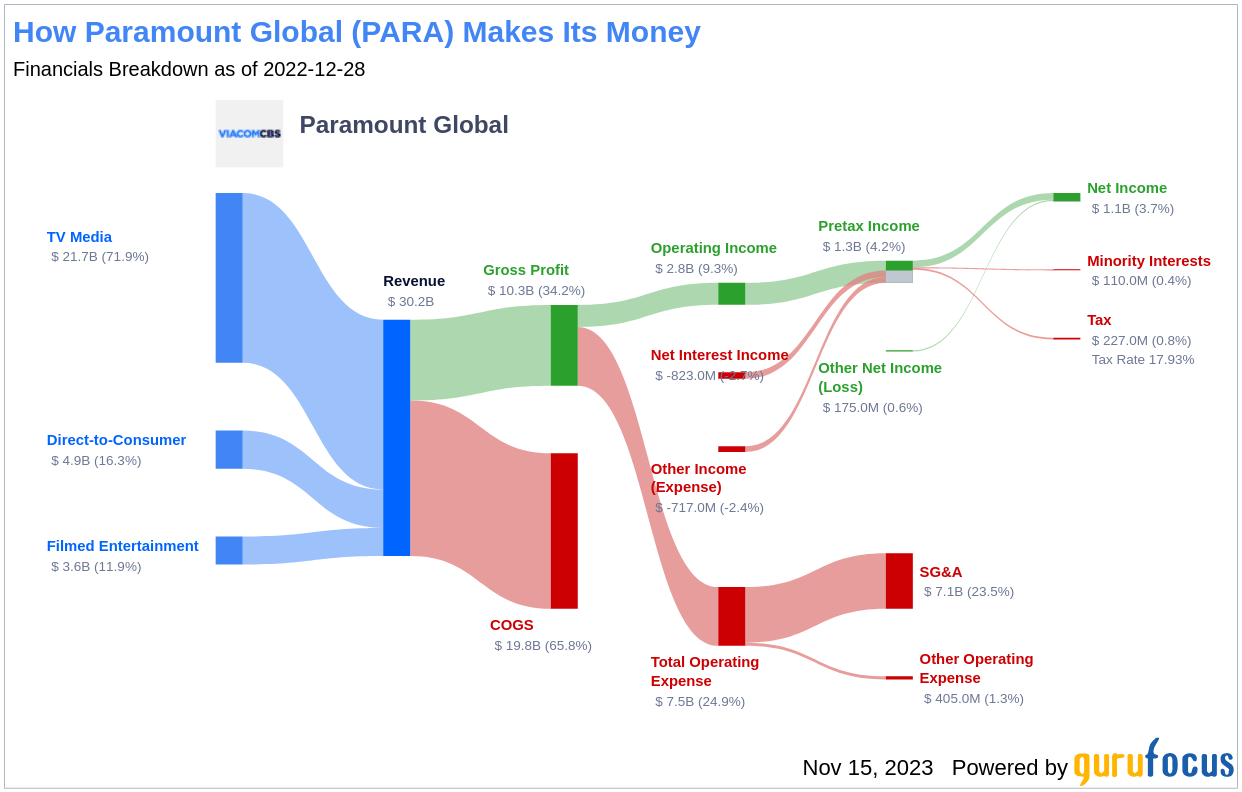

Paramount Global's Business Overview

Paramount Global is a media conglomerate formed from the merger of CBS and Viacom. Its diverse portfolio includes television networks, cable channels, and streaming services such as Paramount+ and Pluto TV, as well as a rich library of films from Paramount Pictures. Despite this impressive array of assets, the company's financial stability is in question, as evidenced by its current stock price's significant discrepancy from the GF Value.

Profitability Concerns

Profitability is a cornerstone of financial health, and Paramount Global's negative return on assets (ROA) is troubling. The company's ROA has declined from 6.10% in 2021 to -1.95% in 2023, which is a clear indicator of diminishing profitability and a critical aspect of the Piotroski F-score assessment.

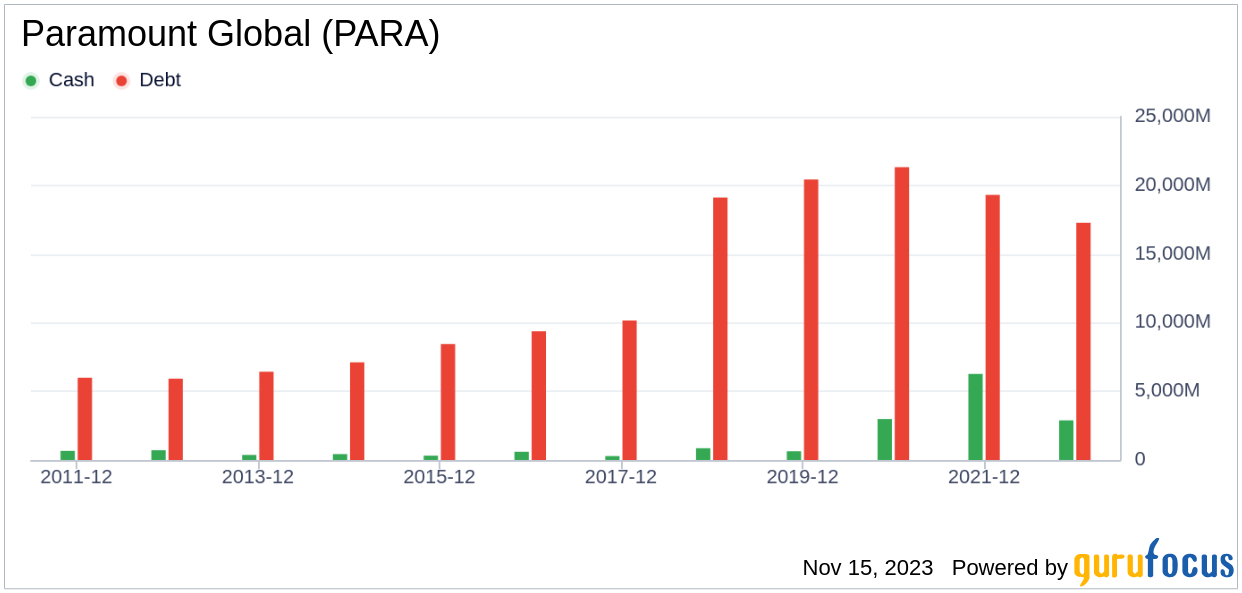

Liquidity and Financial Stability

Paramount Global's decreasing current ratio over the past three years—from 1.66% in 2021 to 1.26% in 2023—signals a weakening ability to meet short-term obligations. This trend is indicative of a potential liquidity crunch, which could hinder the company's operations and financial flexibility.

Operating Efficiency and Share Dilution

An increase in the number of shares outstanding, from 651 million in 2021 to 652 million in 2023, suggests share dilution, which can erode shareholder value. Additionally, the decline in gross margin from 39.89% in 2021 to 24.61% in 2023 and a decrease in asset turnover from 0.51% in 2021 to 0.53% in 2023 reflect a drop in operational efficiency and profitability.

Conclusion: The Value Trap Diagnosis

While Paramount Global's stock might seem like a bargain at first glance, the company's financial health, as indicated by the Piotroski F-score and Altman Z-score, suggests otherwise. The combination of negative profitability trends, liquidity concerns, and operational inefficiencies paints a picture of a potential value trap. Investors should proceed with caution and consider these factors as part of a holistic investment strategy. For those seeking more robust investment options, GuruFocus Premium offers tools such as the Piotroski F-score screener and Walter Schloss Screen to identify stocks with stronger financial health.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.