With a notable daily gain of 4.16%, Bio-Techne Corp (TECH, Financial) has recently caught the attention of investors, despite a three-month loss of -18.68%. This fluctuation in stock price, paired with an Earnings Per Share (EPS) of 1.52, raises the question: is the stock significantly undervalued? To answer this, we delve into a valuation analysis that may reveal hidden insights about Bio-Techne's true market value. Read on for a comprehensive breakdown of Bio-Techne's financial health and growth prospects.

Company Introduction

Bio-Techne Corp (TECH, Financial), headquartered in Minnesota, is a key player in the life sciences field, providing essential consumables and instruments to various markets, including pharmaceuticals, biotechnology, academia, and diagnostics. With a diverse revenue stream, the company operates primarily through two segments: protein sciences, accounting for 75% of revenue, and diagnostics and genomics, making up the remaining 25%. The stock's current price of $63.59 is juxtaposed against a GF Value of $105.28, suggesting a potential mispricing that warrants a closer examination of Bio-Techne's intrinsic value.

Summarize GF Value

The GF Value is a unique metric designed to estimate the intrinsic value of a stock, taking into account historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance projections. Currently, Bio-Techne (TECH, Financial) is deemed significantly undervalued according to this method. With a market cap of $10.10 billion, the stock's fair value is pegged higher than its current trading price, reflecting a strong potential for future returns.

Link: These companies may deliver higher future returns at reduced risk.Financial Strength

Investing in companies with robust financial strength mitigates the risk of capital loss. A glance at Bio-Techne's cash-to-debt ratio of 0.27, which is lower than 90.51% of its peers in the Biotechnology industry, suggests caution. However, GuruFocus confers Bio-Techne a financial strength rating of 7 out of 10, indicating a fair financial position.

Profitability and Growth

Consistent profitability over time equates to lower investment risk. Bio-Techne's impressive profit margins, outperforming 91.04% of the Biotechnology industry, underscore its robust performance potential. With a decade of profitability, annual revenues of $1.10 billion, and an operating margin of 25.4%, Bio-Techne's financial health appears strong.

Furthermore, growth is a pivotal valuation factor, often correlating with long-term stock performance. Bio-Techne's 3-year average annual revenue growth of 14.4% surpasses 59.95% of its industry counterparts, indicating a promising growth trajectory.

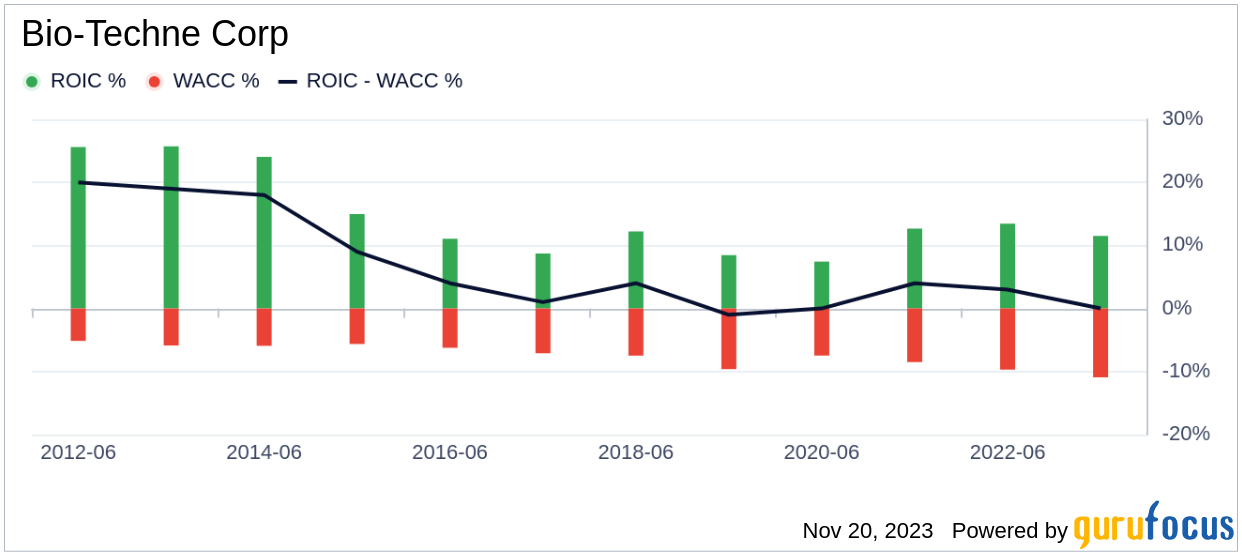

ROIC vs WACC

The comparison between a company's Return on Invested Capital (ROIC) and its Weighted Average Cost of Capital (WACC) can illuminate its profitability. Bio-Techne's ROIC of 11.13, although slightly lower than its WACC of 12.81, suggests that it is on the brink of generating shareholder value.

Conclusion

In summary, Bio-Techne Corp (TECH, Financial) presents itself as a significantly undervalued opportunity in the market. The company's financial condition is fair, its profitability is strong, and its growth is commendable within the Biotechnology industry. For those interested in a deeper financial analysis of Bio-Techne, the company's 30-Year Financials are available for review.

To discover high-quality companies that may deliver above-average returns, consider exploring the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.