Medtronic PLC (MDT, Financial) has experienced a daily gain of 4.6%, yet over the past three months, it has seen a 2.72% decline. With an Earnings Per Share (EPS) of $2.71, investors may wonder if the stock is modestly undervalued. This article delves into the valuation analysis of Medtronic PLC (MDT), providing insights to help answer this question.

Company Introduction

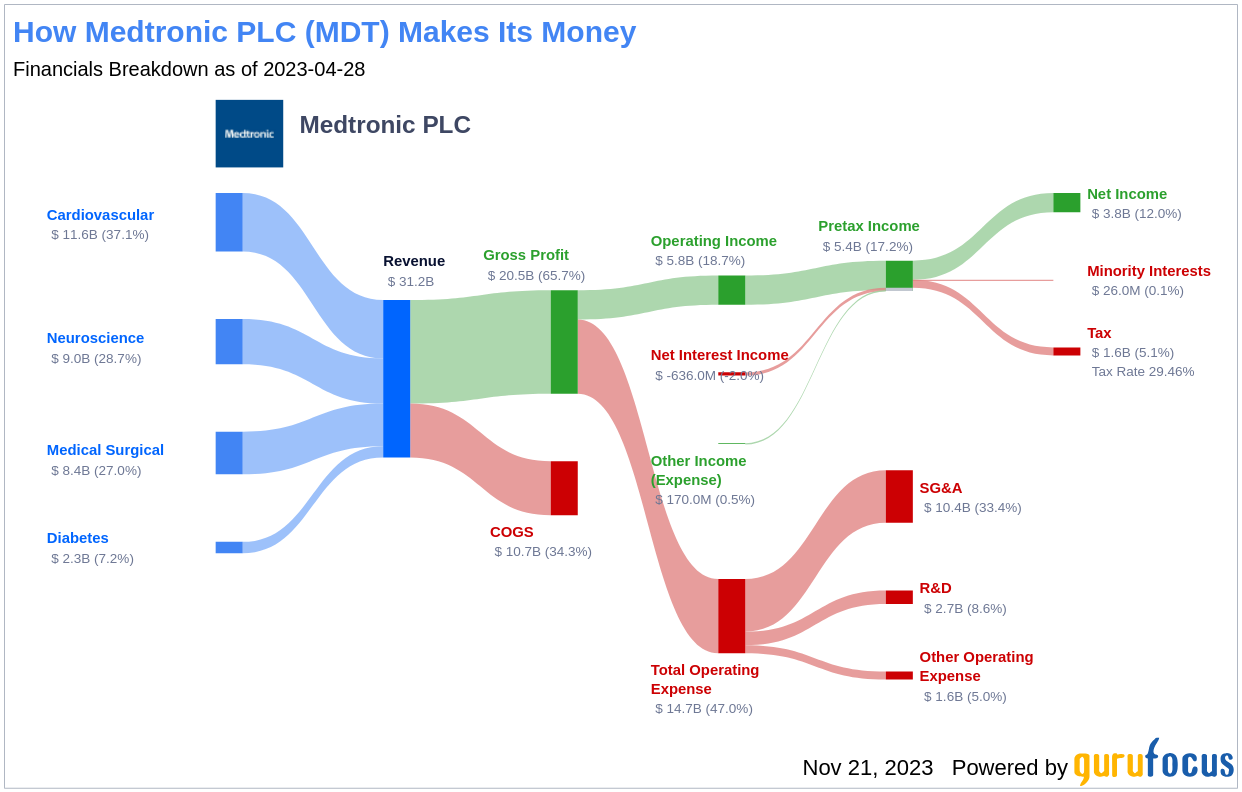

As one of the largest medical-device companies, Medtronic PLC develops and manufactures devices for chronic diseases, with a product portfolio that includes pacemakers, insulin pumps, and surgical tools. The company's global presence is marked by approximately 50% of sales generated overseas. Currently, Medtronic PLC's stock price stands at $78.62, with a market cap of $104.60 billion, suggesting a modest undervaluation when compared to the GF Value of $105.47. This valuation serves as a cornerstone for a deeper exploration of the company's intrinsic worth.

Summarizing the GF Value

The GF Value is a unique measure of a stock's intrinsic value, incorporating historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. Medtronic PLC (MDT, Financial) is currently considered modestly undervalued according to this metric. The GF Value Line suggests a fair trading value, around which the stock price is expected to fluctuate. A stock significantly below this line, as is the case with Medtronic PLC, could indicate higher future returns.

Given Medtronic PLC's relative undervaluation, the long-term return of its stock may surpass its business growth, presenting an attractive opportunity for value investors.

Link: These companies may deliver higher future returns at reduced risk.Financial Strength Assessment

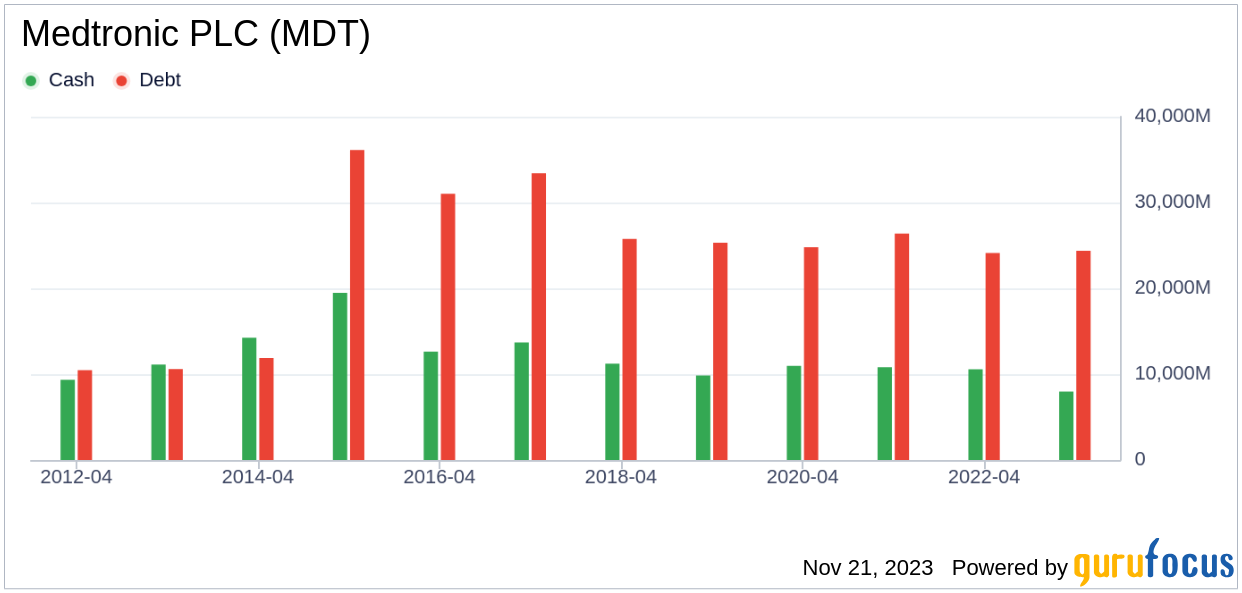

Assessing a company's financial strength is crucial before investing. Medtronic PLC's cash-to-debt ratio of 0.32 positions it lower than 82.52% of its industry peers. With a financial strength rating of 6 out of 10, Medtronic PLC's financial health is deemed fair.

Profitability and Growth Insights

Consistent profitability is a less risky proposition for investors, and Medtronic PLC has maintained profitability for the last decade. With an annual revenue of $31.60 billion and an operating margin of 19.19%, the company stands strong in its industry. The profitability rank of 7 out of 10 reflects a fair level of profitability.

Growth is a pivotal valuation factor, and Medtronic PLC's 3-year average annual revenue growth rate of 3.1% is somewhat lackluster compared to industry standards. Similarly, its EBITDA growth rate of 4.1% suggests potential for improvement.

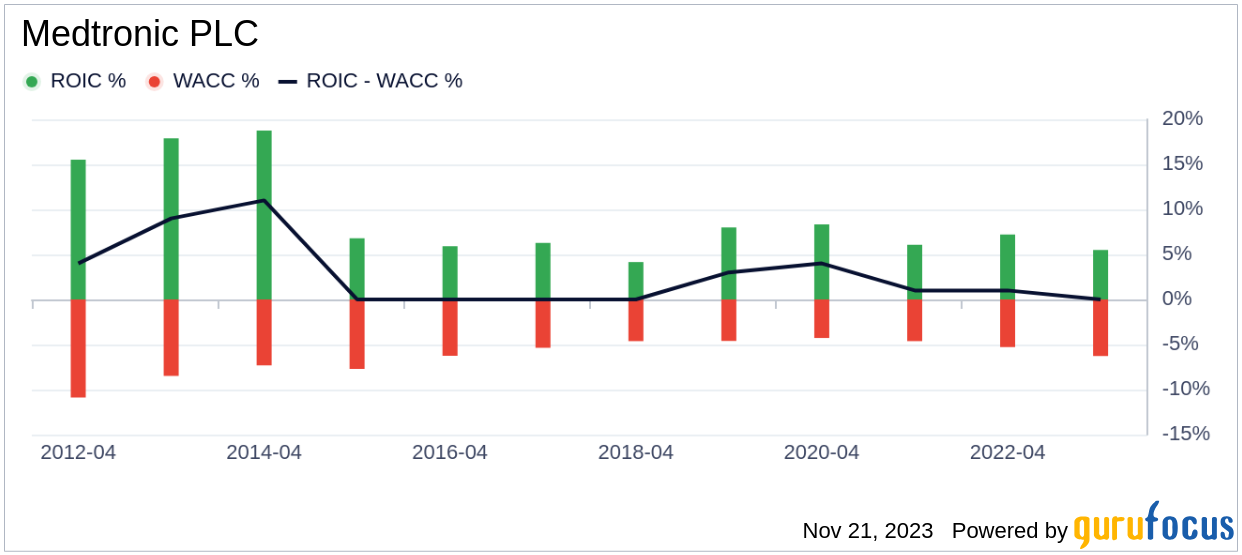

ROIC vs. WACC

An analysis of Return on Invested Capital (ROIC) and Weighted Average Cost of Capital (WACC) can provide insights into profitability. Medtronic PLC's ROIC of 5.28% falls short of its WACC of 6.42%, indicating challenges in creating shareholder value over the past year.

Conclusion

In summary, Medtronic PLC (MDT, Financial) appears to be modestly undervalued. The company's financial condition and profitability are satisfactory, but growth and value creation could see enhancements. For a detailed look at Medtronic PLC's financials over the last 30 years, interested investors can visit the company's financial page.

Discovering High-Quality Investments

To uncover high-quality companies that may deliver above-average returns, consider exploring the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.