Deere & Co (DE, Financial) recently experienced a daily loss of 3.11%, adding to a 3-month decline of 3.41%. Despite these fluctuations, the company boasts a robust Earnings Per Share (EPS) of 33.84. Investors may question whether these market movements accurately reflect the company's value or if Deere (DE) is modestly undervalued. To address this, we delve into a comprehensive valuation analysis, inviting readers to explore the financial intricacies that may reveal the stock's true market position.

Company Introduction

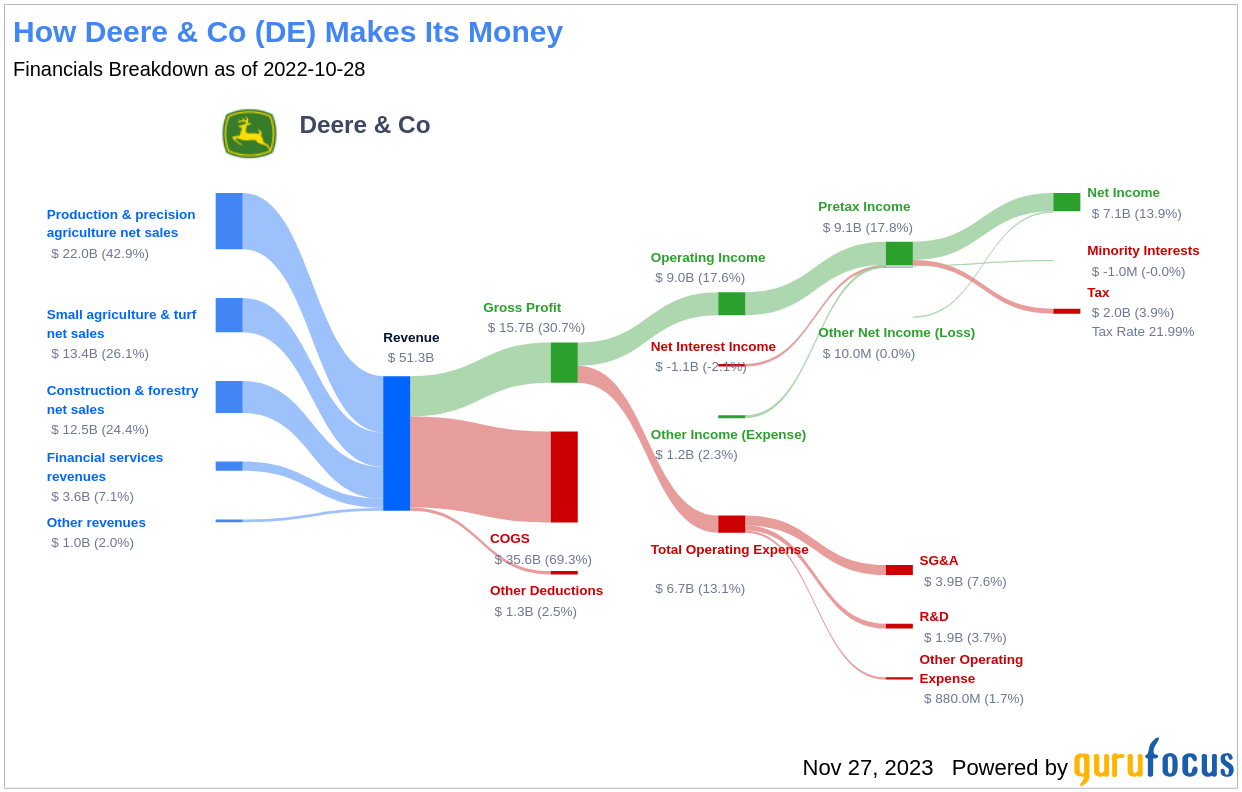

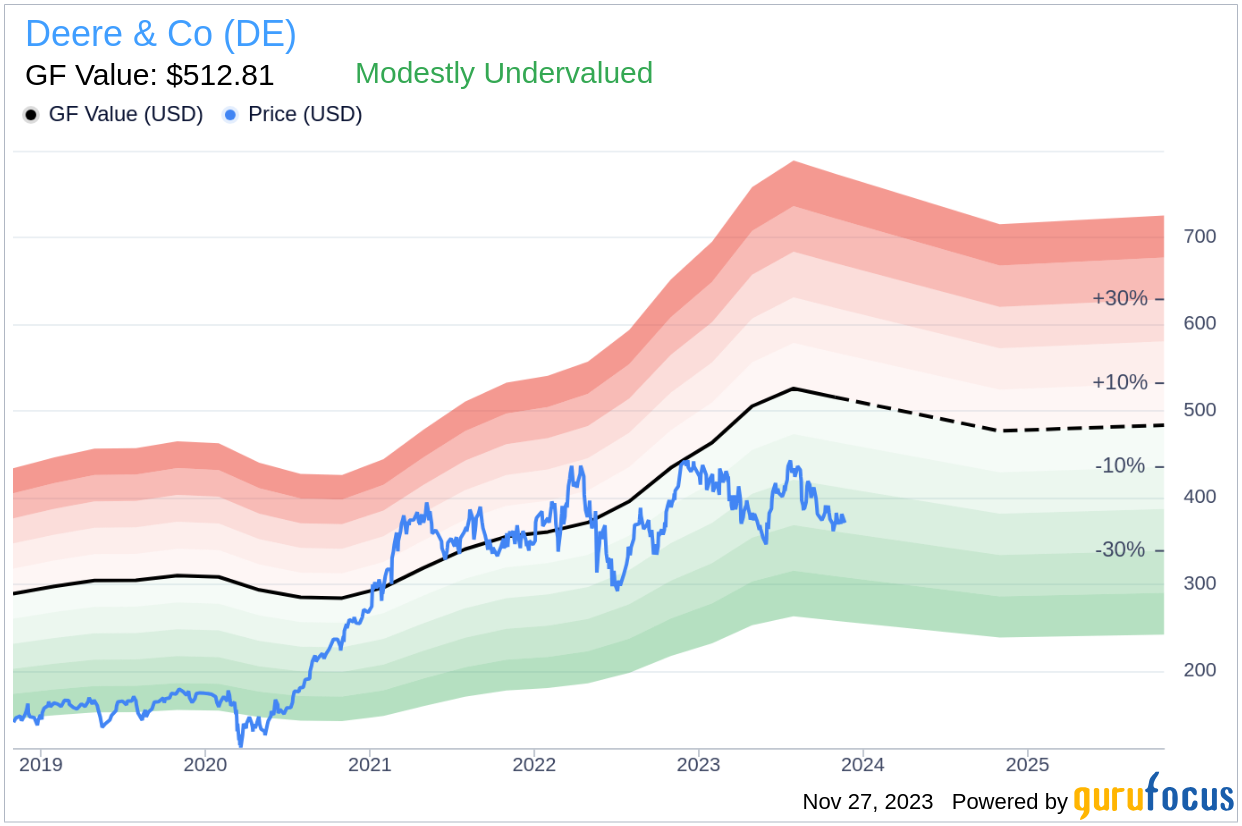

Deere & Co, the world's leading manufacturer of agricultural equipment, presents a complex financial profile. With a market cap of $106.60 billion and a share price of $370.19, juxtaposed against a GF Value of $512.81, the company appears modestly undervalued. Deere operates through multiple segments, including production and precision agriculture, small agriculture and turf, construction and forestry, and John Deere Capital. Its extensive dealer network and financial services arm, John Deere Capital, bolster its market presence. This introduction sets the stage for a deeper valuation assessment, linking financial data with Deere's business fundamentals.

Understanding the GF Value

The GF Value is an exclusive measure designed to estimate the intrinsic value of a stock. It incorporates historical trading multiples, a GuruFocus adjustment factor based on the company's historical performance, and future business prospects. When a stock trades significantly above the GF Value Line, it may suggest overvaluation and potentially lower future returns. Conversely, trading below this line could indicate undervaluation and the potential for higher returns. Deere's current share price suggests that the stock might be trading at a discount to its fair value, implying a promising outlook for long-term investors.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength Assessment

Assessing a company's financial strength is crucial to mitigate the risk of capital loss. Deere's financial strength is fair, with a cash-to-debt ratio of 0.12, which is lower than the majority of its industry peers. A fair financial strength rating of 5 out of 10 suggests that investors should conduct thorough research before making investment decisions.

Profitability and Growth Prospects

Investing in profitable companies, especially those with a track record of consistent profitability, generally poses less risk. Deere's impressive operating margin of 23.15% outperforms 95.67% of its industry counterparts, reflecting strong profitability. Furthermore, the company's revenue growth and EBITDA growth rates surpass industry averages, indicating healthy growth potential.

ROIC Versus WACC

Evaluating Deere's return on invested capital (ROIC) against its weighted average cost of capital (WACC) provides insights into its value creation. With an ROIC of 14.16% exceeding its WACC of 8.47%, Deere demonstrates its ability to generate cash flow efficiently relative to the capital invested.

Concluding Insights

In conclusion, Deere (DE, Financial) presents as modestly undervalued, with fair financial health and robust profitability. The company's growth outpaces much of its industry, suggesting a favorable long-term outlook. For a more detailed financial overview, investors can review Deere's 30-Year Financials here.

To discover high-quality companies that may offer above-average returns, please visit the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.