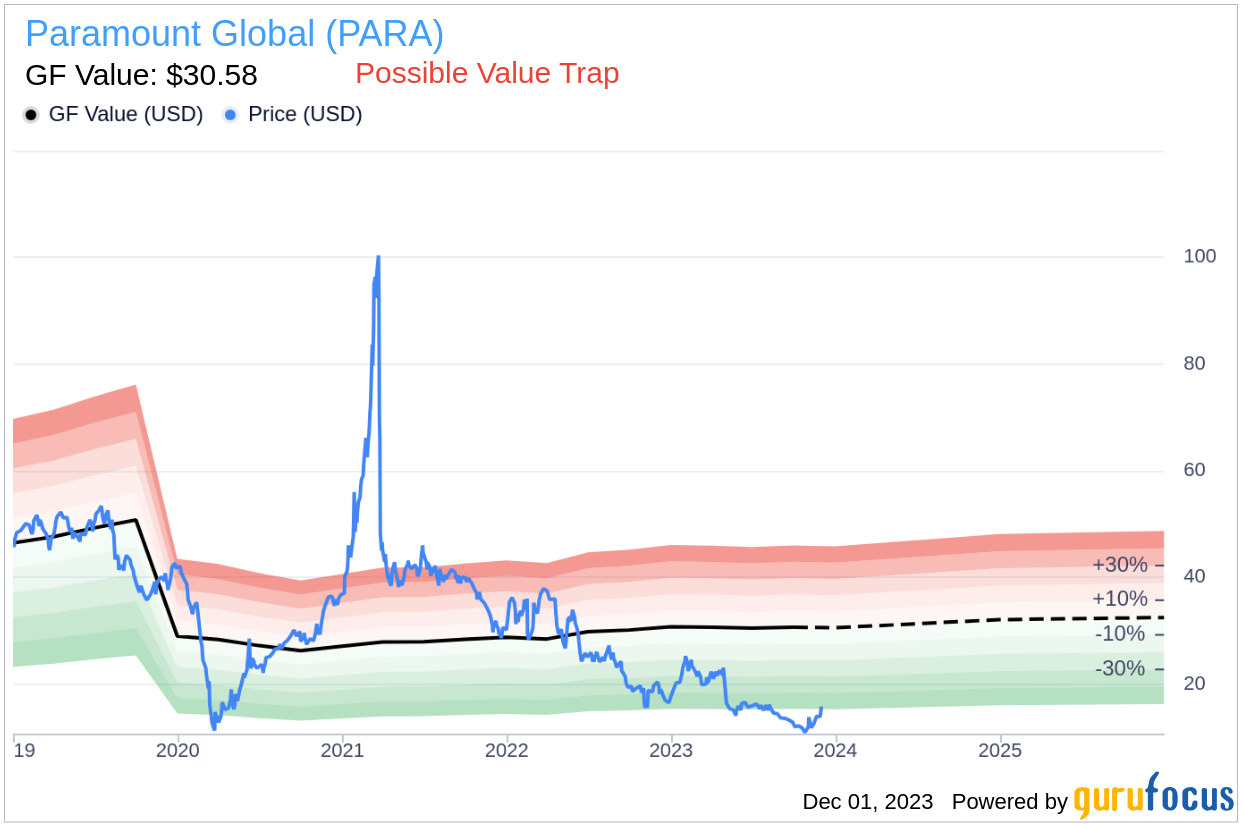

Value-focused investors are always on the hunt for stocks that are priced below their intrinsic value. Paramount Global (PARA, Financial), currently priced at 15.78, has seen a notable gain of 9.81% in a single day and a 3-month increase of 16.04%. According to the GF Value, the stock's fair valuation is estimated at $30.58, suggesting a potential undervaluation.

Understanding GF Value

The GF Value is a proprietary measure that represents the intrinsic value of a stock. It is derived from a combination of historical trading multiples, adjustments based on past returns and growth, and future business performance estimates. The GF Value Line visualizes this fair value, indicating a stock's potential over or undervaluation. If a stock price is significantly below the GF Value Line, it could signal a higher future return, whereas a price above could indicate overvaluation and potentially poor future returns.

However, a deeper analysis is crucial before making an investment decision. Despite Paramount Global's seemingly attractive valuation, risk factors such as a low Piotroski F-score of 1, an Altman Z-score of 1.1, and a five-year revenue/earnings decline suggest that Paramount Global could be a potential value trap. These indicators emphasize the importance of thorough due diligence in investment decision-making.

The Piotroski F-score and Altman Z-score Explained

The Piotroski F-score is a financial assessment tool that evaluates a company's financial health across nine criteria, including profitability, leverage, liquidity, and operating efficiency. A score of 3 or below indicates potential financial instability. Paramount Global's score of 1 raises red flags for investors. The Altman Z-score, meanwhile, predicts bankruptcy risk by combining five financial ratios. A score below 1.8 suggests a high likelihood of financial distress, and unfortunately, Paramount Global's score of 1.1 falls into this risk category.

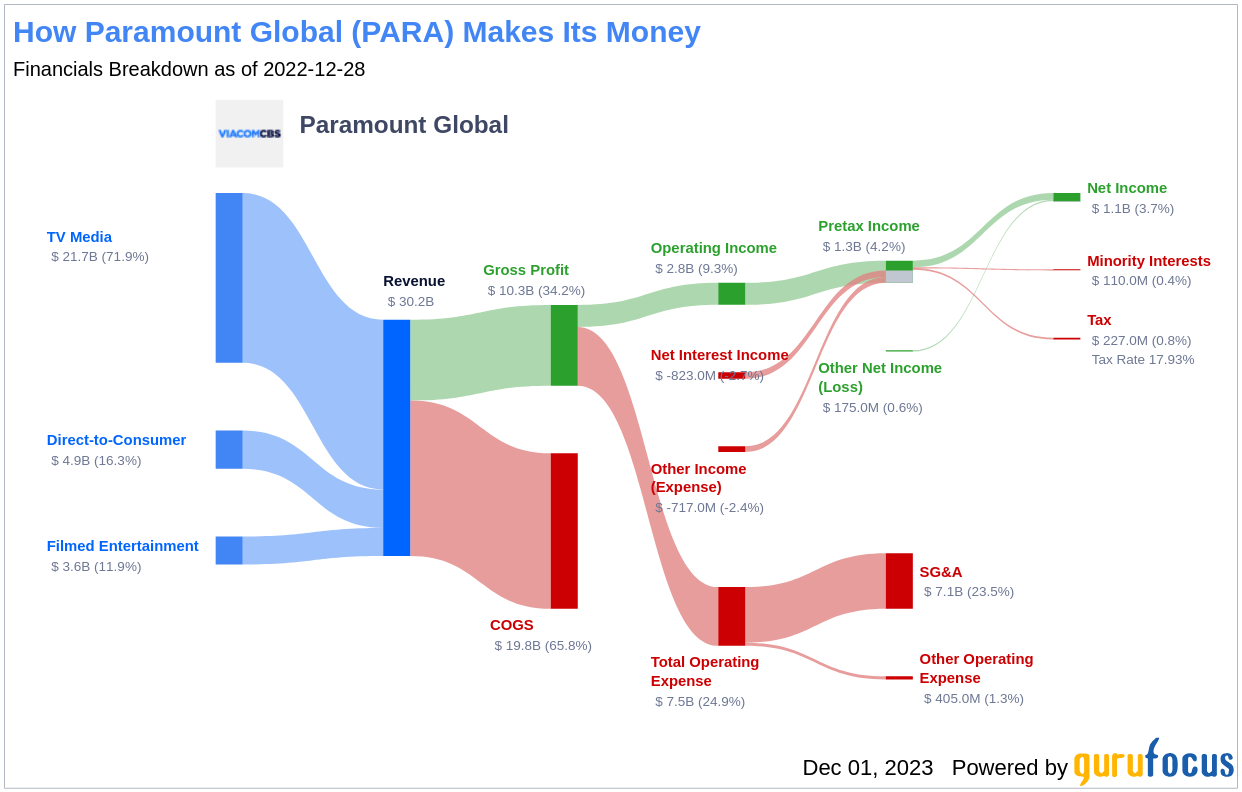

Paramount Global's Business Overview

Paramount Global, the result of the CBS and Viacom recombination, is a media conglomerate with a vast portfolio including Showtime, CBS, Nickelodeon, MTV, BET, and Paramount Pictures. With its extensive library of films and operation of streaming services like Paramount+ and Pluto TV, Paramount Global has a significant presence in the entertainment industry. Despite its comprehensive media assets, the company's current stock price compared to the GF Value warrants a close examination of its financial health and potential as an investment.

Profitability Concerns

Profitability is a critical aspect of the Piotroski F-score, and Paramount Global's negative ROA trend is troubling. The company's ROA has declined from 6.10% in 2021 to -1.95% in 2023, indicating an inability to profit from its assets. This declining ROA, alongside a discrepancy between cash flow from operations and net income, raises concerns about the quality of earnings and the sustainability of operations.

Leverage, Liquidity, and Source of Funds: A Worrying Trend

Paramount Global's liquidity seems to be under pressure, as evidenced by a declining current ratio over the past three years, moving from 1.66 in 2021 to 1.26 in 2023. This trend suggests a deterioration in the company's ability to cover short-term liabilities with short-term assets, raising concerns about its financial stability.

Operating Efficiency: A Darker Picture

The increase in Paramount Global's Diluted Average Shares Outstanding from 651 million in 2021 to 652 million in 2023 indicates share dilution, which could devalue existing shares if earnings do not keep pace. Additionally, a declining gross margin percentage from 39.89% in 2021 to 24.61% in 2023, alongside a decrease in asset turnover, points to potential inefficiencies in operations and asset utilization.

While the Piotroski F-score alone should not be the sole factor in investment decisions, it is a comprehensive indicator of financial health. Paramount Global's low score, combined with its low Altman Z-score, suggests potential financial distress and operational inefficiencies, signaling a cautionary tale for investors.

Paramount Global's Low Altman Z-Score: A Breakdown of Key Drivers

Paramount Global's declining Retained Earnings to Total Assets ratio and a descending EBIT to Total Assets ratio contribute to its low Altman Z-score, further indicating potential financial distress and operational inefficiency.

Conclusion: Navigating the Risks of a Potential Value Trap

Paramount Global presents a challenging case for investors. While its stock price may seem undervalued compared to the GF Value, the company's financial indicators, such as the Piotroski F-score and Altman Z-score, paint a picture of potential financial distress and operational inefficiencies. These warning signs should prompt investors to exercise caution and conduct thorough due diligence before considering an investment in Paramount Global. It's a classic example of the need to look beyond surface-level metrics to understand the true investment potential of a stock.

GuruFocus Premium members seeking robust financial health in their investments can utilize the Piotroski F-score screener and the Walter Schloss Screen to discover stocks with high Altman Z-Scores.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.