The stock market is a dynamic arena, and JM Smucker Co (SJM, Financial) is no exception, with a daily gain of 3.28% and a three-month loss of 17.96%. With a reported Loss Per Share of $0.16, investors are left pondering whether the stock is modestly undervalued. This article delves into the valuation of JM Smucker Co (SJM), engaging readers in an analysis that could reveal investment opportunities.

Company Introduction

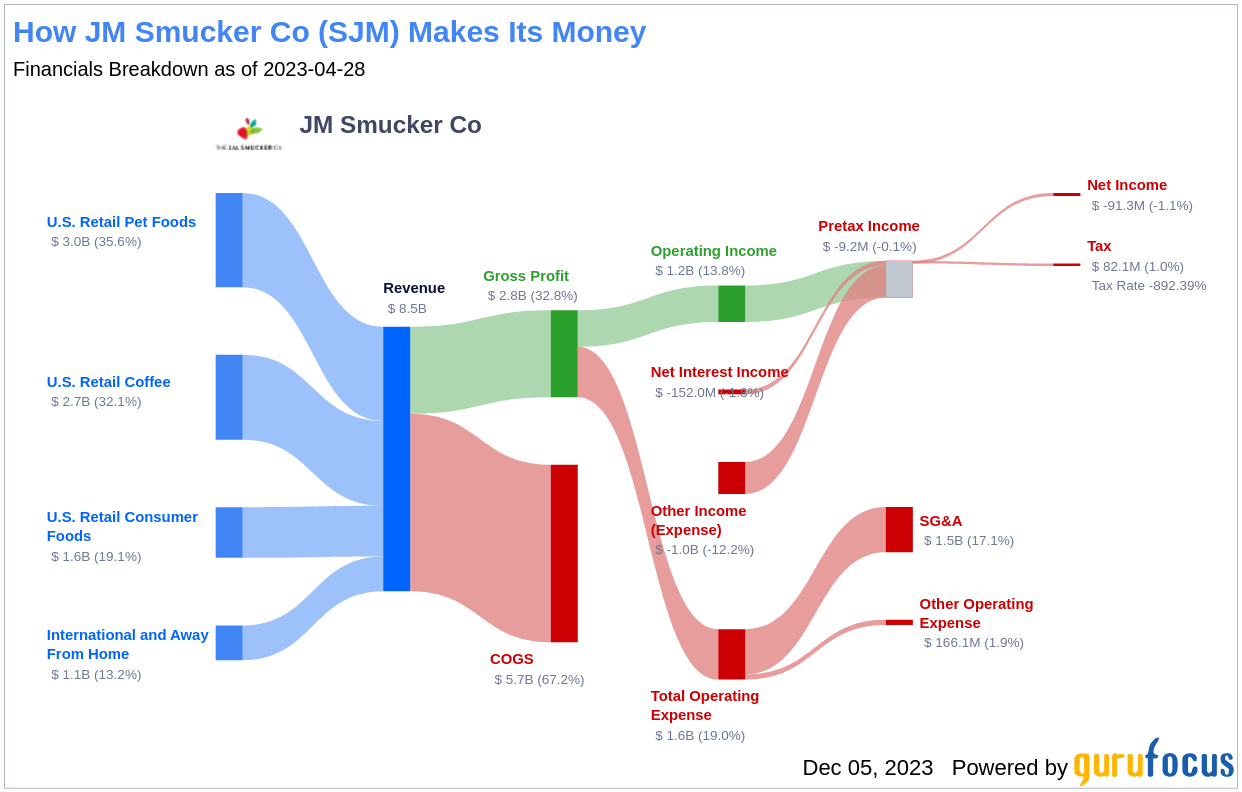

JM Smucker Co (SJM, Financial), a leading packaged food company, primarily serves the U.S. retail channel, which accounts for 84% of its projected fiscal 2024 revenue. The company's portfolio, following divestitures totaling around $1.5 billion in sales, now sees retail coffee as its largest category, spearheaded by brands like Folgers and Dunkin'. The pet foods segment, with top brands such as Milk-Bone and Meow Mix, contributes about 23% of sales. The remaining revenue is largely driven by consumer foods, including Jif peanut butter and Smucker's jelly. The impending acquisition of Hostess Brands is set to further shape JM Smucker Co's market presence.

With a current stock price of $116.12, and a Fair Value (GF Value) of $150.73, JM Smucker Co (SJM, Financial) appears to be modestly undervalued. This valuation discrepancy lays the groundwork for an in-depth evaluation of the company's intrinsic worth.

Summarize GF Value

The GF Value is a proprietary measure that estimates the intrinsic value of a stock, taking into account historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance projections. According to this valuation model, JM Smucker Co (SJM, Financial) is currently priced below its GF Value, indicating potential for higher future returns relative to its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

Investors must scrutinize a company's financial strength to avoid potential capital loss. JM Smucker Co's financial solidity is captured by a cash-to-debt ratio of 0.16, which is lower than 72.49% of its peers in the Consumer Packaged Goods industry. This places its financial strength at a fair rating of 6 out of 10, suggesting a balanced sheet, albeit with room for improvement.

Profitability and Growth

Investing in profitable companies, particularly those with consistent profitability, tends to be less risky. JM Smucker Co has maintained profitability for 9 out of the past 10 years, with a notable operating margin of 15.4%, placing it above 86.29% of its industry counterparts. This solid profitability is rated 7 out of 10. However, JM Smucker Co's growth trajectory has been less impressive, with a 3-year average revenue growth rate lagging behind 55.12% of the industry and a 3-year average EBITDA growth rate ranking lower than 90.38% of its peers.

ROIC vs WACC

An effective way to gauge profitability is by comparing a company's Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC). Ideally, a company should generate higher returns on invested capital than the cost of its capital. Over the past year, JM Smucker Co's ROIC was -1.87, falling short of its WACC of 4.26, suggesting challenges in creating shareholder value.

Conclusion

In conclusion, JM Smucker Co (SJM, Financial) presents as modestly undervalued, with fair financial health and profitability. Despite its weaker growth rankings, the company's overall prospects remain intriguing. For a more detailed financial overview, investors are encouraged to examine JM Smucker Co's 30-Year Financials.

To discover high-quality companies that may deliver above-average returns, consider exploring the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.