Amidst a daily loss of -0.84% and a 3-month decline of -6.28%, investors are closely monitoring Fox Corp (FOXA, Financial). With an Earnings Per Share (EPS) of $2.04, the question arises: is Fox modestly undervalued? The following analysis delves into the valuation of Fox, aiming to provide a clear answer to this pertinent question. Join us as we unravel the intrinsic worth of Fox (FOXA) and explore its potential for long-term investment.

Company Introduction

Fox represents a significant bet on the value of live sports and news in the U.S. market. Notably, the company's assets include Fox News, the FOX broadcast network, and various other media entities. With a current stock price of $29.69 and a Fair Value (GF Value) of $41.65, Fox appears to be modestly undervalued. This disparity between market price and intrinsic value sets the stage for a deeper evaluation of Fox's financial health and growth prospects.

Summarize GF Value

The GF Value is a unique measure that estimates the fair trading value of a stock. It incorporates historical trading multiples, a GuruFocus adjustment factor based on past performance, and future business estimates. When Fox Corp (FOXA, Financial)'s stock price is weighed against this benchmark, it suggests that the company is modestly undervalued, with a market cap of $13.80 billion. This valuation implies that the long-term return on Fox's stock could surpass its business growth, presenting an attractive opportunity for investors.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

Investors must consider the financial strength of a company to avoid potential capital loss. Fox's cash-to-debt ratio of 0.47 ranks in the lower half of the Media - Diversified industry. Despite this, GuruFocus bestows a financial strength rating of 6 out of 10, suggesting a reasonably stable balance sheet.

Profitability and Growth

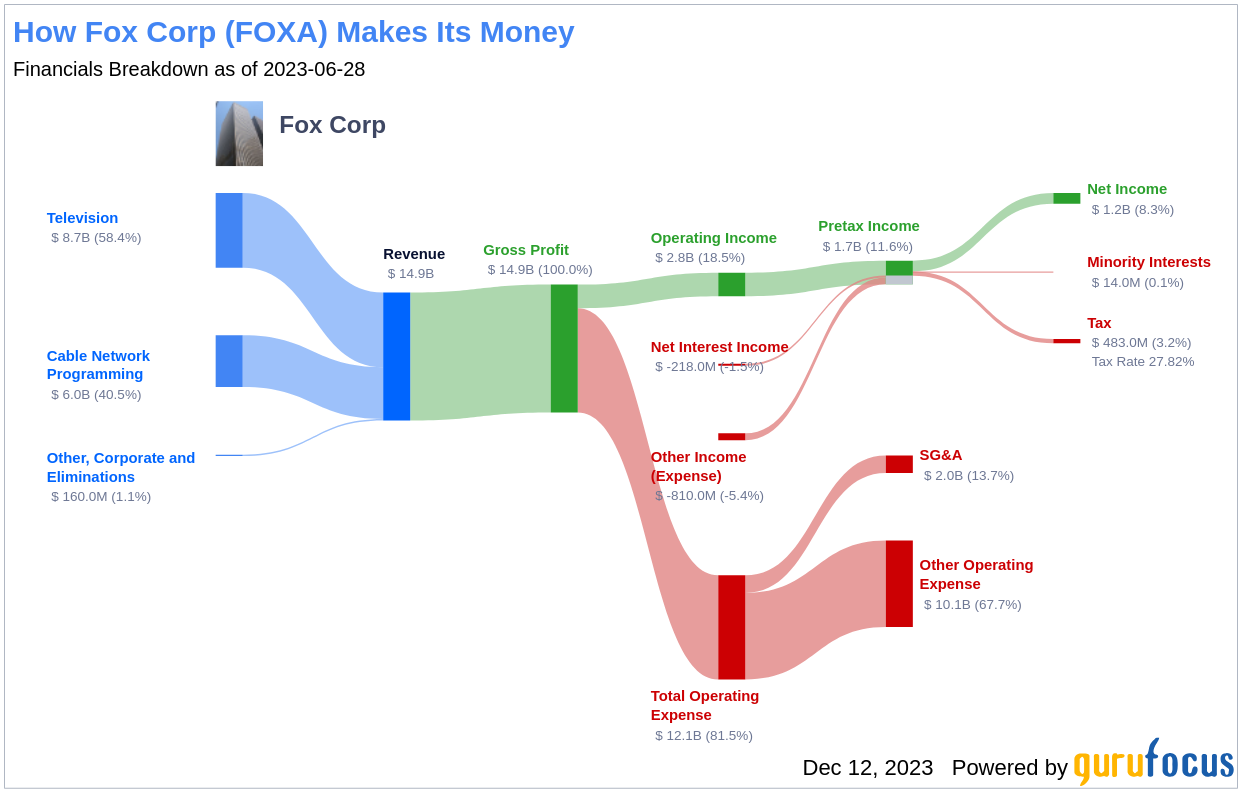

Profitability is a critical indicator of a company's risk profile. Fox has maintained profitability for 8 out of the past 10 years, with a revenue of $14.90 billion and an operating margin of 17.04%, which is commendable within its industry. The company's profitability rank is a robust 8 out of 10. Furthermore, growth is integral to valuation, and Fox's 3-year average annual revenue growth of 12% signifies a promising trajectory, outpacing 79% of its industry peers.

ROIC vs WACC

Comparing Return on Invested Capital (ROIC) with the Weighted Average Cost of Capital (WACC) can reveal a company's profitability relative to the capital invested. Fox's ROIC of 11.19 exceeds its WACC of 5.59, indicating the company is efficiently creating shareholder value.

Conclusion

Overall, Fox (FOXA, Financial) is considered modestly undervalued. With a fair financial condition and strong profitability, alongside growth that outstrips a majority of its competitors, Fox presents an intriguing option for investors. For a more detailed financial analysis, Fox's 30-Year Financials can offer further insights.

To discover high-quality companies that may deliver above-average returns, be sure to explore the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.