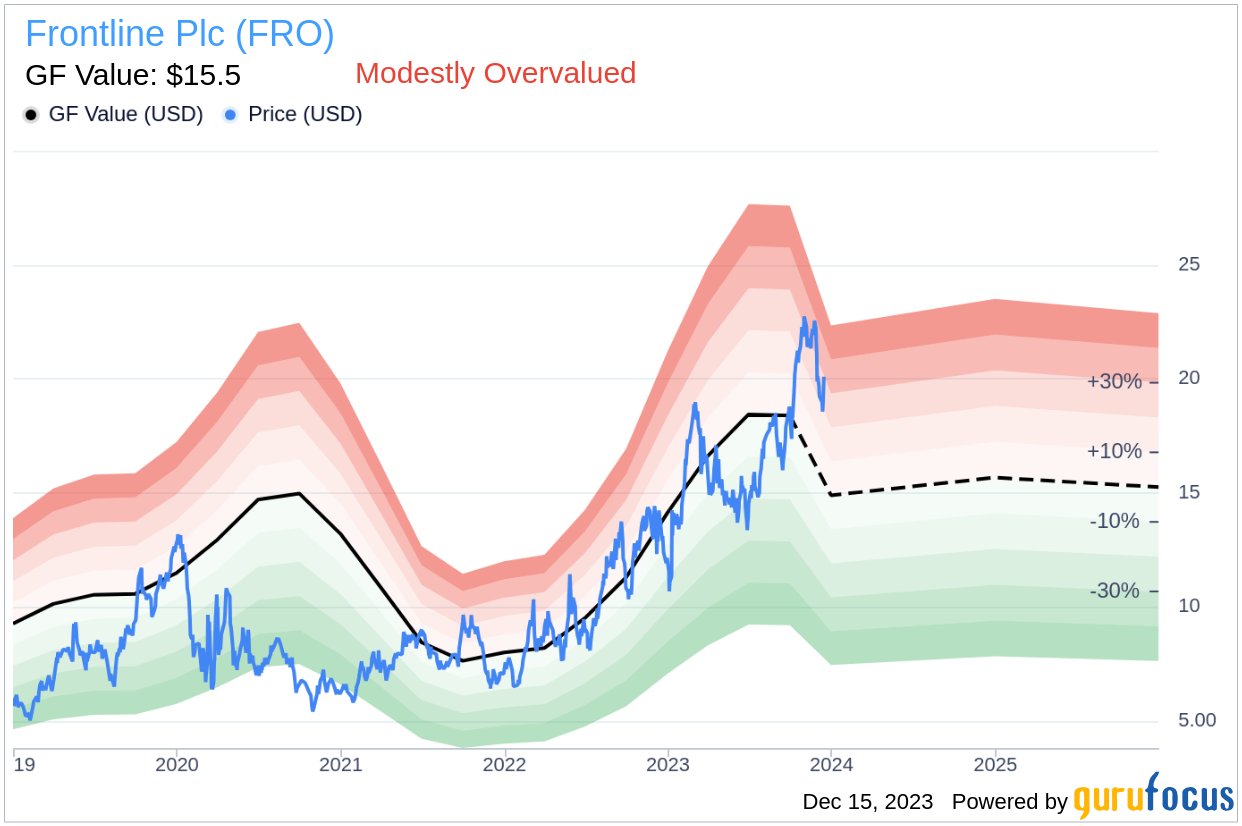

Frontline Plc (FRO, Financial) has recently seen a notable daily gain of 6.52% and an impressive three-month gain of 25.09%. With an Earnings Per Share (EPS) of 3.49, investors are presented with the critical question: Is the stock modestly overvalued? This analysis aims to address this question by examining Frontline Plc's valuation in detail. We invite you to delve into the following comprehensive review to understand the intrinsic value of Frontline Plc's shares.

Company Overview

Frontline Plc is a prominent international shipping company specializing in the seaborne transportation of crude oil and oil products. The company operates primarily through its tankers segment, covering key geographical regions such as the Arabian Gulf, West Africa, the North Sea, and the Caribbean. Frontline Plc generates revenue through various chartering arrangements, including voyage charters, time charters, and finance leases. Additionally, the company is actively engaged in the charter, purchase, and sale of vessels. With a current stock price of $20.09 and a GF Value of $15.5, the company's market capitalization stands at $4.50 billion, prompting investors to assess whether the stock is trading at a fair valuation.

Understanding GF Value

The GF Value is a unique metric that reflects the intrinsic value of a stock, combining historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. This valuation model suggests a fair trading value for the stock, which investors can use as a benchmark. When a stock's price significantly exceeds the GF Value Line, it might be overvalued, implying lower future returns. Conversely, a price well below the GF Value Line could indicate an undervalued stock with higher potential returns.

According to GuruFocus' valuation methods, Frontline Plc (FRO, Financial) appears modestly overvalued. The GF Value is determined by considering historical trading multiples, an internal adjustment based on the company's past growth, and analyst projections of future performance. With a market cap of $4.50 billion and a share price of $20.09, the stock's valuation warrants a closer look.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength Assessment

Investing in companies with solid financial strength is crucial to avoid permanent capital loss. Frontline Plc's cash-to-debt ratio of 0.23 places it below 65.67% of its peers in the Oil & Gas industry. This figure leads GuruFocus to assign a financial strength rating of 5 out of 10, indicating a fair balance sheet.

Profitability and Growth Prospects

Profitable companies, particularly those with consistent long-term profitability, pose less investment risk. Frontline Plc has shown profitability over 6 of the past 10 years. With a revenue of $1.90 billion and an Earnings Per Share (EPS) of $3.49 over the past twelve months, the company's operating margin of 43.38% ranks higher than 89.11% of its industry counterparts. GuruFocus rates Frontline Plc's profitability at 7 out of 10, reflecting fair profitability.

Growth is a critical factor in a company's valuation, often correlating with long-term stock performance. Frontline Plc's 3-year average annual revenue growth rate of 7.8% falls below 56.84% of the companies in the Oil & Gas industry. However, its 3-year average EBITDA growth rate of 19.9% is more competitive, ranking better than 57.45% of its peers.

ROIC vs. WACC Analysis

An effective way to gauge a company's profitability is by comparing its Return on Invested Capital (ROIC) with its Weighted Average Cost of Capital (WACC). Frontline Plc's ROIC of 19.85 over the past 12 months significantly outpaces its WACC of 4.68, indicating the company is creating value for its shareholders.

Concluding Valuation Insights

In conclusion, Frontline Plc (FRO, Financial) is considered modestly overvalued. The company's financial condition and profitability are fair, with growth prospects ranking favorably within the Oil & Gas industry. For a more detailed exploration of Frontline Plc's financials, investors can review its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, please visit the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.