Mid-America Apartment Communities Inc (MAA, Financial) has recently shown a daily gain of 1.67%, with a 3-month gain of 7.02%. With an Earnings Per Share (EPS) of 5.01, investors are keen to understand whether the stock is modestly undervalued. This article delves into the valuation analysis of Mid-America Apartment Communities, providing readers with a detailed examination of the company's financial status and intrinsic value.

Company Introduction

Mid-America Apartment Communities Inc (MAA, Financial) stands as a prominent real estate investment trust, specializing in multifamily apartment communities across the southeastern and southwestern United States. With a current stock price of $136.55 and a GF Value of $162.32, there's a compelling case for the stock being modestly undervalued. This valuation gap presents a unique opportunity for investors to consider Mid-America Apartment Communities as a potential addition to their portfolios.

Summarize GF Value

The GF Value is a proprietary calculation used to determine the intrinsic value of a stock like Mid-America Apartment Communities. It is based on historical trading multiples, adjustments from past performance, and future business performance estimates. Currently, with a market cap of $15.90 billion, Mid-America Apartment Communities' shares are priced beneath the GF Value Line, suggesting a modest undervaluation. This could potentially signal higher future returns for investors compared to the company's business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

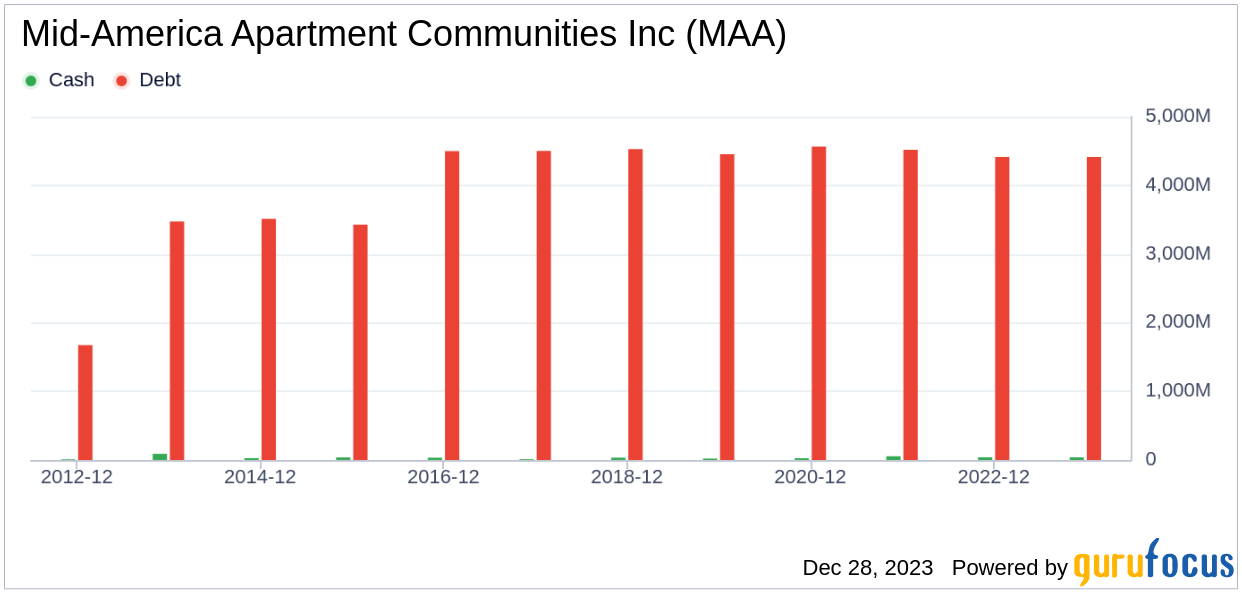

Assessing the financial strength of a company is crucial before investing. Mid-America Apartment Communities has a cash-to-debt ratio of 0.04, which is considered fair in comparison to its industry peers. This indicates that the company's financial health is stable, though it's important to monitor its debt levels relative to cash on hand.

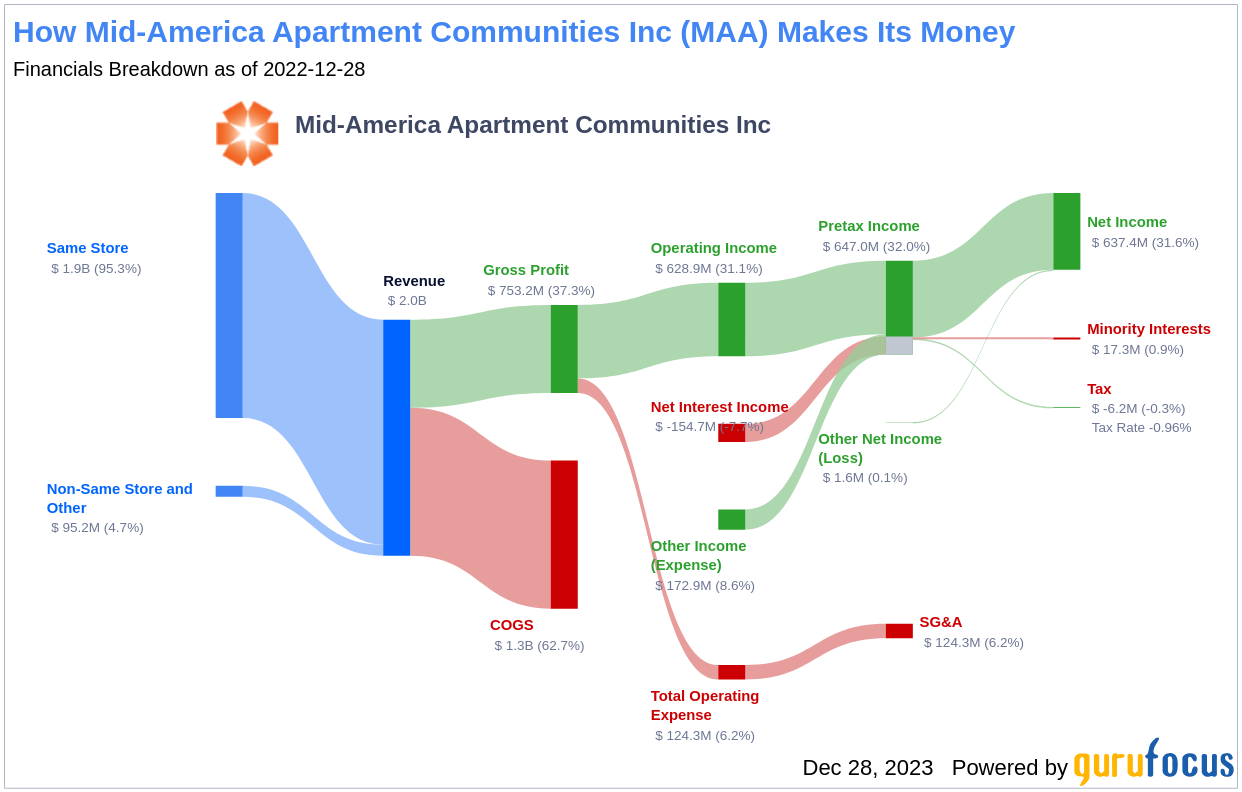

Profitability and Growth

Mid-America Apartment Communities has maintained profitability for the past decade, a testament to its sound operational strategies. With an operating margin of 32.28%, the company's profitability is ranked as strong, despite being lower than some of its industry counterparts. Moreover, its revenue growth outpaces 77.4% of its peers, highlighting its competitive edge in the REITs industry.

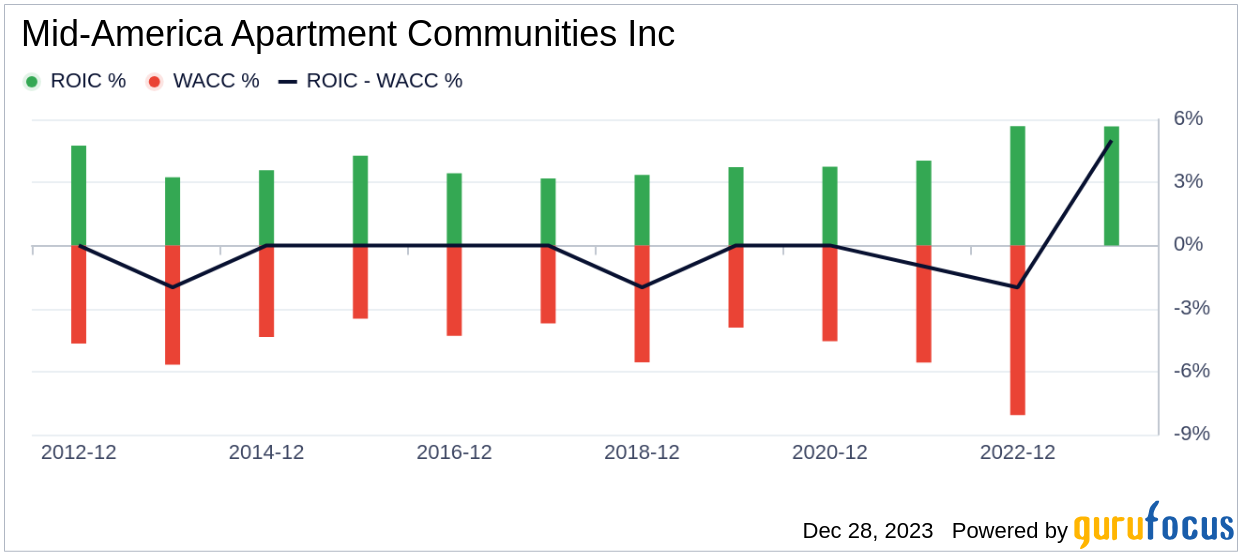

ROIC vs. WACC

The comparison between Return on Invested Capital (ROIC) and Weighted Average Cost of Capital (WACC) is another vital profitability metric. Ideally, ROIC should exceed WACC to indicate efficient capital management. For Mid-America Apartment Communities, the ROIC is currently lower than the WACC, suggesting potential areas for improvement in capital efficiency.

Conclusion

In summary, Mid-America Apartment Communities (MAA, Financial) presents itself as a modestly undervalued investment opportunity. The company's financials are fair, and its profitability is robust, with growth rates surpassing many in the REITs industry. For a more comprehensive understanding of the company's financial journey, interested investors can review Mid-America Apartment Communities' 30-Year Financials here.

To discover high-quality companies that may offer above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.